India Energy Storage Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Energy Storage Market Overview:

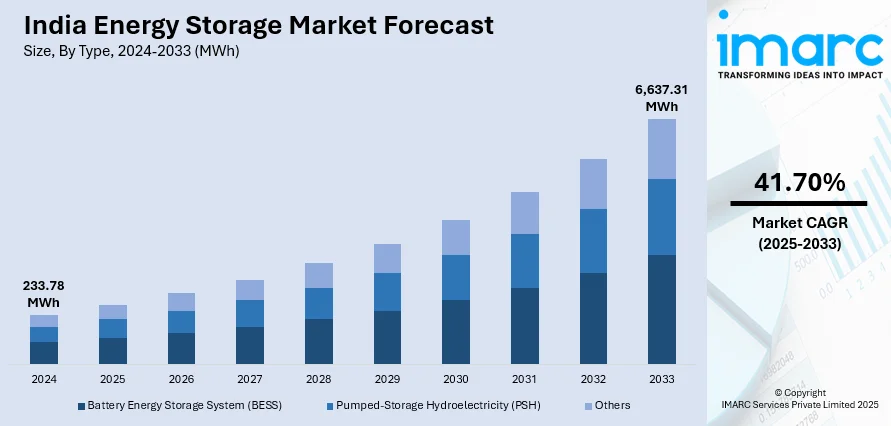

The India energy storage market size reached 233.78 MWh in 2024. Looking forward, IMARC Group estimates the market to reach 6,637.31 MWh by 2033, exhibiting a CAGR of 41.70% from 2025-2033. At present, large investment of funds causing rapid advancement in cutting-edge storage technology is impelling the market growth. Moreover, the implementation of various suitable government policies in the country is supporting the market growth. Apart from this, the ability of smart grids to add more stability, efficiency, and integration of renewable sources is expanding the India energy storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 233.78 MWh |

| Market Forecast in 2033 | 6,637.31 MWh |

| Market Growth Rate (2025-2033) | 41.70% |

India's energy storage sector is witnessing rapid growth, driven by a number of factors ranging from escalating energy demand to the shift towards renewable energy and the requirement for grid stability. With India aiming to achieve its ambitious goals in solar and wind energy, the need for energy storage is becoming ever more indispensable. Energy storage technologies, including lithium-ion batteries, are critical to mitigate the intermittency nature of renewable sources so that there is a reliable and consistent power supply. Government's robust interest in clean energy and sustainability is offering a favorable India energy storage market outlook.

To get more information on this market, Request Sample

The National Electric Mobility Mission Plan (NEMMP) and the Atmanirbhar Bharat Abhiyan initiative are aimed at the development of renewable energy production and minimizing the use of fossil fuels. The entry of different policies and incentives for energy storage options further supports the market growth. Also, the increasing demand for electric vehicles (EVs) and the necessity of efficient energy storage in charging infrastructure is fueling the demand for innovative energy storage technologies. In addition, growing consciousness regarding environmental sustainability and the financial benefits of power storage in minimizing power cuts as well as maximizing energy efficiency are also being counted upon.

India Energy Storage Market Trends:

Increase in Energy Storage Innovations

India is experiencing a tremendous shift to sustainable energy solutions, and there is a large investment of funds causing rapid advancement in cutting-edge storage technology. The aim is to enhance long-term energy storage, establish lithium-ion battery manufacturing, and enhance battery recycling facilities. This work is contributing to the wider adoption of sustainable transport and renewable energy integration. With the nation heading towards decarbonization and energy independence, higher funding pledges are building a robust storage innovation ecosystem. Accelerating the trend for recycling and localized manufacturing aims at reducing dependence on imports and enhancing efficiency and sustainability. The Institute for Energy Economics and Financial Analysis (IEEFA) comments that Indian authorities issued 6.1 GW of standalone energy‑storage tenders in Q1 2025, 64 % of the 9.5 GW total utility‑scale capacity tendered during the period. With a solid regulatory framework and industry engagement, India is well on its way to becoming an energy storage leader, securing the energy security and resilience of the nation.

Government Policies and Incentives

One of the major India energy storage market trends is the implementation of various favorable government policies in the country. The Indian government is also actively encouraging energy storage solutions through policies and incentives, which are driving market growth. While focusing on renewable energy integration, the government is financially supporting, subsidizing, and offering tax incentives for energy storage projects. Efforts such as the National Mission on Electric Mobility and the Atmanirbhar Bharat Abhiyan are leading the demand for energy storage, particularly that of solar and wind power. Further, new regulation that mandates energy storage in grid infrastructure is stimulating the growth of storage solutions. While India is marching towards meeting its renewable energy goals, such policies and initiatives from the government are constantly building a positive investment climate for energy storage technologies. In July 2024, during the 10th India Energy Storage Week (IESW), pledges to invest more than INR 2,000 crore were signed in energy storage, electric vehicles, and green hydrogen sectors. Prominent projects were VFlowTech's energy storage plant for the long term in Haryana, Nash Energy's lithium-ion battery plant in Karnataka, and BatX Energies' battery recycling plant. These milestones place India on a fast-emerging trajectory as a powerhouse of advanced energy solutions.

Improving Battery Storage for Secure Power

Energy storage is becoming an increasingly key part of modern power grids, with the ability to add more stability, efficiency, and integration of renewable sources, thereby offering a favorable India energy storage market growth. With the increasing focus on sustainable options, battery technology advances are creating cost savings and expanding access to clean power. Investments in utility-scale storage technologies enhance grid resilience, provide uninterrupted power supply, and help meet energy transition objectives. These technologies are particularly valuable where there is high power requirement, as the storage technologies can smoothen supply swings at a lower cost. The Union power ministry has unveiled a viability gap funding (VGF) initiative valued at Rs.5,400 crore to facilitate 30,000 MWh (or 30 GWh) of BESS capacity. The program will offer a VGF of Rs.18 lakh per MWh aimed at facilitating the establishment of 30 GWh of battery energy storage system (BESS) capacity. With advancements in technology and increased financial assistance, energy storage will continue to be a vital element in building a greener and autonomous energy future. Phasing out new storage systems marks progress toward achieving long-term energy security and efficiency. For instance, in May 2024, Delhi Electricity Regulatory Commission sanctioned India's first commercial standalone Battery Energy Storage System (BESS) project, a 20 MW/40 MWh facility to be set up at a high-demand substation. The project, funded with a concessional loan of 70% of the project cost, aims to enhance power quality and provide 24-hour reliable electricity to more than 12,000 low-income consumers. The project sets a new affordability standard with a levelized annual tariff approximately 55% lower than previous prices.

India Energy Storage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India energy storage market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Battery Energy Storage System (BESS)

- Pumped-Storage Hydroelectricity (PSH)

- Others

Battery energy storage system (BESS) stands as the largest component in 2024, holding 63.8% of the market. It has an important function in improving grid stability by acting as backup power during peak demand or grid disruption. Through the storage of excess energy during low demand and releasing it at times of high demand, BESS balance supply and demand. This feature provides a stable and secure power supply, especially in high renewable integration areas where power generation can be intermittent. Besides, BESS has the capability to reduce voltage fluctuation and frequency fluctuation, enhancing the performance of the grid. Another advantage of BESS is that they can store energy produced from renewable energy sources like wind and solar. Renewable energy generation tends to be intermittent, and BESS has the potential to store excess energy when generation is high and discharge it when generation is low or in the case of increased demand. This ensures renewable energy is more efficiently used, decreasing the need for fossil fuels and allowing for a cleaner, more sustainable energy grid.

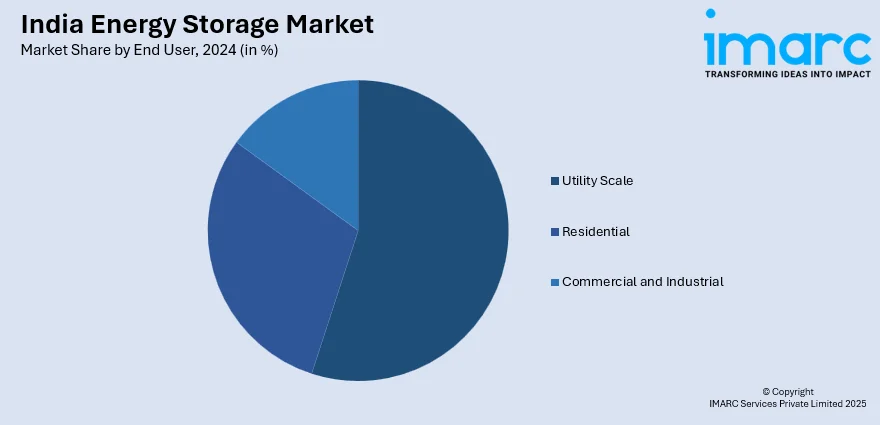

Analysis by End User:

- Residential

- Commercial and Industrial

- Utility Scale

Utility scale leads the market with 54.3% of market share in 2024. Large-scale energy storage systems have an important function in stabilizing the grid through balancing supply and demand. They buffer excess power during off-peak hours, when output exceeds usage, and deliver it during peak usage times when the grid needs more power. This capability to level out variations in demand and supply prevents power blackouts and lessens the necessity for costly peaking power plants, which tend to be less efficient and burn fossil fuels. This balance maintains grid efficiency and reliability. The intermittent nature of renewable energy systems like solar and wind can cause difficulty in providing a stable and sure power supply. Utility-scale energy storage mitigates this concern by storing surplus renewable energy when production outpaces consumption and releasing it when renewable energy generation is low. This improves the flexibility of the grid to accept renewable energy without sacrificing reliability. It facilitates the utilization of renewable energy more efficiently, minimizing dependence on fossil fuel-based backup power and enabling a cleaner, more sustainable mix of energy.

Regional Analysis:

- North India

- South India

- East India

- West India

South India represents the largest region owing to the region's increasing energy demand and its push toward renewable energy integration. South India, home to some of the country’s largest renewable energy projects, particularly in solar and wind power, is driving the need for energy storage systems (ESS) to ensure grid stability and optimize energy usage. As renewable energy generation fluctuates, energy storage solutions are becoming essential in balancing supply and demand, addressing intermittency, and providing reliable power even when renewable sources are not generating electricity. One of the major drivers of the market is the region’s commitment to renewable energy expansion. South Indian states like Tamil Nadu, Karnataka, and Andhra Pradesh have set ambitious targets for renewable energy capacity, aiming to reduce dependence on fossil fuels and curb carbon emissions.

Competitive Landscape:

Key market players in the market are actively expanding their portfolios by developing advanced and cost-effective energy storage solutions. Companies are investing heavily in research and development to improve the efficiency and lifespan of battery technologies, particularly lithium-ion batteries. They are forming strategic partnerships with renewable energy firms to integrate energy storage with solar and wind power projects. Additionally, market players are focusing on enhancing their manufacturing capabilities to meet the growing demand for utility-scale storage systems and electric vehicle (EV) batteries. Some are also offering turnkey solutions that combine energy storage with grid management services, enhancing their competitive edge. As per the India energy storage market forecasts, players are expected to engage with government initiatives and policy frameworks to take advantage of subsidies and incentives designed to boost energy storage adoption.

The report provides a comprehensive analysis of the competitive landscape in the India energy storage market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: NTPC Green Energy Ltd tendered a 250 MW/1,000 MWh battery energy storage system at its Kayamkulam plant in Kerala. The EPC package included design, supply, and 15-year O&M. The project was split into two 125 MW/500 MWh blocks, using standardized containers with at least 5 MWh DC capacity each.

- May 2025: AmpereHour Energy and Indigrid’s Kirlokari BESS Pvt Ltd commissioned India’s first regulator‑approved urban battery energy storage system for BSES Rajdhani in Delhi. The 20 MW/40 MWh turnkey project went live in April 2025, eleven months after kickoff. It delivered four‑hour daily peak support, cut diesel use, deferred grid capex, and displaced roughly 65 tCO₂ each day.

- May 2025: Cygni Energy inaugurated a 4.8 GWh BESS assembly plant in Hyderabad on April 30, 2025, with ₹1 billion invested in its first phase. The facility, located in the Electronics Manufacturing Cluster, marked a major step in domestic energy storage production. Phase II plans aim to expand capacity to 10.8 GWh.

- March 2025: PUR Energy unveiled its PuREPower energy storage product line on March 25, 2025, in Hyderabad. Featuring AI-powered electronics and advanced battery tech, PuREPower targeted applications from home to grid scale. The launch aligned with India's net-zero goals by addressing grid stability and renewable energy integration challenges like the duck curve effect.

- March 2025: Hindustan Power announced its plans to invest INR 620 Crore in solar and battery energy storage projects in Assam under a new agreement with the state government. This effort seeks to increase renewable energy generation and grid stability, therefore assisting India's transition to sustainable power solutions and assuring stable electricity supply in the region.

India Energy Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | MWh |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Battery Energy Storage System (BESS), Pumped-Storage Hydroelectricity (PSH), Others |

| End Users Covered | Residential, Commercial and Industrial, Utility Scale |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India energy storage market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India energy storage market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The energy storage market in India reached 233.78 MWh in 2024.

The India energy storage market is projected to exhibit a CAGR of 41.70% during 2025-2033, reaching a volume of 6,637.31 MWh by 2033.

Key factors driving the India energy storage market include increasing energy demand, the shift toward renewable energy integration, government support through favorable policies and incentives, the need for grid stability, and the growing adoption of electric vehicles (EVs) that require efficient energy storage infrastructure.

Battery energy storage system (BESS) holds a share of 63.8% as it has an important function in improving grid stability by acting as backup power during peak demand or grid disruption.

The utility scale dominates the market with 54.3% of the market share as it buffers excess power during off-peak hours, when output exceeds usage, and delivers it during peak usage times when the grid needs more power.

South India represents the biggest segment owing to the increasing energy demand and the region’s push toward renewable energy integration. It is also home to some of the country’s largest renewable energy projects, particularly in solar and wind power, which is driving the need for energy storage systems (ESS) to ensure grid stability and optimize energy usage.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)