India Fisheries Infrastructure Market Size, Share, Trends and Forecast by Infrastructure Type, Sector, End-User, and Region, 2025-2033

India Fisheries Infrastructure Market Overview:

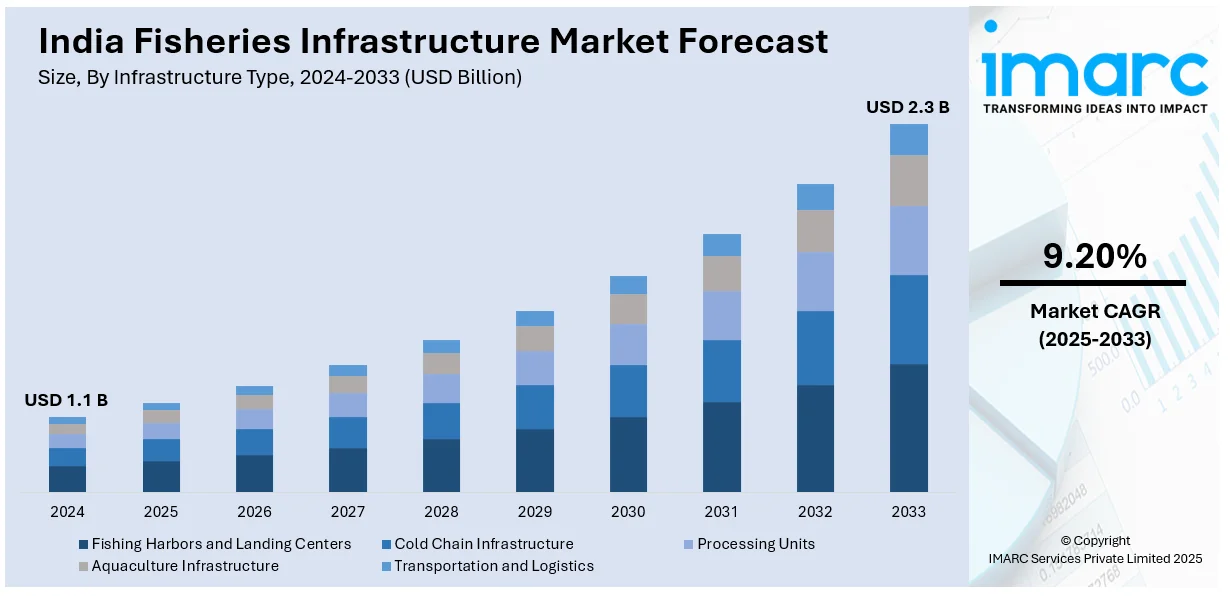

The India fisheries infrastructure market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. Rising seafood exports, government schemes, expanding cold chain networks, improved aquaculture practices, and increased domestic fish consumption are some of the factors propelling the growth of the market. Investment in harbors, processing units, and logistics facilities is also boosting sectoral growth and rural livelihood opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Market Growth Rate (2025-2033) | 9.20% |

India Fisheries Infrastructure Market Trends:

Rising Commercialization of Fish Farming

India’s fish farming sector is expanding steadily, driven by the growing demand for protein-rich food, the adoption of advanced aquaculture practices, and improved market access. Farmers are increasingly using systems like biofloc and recirculating aquaculture to enhance productivity and reduce ecological impact. Supportive government schemes are enabling infrastructure upgrades, training programs, and financial assistance, making fish farming more viable and scalable. Cold chain improvements, digital market integration, and private sector involvement are also helping formalize the value chain. As profitability rises, more rural and coastal communities are participating in fish farming, shifting it from a subsistence activity to a structured enterprise. The sector is gradually transforming into a key contributor to rural livelihoods and national food security. The India fish farming market size was valued at USD 10.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.1 Billion by 2033, exhibiting a CAGR of 7.40% from 2025 to 2033.

To get more information on this market, Request Sample

Adoption of Advanced Aquaculture Systems

India is moving toward more efficient and sustainable aquaculture practices by embracing modern technologies like recirculating aquaculture systems (RAS) and biofloc technology (BFT). These methods allow fish farming with minimal water usage, better disease control, and higher yields, making them suitable for both small and large-scale operations. Farmers are showing a growing interest in adopting such systems due to lower production costs, reduced environmental impact, and increased profitability. Government support, training programs, and technical guidance are further encouraging this shift. The use of closed-loop systems and microbial management in farming is enhancing productivity while promoting ecological sustainability. This shift signals a broader transition in Indian aquaculture toward innovation-driven, climate-resilient, and resource-efficient fish farming practices. According to industry reports, as of 2024, India is the second-biggest producer of farmed fish globally and is actively implementing recirculating aquaculture systems (RAS) and biofloc technology (BFT).

India Fisheries Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on infrastructure type, sector, and end-user.

Infrastructure Type Insights:

- Fishing Harbors and Landing Centers

- Cold Chain Infrastructure

- Cold Storage

- Ice Plants

- Processing Units

- Fish Processing Plants

- Packaging Units

- Aquaculture Infrastructure

- Hatcheries

- Feed Plants

- Transportation and Logistics

- Refrigerated Vehicles

- Supply Chain

The report has provided a detailed breakup and analysis of the market based on the infrastructure type. This includes fishing harbors and landing centers, cold chain infrastructure (cold storage and ice plants), processing units (fish processing plants and packaging units), aquaculture infrastructure (hatcheries and feed plants), and transportation and logistics (refrigerated vehicles and supply chain).

Sector Insights:

- Marine Fisheries

- Inland Fisheries

- Aquaculture

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes marine fisheries, inland fisheries, and aquaculture.

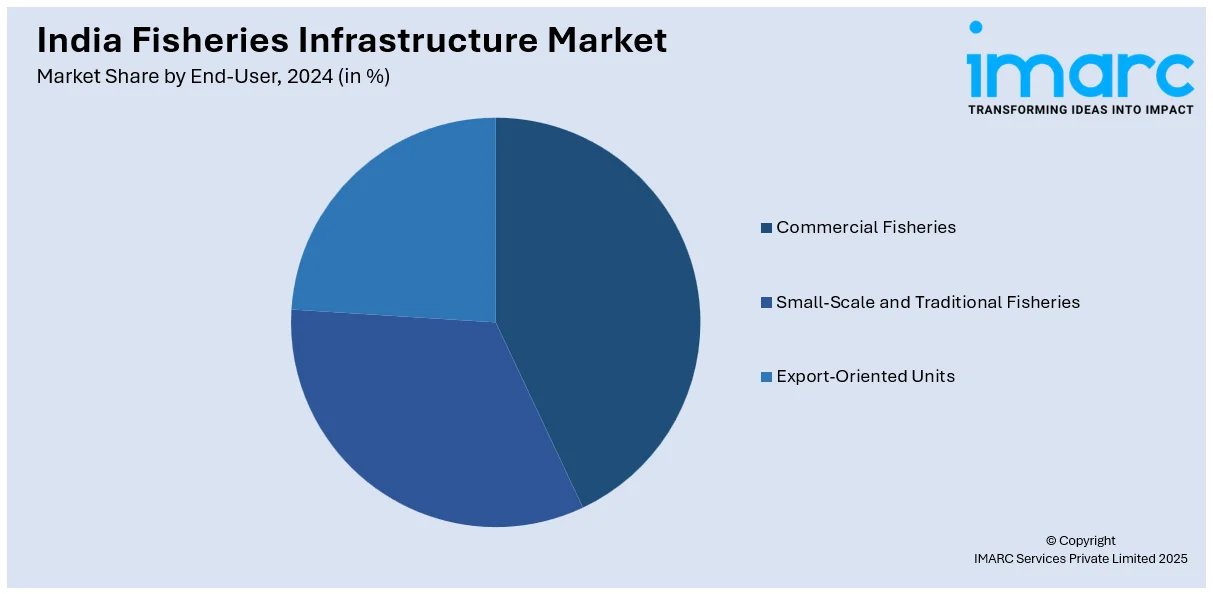

End-User Insights:

- Commercial Fisheries

- Small-Scale and Traditional Fisheries

- Export-Oriented Units

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes commercial fisheries, small-scale and traditional fisheries, and export-oriented units.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fisheries Infrastructure Market News:

- In November 2024, Punjab Agriculture and Farmers Welfare introduced a new fish market in Patiala. The market is developed with a significant investment of INR 4.5 Crore. This wholesale fish market would aim to incentivize the fisheries sector along with paving new income prospects for local fish providers.

- In November 2024, the state government of Kerala announced the development of 100 climate-resilient coastal fishing villages under the PMMSY, with INR 2 Crore allocated for each village to enhance infrastructure and foster sustainable livelihoods. The initiative aims to enhance climate resilience by establishing facilities such as fish drying platforms, processing hubs, and rescue operations.

India Fisheries Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Infrastructure Types Covered |

|

| Sectors Covered | Marine Fisheries, Inland Fisheries, Aquaculture |

| End-Users Covered | Commercial Fisheries, Small-Scale and Traditional Fisheries, Export-Oriented Units |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fisheries infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fisheries infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fisheries infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fisheries infrastructure market in India was valued at USD 1.1 Billion in 2024.

The India fisheries infrastructure market is projected to exhibit a CAGR of 9.20% during 2025-2033, reaching a value of USD 2.3 Billion by 2033.

The India fisheries infrastructure market is driven by rising demand for seafood, government investments in modern fishing harbors, cold storage, and processing facilities, and growing export opportunities. Technological advancements in aquaculture, along with initiatives to improve supply chains and reduce post-harvest losses, further support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)