India Flame Retardants Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Flame Retardants Market Overview:

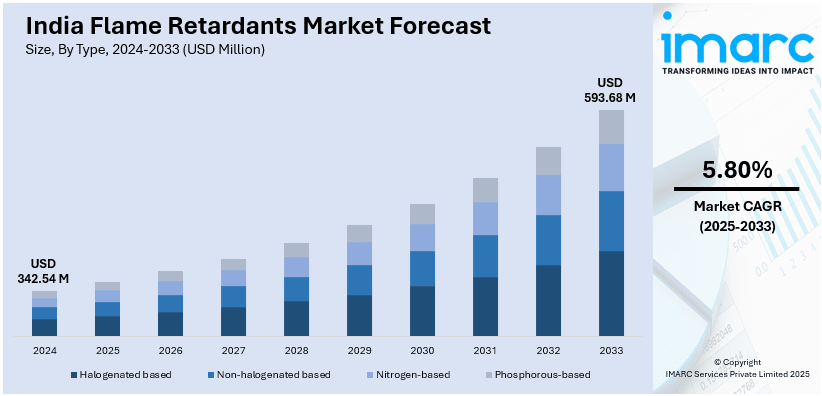

The India flame retardants market size reached USD 342.54 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 593.68 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The India flame retardants market share is expanding, driven by the rising emphasis on improving vehicle safety standards and meeting regulatory requirements, along with the expansion of high-rise buildings and urban infrastructure projects, which is creating the need for fire-resistant materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 342.54 Million |

| Market Forecast in 2033 | USD 593.68 Million |

| Market Growth Rate 2025-2033 | 5.80% |

India Flame Retardants Market Trends:

Rising vehicle production

The increasing vehicle production is fueling the India flame retardants market growth. As per the Society of Indian Automobile Manufacturers (SIAM), in 2024, India’s automobile sales saw an 11.6% rise, hitting a record 2.5 Crore units, up from 2.3 Crore units in 2023. This increase strengthened India’s status as the world's third-largest automotive market. As more vehicles, trucks, and two-wheelers are manufactured, there is a growing demand for materials that reduce fire hazards in automotive components. Flame retardants are commonly used in automobile interiors, seats, dashboards, and wiring to keep flames from spreading in the event of an accident or an electrical issue. As vehicle makers strive for lightweight designs to improve fuel efficiency, they use plastic and composite materials that require flame retardant chemicals to enhance fire resistance. The rise in electric vehicle (EV) production is also catalyzing the demand, as battery systems and wiring need extensive fire protection. Furthermore, government rules and safety standards encourage manufacturers to add flame-retardant materials into automobiles. The rising preference for high-end cars with advanced safety features is another factor promoting the utilization of flame retardants. Auto component manufacturers are also working on developing eco-friendly flame retardant solutions to meet sustainability goals.

To get more information on this market, Request Sample

Growing awareness about fire safety

The rising awareness among the masses about fire safety is offering a favorable India flame retardants market outlook. With increasing cases of fire incidents in residential buildings, commercial spaces, and industrial facilities, there is a growing need for materials that can reduce fire hazards. According to the data released by the Fire Department of India, Delhi saw a 37% rise in fire incidents in 2024 compared to 2023, with 20,795 fire calls reported by Dec 18, demonstrating a significant rise from 15,169 calls in the same timeframe in 2023. Flame retardants are widely used in construction materials, furniture, textiles, and electrical products to enhance fire resistance and minimize damage in case of an accident. Government agencies are also implementing stricter fire safety regulations, motivating companies to adopt flame-retardant solutions in their items. In sectors like electronics and aviation, manufacturers are incorporating flame retardants to meet safety standards and protect people. The expansion of high-rise buildings and urban infrastructure projects is further creating the need for fire-resistant materials. Additionally, businesses are investing in fireproof coatings and insulation materials to safeguard assets and prevent losses. Individuals are also becoming more conscious about fire safety, leading to a preference for flame-retardant home furnishings and appliances.

India Flame Retardants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Halogenated based

- Non-halogenated based

- Nitrogen-based

- Phosphorous-based

The report has provided a detailed breakup and analysis of the market based on the type. This includes halogenated based, non-halogenated based, nitrogen-based, and phosphorous-based.

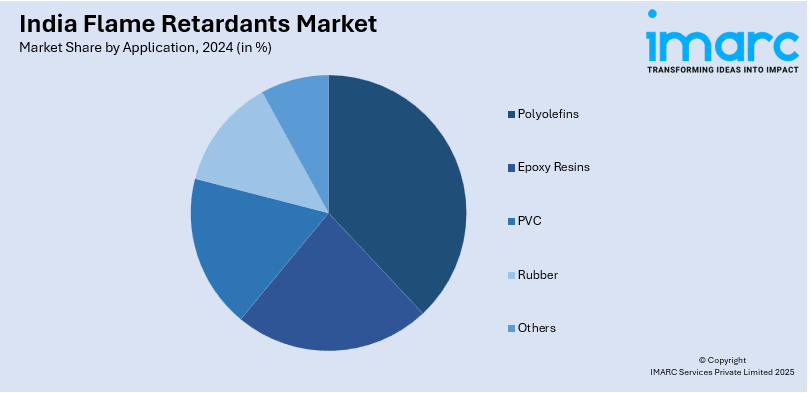

Application Insights:

- Polyolefins

- Epoxy Resins

- PVC

- Rubber

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes polyolefins, epoxy resins, PVC, rubber, and others.

End User Insights:

- Building and Construction

- Electronic and Appliances

- Automotive

- Electrical and Electronics

- Adhesives and Sealants

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes building and construction, electronic and appliances, automotive, electrical and electronics, adhesives and sealants, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Flame Retardants Market News:

- In February 2025, Elecrama 2025, hosted at the India Expo Mart in Greater Noida, provided Envalior the opportunity to showcase its new advanced thermoplastic solutions for the expanding electrical and electronics sector in India. The firm introduced Xytron™, a flame-resistant polyphenylene sulfide (PPS) and EcoPaXX®, a bio-sourced polyamide recognized for its mechanical durability. Other items, Arnite®, Durethan® A & B, and Pocan®, equipped with flame-retardant and hydrolysis-resistant characteristics, were highlighted.

- In June 2024, Evion Group, the prominent graphite developer, declared that it was approaching full production at its expandable graphite plant in India after finishing testing. The output was anticipated to progressively rise in the next months, aiming for a full production capacity of at least 150 Tons. A primary application of expandable graphite was as a fire retardant.

India Flame Retardants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Halogenated based, Non-halogenated based, Nitrogen-based, Phosphorous-based |

| Applications Covered | Polyolefins, Epoxy Resins, PVC, Rubber, Others |

| End Users Covered | Building and Construction, Electronic and Appliances, Automotive, Electrical and Electronics, Adhesives and Sealants, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India flame retardants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India flame retardants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India flame retardants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flame retardants market in India was valued at USD 342.54 Million in 2024.

The India flame retardants market is projected to exhibit a CAGR of 5.80% during 2025-2033, reaching a value of USD 593.68 Million by 2033.

The flame retardants market in India is expanding because of increasing industrialization, stringent safety regulations, and growing awareness about fire hazards. The demand for flame retardants is also supported by sectors like construction, automotive, and electronics, where fire-resistant materials are essential. Additionally, advancements in chemical formulations and the rising focus on sustainable products contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)