India Energy Efficiency Retrofits Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Energy Efficiency Retrofits Market Overview:

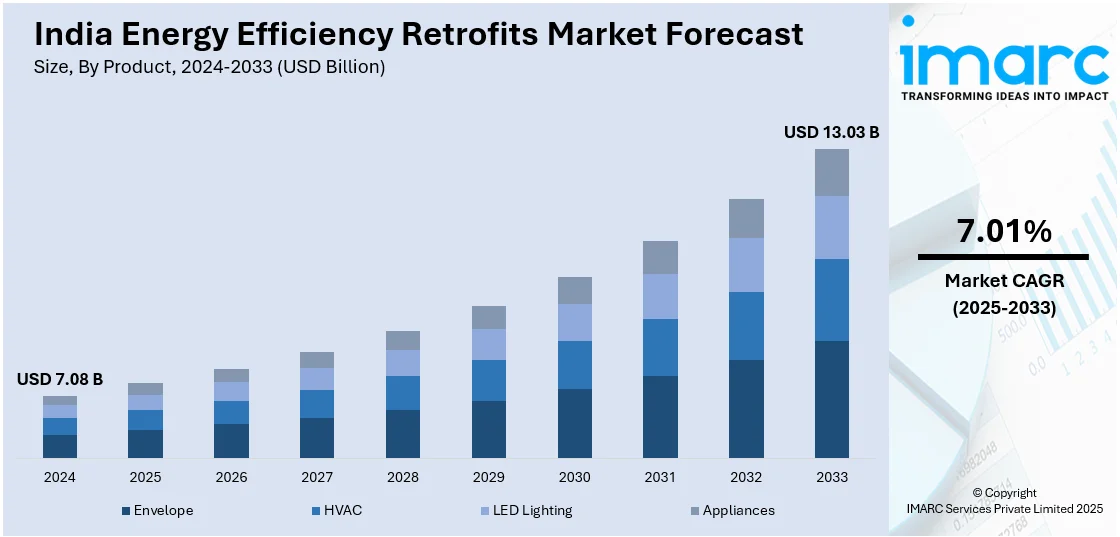

The India energy efficiency retrofits market size reached USD 7.08 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.03 Billion by 2033, exhibiting a growth rate (CAGR) of 7.01% during 2025-2033. The market is driven by increasing government support through policies like the Perform, Achieve, and Trade (PAT) scheme, growing energy costs, and a strong push towards sustainable development. Rising awareness about reducing carbon footprints, coupled with corporate sustainability goals, further propels the India energy efficiency retrofits market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.08 Billion |

| Market Forecast in 2033 | USD 13.03 Billion |

| Market Growth Rate 2025-2033 | 7.01% |

India Energy Efficiency Retrofits Market Trends:

Government Initiatives and Policies

India's energy efficiency retrofits sector is heavily driven by government policies for enhancing energy performance in the existing building stock. The Bureau of Energy Efficiency (BEE) is at the forefront of promoting retrofitting by way of regulation and incentives. Initiatives such as the National Energy Efficiency Plan, combined with state-specific policy, are increasing investments in energy-efficient technology. Enforcement of the Energy Conservation Building Code (ECBC) requires energy efficiency regulations in buildings, hence creating demand for retrofitting. Furthermore, establishment of carbon trading schemes, e.g., the Perform, Achieve, and Trade (PAT) scheme, encourages industries to minimize energy consumption, further pushing the market for retrofits. Such government-sponsored initiatives aid in addressing energy demand while fulfilling sustainability objectives, spurring market development. For instance, Energeia, a leading energy service company (ESCO), plays a key role in enhancing sustainability and energy efficiency in India. It provides services like Energy Savings Performance Contracts (ESPCs), energy audits, retrofitting, and energy management systems. Energeia has helped clients like LG Electronics and The Leela Hotels reduce energy use and carbon emissions. Committed to sustainability, the company aligns with India's government initiatives and contributes to the UN Sustainable Development Goals, with plans for further expansion.

To get more information on this market, Request Sample

Rising Adoption of Smart Building Technologies

Smart building technologies are transforming the energy efficiency retrofits landscape in India. The integration of Internet of Things (IoT) sensors, advanced energy management systems (EMS), and automated lighting and HVAC systems is becoming more prevalent. These technologies enable real-time monitoring of energy consumption, leading to more efficient building operations and reducing wastage. As businesses and industries focus on operational efficiency, the adoption of smart technologies in existing buildings is growing, furthering India energy efficiency market growth. These retrofits not only enhance energy efficiency but also improve occupant comfort, making them attractive for both commercial and residential spaces. The increased emphasis on digitalization and automation in facilities management further supports the growing demand for energy efficiency retrofits. For instance, as per a 2024 research study, building energy consumption constitutes 37% of India’s annual primary energy use and is rising at 8% annually. A comprehensive energy audit at Siksha 'O' Anusandhan University’s Campus 1 in Bhubaneswar identified key energy conservation opportunities (ECOs), leading to proposed annual energy savings of 47,28,178 kWh. By implementing measures like replacing ceiling fans with BLDC fans, switching to LED lighting, using variable-speed drives, and applying solar-reflective paint, the university could save INR 3.19 crore per year with an investment of INR 21.33 crore. The initiative followed the Odisha Energy Conservation Building Code (OECBC), which can reduce energy consumption by up to 30% in existing buildings.

India Energy Efficiency Retrofits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Envelope

- HVAC

- LED Lighting

- Appliances

The report has provided a detailed breakup and analysis of the market based on the product. This includes envelope, HVAC, LED lighting, and appliances.

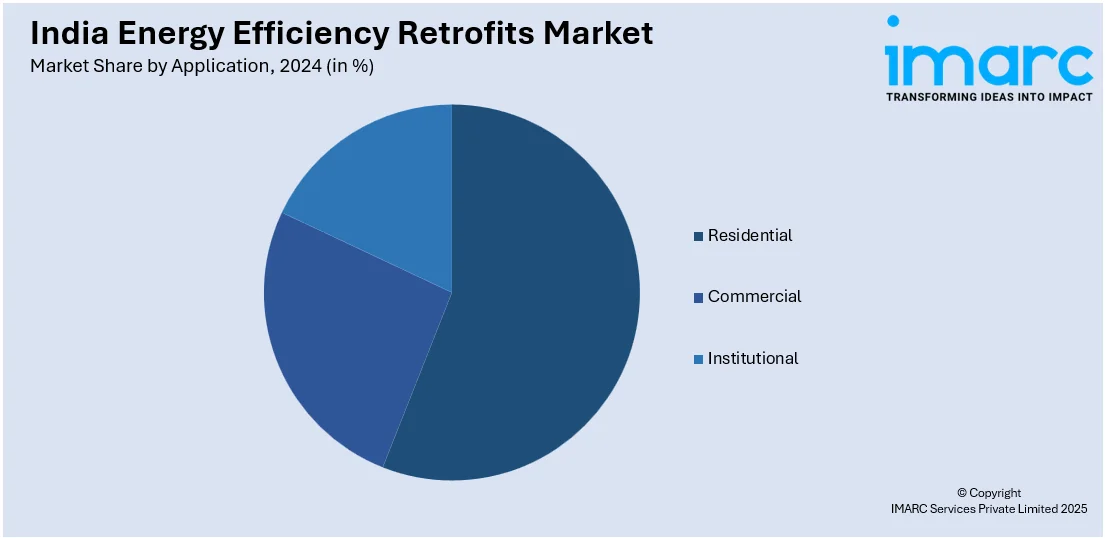

Application Insights:

- Residential

- Single-Family

- 2+ Unit Building

- Mobile Home

- Commercial

- Food Sales & Service

- Lodging

- Mercantile

- Office Buildings

- Public Assembly

- Warehouse/ Storage

- Others

- Institutional

- Education

- Healthcare

- Public Order & Safety

- Worship Buildings

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential (single-family homes, 2+ unit buildings, and mobile home), commercial (food sales and service, lodging, mercantile, office buildings, public assembly, warehouse/ storage, and others), and institutional (education, healthcare, public order and safety, and worship buildings).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Energy Efficiency Retrofits Market News:

- In August 2024, Merino Industries, a prominent Indian manufacturer, fulfilled 74.6% of its energy requirements using renewable sources by prioritizing sustainability. Through its Nirmal Sustainability Program, the company minimized reliance on fossil fuels, enhanced energy efficiency, and embraced circular economy principles. Leveraging biomass such as rice husk and sawdust, along with solar power and advanced combustion technology, Merino significantly reduced emissions while benefiting local communities. With eco-conscious practices integrated across operations, the company aims to reach 90% renewable energy usage by 2027, setting a standard for industrial sustainability.

India Energy Efficiency Retrofits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Envelope, HVAC, LED Lighting, Appliances |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India energy efficiency retrofits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India energy efficiency retrofits market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India energy efficiency retrofits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The energy efficiency retrofits market in India was valued at USD 7.08 Billion in 2024.

The India energy efficiency retrofits market is projected to exhibit a CAGR of 7.01% during 2025-2033, reaching a value of USD 13.03 Billion by 2033.

Key factors driving the India energy efficiency retrofits market include rising energy costs, increasing government regulations and incentives for energy conservation, growing adoption of sustainable building practices, and heightened awareness among industries and commercial establishments about reducing carbon emissions. Technological advancements in efficient systems further support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)