India Food Allergy Market Size, Share, Trends and Forecast by Allergen Type, Drug Type, Route of Administration, End-Use, and Region, 2025-2033

India Food Allergy Market Overview:

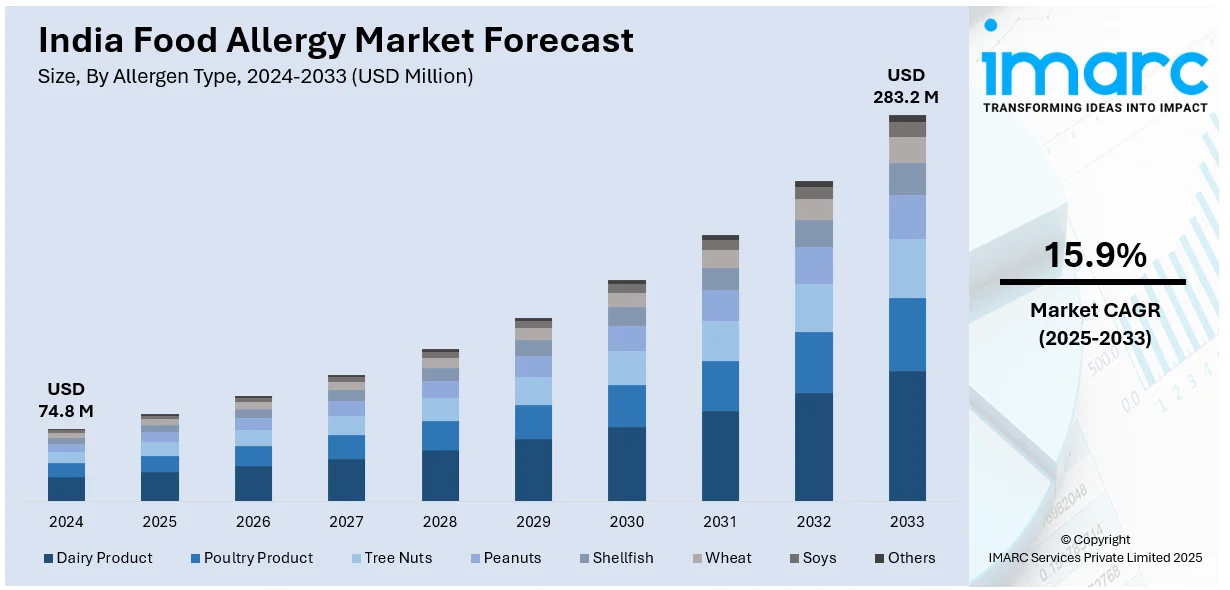

The India food allergy market size reached USD 74.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 283.2 Million by 2033, exhibiting a growth rate (CAGR) of 15.9% during 2025-2033. The market is driven by awareness about food allergies, growing incidence of allergic episodes, and heightened concern for health and nutrition. Moreover, the presence of food products that are free from allergens, government efforts at food labeling, and improving disposable incomes are also fueling India food allergy market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 74.8 Million |

| Market Forecast in 2033 | USD 283.2 Million |

| Market Growth Rate 2025-2033 | 15.9% |

India Food Allergy Market Trends:

Rising Awareness and Education on Food Allergies

In India, there has been an increasing awareness about food allergies, leading to higher demand for allergen-free foods and services. Industry reports indicate that approximately one-third of the world’s population thinks they or a relative has a particular food allergy. Current surveys show that merely 2%-8% of children and 1%-2% of adults have clinically confirmed food allergies, with the rest categorized as food intolerances. Healthcare professionals, NGOs, and government organizations have conducted awareness campaigns to educate the masses regarding the danger of food allergies and appropriate diagnosis and management. As there is an increase in the number of food allergies, particularly in children, people are increasingly aware of what is being put into their food and what could cause an allergic reaction. As a result, the demand for allergen-friendly products, i.e., gluten-free, dairy-free, and nut-free foods, has skyrocketed. Furthermore, social media websites and internet forums are helping in the dissemination of information and linking people with food allergies. Consequently, brands are investing in providing transparent labeling and certification of allergen-free products to enable consumers to easily spot safe food choices, resulting in an increase in the market.

To get more information on this market, Request Sample

Increased Adoption of Allergen-Free Food Products

The India food allergy market outlook is experiencing strong growth due to increasing food allergies and lifestyle changes. According to industry reports, allergies are becoming more common in today's society, with approximately 20-30% of the population facing some kind of allergy at some point in their lives. Furthermore, recent studies have shown that as the global population grows older, allergy symptoms in elderly individuals will become more prevalent. Hence, consumers are gravitating toward food products that do not contain popular allergens like gluten, dairy, nuts, and soy in order to avoid triggering allergic responses. This is most evident in urban regions, where the choice of specialty food items is on the rise. Food companies are reacting by introducing new allergen-free and health-focused food products, meeting the demand of people with food allergies. The trend toward plant-based diets is also driving the market, as most plant-based foods inherently avoid common allergens. In addition, a rise in the number of restaurants and food chains that provide allergen-free alternatives is further enhancing the market. With more individuals embracing allergen-free diets due to health or medical purposes, demand for the products is set to continue growing, giving companies new business opportunities.

India Food Allergy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on allergen type, drug type, route of administration, and end-use.

Allergen Type Insights:

- Dairy Product

- Poultry Product

- Tree Nuts

- Peanuts

- Shellfish

- Wheat

- Soys

- Others

The report has provided a detailed breakup and analysis of the market based on the allergen type. This includes dairy product, poultry product, tree nuts, peanuts, shellfish, wheat, soys, and others.

Drug Type Insights:

- Antihistamines

- Epinephrine

- Immunotherapy

- Xolair

- PALFORZIA

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes antihistamines, epinephrine, immunotherapy (Xolair, PALFORZIA, others), and others.

Route of Administration Insights:

- Oral

- Parenteral

- Others

The report has provided a detailed breakup and analysis of the market based on the route of administration. This includes oral, parenteral, and others.

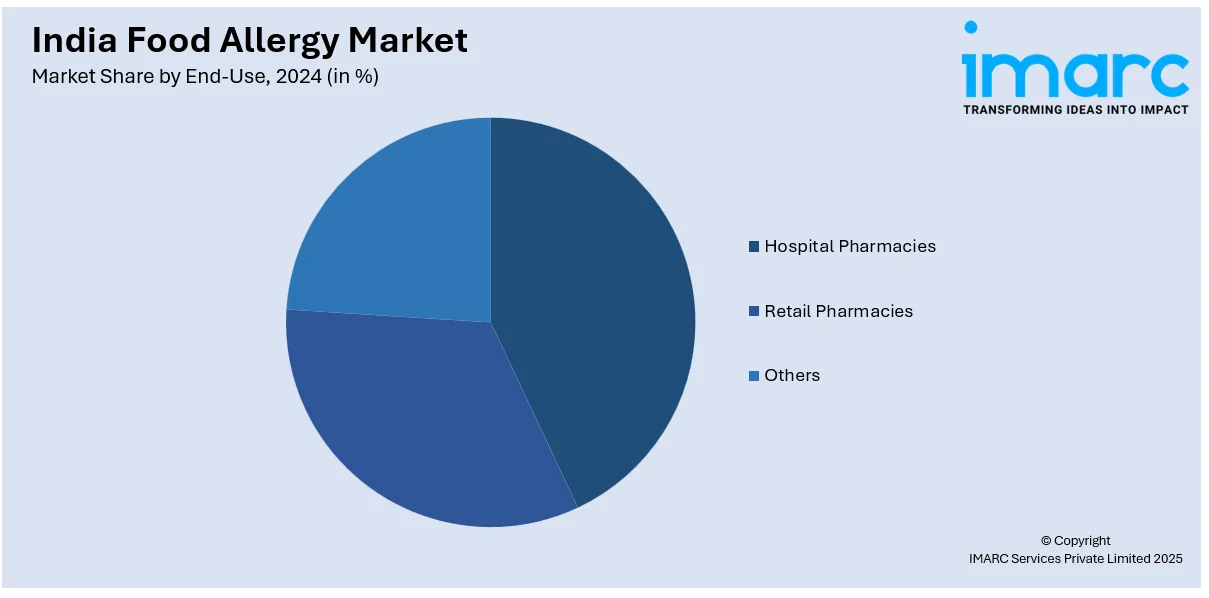

End-Use Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes hospital pharmacies, retail pharmacies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Allergy Market News:

- In May 2023, Dr Dangs Lab introduced an AI-driven novel allergy test named 'Allergynius Dx', which is a cutting-edge Molecular Allergy Diagnostics test utilizing Microarray technology, designed to provide reports that assist patients and doctors in making informed choices regarding allergy management.

India Food Allergy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Allergen Types Covered | Dairy Product, Poultry Product, Tree Nuts, Peanuts, Shellfish, Wheat, Soys, Others |

| Drug Types Covered |

|

| Routes of Administration Covered | Oral, Parenteral, Others |

| End-Uses Covered | Hospital Pharmacies, Retail Pharmacies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India food allergy market performed so far and how will it perform in the coming years?

- What is the breakup of the India food allergy market on the basis of allergen type?

- What is the breakup of the India food allergy market on the basis of drug type?

- What is the breakup of the India food allergy market on the basis of route of administration?

- What is the breakup of the India food allergy market on the basis of end-use?

- What is the breakup of the India food allergy market on the basis of region?

- What are the various stages in the value chain of the India food allergy market?

- What are the key driving factors and challenges in the India food allergy market?

- What is the structure of the India food allergy market and who are the key players?

- What is the degree of competition in the India food allergy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food allergy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food allergy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food allergy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)