India Ethnic Foods Market Size, Share, Trends and Forecast by Cuisine Type, Food Type, Distribution Channel, and Region, 2025-2033

India Ethnic Foods Market Overview:

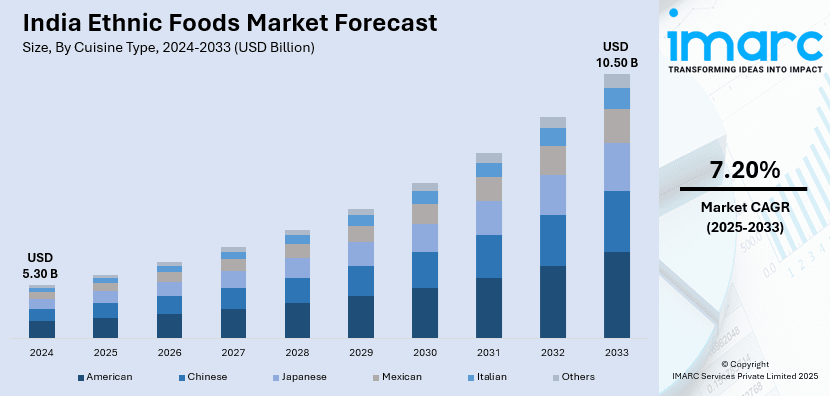

The India ethnic foods market size reached USD 5.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.50 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. Rising consumer preference for authentic regional flavors, increasing disposable incomes, rapid urbanization, expanding quick-service restaurant chains, growing demand for convenience foods, influence of social media on food trends, availability of packaged ethnic foods, and the expansion of e-commerce platforms are expanding the India ethnic foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.30 Billion |

| Market Forecast in 2033 | USD 10.50 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

India Ethnic Foods Market Trends:

Growing Demand for Authentic and Regional Flavors

The India ethnic foods market growth is driven by the increase in demand for authentic and region-specific cuisines, driven by increasing consumer preference for traditional flavors. With a growing number of Indians exploring diverse culinary experiences, brands are offering ready-to-eat and frozen ethnic foods representing various regional delicacies. Urbanization, rising disposable incomes, and exposure to global food trends further fuel this shift. Notably, according to a research published on February 11, 2025, there would be 600 million people living in metropolitan regions in India, and these places will account for 75% of the country's GDP by 2036. Additionally, the health-conscious population is seeking organic and preservative-free ethnic food options, promoting clean-label products. The market is also benefiting from e-commerce expansion, making regional and niche ethnic food products more accessible to a wider consumer base.

To get more information on this market, Request Sample

Expansion of Ethnic Food Chains and Packaged Food Offerings

The expansion of ethnic food restaurant chains and packaged food brands is transforming India's ethnic foods market. For instance, the Indian restaurant and confectionery franchise Bansooriwala's announced on February 29, 2024, that it will invest INR 8 Crore to open four more stores in the Delhi-NCR area within the year. The company hopes to quadruple its footprint from four to eight locations. In the upcoming months, the first new location on the Delhi-Mumbai expressway is expected to open. Increasing investments in Quick Service Restaurants (QSRs) specializing in regional cuisines, such as South Indian, Northeastern, and Rajasthani foods, are driving the market growth. Packaged ethnic food products, including pickles, spice mixes, and ready-to-cook meals, are gaining traction among busy urban consumers. Additionally, food delivery platforms and online grocery stores are boosting the availability of ethnic food options. With rising demand for convenience, companies are introducing frozen and heat-and-eat ethnic meals, catering to both domestic and international markets while ensuring authenticity, which in turn is positively impacting India ethnic foods market outlook.

India Ethnic Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on cuisine type, food type, and distribution channel.

Cuisine Type Insights:

- American

- Chinese

- Japanese

- Mexican

- Italian

- Others

The report has provided a detailed breakup and analysis of the market based on the cuisine type. This includes American, Chinese, Japanese, Mexican, Italian, and others.

Food Type Insights:

- Vegetarian

- Non-Vegetarian

A detailed breakup and analysis of the market based on the food type have also been provided in the report. This includes vegetarian and non-vegetarian.

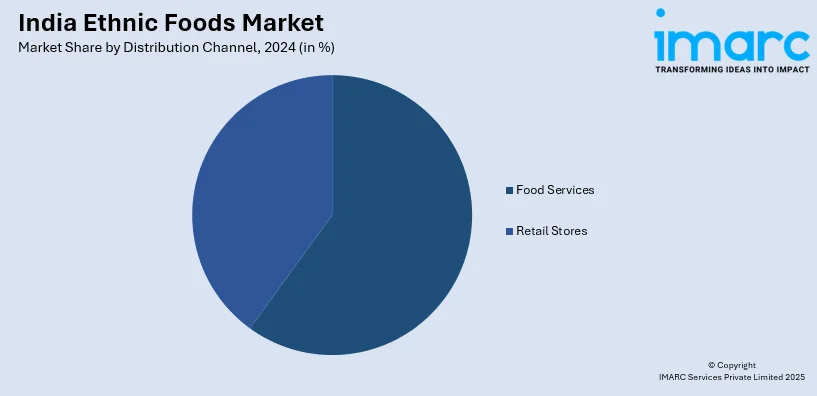

Distribution Channel Insights:

- Food Services

- Retail Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes food services and retail stores.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ethnic Foods Market News:

- On October 14, 2024, the Wendy's Company announced that Rebel Foods, the largest online restaurant brand in the world and the master franchise holder for Wendy's in India, has launched its 160th Wendy's restaurant at Bengaluru's BTM Layout. Rebel Foods' quick expansion plan is seen in the record 36-month time it took to reach this milestone. Although sustainability measures were not specifically mentioned in the release, the quick expansion of Wendy's locations under Rebel Foods' leadership would offer chances to integrate sustainable practices into operations going forward.

- On September 13, 2024, Una Villa Traditional increased its footprint by establishing a second location in Indira Nagar, Adyar, Chennai. This restaurant serves traditional South Indian food with the goal of giving its customers real gastronomic experiences.

India Ethnic Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cuisine Types Covered | American, Chinese, Japanese, Mexican, Italian, Others |

| Food Types Covered | Vegetarian, Non-Vegetarian |

| Distribution Channels Covered | Food Services, Retail Stores |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ethnic foods market performed so far and how will it perform in the coming years?

- What is the breakup of the India ethnic foods market on the basis of cuisine type?

- What is the breakup of the India ethnic foods market on the basis of food type?

- What is the breakup of the India ethnic foods market on the basis of distribution channel?

- What is the breakup of the India ethnic foods market on the basis of region?

- What are the various stages in the value chain of the India ethnic foods market?

- What are the key driving factors and challenges in the India ethnic foods?

- What is the structure of the India ethnic foods market and who are the key players?

- What is the degree of competition in the India ethnic foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ethnic foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ethnic foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ethnic foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)