India Floating Wind Turbine Market Size, Share, Trends and Forecast by Foundation, Depth, and Region, 2025-2033

India Floating Wind Turbine Market Size and Share:

The India floating wind turbine market size reached USD 213.77 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,859.84 Million by 2033, exhibiting a growth rate (CAGR) of 33.40% during 2025-2033. The market is poised for significant expansion, impacted by heightening renewable energy investments, government ventures, and advancements in offshore wind technology. Floating turbines offer scalability and efficiency in deep waters, positioning India as a key player in sustainable energy transition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 213.77 Million |

| Market Forecast in 2033 | USD 2,859.84 Million |

| Market Growth Rate (2025-2033) | 33.40% |

India Floating Wind Turbine Market Trends:

Government Initiatives and Policy Support

The government of the country has set ambitious targets to harness offshore wind energy, aiming for 30 GW of capacity by 2030. This commitment is evident through the approval of plans for the country's first two offshore wind farms, each with a capacity of 500 MW, located off the coasts of Gujarat and Tamil Nadu, with a significant investment of USD 891 Million. Additionally, the government has introduced a Viability Gap Funding (VGF) policy to aid the financial feasibility of offshore wind projects, aiming to attract private sector participation and reduce initial capital expenditure challenges. Such schemes are mainly developed to offer a conducive ecosystem for the substantial expansion of the floating wind turbine sector across India, incentivizing both domestic and international stakeholders to invest in this emerging sector. Besides this, collaborations with international entities are helping India develop a robust regulatory framework. These initiatives aim to reduce the cost of floating wind projects and accelerate large-scale deployment. With the government’s emphasis on differentiating energy sources and lowering dependency on fossil fuels, policy-driven growth is expected to be a defining trend in India's floating wind turbine market.

.webp)

To get more information on this market, Request Sample

Technological Advancements and Industry Collaboration

Technological advancements in floating wind turbine designs are driving cost reductions and increasing the viability of large-scale deployment in India. Innovations in substructures, including tension leg platforms (TLPs), spar-buoy systems, and semi-submersibles, are enhancing stability and efficiency in deepwater environments where fixed-bottom turbines are impractical. Improved anchoring systems, lightweight composite materials, and advanced digital monitoring technologies are further optimizing performance and reducing maintenance costs. Additionally, the integration of hybrid systems, such as floating solar-wind farms, is being explored to maximize offshore renewable energy potential. Research and offshore wind initiatives supported by Indian institutions and collaborations with global technology leaders are facilitating knowledge transfer and adaptation of best practices. For instance, in February 2024, ONGC, a notable India-based oil producer, and NTPC, a major power company in India, announced a JV agreement to develop offshore wind energy venture to fuel partnership in renewable energy segment. Furthermore, as manufacturing scales up and supply chain efficiencies improve, the levelized cost of electricity (LCOE) for floating wind projects is expected to decline, making the technology more competitive with traditional energy sources. These advancements are crucial for the long-term sustainability of India’s floating wind sector.

India Floating Wind Turbine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on foundation and depth

Foundation Insights:

- Spar-buoy Foundation

- Tension-leg platform (TLP) Foundation

- Semi-submersible Foundation

- Others

The report has provided a detailed breakup and analysis of the market based on the foundation. This includes spar-buoy foundation, tension-leg platform (TLP) foundation, semi-submersible foundation, and others.

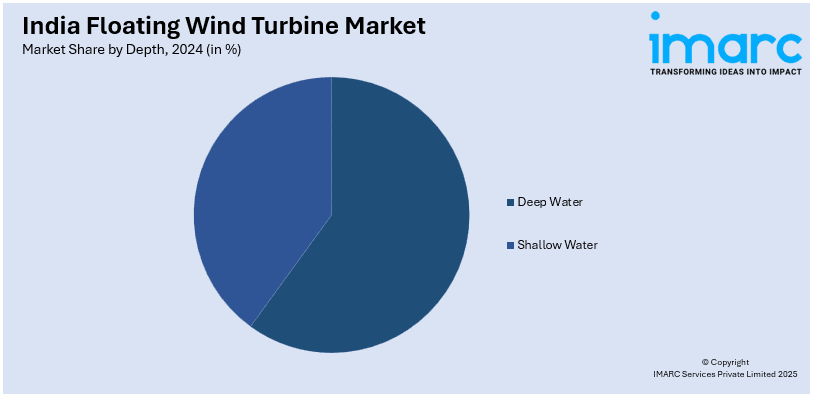

Depth Insights:

- Deep Water

- Shallow Water

A detailed breakup and analysis of the market based on the depth have also been provided in the report. This includes deep water and shallow water.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Floating Wind Turbine Market News:

- In January 2025, Envision Energy India announced an alliance with Juniper Green Energy for wind turbines as well as energy storage systems supply, highlighting a tactical move in nation's renewable energy industry. The collaboration includes the supply of wind turbine generators with capacity of 5MW.

- In September 2024, Senvion India unveiled its new wind turbine with 4.2 MW capacity. Model name 4.2M160, this new turbine is designed for low wind environment and can efficiently operate in elevated temperatures, dust, and sand.

India Floating Wind Turbine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Foundations Covered | Spar-buoy Foundation, Tension-leg platform (TLP) Foundation, Semi-submersible Foundation, Others |

| Depths Covered | Deep Water, Shallow Water |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India floating wind turbine market performed so far and how will it perform in the coming years?

- What is the breakup of the India floating wind turbine market on the basis of XX?

- What is the breakup of the India floating wind turbine market on the basis of XX?

- What are the various stages in the value chain of the India floating wind turbine market?

- What are the key driving factors and challenges in the India floating wind turbine market?

- What is the structure of the India floating wind turbine market and who are the key players?

- What is the degree of competition in the India floating wind turbine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India floating wind turbine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India floating wind turbine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India floating wind turbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)