India Enterprise Network LAN Equipment Market Size, Share, Trends and Forecast by Component, Technologies, End Users, and Region, 2026-2034

India Enterprise Network LAN Equipment Market Size and Share:

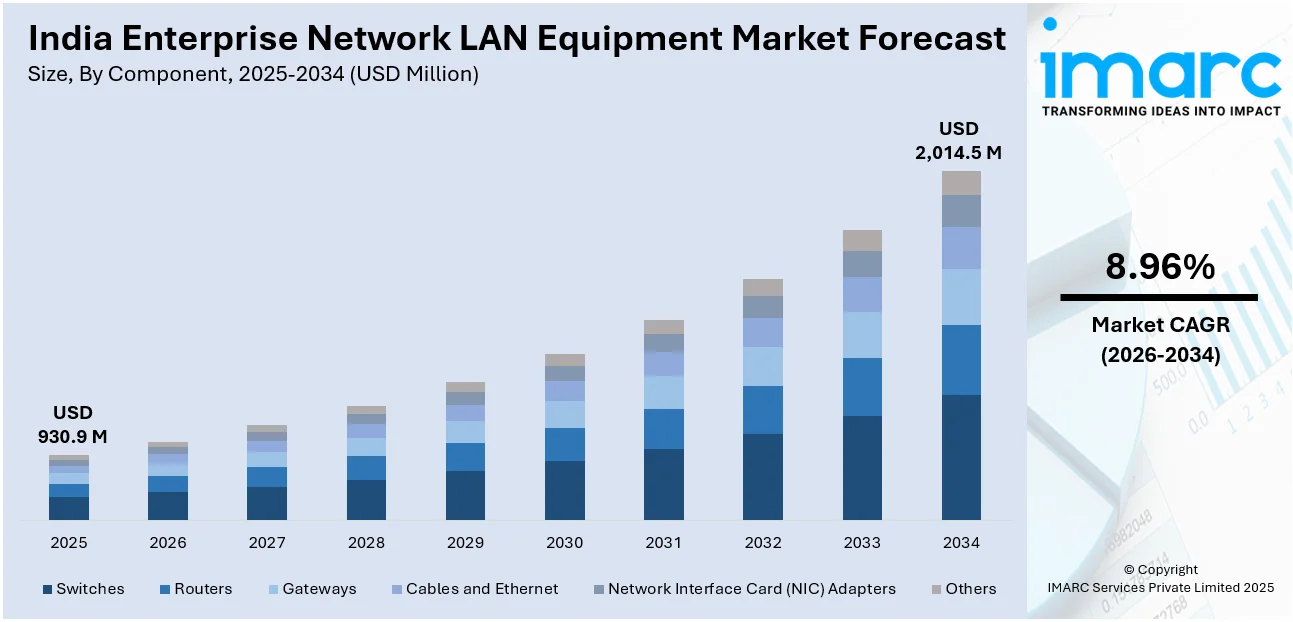

The India enterprise network LAN equipment market size reached USD 930.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,014.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.96% during 2026-2034. The India enterprise network LAN equipment market share is expanding, driven by the growing expenditure on advanced wireless-fidelity (Wi-Fi)-enabled solutions that can handle high network traffic efficiently, along with the increasing reliance on cloud services for storage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 930.9 Million |

| Market Forecast in 2034 | USD 2,014.5 Million |

| Market Growth Rate 2026-2034 | 8.96% |

India Enterprise Network LAN Equipment Market Trends:

Rise in hybrid and remote work arrangements

An increase in hybrid and remote work models is impelling the India enterprise network LAN equipment market growth. As per industry reports, in July 2024, among roughly 110,000 job listings in the information technology (IT) industry in India, 42,000 positions were either hybrid or remote. Companies that have people working from several locations require reliable and secure network infrastructure to provide smooth connectivity. Enterprises are upgrading their LAN equipment to support high-speed data transfer, low latency, and better security to accommodate remote access to corporate networks. As video conferencing and virtual collaboration tools have become essential for daily operations, businesses are investing in advanced routers, switches, and Wi-Fi 6-enabled solutions to handle increased network traffic efficiently. IT teams are also focusing on enhancing network security to prevent cyber threats and unauthorized access to sensitive data. With a hybrid work environment becoming the norm, companies are setting up flexible networking solutions that offer smooth connectivity both in-office and remotely. Industries, such as BFSI, education, and e-commerce, are especially wagering on enterprise network LAN solutions to maintain productivity and operational effectiveness.

To get more information on this market Request Sample

Increasing utilization of cloud computing

The rising adoption of cloud computing is offering a favorable India enterprise network LAN equipment market outlook. Companies of all sizes are shifting their workloads to cloud platforms, requiring faster, more secure, and high-capacity networking solutions to support seamless connectivity. As cloud computing grows, enterprises need advanced LAN infrastructure to handle large amounts of data traffic efficiently, minimize latency, and ensure uninterrupted access to applications. LAN equipment is becoming essential to support cloud-driven operations. The demand for gigabit Ethernet solutions is also increasing, as organizations prioritize higher bandwidth and low-latency networks. Additionally, cloud-based applications require robust network security, encouraging enterprises to wager on LAN solutions with advanced security features to protect sensitive data. The thriving sectors like banking and manufacturing are further promoting the usage of enterprise LAN equipment, as these industries heavily depend on cloud-based tools for daily tasks. As more businesses employ digital transformation and cloud computing services, the need for high-performance enterprise network LAN equipment continues to rise, making it a key driver of the market. According to the IMARC Group, the India cloud computing market is set to attain USD 232.78 Billion by 2033, showing a growth rate (CAGR) of 25.80% during 2025-2033.

India Enterprise Network LAN Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on component, technologies, and end users.

Component Insights:

- Switches

- Routers

- Gateways

- Cables and Ethernet

- Network Interface Card (NIC) Adapters

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes switches, routers, gateways, cables and ethernet, network interface card (NIC) adapters, and others.

Technologies Insights:

- Token Ring

- Fiber Distributed Data Interface

- ARCNET

- Ethernet

- Wireless LAN

A detailed breakup and analysis of the market based on the technologies have also been provided in the report. This includes token ring, fiber distributed data interface, ARCNET, ethernet, and wireless LAN.

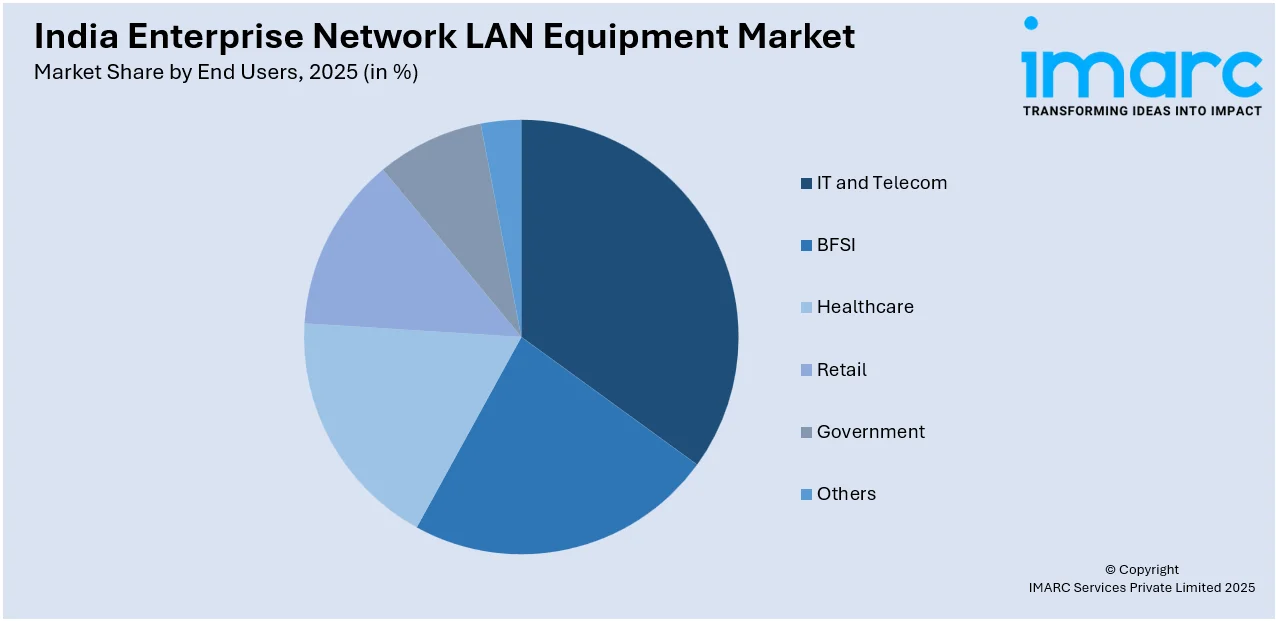

End Users Insights:

Access the Comprehensive Market Breakdown Request Sample

- IT and Telecom

- BFSI

- Healthcare

- Retail

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the end users. This includes IT and telecom, BFSI, healthcare, retail, government, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Enterprise Network LAN Equipment Market News:

- In September 2024, Airtel Business teamed up with Cisco Meraki India Region to introduce the Airtel Software-Defined (SD) Branch, which was an easy, secure, cloud-oriented fully managed network solution for businesses in India. It aimed to allow the cohesive management of networks spanning LAN, WAN, security, and connectivity across various branch locations, assisting enterprises in streamlining their network management, improving application performance, and offering increased flexibility and oversight of the complete branch network infrastructure.

India Enterprise Network LAN Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Switches, Routers, Gateways, Cables and Ethernet, Network Interface Card (NIC) Adapters, Others |

| Technologies Covered | Token Ring, Fiber Distributed Data Interface, ARCNET, Ethernet, Wireless LAN |

| End Users Covered | IT and Telecom, BFSI, Healthcare, Retail, Government, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India enterprise network LAN equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India enterprise network LAN equipment market on the basis of component?

- What is the breakup of the India enterprise network LAN equipment market on the basis of technologies?

- What is the breakup of the India enterprise network LAN equipment market on the basis of end users?

- What is the breakup of the India enterprise network LAN equipment market on the basis of region?

- What are the various stages in the value chain of the India enterprise network LAN equipment market?

- What are the key driving factors and challenges in the India enterprise network LAN equipment market?

- What is the structure of the India enterprise network LAN equipment market and who are the key players?

- What is the degree of competition in the India enterprise network LAN equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India enterprise network LAN equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India enterprise network LAN equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India enterprise network LAN equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)