India Enterprise Mobility Management Market Size, Share, Trends and Forecast by Solution, Deployment, Enterprise Size, Vertical, and Region, 2025-2033

India Enterprise Mobility Management Market Overview:

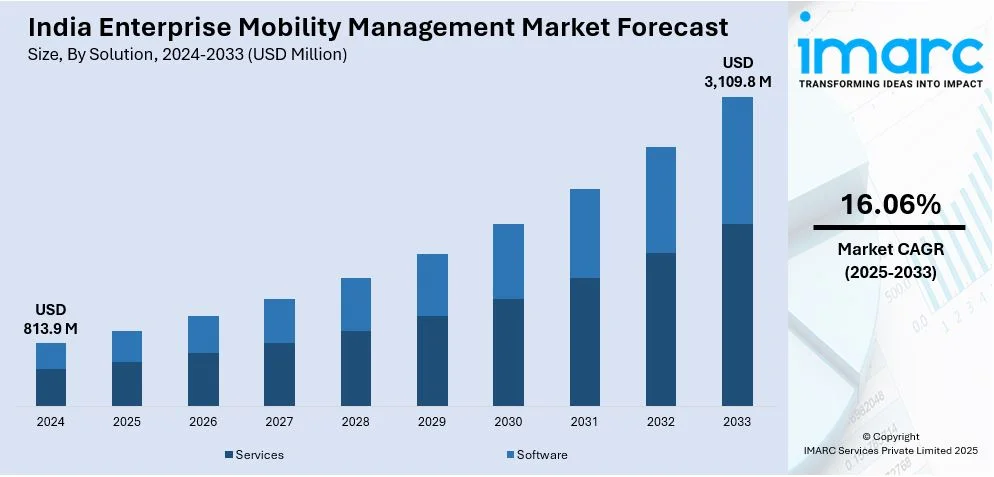

The India enterprise mobility management market size reached USD 813.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,109.8 Million by 2033, exhibiting a growth rate (CAGR) of 16.06% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of unified endpoint management solutions and the rising demand for AI-driven security and compliance solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 813.9 Million |

| Market Forecast in 2033 | USD 3,109.8 Million |

| Market Growth Rate 2025-2033 | 16.06% |

India Enterprise Mobility Management Market Trends:

Increased Adoption of Unified Endpoint Management (UEM) Solutions

The India enterprise mobility management (EMM) market is significantly tilted toward a more unified management of devices, applications, and security with organizations now moving toward UEM solutions. Given the fact that the workforce is becoming increasingly mobile and opens up remote work models, centralization of assets will soon become the priority of enterprises in order to manage, secure, and control corporate assets. UEM solutions, which merge mobile device management (MDM), mobile application management (MAM), and endpoint security, allow enterprises to enforce compliance policies, monitor device health, and mitigate risk all in one interface. For instance, in September 2024, Hexnode announced its partnership with Inflow Technologies to expand its Unified Endpoint Management (UEM) solutions in India, enhancing Inflow’s product portfolio and increasing Hexnode’s accessibility for businesses across the country. The widespread adoption of bring-your-own-device (BYOD) policies further drives the need for UEM platforms, as businesses require secure access controls and real-time threat detection mechanisms. Major vendors in the Indian market, including Microsoft, VMware, and IBM, are expanding their UEM offerings with advanced automation, artificial intelligence-driven analytics, and zero-trust security models. Additionally, the demand for cloud-based EMM solutions is rising, enabling organizations to manage endpoints remotely without extensive on-premise infrastructure. The integration of UEM with identity and access management (IAM) solutions also enhances enterprise security by providing seamless authentication and role-based access controls. As cybersecurity threats become more sophisticated, Indian enterprises are investing heavily in UEM platforms to ensure regulatory compliance, mitigate risks, and enhance operational efficiency in mobile-first work environments.

To get more information on this market, Request Sample

Rising Demand for AI-Driven Security and Compliance Solutions

The rapid digital transformation of Indian enterprises has elevated the need for robust security frameworks within enterprise mobility management. With the rising adoption of mobile applications, cloud-based storage, and remote collaboration tools, businesses are increasingly turning to artificial intelligence (AI)-driven security solutions to mitigate risks and ensure regulatory compliance. With the aid of AI, EMM solutions enhance threat detection by incessantly monitoring user behavior, the flow of network traffic, and endpoint vulnerabilities. This anomaly detection is performed by machine learning algorithms in determining real-time breaches and incipient opportunities for threat mitigation. The adoption of AI-driven security frameworks is particularly prominent in industries such as banking, financial services, and healthcare, where data confidentiality and regulatory compliance are paramount. Indian enterprises are also leveraging AI for automated policy enforcement, ensuring that employees adhere to cybersecurity protocols without manual intervention. For instance, as per industry reports, in March 2025, Indian CISOs must embrace collaborative risk management for AI security, as end-user spending on information security in India is projected to reach $3.3 billion, a 16.4% increase from 2024. The integration of AI with mobile threat defense (MTD) solutions provides additional security layers, detecting malicious applications, unauthorized access attempts, and phishing attacks. Additionally, compliance with data protection laws such as the Digital Personal Data Protection Act (DPDPA) of India is driving enterprises to implement AI-based compliance monitoring systems that track policy adherence across all mobile endpoints. As cyber threats evolve, AI-driven security solutions are becoming a critical component of enterprise mobility strategies, ensuring resilience against data breaches while maintaining regulatory compliance

India Enterprise Mobility Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on solution, deployment, enterprise size, and vertical.

Solution Insights:

- Services

- Software

The report has provided a detailed breakup and analysis of the market based on the solution. This includes services and software.

Deployment Insights:

- Cloud

- On-premises

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud and on-premises.

Enterprise Size Insights:

- Small and Medium-Sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

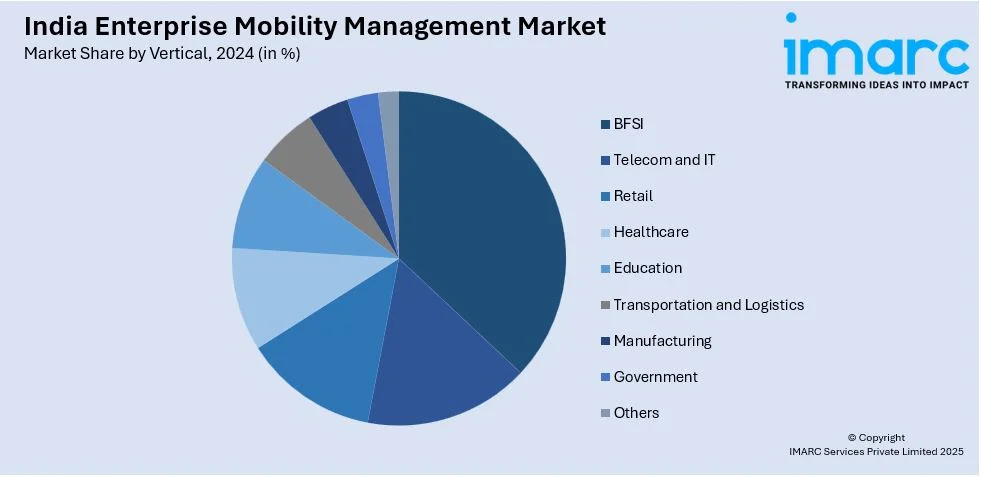

Vertical Insights:

- BFSI

- Telecom and IT

- Retail

- Healthcare

- Education

- Transportation and Logistics

- Manufacturing

- Government

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, telecom and IT, retail, healthcare, education, transportation and logistics, manufacturing, government, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Enterprise Mobility Management Market News:

- In September 2024, SEBI's new cybersecurity guidelines mandate offline, encrypted data backups with regular testing for integrity and security. Businesses now require a unified enterprise mobility solution for secure device management, application development, analytics, and IoT management. ETCIO, iValue Group, and SOTI invite discussions on enterprise mobility in light of these regulations.

India Enterprise Mobility Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Services, Software |

| Deployments Covered | Cloud, On-premises |

| Enterprise Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Telecom and IT, Retail, Healthcare, Education, Transportation and Logistics, Manufacturing, Government, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India enterprise mobility management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India enterprise mobility management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India enterprise mobility management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in India was valued at USD 813.9 Million in 2024.

The India enterprise mobility management market is projected to exhibit a CAGR of 16.06% during 2025-2033, reaching a value of USD 3,109.8 Million by 2033.

The growing adoption of unified endpoint management solutions, increased demand for cloud-based and AI-driven security platforms, and the rise of mobile-first work environments with BYOD policies are fueling market growth. Enhanced threat detection, zero-trust security models, and regulatory compliance needs also boost EMM investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)