India Fire Resistant Clothing Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Application, End User, and Region, 2025-2033

India Fire Resistant Clothing Market Overview:

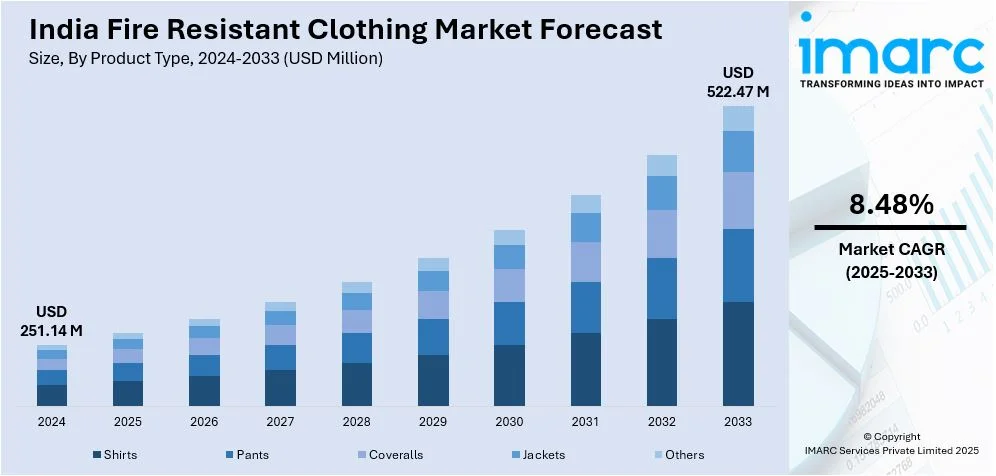

The India fire resistant clothing market size reached USD 251.14 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 522.47 Million by 2033, exhibiting a growth rate (CAGR) of 8.48% during 2025-2033. The market is driven by rising workplace safety regulations, rapid industrialization, growing product application in construction, oil and gas, and manufacturing sectors, and heightened awareness about personal protective equipment (PPE). Advancements in flame-retardant fabric technology and demand for high-performance safety gear also fuel India fire-resistant clothing market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 251.14 Million |

| Market Forecast in 2033 | USD 522.47 Million |

| Market Growth Rate 2025-2033 | 8.48% |

India Fire Resistant Clothing Market Trends:

Advancements in Fire-Resistant Fabric Technology

The development of fire-retardant materials through innovation has produced lightweight and durable, and breathable FRC fabrics. Companies are currently investing their resources in aramid fibers and treated cotton, as well as inherent fire-resistant materials, to achieve better worker safety and comfort. The demand for multi-functional clothing that offers fire resistance, chemical protection, and anti-static properties is also increasing, fueling the India fire-resistant clothing market share. For instance, in August 2024, Retter Workwear announced the launch of a new collection of fire-resistant clothing, including the Fire-Retardant Boiler Suit and Work Suit, aimed at enhancing safety for professionals in hazardous environments. These garments combine advanced fire-resistant materials and innovative design to ensure maximum protection, comfort, and durability in high-risk industries.

To get more information on this market, Request Sample

Growth in Industrialization and High-Risk Sectors

The fast-growing oil & gas, as well as power generation and chemicals, and construction sectors drive the increasing demand for fire-resistant protective clothing. Laborers operating in high-risk areas require flame-retardant (FR) clothing to safeguard themselves from exposure to flames sparks as well as heat. The Indian Make in India initiative and expanding manufacturing together with increasing infrastructure projects have made industrial safety requirements stricter, thus promoting the adoption of fire-resistant protective uniforms and coveralls and safety gear. For instance, in June 2023, Birla Cellulose, a part of the Aditya Birla Group and unit of Grasim Industries Limited, announced the launch of its innovative Birla SaFR, a phosphate-based sustainable flame-retardant fiber, at ITMA in Milan. Developed indigenously, this new fiber enhances safety in technical textiles and meets high protection standards. It’s suitable for industries like defense, oil and gas, and emergency response, supporting the “Made in India” initiative. India’s expanding industrial sector, particularly in manufacturing, construction, and hazardous environments, has increased the demand for durable, effective FR clothing, which is creating a positive India fire-resistant clothing market outlook.

India Fire Resistant Clothing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, application, and end user.

Product Type Insights:

- Shirts

- Pants

- Coveralls

- Jackets

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes shirts, pants, coveralls, jackets, and others.

Material Type Insights:

- Treated FR Fabric

- Inherent FR Fabric

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes treated FR fabric and inherent FR fabric.

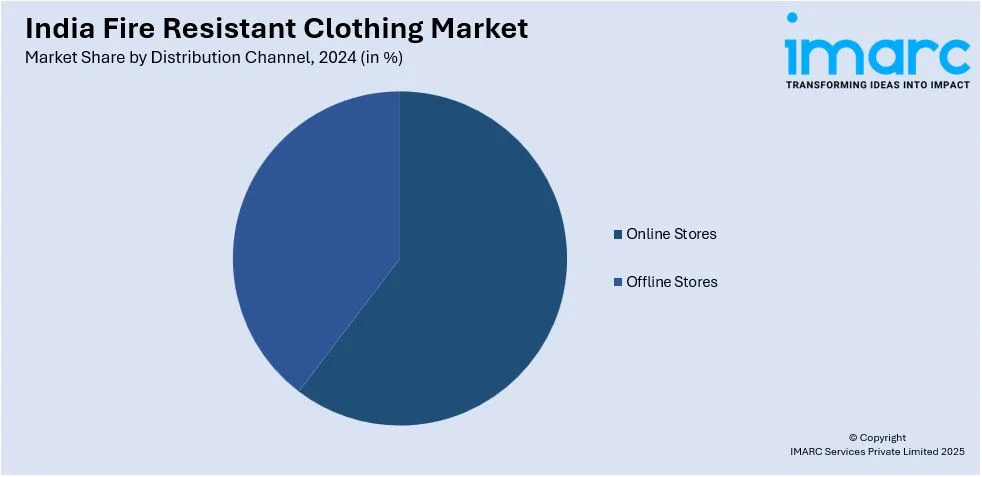

Distribution Channel Insights:

- Online Stores

- Offline Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores and offline stores.

Application Insights:

- Oil and Gas

- Construction

- Manufacturing

- Mining

- Military

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, construction, manufacturing, mining, military, and others.

End User Insights:

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, commercial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fire Resistant Clothing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shirts, Pants, Coveralls, Jackets, Others |

| Material Types Covered | Treated FR Fabric, Inherent FR Fabric |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Applications Covered | Oil And Gas, Construction, Manufacturing, Mining, Military, Others |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fire resistant clothing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fire resistant clothing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fire resistant clothing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fire resistant clothing market size reached USD 251.14 Million in 2024.

The India fire resistant clothing market is expected to reach USD 522.47 Million by 2033, exhibiting a CAGR of 8.48% during 2025-2033.

Market growth is driven by increasing workplace safety regulations, rising awareness about fire hazards in industrial sectors, expanding oil & gas and manufacturing industries, and growing demand for protective gear among workers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)