India Enterprise Asset Leasing Market Size, Share, Trends, and Forecast by Asset Type, Leasing Type, Enterprise Size, Industry Vertical, and Region, 2026-2034

India Enterprise Asset Leasing Market Overview:

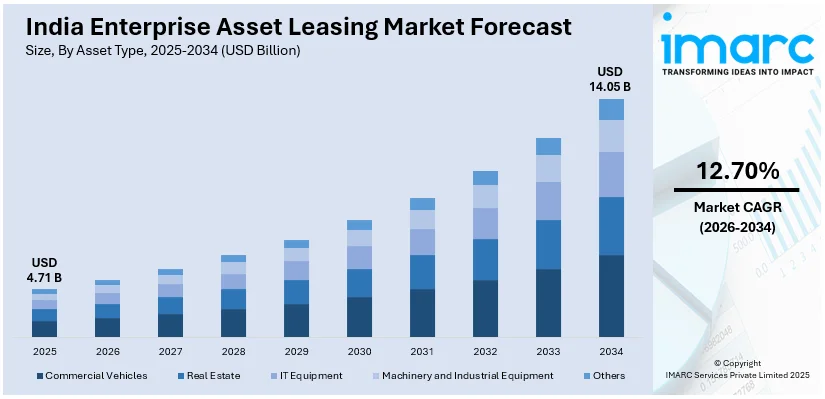

The India enterprise asset leasing market size reached USD 4.71 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 14.05 Billion by 2034, exhibiting a growth rate (CAGR) of 12.70% during 2026-2034. The market is experiencing robust growth, fueled by the increasing need for efficient asset utilization across industries. Additionally, the widespread adoption of advanced technologies such as IoT, AI, and cloud-based solutions is driving the demand for integrated asset management systems, improving operational efficiency and reducing maintenance costs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.71 Billion |

| Market Forecast in 2034 | USD 14.05 Billion |

| Market Growth Rate 2026-2034 | 12.70% |

India Enterprise Asset Leasing Market Trends:

Shift Towards Cloud-Based Enterprise Asset Management

Indian enterprises are increasingly adopting cloud-based Enterprise Asset Management (EAM) solutions due to their scalability, cost-effectiveness, and seamless integration with existing business systems. For instance, in November 2024, the Reserve Bank of India (RBI) announced plans to launch a pilot programme in 2025 to provide affordable local cloud storage for financial firms, aiming to reduce dependence on global providers like AWS, Microsoft Azure, Google Cloud, and IBM Cloud. Cloud platforms provide instant access to asset information, allowing organizations to maximize maintenance, minimize downtime, and enhance operational effectiveness. Small and medium-sized businesses (SMEs) are most benefiting from such solutions since they eliminate with the requirement for costly IT infrastructure. Cloud-based EAM systems also facilitate remote monitoring of assets, an essential aspect for organizations with operations across various locations. The support for Enterprise Resource Planning (ERP) and Internet of Things (IoT) system integration extends data accuracy and decision-making power. Additionally, as digitalization speeds up in industries, asset management adoption of the cloud will increase, allowing companies to improve efficiency while realizing long-term cost savings.

To get more information on this market, Request Sample

Increasing Focus on Compliance and Sustainability

Regulatory compliance and sustainability have become priorities in India’s enterprise asset management landscape. For instance, in December 2024, the Securities and Exchange Board of India (SEBI) announced the launch of a new asset class for high-risk investors, allowing asset management companies to offer strategies like long-short equity with a minimum investment of 1 million rupees. This initiative aims to provide exposure to equity derivatives, positioned between mutual funds and portfolio services. Additionally, stricter environmental regulations and corporate governance policies are driving businesses to implement EAM systems that ensure adherence to safety, emissions, and waste management standards. Moreover, organizations are focusing on sustainable asset lifecycle management, optimizing energy use, and reducing carbon footprints. Advanced EAM solutions help track compliance with government-mandated guidelines while offering detailed reporting and audit capabilities. This trend is also influencing procurement decisions, with businesses favoring environmentally friendly equipment and materials. Furthermore, by integrating compliance and sustainability into asset management, enterprises not only reduce operational risks but also enhance brand reputation and competitiveness in both domestic and international markets.

India Enterprise Asset Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on asset type, leasing type, enterprise size, and industry vertical.

Asset Type Insights:

- Commercial Vehicles

- Real Estate

- IT Equipment

- Machinery and Industrial Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the asset type. This includes commercial vehicles, real estate, IT equipment, machinery and industrial equipment, and others.

Leasing Type Insights:

- Operating Lease

- Financial Lease

A detailed breakup and analysis of the market based on the leasing type have also been provided in the report. This includes operating lease and financial lease.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

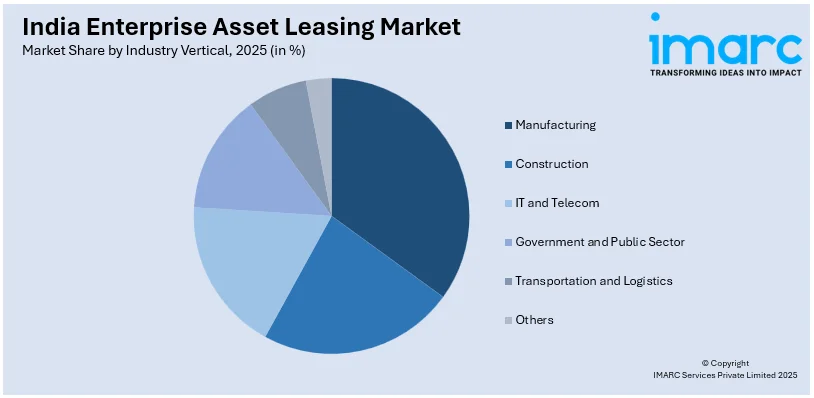

Industry Vertical Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Manufacturing

- Construction

- IT and Telecom

- Government and Public Sector

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes manufacturing, construction, IT and telecom, government and public sector, transportation and logistics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Enterprise Asset Leasing Market News:

- In September 2024, Brookfield-backed Data Infrastructure Trust announced raising USD 941 Million through rupee bonds to fund its USD 2.5 Billion acquisition of ATC’s India operations. The bonds, maturing in 2029, offer a 9.99% interest rate, with anchor investors including Deutsche Bank, DBS Bank, and JP Morgan.

- In October 2024, Jio Financial Services, in partnership with BlackRock, announced that they received SEBI’s in-principle approval to establish a mutual fund in India. This joint venture involves a USD 150 Million investment each, aiming to expand affordable and innovative investment solutions.

India Enterprise Asset Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Asset Types Covered | Commercial Vehicles, Real Estate, IT Equipment, Machinery and Industrial Equipment, Others |

| Leasing Types Covered | Operating Lease, Financial Lease |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | Manufacturing, Construction, IT and Telecom, Government and Public Sector, Transportation and Logistics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India enterprise asset leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the India enterprise asset leasing market on the basis of asset type?

- What is the breakup of the India enterprise asset leasing market on the basis of leasing type?

- What is the breakup of the India enterprise asset leasing market on the basis of enterprise size?

- What is the breakup of the India enterprise asset leasing market on the basis of industry vertical?

- What is the breakup of the India enterprise asset leasing market on the basis of region?

- What are the various stages in the value chain of the India enterprise asset leasing market?

- What are the key driving factors and challenges in the India enterprise asset leasing?

- What is the structure of the India enterprise asset leasing market and who are the key players?

- What is the degree of competition in the India enterprise asset leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India enterprise asset leasing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India enterprise asset leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India enterprise asset leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)