India Food Enzymes Market Size, Share, Trends and Forecast by Type, Source, Formulation, Application, and Region, 2025-2033

Market Overview:

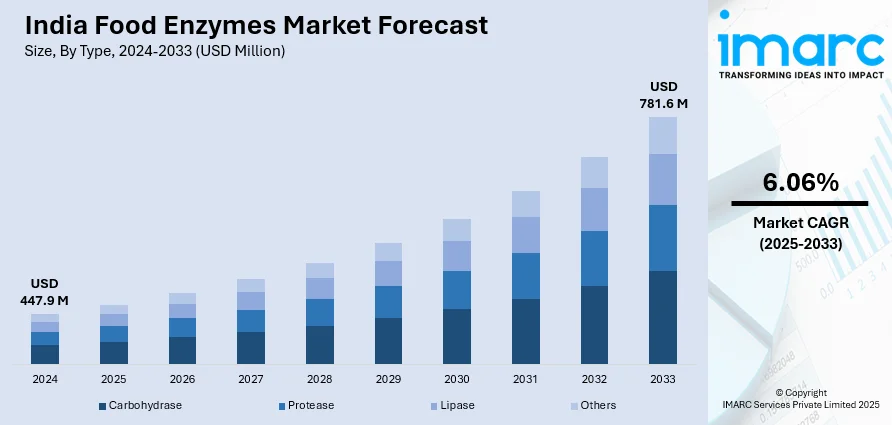

The India food enzymes market size reached USD 447.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 781.6 Million by 2033, exhibiting a growth rate (CAGR) of 6.06% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 447.9 Million |

|

Market Forecast in 2033

|

USD 781.6 Million |

| Market Growth Rate 2025-2033 | 6.06% |

Food enzymes refer to biocatalysts that aid in the breakdown of nutrients, such as proteins, carbohydrates, fats and vitamins, into simpler forms. They are commonly available in the form of protease, amylase, lipase and cellulase. These enzymes are usually manufactured using plant, animal and microbial-sourced ingredients. They aid in improving the flavor, texture and fragrance of the food products and are widely used in the manufacturing of bakery products, cheese and starch processing, meat tenderizing and production of fruit juices.

To get more information of this market, Request Sample

The increasing demand for food enzymes from the food and beverage industry is one of the key factors favoring the market growth. Resulting from changing lifestyles and improving dietary patterns, there is a rising demand for nutrient-rich food and beverages across India. This has further led to the increasing adoption of food enzymes to enhance the quality of these products. Additionally, widespread utilization of food enzymes for the extraction, clarification and filtration of fruit and vegetable juices is also contributing to the market growth. Some of the other factors driving the growth of the market across the country include extensive research and development (R&D) by poultry producers on protease to improve protein digestion and the development of innovative techniques to synthesize these enzymes naturally.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India food enzymes market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, source, formulation and application.

Breakup by Type:

- Carbohydrase

- Amylase

- Cellulase

- Lactase

- Pectinase

- Others

- Protease

- Lipase

- Others

Breakup by Source:

- Microorganisms

- Bacteria

- Fungi

- Plants

- Animals

Breakup by Formulation:

- Powder

- Liquid

- Others

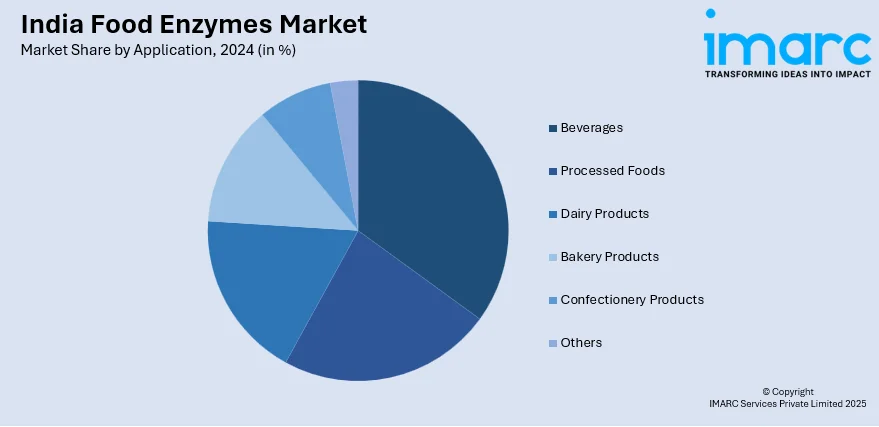

Breakup by Application:

- Beverages

- Processed Foods

- Dairy Products

- Bakery Products

- Confectionery Products

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, Source, Formulation, Application, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India food enzymes market was valued at USD 447.9 Million in 2024.

We expect the India food enzymes market to exhibit a CAGR of 6.06% during 2025-2033.

The rising demand for nutrient-rich beverages, along with the increasing utilization of food enzymes for the extraction, clarification, and filtration of fruit and vegetable juices, is primarily driving the India food enzymes market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of food enzymes across the nation.

Based on the type, the India food enzymes market can be segmented into carbohydrase, protease, lipase, and others. Currently, carbohydrase holds the majority of the total market share.

Based on the source, the India food enzymes market has been divided into microorganisms, bacteria, fungi, plants, and animals. Among these, microorganisms currently exhibit a clear dominance in the market.

Based on the application, the India food enzymes market can be categorized into beverages, processed foods, dairy products, bakery products, confectionery products, and others. Currently, beverages account for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)