India Flavors and Fragrances Market Size, Share, Trends and Forecast by Product Type, Form, Application, Ingredients and Region, 2026-2034

India Flavors and Fragrances Market Overview:

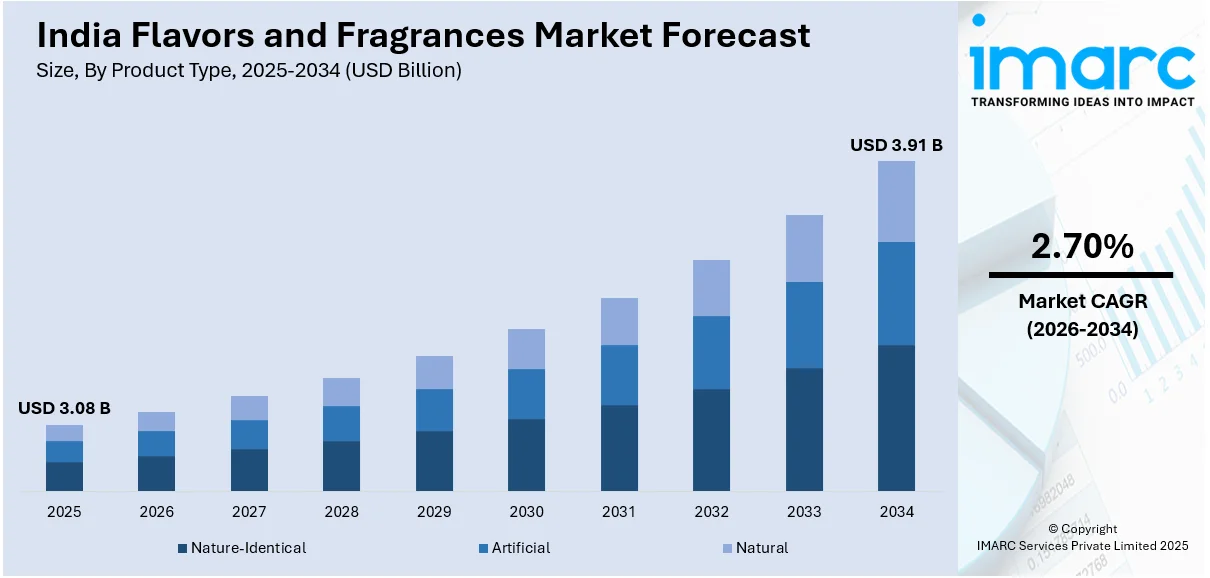

The India flavors and fragrances market size reached USD 3.08 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.91 Billion by 2034, exhibiting a growth rate (CAGR) of 2.70% during 2026-2034. The market is expanding due to rising consumer demand for natural and organic ingredients, growing applications in food, beverages (F&B), personal care, and home care products, and increasing investments in research and innovation to develop unique, culturally resonant scent and taste profiles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.08 Billion |

| Market Forecast in 2034 | USD 3.91 Billion |

| Market Growth Rate 2026-2034 | 2.70% |

India Flavors and Fragrances Market Trends:

Rising Demand for Natural and Organic Ingredients

The India flavors and fragrances market growth exhibits a major transformation toward natural and organic ingredients because customers show greater interest in health, wellness, and sustainable choices. Manufacturers in the F&B sector and personal care industry choose plant-based ingredients free of genetically modified organisms (GMO) contaminants together with clean-label flavors and fragrances because consumers worry about synthetic additives and allergens. Moreover, smart businesses across food manufacturing and personal care companies choose essential oils along with botanical extracts and natural flavor compounds to enhance their products for packaged foods and liquids and personal and home-use items. Besides this, natural alternative adoption receives additional support from the Food Safety and Standards Authority of India (FSSAI) regulations and Ayurvedic product endorsements along with government guidelines. For example, on October 21, 2024, FSSAI announced amendments to the Food Product Standards and Additives Regulations, enhancing guidelines for natural flavor usage in food products. This move aims to ensure consumer safety and promote the use of natural ingredients. Furthermore, major industry participants dedicate funds to plant-derived formulation research and innovation, which creates products that follow traditional Indian values and Ayurvedic standards. As a result, the market is expanding sustainably alongside consumer need changes because of the increasing use of natural ingredients, thereby enhancing the India flavors and fragrances market outlook.

To get more information on this market Request Sample

Expansion of Functional and Customized Fragrances

The fragrance market in India transforms through customization aspects and functional demands, focusing on personal care products together with home care items and wellness solutions. The current market demands fragrances with therapeutic benefits, which provide stress relief, as well as improve mood and provide better sleep quality. Additionally, essential oil aromatherapy products and herbal infusions along with mood-altering perfumes continue to rise in market popularity. Brands have also started to use artificial intelligence (AI) alongside data analytics to create individualized perfume scents which match customer preferences. Moreover, the Indian market receives region-specific perfume and deodorant launches from luxury and mass-market fragrance firms which match the country's climatic zones and cultural scent traditions. For instance, on December 5, 2024, Pantone announced a collaboration with Pura to debut the 2025 Color of the Year, Mocha Mousse, through a new scent. This partnership introduces innovative fragrance experiences, aligning with contemporary design trends and India's growing demand for unique, mood-enhancing fragrances. The increasing trend towards premiumization in home care products such as luxurious air fresheners and scented candles continues to drive market demand. Apart from this, companies are expanding their product lines with unique and premium fragrances to capture Indian consumers who value distinctive smells and high-quality perfumes, thus making India an essential market for new fragrance development.

India Flavors and Fragrances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, form, application, and ingredients.

Product Type Insights:

- Nature-Identical

- Artificial

- Natural

The report has provided a detailed breakup and analysis of the market based on the product type. This includes nature-identical, artificial, and natural.

Form Insights:

- Liquid

- Dry

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and dry.

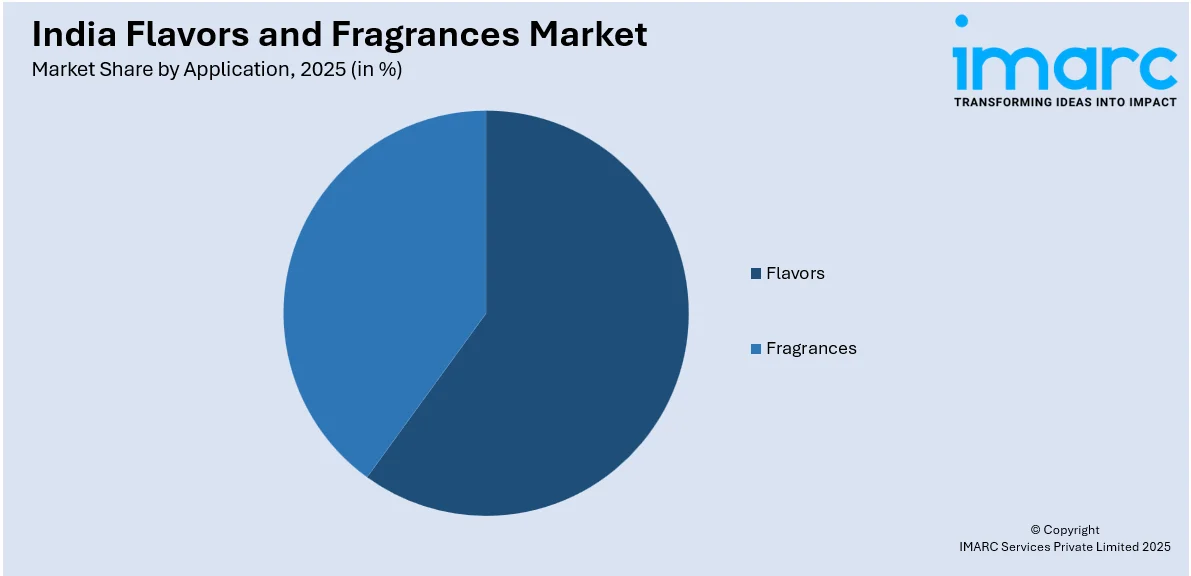

Application Insights:

Access the comprehensive market breakdown Request Sample

- Flavors

- Beverages

- Dairy and Frozen Desserts

- Bakery and Confectionery Products

- Savories and Snacks

- Fragrances

- Soap and Detergents

- Cosmetics and Toiletries

- Fine Fragrances

- Household Cleaners and Air Fresheners

The report has provided a detailed breakup and analysis of the market based on the application. This includes flavors (beverages, dairy and frozen desserts, bakery and confectionery products, savories and snacks), and fragrances (soap and detergents, cosmetics and toiletries, fine fragrances, and household cleaners and air fresheners).

Ingredients Insights:

- Natural

- Synthetic

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes natural and synthetic.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Flavors and Fragrances Market News:

- In October 2024, Lucta Group announced a partnership with Quintessence Fragrances, a company with a strong presence in the UK and India. This collaboration strengthens Lucta’s global fragrance capabilities and opens new commercial segments, such as home care and fine fragrances, thereby enriching the Indian market with diverse product offerings.

- In March 2024, fashion brand KAZO expanded into the fragrance sector by launching its first signature perfume collection. This diversification allows KAZO to leverage its existing customer base, enhancing brand loyalty and contributing to the growth of the fragrance market in India.

India Flavors and Fragrances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Nature-Identical, Artificial, Natural |

| Forms Covered | Liquid, Dry |

| Applications Covered |

|

| Ingredients Covered | Natural, Synthetic |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India flavors and fragrances market performed so far and how will it perform in the coming years?

- What is the breakup of the India flavors and fragrances market on the basis of product type?

- What is the breakup of the India flavors and fragrances market on the basis of form?

- What is the breakup of the India flavors and fragrances market on the basis of application?

- What is the breakup of the India flavors and fragrances market on the basis of ingredients?

- What is the breakup of the India flavors and fragrances market on the basis of region?

- What are the various stages in the value chain of the India flavors and fragrances market?

- What are the key driving factors and challenges in the India flavors and fragrances?

- What is the structure of the India flavors and fragrances market and who are the key players?

- What is the degree of competition in the India flavors and fragrances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India flavors and fragrances market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India flavors and fragrances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India flavors and fragrances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)