India Fitness Equipment Market Size, Share, Trends and Forecast by Type, Price Point, End User, and Region, 2025-2033

India Fitness Equipment Market Overview:

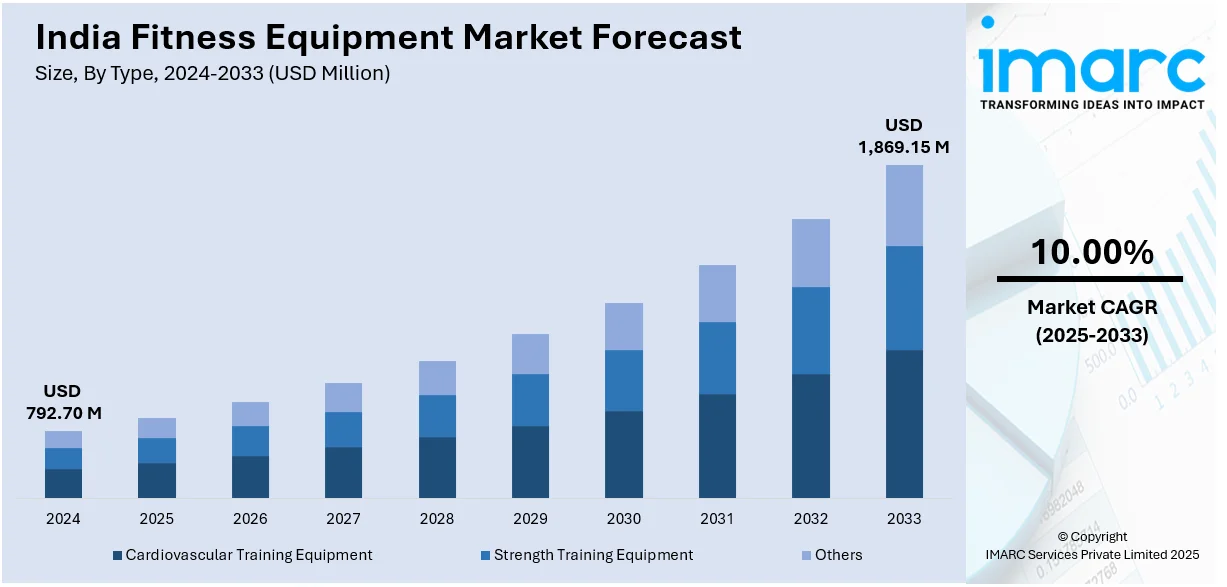

The India fitness equipment market size reached USD 792.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,869.15 Million by 2033, exhibiting a growth rate (CAGR) of 10.00% during 2025-2033. Rising health awareness, increasing gym memberships, home fitness trends, digital fitness integration, corporate wellness programs, government initiatives, influencer marketing, e-commerce expansion, premium equipment demand, and technological advancements are driving the growth of India's fitness equipment market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 792.70 Million |

| Market Forecast in 2033 | USD 1,869.15 Million |

| Market Growth Rate (2025-2033) | 10.00% |

India Fitness Equipment Market Trends:

Digital Fitness Integration and Smart Equipment

Digital fitness integration is revolutionizing the fitness equipment industry by integrating technology with conventional exercise machines. Treadmills, stationary bikes, and weight machines are equipped with smart features such as AI-based personal training, real-time performance tracking, and integration with mobile apps. In 2023, nearly 28% of new models of fitness equipment had smart features, a number that is estimated to grow to 45% by 2025. Consumers are getting inclined towards customized exercise routines, interactive feedback, and remote guidance, which lead to greater engagement and better outcomes. Recent surveys suggest that 52% of city fitness enthusiasts are more interested in smart equipment than traditional devices. Market research reports indicate that India's digital fitness market is expanding at a 17% annual rate from 2023 to 2025. This growth is partly driven by the rising adoption of smartphones and enhanced internet connectivity, allowing consumers to access advanced fitness apps. Gyms and boutique fitness studios are also transitioning to digital platforms to provide immersive experiences, including live classes and virtual reality training sessions. Large brands have introduced new products with wearable technology to synchronize exercise information with health types, which enable users to easily monitor progress and modify routines, thus reinforcing the market growth.

To get more information on this market, Request Sample

Home Fitness Surge and Corporate Wellness Adoption

The increased adoption of home fitness has speeded up the Indian market growth of fitness equipment. Urban lifestyle and changing workplace cultures have influenced people to establish their own personal gyms in the comfort of their homes. Sales of home fitness equipment went up by close to 32% in 2023, and estimates project an increase of 40% by 2025. Escalated awareness of the need for good health and wellness following the changes in work-from-home and flexible timings has spurred demand. With individuals looking for convenient fitness solutions, space-saving and multi-purpose tools like foldable treadmills, adjustable dumbbells, and resistance bands are gaining traction. Additionally, businesses are also spending on corporate wellness initiatives, incorporating fitness as part of employee benefits to improve productivity and lower absenteeism. Statistics in 2023 indicate that approximately 47% of medium and large businesses have added wellness programs with subsidized home fitness equipment purchases, a trend which is projected to reach 55% by the year 2025. Improved digital retail websites and enhanced e-commerce logistics have also facilitated the trend, with consumers finding it more convenient to research, compare, and buy quality home gym equipment. As urban dwellers increasingly focus on health, manufacturers are quickly innovating to provide compact, cost-effective, and multi-functional solutions. This double stimulus from individual consumers and corporate initiatives is supporting market growth.

India Fitness Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, price point, and end user.

Type Insights:

- Cardiovascular Training Equipment

- Treadmills

- Stationary Cycles

- Elliptical

- Others

- Strength Training Equipment

- Free Weights

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes cardiovascular training equipment (treadmills, stationary cycles, elliptical, and others), strength training equipment (free weights, and others), and others.

Price Point Insights:

- Standard

- Premium/Luxury

A detailed breakup and analysis of the market based on the price point have also been provided in the report. This includes standard and premium/luxury.

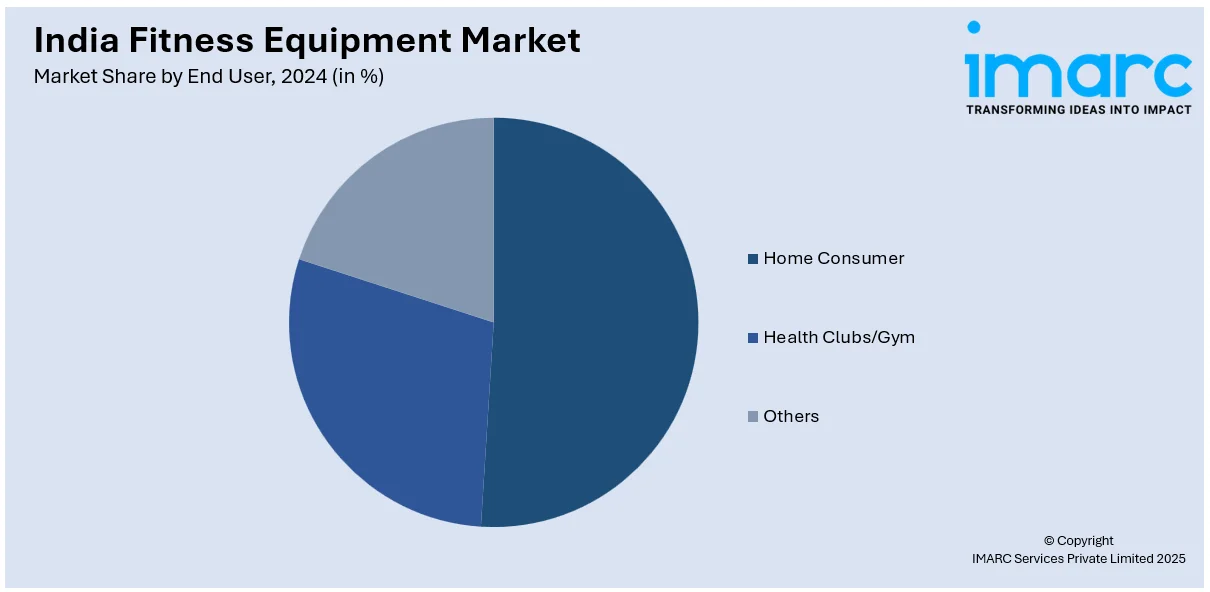

End User Insights:

- Home Consumer

- Home

- Apartment

- Health Clubs/Gym

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes home consumer (home and apartment), health clubs/gym, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fitness Equipment Market News:

- December 2024: Portl, located in Hyderabad, launched the UltraGym, a small strength training equipment that uses unique Hydraulic and Electromagnetic Resistance Technology. The UltraGym, priced at ₹59,990, promises to make strength training accessible for home users.

- August 2024: Decathlon announced intentions to invest €100 million ($111 million) in India over the next five years to boost its store network to 190 locations, improve digital engagement, and source more made-in-India items. The firm now has 127 locations in 50 cities in India and expects to open 63 more outlets in 40 cities over the next five years.

India Fitness Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Price Points Covered | Standard, Premium/Luxury |

| End Users Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fitness equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fitness equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fitness equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fitness equipment market was valued at USD 792.70 Million in 2024.

The India fitness equipment market is projected to exhibit a CAGR of 10.00% during 2025-2033, reaching a value of USD 1,869.15 Million by 2033.

The India fitness equipment market is driven by rising health awareness, increasing disposable incomes, urbanization, and growing lifestyle-related diseases. Expanding gym chains, digital fitness platforms, and government initiatives promoting wellness also fuel demand. Youth interest in bodybuilding and home fitness solutions post-pandemic further accelerates market growth across urban and semi-urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)