India Expansion Joints Market Size, Share, Trends and Forecast by Product Type, Material Type, Application, End-Use, and Region, 2025-2033

India Expansion Joints Market Overview:

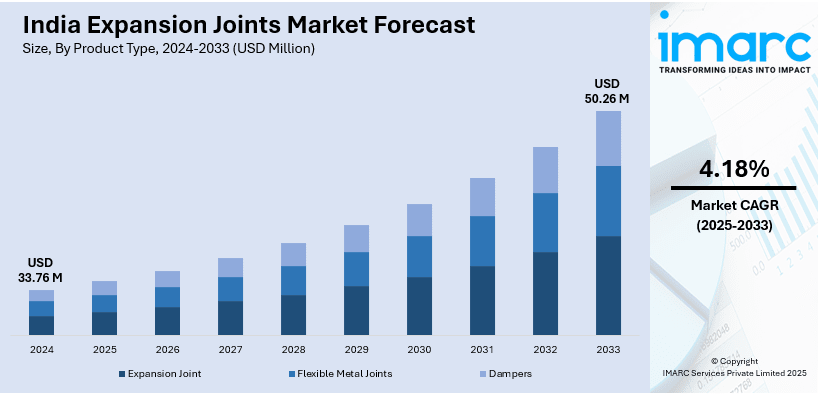

The India expansion joints market size reached USD 33.76 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 50.26 Million by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. Rising infrastructure investment, including highways and metro projects, is influencing India expansion joints market share. Besides this, rapid urbanization and smart city initiatives are driving usage in buildings, drainage, and transport networks. Along with this, the growing industrialization and power projects further catalyzes the demand for durable, high-performance expansion joints.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 33.76 Million |

| Market Forecast in 2033 | USD 50.26 Million |

| Market Growth Rate (2025-2033) | 4.18% |

India Expansion Joints Market Trends:

Rising Investment in Infrastructure Development

Increasing investments in infrastructure development is significantly influencing the market outlook. The government is heavily investing in highways, bridges, and metro projects, increasing the need for durable expansion joints. India’s National Highway (NH) network expanded from 65,569 km in 2004 to 91,287 km in 2014 and 146,145 km in 2024, highlighting rapid infrastructure growth. Expanding transportation networks require high-performance expansion joints to handle thermal movements and structural shifts efficiently. Rapid urbanization is leading to large-scale residential and commercial construction, further fueling India expansion joints market growth. Smart city initiatives are catalyzing the demand for advanced expansion joints in water supply and drainage systems. Expansion joints are essential in flyovers and tunnels to absorb vibrations and prevent structural damage. The growing investments in airports and railway networks are further influencing the adoption of expansion joints. Industrial zones and manufacturing hubs require expansion joints for pipelines, machinery, and heating, ventilation, and air conditioning (HVAC) systems. Power plants, including renewable energy projects, are using expansion joints to manage heat-induced structural changes. Rising infrastructure spending is increasing retrofitting and maintenance activities, supporting market expansion.

To get more information on this market, Request Sample

Rising Urbanization and Smart City Initiatives

Rapid population growth and increasing urbanization are driving residential and commercial construction, fueling expansion joint demand. As per the Economic Survey 2023-24, more than 40% of India’s population is expected to reside in urban localities by the year 2030, accelerating infrastructure development. Expanding urban infrastructure requires durable expansion joints to accommodate thermal movements and structural shifts. Government-led smart city projects are enhancing transportation, water supply, and sanitation systems, increasing expansion joint usage. Modern drainage and sewage systems need high-performance expansion joints for effective water flow and structural stability. Increasing high-rise constructions and commercial complexes are fueling the demand for expansion joints in HVAC and piping systems. Expansion joints are essential in flyovers, metro projects, and bridges to manage vibrations and prevent structural damage. Smart roads and highways require expansion joints for long-term durability and improved load-bearing capacity. Technological advancements in expansion joint materials are ensuring better performance in urban infrastructure projects. Sustainable construction practices in smart cities are increasing the adoption of eco-friendly and long-lasting expansion joints. Government investments in urban mobility projects are further influencing the India expansion joints market outlook. With rapid urbanization and smart city initiatives expanding, the demand for advanced expansion joints continues to grow steadily.

India Expansion Joints Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, material type, application, and end-use.

Product Type Insights:

- Expansion Joint

- Flexible Metal Joints

- Dampers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes expansion joint, flexible metal joints, and dampers.

Material Type Insights:

- Metallic Type

- Stainless Steel

- Nickel Alloy

- Others

- Non-Metallic Type

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes metallic type (stainless steel, nickel alloy, and others) and non-metallic type.

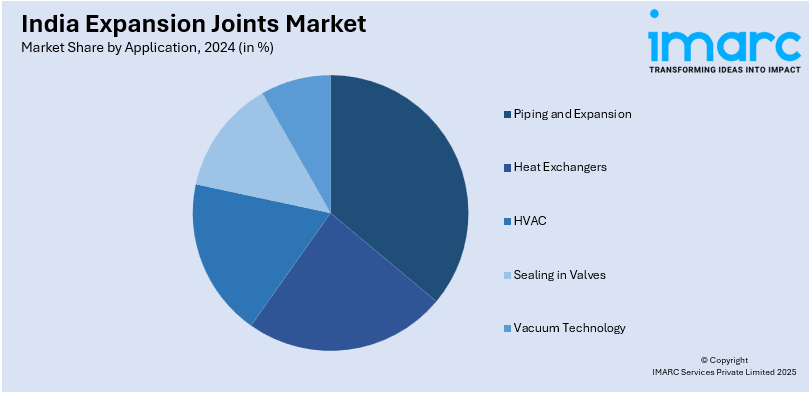

Application Insights:

- Piping and Expansion

- Heat Exchangers

- HVAC

- Sealing in Valves

- Vacuum Technology

The report has provided a detailed breakup and analysis of the market based on the application. This includes piping and expansion, heat exchangers, HVAC, sealing in valves, and vacuum technology.

End-Use Insights:

- Petrochemical and Refinery

- Power Generation

- Oil and Gas

- Metal Production

- Cement Industry

- Chemical Processing

- Industrial Gases

- Railway Industry

- Electrical Industry

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes petrochemical and refinery, power generation, oil and gas, metal production, cement industry, chemical processing, industrial gases, railway industry, electrical industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Expansion Joints Market News:

- In February 2025, two lanes of Dwarka Expressway near Bajghera exit are closed for expansion joint repairs, with National Highways Authority of India (NHAI) overseeing the work. The repairs, expected to be completed in a week, highlight the ongoing demand for expansion joints in India's infrastructure sector and the importance of regular maintenance to ensure road safety and durability.

- In September 2024, the Kolkata Metropolitan Development Authority (KMDA) announced to replace 12 damaged expansion joints on the Samprity Flyover to ensure structural safety. The project, funded by the state urban development department, involves night closures for three months. Tenders have been issued, highlighting ongoing demand in India’s expansion joints market for infrastructure maintenance and upgrades.

India Expansion Joints Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Expansion Joint, Flexible Metal Joints, Dampers |

| Material Types Covered |

|

| Applications Covered | Piping and Expansion, Heat Exchangers, HVAC, Sealing in Valves, Vacuum Technology |

| End-Uses Covered | Petrochemical and Refinery, Power Generation, Oil and Gas, Metal Production, Cement Industry, Chemical Processing, Industrial Gases, Railway Industry, Electrical Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India expansion joints market performed so far and how will it perform in the coming years?

- What is the breakup of the India expansion joints market on the basis of product type?

- What is the breakup of the India expansion joints market on the basis of material type?

- What is the breakup of the India expansion joints market on the basis of application?

- What is the breakup of the India expansion joints market on the basis of end-use?

- What is the breakup of the India expansion joints market on the basis of region?

- What are the various stages in the value chain of the India expansion joints market?

- What are the key driving factors and challenges in the India expansion joints market?

- What is the structure of the India expansion joints market and who are the key players?

- What is the degree of competition in the India expansion joints market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India expansion joints market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India expansion joints market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India expansion joints industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)