India Emobility Market Size, Share, Trends and Forecast by Product, Voltage, Battery, and Region, 2025-2033

India Emobility Market Overview:

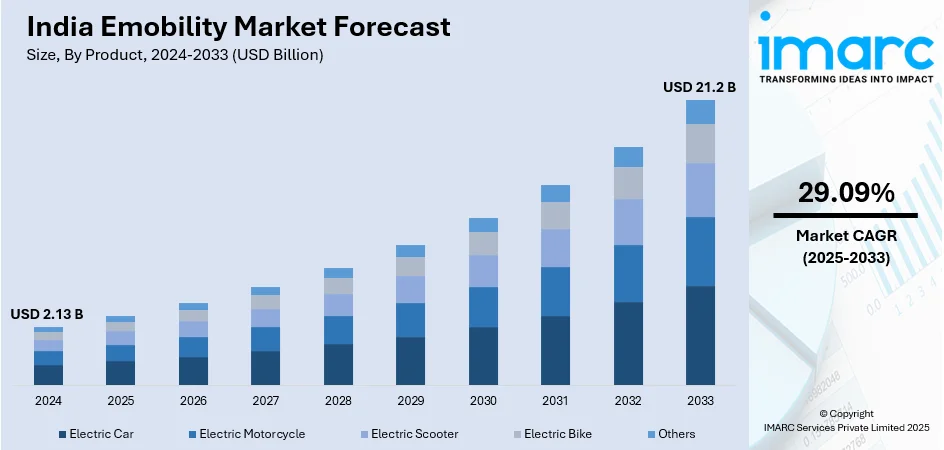

The India emobility market size reached USD 2.13 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.2 Billion by 2033, exhibiting a growth rate (CAGR) of 29.09% during 2025-2033. Government incentives, rising fuel costs, urban air pollution concerns, advancements in battery technology, expanding EV charging infrastructure, growing consumer adoption, and investments by automakers in electric two-wheelers, three-wheelers, and commercial EVs are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.13 Billion |

| Market Forecast in 2033 | USD 21.2 Billion |

| Market Growth Rate 2025-2033 | 29.09% |

India Emobility Market Trends:

Accelerating Domestic Innovation in Electric Mobility

India is advancing its position in electric mobility by focusing on research and development across critical areas such as energy storage, component manufacturing, materials recycling, and charging infrastructure. Efforts are shifting toward reducing dependence on imports while strengthening local technological capabilities. Strategic planning is driving investments in advanced battery solutions, efficient powertrain systems, and sustainable material recovery. With a strong emphasis on innovation, these initiatives are expected to enhance manufacturing efficiency and cost-effectiveness, supporting widespread adoption of electric vehicles. Over the next few years, this approach aims to create a self-sustaining ecosystem that fosters technological leadership, making the country a competitive player in the global electric mobility landscape. For example, in July 2024, India's Principal Scientific Adviser unveiled the “e-Mobility R&D Roadmap for India.” This strategic plan outlines research initiatives in energy storage, EV components, materials recycling, and charging infrastructure. The roadmap aims to reduce import reliance, bolster domestic R&D, and position India as a leader in the global electric mobility sector within five to seven years.

To get more information on this market, Request Sample

Expanding Charging Infrastructure for Wider EV Adoption

Efforts to enhance electric vehicle accessibility are gaining momentum with a focus on expanding charging networks. A growing number of charging stations are being integrated into user-friendly platforms, ensuring seamless access for EV owners. This shift addresses range anxiety and supports long-distance travel, making electric mobility more practical. Increased collaboration between stakeholders is driving large-scale deployment of charging points, particularly in urban and highway locations. The push for a widespread network is also encouraging technological advancements in fast-charging solutions, reducing downtime for users. By strengthening infrastructure, the overall adoption of electric vehicles is expected to accelerate, fostering a more sustainable transportation ecosystem while aligning with national energy goals. For instance, in March 2024, Mahindra & Mahindra signed an MoU with Adani Total Energies E-Mobility Limited (ATEL) to expand EV charging infrastructure across India. This collaboration would provide Mahindra XUV400 customers access to over 1,100 chargers via the Bluesense+ App, enhancing charging convenience nationwide.

India Emobility Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, voltage, and battery.

Product Insights:

- Electric Car

- Electric Motorcycle

- Electric Scooter

- Electric Bike

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes electric car, electric motorcycle, electric scooter, electric bike, and others.

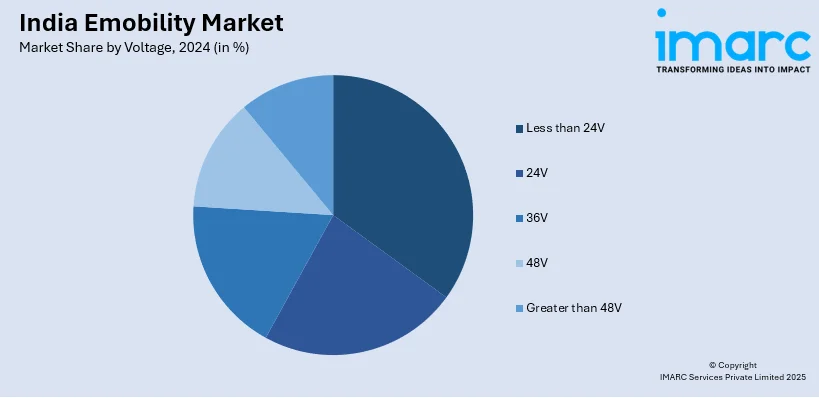

Voltage Insights:

- Less than 24V

- 24V

- 36V

- 48V

- Greater than 48V

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes less than 24V, 24V, 36V, 48V, and greater than 48V.

Battery Insights:

- Sealed Lead Acid

- Li-ion

- NiMH

A detailed breakup and analysis of the market based on the battery have also been provided in the report. This includes sealed lead acid, li-ion, and NiMH.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Emobility Market News:

- In April 2024, Tata Passenger Electric Mobility Ltd. (TPEM) signed a non-binding memorandum of understanding with Vertelo, a Macquarie-managed integrated fleet electrification platform, to deliver 2,000 XPRES-T electric vehicles. This collaboration aims to accelerate India's transition to sustainable e-mobility, with deliveries commencing in phases.

- In February 2024, Volkswagen Group and Mahindra & Mahindra Ltd. signed a supply agreement for electric components from Volkswagen's MEB platform, including unified cells, to be integrated into Mahindra's INGLO electric platform. This collaboration aims to strengthen their presence in India's growing electric mobility market.

India Emobility Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electric Car, Electric Motorcycle, Electric Scooter, Electric Bike, Others |

| Voltages Covered | Less than 24V, 24V, 36V, 48V, Greater than 48V |

| Batteries Covered | Sealed Lead Acid, Li-ion, NiMH |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India emobility market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India emobility market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India emobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India eMobility market was valued at USD 2.13 Billion in 2024.

The India eMobility market is expected to exhibit a CAGR of 29.09% during 2025-2033, reaching a value of USD 21.2 Billion by 2033.

The growth of the India eMobility market is driven by government incentives, rising fuel costs, urban air pollution concerns, advancements in battery technology, expanding EV charging infrastructure, growing consumer adoption, and increasing investments by automakers in electric two-wheelers, three-wheelers, and commercial EVs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)