India Electrical Wires and Cables Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Electrical Wires and Cables Market Summary:

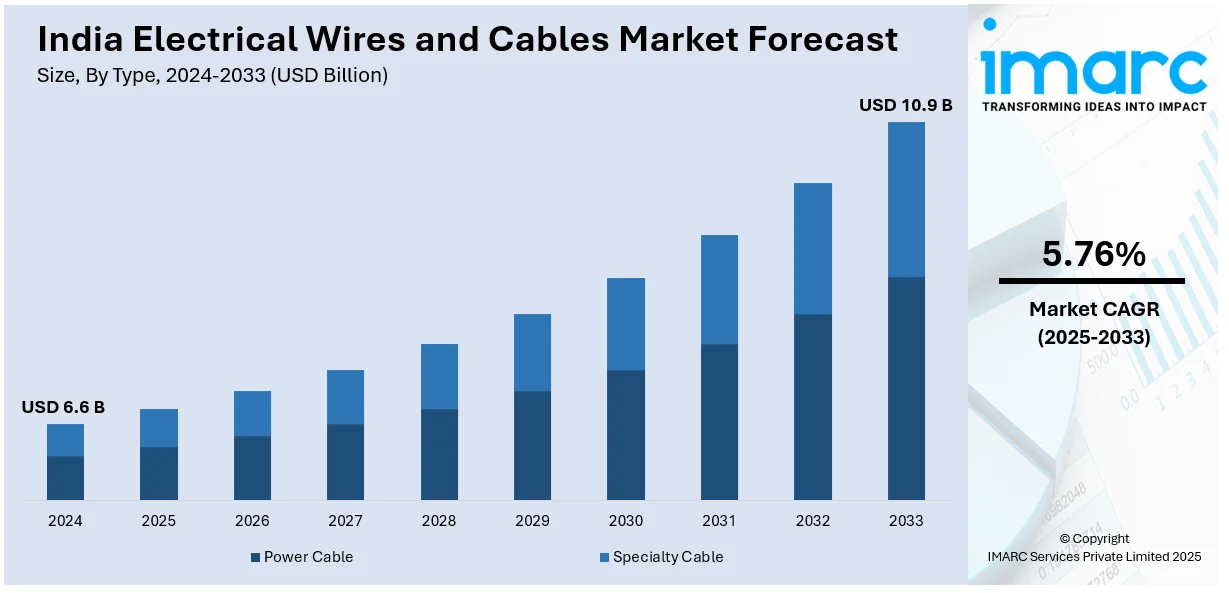

The electrical wires and cables market size was valued at USD 6.6 Billion in 2024. The market is projected to grow USD 10.9 Billion by 2033, exhibiting a CAGR of 5.76% during the 2025-2033. The market is driven by rapid urbanization, government initiatives like "Power for All," rising renewable energy integration, increasing infrastructure investments, and the expansion of high-speed internet networks, leading to higher demand for advanced cables in the power transmission, smart grid, and telecommunication sectors across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.6 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Market Growth Rate 2025-2033 | 5.76% |

India Electrical Wires and Cables Market Trends:

Expansion of the Power and Energy Sector

The spurt in the growth of India's power and energy sector has substantially strengthened the electrical wire and cable demand. In the "Energy Statistics India 2021" report by the Ministry of Statistics and Programme Implementation, the installed electricity generation capacity of India was at 382.15 GW as of March 2021, indicating a high spike from the past. This growth requires huge transmission and distribution networks, thereby strengthening the wires and cables industry directly. Increased government emphasis on rural electrification and programs such as the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) are designed to ensure a steady power supply to rural regions. These programs entail heavy investments in electrical infrastructure, such as wires and cables, in order to connect far-flung areas to the national grid. Stress on minimizing transmission and distribution losses further accentuates the importance of high-quality cables, driving market growth. Additionally, the use of solar and wind power as renewable energy sources has led to a higher demand for power cables that can transmit variable loads. The Bureau of Energy Efficiency points out the growing proportion of renewables in India's energy consumption in its report "National Energy Data: Survey and Analysis," suggesting the need for sophisticated wiring solutions to transmit power efficiently.

To get more information on this market, Request Sample

Government Initiatives Promoting Domestic Manufacturing

The Government of India initiatives toward encouraging indigenous production have influenced the electrical wires and cables industry. The Department of Heavy Industry "Indian Electrical Equipment Industry Mission Plan 2012-2022" indicates action plans for developing the electrical equipment industry's competitive edge, among which include wires and cables. It lays stress on cutting down the dependency on imports and growing domestic capacity. Schemes such as the Production-Linked Incentive (PLI) scheme induce manufacturers to expand production, enhance quality, and invest in research and development. Such incentives have drawn large investments in the wires and cables industry, resulting in technological upgradation and capacity addition. For example, the foray of big players such as UltraTech Cement into the wires and cables segment, with an investment of INR 18 billion, reflects India electrical wires and cables industry growth. In addition, the report on "Investment Opportunities in Capital Goods" by Invest India identifies the government's emphasis on developing infrastructure as a driving factor indirectly for demand in electrical items, such as wires and cables. The "Make in India" initiative through emphasizing on the creation of a strong manufacturing ecosystem matches up with developing infrastructure, making the environment friendly for the industry of wires and cables to grow.

Rising Demand for Low Voltage Cables in Real Estate

The market is experiencing a huge increase in demand for low-voltage cables, driven mainly by strong growth in the real estate and construction industry. There is rapid urbanization and increased housing development, mostly in Tier 1 and Tier 2 cities. According to industry reports, by the year 2036, 600 million, or 40% of the population of the country, will live in its towns and cities. This is likely to increase the need for effective and secure power distribution systems, where low-voltage cables play an important part. These cables find widespread application in residential and commercial complexes in power transmission, lighting, HVAC, and fire protection systems. Further, the government's efforts towards housing at reasonable costs through programs like Pradhan Mantri Awas Yojana (PMAY) have also spurred construction activity, thereby driving the usage of these cables. Moreover, the increasing use of smart homes, building management systems, and energy-efficient infrastructure has compelled developers to make investments in top-class voltage cabling solutions that are safe, reliable, and cost-effective.

Role of Smart Grid Projects in Market Expansion

Smart grid projects in India are playing a substantial role in the growth of the electrical wires and cables market in India. Two smart grid projects are implemented under the NSGM, with the goal of providing power to about 180,000 consumers at an investment of INR 1.16 Billion as per an industry report dated March 2024. These projects seek to upgrade the electrical infrastructure of the nation by combining digital communication and automation technologies with the conventional grid system. The adoption of smart meters, advanced metering infrastructure (AMI), and renewable resources have fueled the demand for specialty cables, including fiber optic and control cables, that enable real-time monitoring, fault identification, and enhanced load management. The Government of India's National Smart Grid Mission (NSGM) and rising investments by state utilities in grid automation are driving constant demand for high-performance transmission as well as distribution cables. In addition to this, the consistent drive for renewable energy integration, including solar and wind, is fueling the development of energy evacuation infrastructure that necessitates weather-tolerant and high-voltage cables.

Challenges in the India Cable Manufacturing Sector

While registering significant growth, the market also encounters several operational and structural issues that interfere with market performance. It includes price volatility of raw materials, particularly copper and aluminum, which represent a major share of the cost of production. This volatility impacts pricing strategy and tightens margins for producers. Furthermore, the market is highly fragmented, with many unorganized players manufacturing inferior cables, thus influencing the overall quality and safety standards of the product. Compliance and certification requirements are usually not followed in this segment, which creates safety risks. Infrastructure bottlenecks, like irregular power supply and poor logistics, also interrupt production cycles. Additionally, inadequate research and development (R&D) spending and reliance on vintage production technologies hinder Indian producers from competing with international producers that provide technologically innovative, high-efficiency cables that match changing energy and connectivity requirements. However, increasing government support for renewable infrastructure and the entry of organized players with advanced manufacturing capabilities are helping the industry gradually overcome these challenges and also further contribute to augmenting the India electrical wires and cables market share.

Challenges in India’s Electrical Cable Industry Amid Solar Power Boom

As per the India electrical wires and cables industry analysis, during its growth, the market faces several unique challenges. As the country accelerates its solar power capacity, there is a growing demand for weather-resistant, high-performance solar cables. However, most domestic manufacturers are yet to scale production of UV- and moisture-proof cables that meet international photovoltaic (PV) standards. Additionally, the transition to decentralized energy systems, such as rooftop solar and microgrids, demands more flexible and durable cable solutions, which the current supply chain struggles to deliver consistently. The sector also encounters technological gaps in insulation materials, particularly for fire-retardant and halogen-free variants essential for modern infrastructure. Limited research and development (R&D) capabilities, a shortage of skilled technicians, and weak last-mile logistics further hinder progress, slowing the industry’s ability to adapt to the evolving energy and construction landscape.

India Electrical Wires and Cables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, end user, and region.

Type Insights:

- Power Cable

- Specialty Cable

The report has provided a detailed breakup and analysis of the market based on the type. This includes power cable and specialty cable

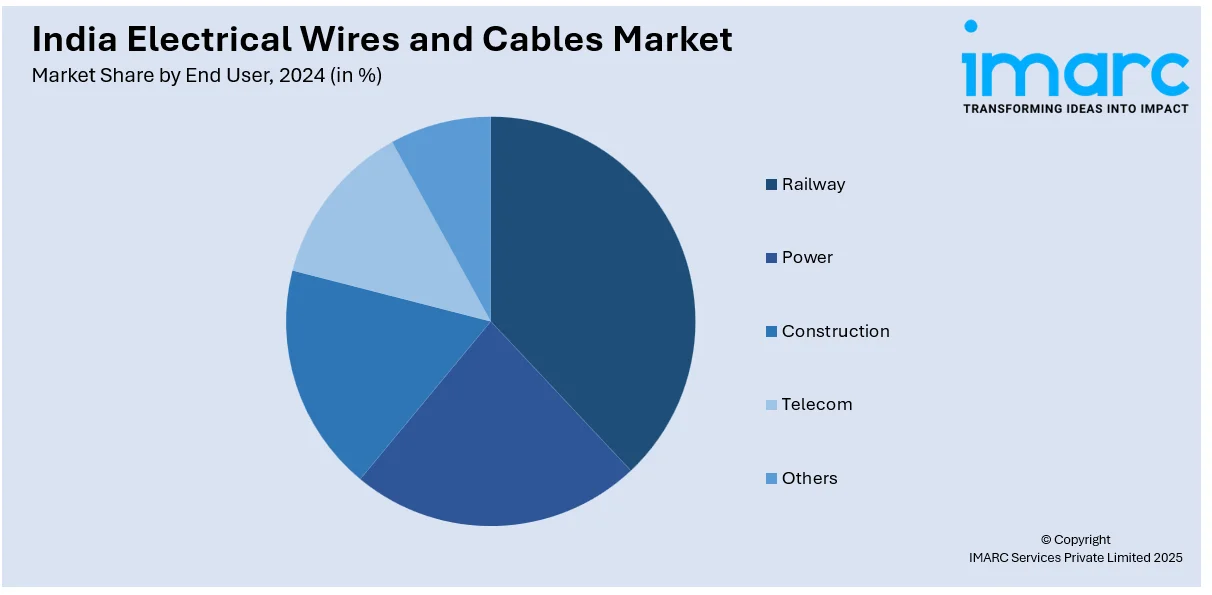

End User Insights:

- Railway

- Power

- Construction

- Telecom

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes railway, power, construction, telecom, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electrical Wires and Cables Market News:

- June 2025: Luker Electric Technologies Pvt Ltd (Luker India) announced its entry into the wires and cables market with an INR 150 Crore (about USD 18.07 Million) investment in its Coimbatore manufacturing facility, aiming for a South India launch by the end of June 2025. The company, which previously specialized in LED lighting and BLDC fans, plans to capitalize on the estimated INR 35,000 Crore (about USD 4.22 Billion). Indian wires and cables market, supported by infrastructure growth in rural areas.

- February 2025: UltraTech Cement announced it would invest INR 18 Billion (approximately USD 206 Million) over two years to establish a wires and cables manufacturing plant in Gujarat under its Building Products Division. The plant is slated for commissioning by December 2026. This strategic diversification complements UltraTech’s existing building-materials portfolio and follows its broader expansion, including recent cement acquisitions.

- January 2025: Finolex Cables unveiled FinoUltra, a new range of wires engineered using advanced Electron Beam (E‑Beam) cross‑linking technology. The E‑Beam process enhances mechanical and thermal properties, enabling a 75 % increase in current capacity, support for operation up to 125 °C, and reduced energy loss while also integrating Low Smoke Zero Halogen (LSZH) design for improved fire safety and compliance with RoHS and REACH standards. The launch underscores Finolex’s commitment to innovation in modern infrastructure markets.

- August 2024: India is going to increase its internet capacity four times by 2025 with the help of three significant undersea cable projects namely, 2Africa Pearls, India-Asia-Express (IAX), and India-Europe-Express (IEX). All these projects would highly significantly enhance digital connectivity in the country, prompting widespread deployment of optical fiber cables to accommodate expanded infrastructure. It is anticipated to boost India's electrical wires and cables market size with high growth.

- July 2024: Havells India set out to boost cable production capacity in Alwar to cater to the high demand for electrical wires and cables. This expansion facilitates the rapidly expanding global infrastructure, real estate, and industrial demand, with improved supply chain efficiency. Increased production capacity fortifies India's electrical wires and cables market through improved availability and technological incorporation.

India Electrical Wires and Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Cable, Specialty Cable |

| End Users Covered | Railway, Power, Construction, Telecom, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electrical wires and cables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electrical wires and cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electrical wires and cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India electrical wires and cables market was valued at USD 6.6 Billion in 2024.

The India electrical wires and cables market is expected to exhibit a CAGR of 5.76% during 2025-2033.

The electrical wires and cables market in India is projected to reach a value of USD 10.9 Billion by 2033.

The market is driven by rapid urbanization, government initiatives like “Power for All,” rising renewable energy integration, increasing infrastructure investments, and the expansion of high-speed internet networks. These trends are fueling the demand for advanced cables in power transmission, smart grid, and telecommunication sectors across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)