India FMCG Market Size, Share, Trends and Forecast by Product Type, Demographics, Sales Channel, and Region, 2026-2034

India FMCG Market Summary:

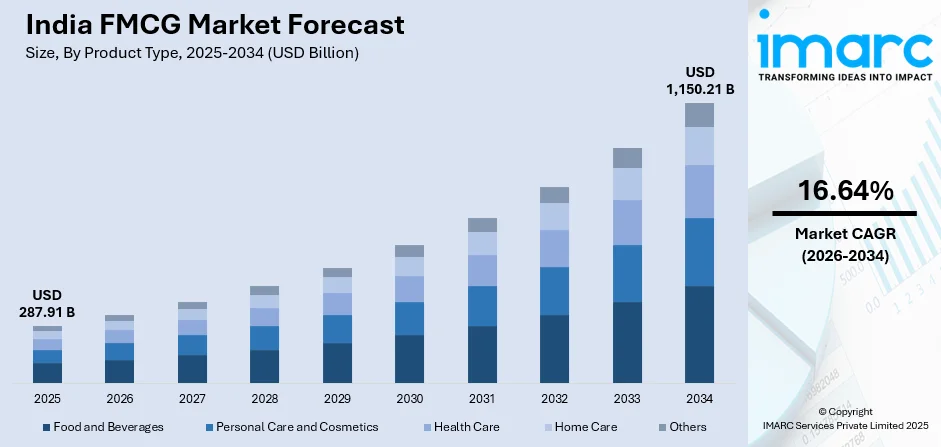

The India FMCG market size was valued at USD 287.91 Billion in 2025 and is projected to reach USD 1,150.21 Billion by 2034, growing at a compound annual growth rate of 16.64% from 2026-2034.

The India FMCG market is experiencing robust expansion driven by rising disposable incomes, rapid urbanization, and evolving consumer lifestyles seeking convenience-oriented products. The sector benefits from strong retail infrastructure development, digital transformation, and increased brand consciousness among consumers. Government initiatives supporting rural electrification, manufacturing incentives under Production-Linked Incentive schemes, and expanding e-commerce penetration are accelerating market accessibility across urban and rural demographics.

Key Takeaways and Insights:

-

By Product Type: Personal care and cosmetics dominate the market with a share of 48% in 2025, driven by increasing consumer awareness regarding grooming, premiumization trends, and rising demand for skincare and personal hygiene products across demographics.

-

By Demographics: Urban segment leads the market with a share of 63% in 2025, supported by higher purchasing power, modern retail infrastructure, extensive distribution networks, and greater exposure to branded products through digital channels.

-

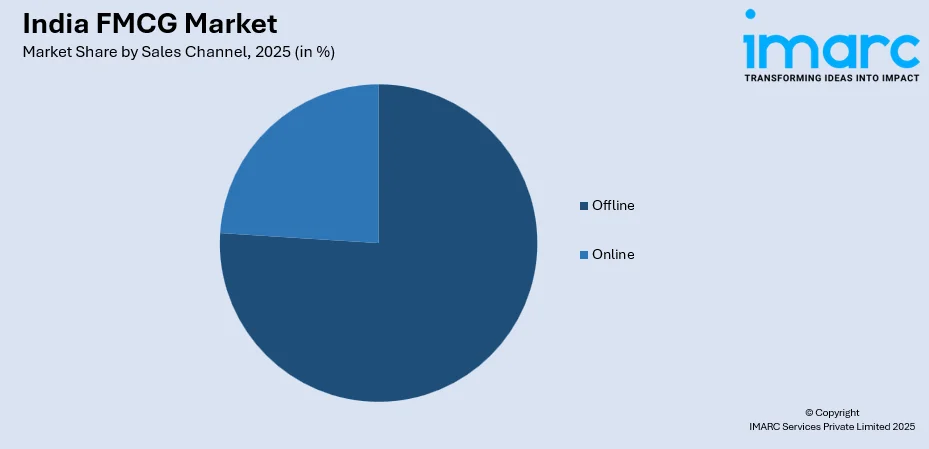

By Sales Channel: Offline channel represents the largest segment with a market share of 76% in 2025, owing to the widespread presence of traditional Kirana stores, supermarkets, hypermarkets, and organized retail outlets ensuring product accessibility nationwide.

-

By Region: Maharashtra exhibits a clear dominance with a share of 12% in 2025, driven by Mumbai's purchasing power, robust retail infrastructure, strong manufacturing base, and growing middle-class consumer demand.

-

Key Players: The India FMCG market exhibits a highly competitive landscape with multinational corporations and domestic giants vying for market share through product innovation, strategic acquisitions, and digital transformation initiatives. Some of the key players include AB InBev India (Anheuser-Busch InBev SA/NV), Amul, Asian Paints Ltd, Britannia Industries Limited, Coca-Cola India (The Coca-Cola Company), Colgate Palmolive (India) Ltd (Colgate-Palmolive Company), Dabur Ltd, Godrej Consumer Products Limited, Hindustan Unilever Limited (Unilever Plc), ITC Limited, Marico Limited, Nestlé India Limited (Nestlé S.A.), Patanjali Ayurved Limited, PepsiCo (India) Holdings Pvt. Ltd. (PepsiCo Inc.), and Procter & Gamble Hygiene and Health Care Limited (The Procter &Gamble Company).

To get more information on this market Request Sample

The India FMCG market represents one of the most dynamic consumer-driven sectors in the economy, characterized by high-volume sales, rapid inventory turnover, and diverse product portfolios catering to essential daily requirements. Market expansion is fueled by demographic advantages, creating substantial demand for personal care, packaged foods, and convenience products. Digital penetration has transformed consumer engagement, with e-commerce contributing significantly to market reach across tier-two and tier-three cities. The sector witnessed notable consolidation activity in recent times, with Hindustan Unilever (HUL) acquiring Minimalist, demonstrating strategic moves by legacy players to capture digital-first consumer segments. Under the direction of Harman Dhillon, Executive Director, Beauty & Wellbeing, HUL, Minimalist will join the robust portfolio of brands in our Beauty & Wellbeing division. In cooperation with HUL, the current Minimalist team will continue to run the company. It is anticipated that the deal will be finished in the first quarter of FY 2026. Rural markets have emerged as critical growth engines, with average basket sizes increasing substantially as improved connectivity and rising agricultural incomes drive consumption patterns.

India FMCG Market Trends:

Premiumization and Health-Conscious Consumption

Indian consumers are increasingly gravitating toward premium and wellness-oriented products, demonstrating willingness to pay higher prices for superior quality and health benefits. This shift is particularly pronounced in personal care and packaged food categories where functional ingredients, organic formulations, and clean-label products command growing demand. The trend reflects evolving consumer aspirations among urban and semi-urban populations who prioritize ingredient transparency, natural compositions, and scientifically backed formulations. Younger demographics especially seek products aligning with holistic wellness lifestyles, driving manufacturers to innovate across categories with health-focused offerings.

Quick Commerce Revolution

The rapid expansion of quick commerce platforms is fundamentally reshaping FMCG distribution dynamics, particularly in metropolitan centers. Ultra-fast delivery services offering fulfillment within minutes have captured substantial market share, accounting for a dominant portion of e-grocery orders. This channel transformation has prompted traditional retailers and FMCG manufacturers to recalibrate distribution strategies, with quick commerce applications emerging as significant revenue contributors representing a substantial portion of e-commerce sales for leading FMCG firms.

Artificial Intelligence Integration

Artificial intelligence adoption is accelerating across FMCG operations, influencing product development, pricing strategies, and consumer engagement. Industry reports indicate AI technologies powered approximately half of new FMCG product launches in recent periods while influencing pricing decisions across majority of market segments. Leading manufacturers are deploying AI-powered analytics platforms for demand forecasting, personalized marketing, and supply chain optimization, enhancing operational efficiency and consumer responsiveness.

Market Outlook 2026-2034:

The India FMCG market demonstrates strong growth momentum supported by favorable macroeconomic conditions, easing inflationary pressures, and sustained rural demand recovery. Government initiatives including Production-Linked Incentive schemes continue attracting investments in manufacturing capacity expansion, while digital infrastructure development enables deeper market penetration across tier-two and tier-three cities. Rising consumer confidence, expanding middle-class population, and increasing brand consciousness further bolster market prospects. The convergence of traditional retail strength with rapid e-commerce adoption creates diverse growth avenues, positioning the sector for robust expansion throughout the forecast period. The market generated a revenue of USD 287.91 Billion in 2025 and is projected to reach a revenue of USD 1,150.21 Billion by 2034, growing at a compound annual growth rate of 16.64% from 2026-2034.

India FMCG Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Personal Care and Cosmetics | 48% |

| Demographics | Urban | 63% |

| Sales Channel | Offline | 76% |

| Region | Maharashtra | 12% |

Product Type Insights:

- Food and Beverages

- Juices and Drinks

- Tea and Coffee

- Fresh Food

- Others

- Personal Care and Cosmetics

- Body Care

- Hair Care

- Oral Care

- Skin Care

- Baby Care

- Health Care

- Feminine Care

- Over the Counter (OTC)

- Others

- Home Care

- Cleaning Products

- Fragrance

- Others

- Others

The personal care and cosmetics dominate with a market share of 48% of the total India FMCG market in 2025.

The personal care and cosmetics segment demonstrates robust expansion driven by heightened consumer consciousness regarding grooming, skincare, and personal hygiene across all demographic segments. Rising disposable incomes and aspirational lifestyles have elevated demand for premium beauty products, with consumers increasingly seeking science-backed formulations containing active ingredients. The India beauty and personal care market size was valued at USD 31.2 Billion in 2025, with industry forecasts projecting substantial growth supported by digital-first distribution channels and premiumization trends.

The personal care and cosmetics market expansion is further accelerated by the proliferation of direct-to-consumer brands targeting millennial and generation-Z consumers through digital platforms and personalized marketing strategies. Legacy FMCG manufacturers are responding through strategic acquisitions of digital-native brands and launching ingredient-forward innovations within established product lines. The segment benefits from expanding organized retail presence, salon partnerships, and influencer-driven marketing campaigns that resonate with younger demographics prioritizing self-care and wellness-oriented consumption.

Demographics Insights:

- Urban

- Rural

The urban segment leads with a share of 63% of the total India FMCG market in 2025.

Urban markets continue commanding market leadership driven by concentrated purchasing power, established modern trade infrastructure, and higher brand awareness among metropolitan consumers. Major urban centers including Mumbai, Delhi, Bangalore, and Chennai serve as primary demand hubs with diverse consumer bases demonstrating strong preferences for premium and convenience-oriented products. According to IBEF data, by April 2025, household FMCG spending increased by 8% to Rs. 17,792 Crore (US$ 2.07 Billion), and it is anticipated to increase even more by year's end due to both staples and non-staples.

The urban segment benefits from sophisticated retail ecosystems encompassing hypermarkets, supermarkets, convenience stores, and rapidly expanding quick commerce channels enabling instant product accessibility. Digital adoption rates remain substantially higher in urban areas, facilitating e-commerce penetration and direct-to-consumer brand engagement. However, growth rates in urban markets have moderated relative to rural counterparts, prompting manufacturers to recalibrate distribution strategies and product portfolios addressing evolving consumption patterns.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline channel exhibits a clear dominance with a 76% share of the total India FMCG market in 2025.

The offline channel, such as the traditional retail channels maintain market dominance through the extensive network of Kirana stores, supermarkets, hypermarkets, and organized retail outlets ensuring nationwide product accessibility. The offline segment benefits from established consumer trust, immediate product availability, and the tactile shopping experience preferred for essential daily purchases. Modern trade channels continue demonstrating strong double-digit growth rates while traditional trade maintains steady performance supported by deep rural penetration and localized distribution networks.

The segment evolution reflects ongoing transformation as retailers embrace omnichannel strategies integrating digital ordering with physical store fulfillment. Quick commerce emergence has intensified competition within offline channels, prompting traditional retailers to enhance service propositions and operational efficiency. Industry forecasts indicate e-commerce channels may represent substantially higher market share by decade end, though offline channels are expected to retain majority share given India's diverse retail landscape and consumer preferences for in-store purchasing across categories.

Regional Insights:

- Maharashtra

- Tamil Nadu

- Uttar Pradesh

- Gujarat

- Karnataka

- West Bengal

- Rajasthan

- Andhra Pradesh

- Telangana

- Madhya Pradesh

- Delhi NCR

- Punjab

- Haryana

- Others

Maharashtra dominates with a market share of 12% of the total India FMCG market in 2025.

Maharashtra commands market leadership driven by thriving urban centers including Mumbai, Pune, and Nagpur that demonstrate high purchasing power and substantial consumer bases. The state's robust retail infrastructure encompassing supermarkets, hypermarkets, and modern trade outlets facilitates widespread FMCG product distribution. Quick commerce applications have emerged as important revenue channels, contributing significantly to e-commerce sales in the region. Maharashtra's growing middle class coupled with rising disposable incomes and evolving lifestyles fuels demand for both premium and essential goods.

The state benefits from a well-established manufacturing base with strong presence of multinational and domestic FMCG companies maintaining headquarters and production facilities in Maharashtra. This concentration contributes to competitive advantages in supply chain efficiency and market responsiveness. Additionally, the favorable business environment, developed transportation networks, and skilled workforce continue attracting investments in FMCG manufacturing and distribution infrastructure, reinforcing Maharashtra's position as a leading hub for consumer goods operations.

Market Dynamics:

Growth Drivers:

Why is the India FMCG Market Growing?

Rising Disposable Incomes and Expanding Middle Class

India's sustained economic growth has elevated per capita income levels, enabling greater consumer spending on quality FMCG products across categories. The expanding middle-class population, now larger than several major economies combined, is reshaping consumption patterns with increasing preferences for branded, premium, and convenience-oriented products. Rising financial inclusion through government initiatives and banking penetration has improved purchasing capacity among previously underserved demographics. Urban consumers demonstrate willingness to pay premiums for quality and innovation, while rural markets show accelerating adoption of branded products replacing unorganized alternatives. This income-driven consumption growth creates substantial opportunities for market expansion across product categories and price segments.

Digital Transformation and E-commerce Expansion

Digital penetration is fundamentally transforming FMCG distribution and consumer engagement across India. Internet users are projected to exceed nine hundred million, with rural areas accounting for majority of new digital adopters. E-commerce platforms have democratized product accessibility, enabling consumers in smaller towns and rural areas to access diverse FMCG portfolios previously available only in metropolitan centers. Quick commerce emergence has revolutionized fulfillment expectations, with platforms delivering products within minutes in urban areas. Direct-to-consumer models have enabled emerging brands to bypass traditional distribution barriers, reaching consumers through targeted digital marketing and personalized engagement. This digital transformation continues accelerating market expansion while reshaping competitive dynamics.

Government Initiatives and Policy Support

Government initiatives have created favorable conditions for FMCG sector expansion through infrastructure development, manufacturing incentives, and rural market development programs. The Production-Linked Incentive scheme for food processing has attracted substantial investments while creating employment opportunities across the value chain. Rural electrification programs have expanded refrigeration and storage capabilities, enabling distribution of temperature-sensitive products to previously inaccessible markets. GST implementation has streamlined interstate commerce, reduced logistics complexity, and improved supply chain efficiency. Government focuses on rural infrastructure development, including road connectivity and digital networks, and continues enhancing market accessibility while supporting rural income growth that drives consumption expansion.

Market Restraints:

What Challenges the India FMCG Market is Facing?

Rising Input Costs and Margin Pressures

Escalating raw material costs including palm oil, packaging materials, and agricultural commodities are pressuring manufacturer margins across categories. Currency volatility amplifies imported input costs, particularly for companies’ dependent on overseas sourcing. Intense competition limits pricing flexibility, forcing manufacturers to absorb cost increases, or implement shrinkflation strategies that risk consumer perception.

Supply Chain Complexity and Distribution Challenges

India's diverse geography and fragmented retail landscape present significant distribution challenges for FMCG manufacturers. Logistics inefficiencies in rural areas increase operational costs while limiting market reach. Cold chain infrastructure gaps constrain the distribution of temperature-sensitive products. Quick commerce disruption is intensifying pressure on traditional distributors and kirana stores, requiring adaptation to evolving channel dynamics.

Intensifying Competition and Market Fragmentation

The market exhibits intense competition among multinational corporations, domestic giants, regional players, and emerging direct-to-consumer brands. Digital-first startups are capturing consumer attention through innovative products and targeted marketing, challenging established market positions. Price competition in mass segments limits profitability while premiumization requires significant investment in brand building and product development.

Competitive Landscape:

The India FMCG market exhibits a highly competitive landscape characterized by the presence of multinational corporations, established domestic giants, and emerging digital-native brands competing across diverse product categories. Market leaders leverage extensive distribution networks, strong brand equity, and substantial marketing investments to maintain competitive positions while continuously innovating to address evolving consumer preferences. Strategic acquisitions have intensified as legacy players seek to capture digital-first consumer segments and expand premium product portfolios. Competition is further driven by regional manufacturers offering localized products at competitive price points, and direct-to-consumer brands disrupting traditional distribution models through digital engagement strategies. Some of the key players in the India FMCG market include:

- AB InBev India (Anheuser-Busch InBev SA/NV)

- Amul

- Asian Paints Ltd

- Britannia Industries Limited

- Coca-Cola India (The Coca-Cola Company)

- Colgate Palmolive (India) Ltd (Colgate-Palmolive Company)

- Dabur Ltd

- Godrej Consumer Products Limited

- Hindustan Unilever Limited (Unilever Plc)

- ITC Limited

- Marico Limited

- Nestlé India Limited (Nestlé S.A.)

- Patanjali Ayurved Limited

- PepsiCo (India) Holdings Pvt. Ltd. (PepsiCo Inc.)

- Procter & Gamble Hygiene and Health Care Limited (The Procter &Gamble Company)

Recent Developments:

-

In October 2024, Tata Consumer Products Limited (TCPL), a top consumer goods firm, and Salesforce announced a strategic partnership to further TCPL's digital transformation. Together, the two businesses have introduced MAVIC, an AI-powered Go-to-Market (GTM) platform that aims to significantly speed up and improve TCPL's sales and distribution processes.

-

In August 2024, Emami Limited, one of the top FMCG firms in India, has signed a binding agreement with Helios Lifestyle Pvt Ltd. (also known as Helios), a company well-known for its high-end men's grooming brand The Man Company, to acquire 100% ownership by purchasing the remaining 49.60%. Emami Ltd. already owns 50.40% of Helios, making it a subsidiary.

India FMCG Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Demographics Covered | Urban, Rural |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, Others |

| Companies Covered | AB InBev India (Anheuser-Busch InBev SA/NV), Amul, Asian Paints Ltd., Britannia Industries Limited, Coca-Cola India (The Coca-Cola Company), Colgate Palmolive (India) Ltd (Colgate-Palmolive Company), Dabur Ltd., Godrej Consumer Products Limited, Hindustan Unilever Limited (Unilever Plc), ITC Limited, Marico Limited, Nestlé India Limited (Nestlé S.A.), Patanjali Ayurved Limited, PepsiCo (India) Holdings Pvt. Ltd. (PepsiCo Inc.), Procter & Gamble Hygiene and Health Care Limited (The Procter &Gamble Company), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India FMCG market size was valued at USD 287.91 Billion in 2025.

The India FMCG market is expected to grow at a compound annual growth rate of 16.64% from 2026-2034 to reach USD 1,150.21 Billion by 2034.

Personal care and cosmetics dominated with approximately 48% market share in 2025, driven by rising consumer consciousness regarding grooming, premiumization trends, and expanding demand across skincare and personal hygiene categories.

Key factors driving the India FMCG market include rising disposable incomes, rapid urbanization, expanding middle-class population, digital transformation and e-commerce growth, government initiatives supporting manufacturing and rural development, and evolving consumer preferences toward premium and health-conscious products.

Major challenges include rising input costs and margin pressures, supply chain complexity and distribution challenges in diverse geographies, intensifying competition from domestic and international players, regulatory compliance requirements, and adapting to rapidly evolving consumer preferences and channel dynamics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)