India Energy Management Software Market Size, Share, Trends and Forecast by Software, Solution, End Use Application, and Region, 2025-2033

India Energy Management Software Market Overview:

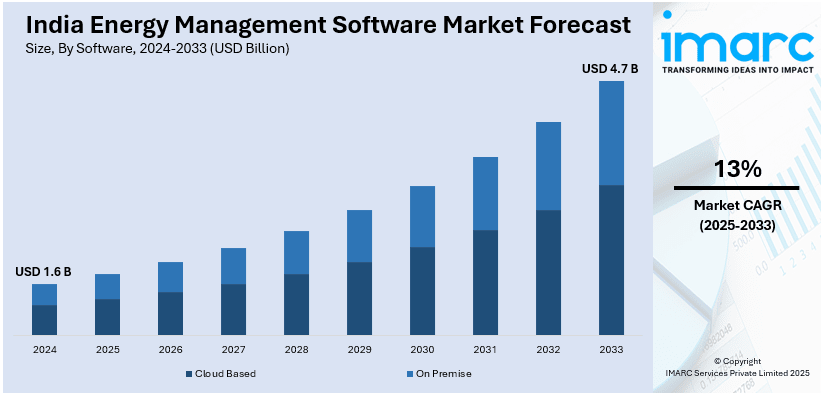

The India energy management software market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 13% during 2025-2033. Rising energy costs, government regulations, and smart technologies like Internet of Things (IoT) and artificial intelligence (AI) that enable real-time monitoring and automation are influencing the India energy management software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Market Growth Rate (2025-2033) | 13% |

India Energy Management Software Market Trends:

Growing Focus on Sustainability & Carbon Reduction

Organizations are implementing energy management solutions to monitor and optimize energy utilization for achieving sustainability targets. Regulatory frameworks and environmental policies are mandating industries to adopt energy-efficient practices and reporting mechanisms. Companies are increasingly investing in software solutions to track carbon emissions and ensure regulatory compliance. Rising corporate commitments toward net-zero emissions are encouraging industries to adopt energy-efficient digital solutions. Businesses are integrating renewable energy sources with energy management software for efficient energy utilization, which further strengthens India energy management software market growth. Individuals are demanding environmentally responsible business operations, compelling companies to implement energy-saving software solutions. Advanced analytics and real-time monitoring enable organizations to detect inefficiencies and lower their carbon emissions. Cloud-based energy management solutions are enabling remote monitoring and optimization of energy consumption across multiple locations. The integration of AI and IoT in energy software is enhancing automation and predictive analytics capabilities. Green certifications and sustainability rankings are motivating enterprises to adopt energy-efficient digital tools. For instance, in October 2024, BPCL, Mumbai Port Authority, and MPSF announced India’s first green fuel ecosystem at Mumbai Port. The initiative includes EV charging stations, cleaner fuel alternatives for vessels, and waste management solutions to reduce emissions. Such initiatives align with India's broader sustainability goals, driving demand for advanced energy management solutions across industries.

To get more information on this market, Request Sample

Integration of Smart Technologies

The convergence of smart technologies is having a positive impact on the India energy management software market outlook. With companies implementing IoT-based energy management solutions to track usage patterns and improve operational efficiency. AI-driven analytics are assisting organizations in forecasting energy demand and streamlining resource allocation efficiently. Cloud-based platforms are facilitating real-time data processing and remote energy management across locations. Automation technologies are optimizing energy utilization by varying usage according to real-time demand variations. Additionally, smart meters and sensors are offering precise energy consumption data for enhanced decision-making and cost reduction. Blockchain technology adoption is guaranteeing secure and transparent energy transactions for decentralized energy markets. Predictive maintenance solutions are minimizing downtime and enhancing the efficiency of energy-intensive industrial processes. Smart grid integration is facilitating demand-side management and optimizing energy delivery through power grids. In February 2025, Alishan Green Energy launched its Low Acid EVA encapsulant during Intersolar India 2025, making solar modules more efficient and robust. The breakthrough minimizes potential-induced degradation (PID) and enhance energy generation, aiding the development of India's solar energy industry. Edge computing is refining data processing functionality, allowing faster insights for energy optimization measures. Companies are using digital twins to model and optimize energy consumption in industrial and commercial settings.

India Energy Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on software, solution, and end use application.

Software Insights:

- Cloud Based

- On Premise

The report has provided a detailed breakup and analysis of the market based on the software. This includes cloud based and on premise.

Solution Insights:

- Carbon Management System

- Utility Billing System

- Customer Information System

- Demand Response Management

- Others

A detailed breakup and analysis of the market based on the solution have also been provided in the report. This includes carbon management system, utility billing system, customer information system, demand response management, and others.

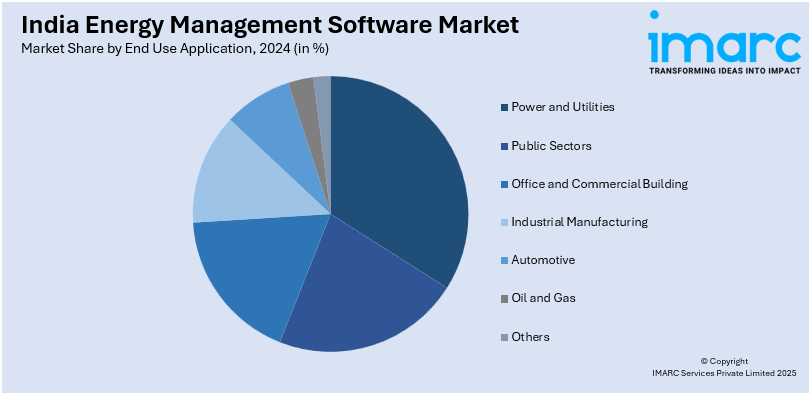

End Use Application Insights:

- Power and Utilities

- Public Sectors

- Office and Commercial Building

- Industrial Manufacturing

- Automotive

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes power and utilities, public sectors, office and commercial building, industrial manufacturing, automotive, oil and gas, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Energy Management Software Market News:

- In January 2025, Kazam unveiled its LEVDC fast charger and energy management system (EMS) at Bharat Mobility Expo 2025. The LEVDC charger enables rapid charging for 2/3 wheelers, while the EMS optimizes e-bus charging operations. With 50,000+ chargers deployed, Kazam is advancing India’s EV infrastructure, enhancing energy efficiency, and expanding across Southeast Asia.

- In September 2024, Larsen & Toubro (L&T) announced to deploy energy management systems (EMS) in South India's state load dispatch centers to enhance real-time grid monitoring. The project covers 12 control rooms using L&T-Spark-CRIM for efficient power transmission management. This initiative strengthens India’s energy infrastructure, improving grid reliability and supporting smart energy management advancements.

India Energy Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software’s Covered | Cloud Based, On Premise |

| Solutions Covered | Carbon Management System, Utility Billing System, Customer Information System, Demand Response Management, Others |

| End Use Applications Covered | Power and Utilities, Public Sectors, Office and Commercial Building, Industrial Manufacturing, Automotive, Oil and Gas, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India energy management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India energy management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India energy management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The energy management software market in India was valued at USD 1.6 Billion in 2024.

The India energy management software market is projected to exhibit a (CAGR) of 13% during 2025-2033, reaching a value of USD 4.7 Billion by 2033.

Adoption of energy management software in India is driven by the amplifying requirement for energy efficiency across industrial, commercial, and residential applications. Environmental policies, increasing energy prices, and digital transformation initiatives propel software deployment. Convergence with smart grid infrastructure and renewable power, and government sponsored sustainability initiatives, is further building market steam.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)