India Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2025-2033

India Family Offices Market Overview:

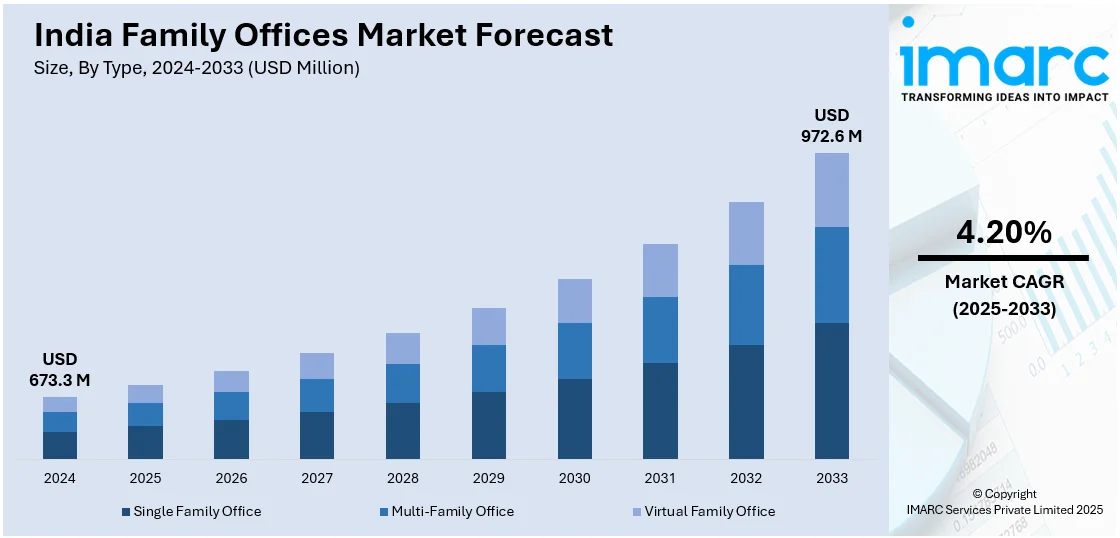

The India family offices market size reached USD 673.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 972.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The growth of the market is fueled by rising UHNW wealth, increasing financial sophistication, and the need for diversified portfolios. Regulatory reforms, global investment opportunities, and succession planning demands are also augmenting the India family office market share. Additionally, tech-driven solutions and professionalization trends are transforming traditional wealth management into structured, institutional-grade frameworks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 673.3 Million |

| Market Forecast in 2033 | USD 972.6 Million |

| Market Growth Rate 2025-2033 | 4.20% |

India Family Offices Market Trends:

Increasing Diversification into Alternative Investments

The significant shift toward alternative investments, driven by the need for higher returns and portfolio diversification is majorly driving the India family offices market growth. Traditionally, family offices in India favored equities, real estate, and fixed-income instruments. However, with rising market volatility and lower yields in conventional assets, ultra-high-net-worth families are increasingly allocating capital to private equity, venture capital, hedge funds, and structured credit. According to industry reports, numerous Indian family offices now invest in startups and unlisted companies, particularly in tech, healthcare, and fintech sectors. In 2024, India's startup ecosystem grew tremendously, achieving over 128,000 startups, which created 1.3 million jobs and drew more than 5,000 angel investors and more than 1,400 venture capital firms. There is a growing interest in family offices. The country has over 110 unicorns and had USD 6.6 Billion in exits in 2023, of which almost half this activity took place in tier 2 and tier 3 cities. This growth is largely attributed to government-backed funds such as the USD 1.4 Billion Fund of Funds for Startups (FFS) and the USD 115 Million Startup India Seed Fund Scheme (SISFS), as well as family offices, which have shifted their focus to sectors such as deep tech, artificial intelligence and healthcare for impactful investments. Additionally, there is growing interest in global alternative assets, including international real estate and private debt, to mitigate domestic risks. This trend reflects a broader global movement among family offices seeking alpha generation while balancing risk through sophisticated asset allocation strategies.

To get more information on this market, Request Sample

Adoption of Technology and Digital Asset Investments

Indian family offices are increasingly integrating advanced technologies including AI and blockchain into their operations for enhanced portfolio tracking, risk assessment, and data-driven decision-making. Simultaneously, many are cautiously exploring digital assets including cryptocurrencies, NFTs, and tokenized real estate despite regulatory ambiguity. On 30th July 2024, Reserve Bank of India (RBI) highlighted the introduction of eRupee Central Bank Digital Currency (CBDC) for enabling cross-border transactions in order to strengthen India's standing around the world and reshape the global office of the financial world in favor of the country, noting that eRupee can benefit digital trade regulations. Currently, in an advanced testing phase, the blockchain-linked rupee has garnered participation from 5 million users and 420,000 merchants. This step aligns with the growth in India's fintech sector and aims to ensure data security as well as facilitate growth in developing the digital skill set. Therefore, this is also creating a positive India family offices market outlook. While direct crypto exposure remains limited, some family offices are investing in blockchain startups, crypto funds, and Web3 infrastructure projects through venture capital routes. This trend reflects a generational shift, with next-gen leaders driving digital adoption while balancing innovation with risk management. As institutional interest in digital assets grows globally, Indian family offices are gradually diversifying into this emerging asset class, though with measured allocations due to volatility and changing regulations. The focus remains on long-term potential rather than speculative gains.

India Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

Office Type Insights:

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

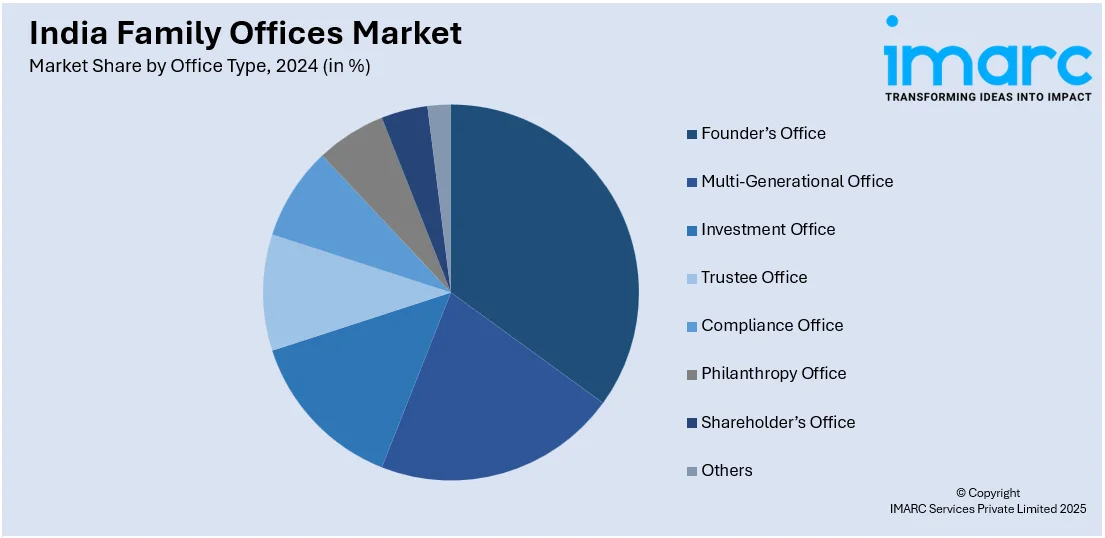

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes founder’s office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equalities

- Alternatives Investments

- Commodities

- Cash or Cash Equivalents

The report has provided a detailed breakup and analysis of the market based on the asset class. This includes bonds, equalities, alternatives investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Family Offices Market News:

- May 26, 2024: Venturi Partners announced establishing a fund ranging from USD 75 to USD 100 Million, specifically aimed at family offices in India. The objective is to invest in 8 to 10 growth-stage companies within the consumer sector, with individual investments between USD 25 and USD 50 Million. This new fund will adopt a co-investment model similar to that of its USD 180 Million Asia fund, focusing on a concentrated strategy that involves making 2 to 3 investments each year. With 60 to 65% of its primary fund already allocated to India, Venturi identifies increasing consumption, health, and premiumization as significant investment opportunities for Indian families.

India Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founder’s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equalities, Alternatives Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India family offices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The family offices market in India was valued at USD 673.3 Million in 2024.

The India family offices market is projected to exhibit a CAGR of 4.20% during 2025-2033, reaching a value of USD 972.6 Million by 2033.

India’s family offices market is expanding rapidly due to rising ultra-high-net-worth individuals, a massive intergenerational wealth transfer, growing interest in alternative assets, and supportive regulatory frameworks like GIFT City, encouraging structured wealth management and global investment by affluent families.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)