India Food Processing Equipment Market Size, Share, Trends and Forecast by Mode of Operation, Type, Application, and Region, 2025-2033

India Food Processing Equipment Market Overview:

The India food processing equipment market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The market share is expanding, driven by the rising preference for frozen food products and convenience snacks owing to busy lifestyles, along with the expansion of food delivery services that require reliable tools for maintaining quality and extended shelf life.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 1.5 Billion |

| Market Growth Rate 2025-2033 | 3.70% |

India Food Processing Equipment Market Trends:

Growing demand for packaged food items

The rising need for packaged food items is impelling the India food processing equipment market growth. With rapid urbanization, people have less time for traditional cooking, so they rely on processed and packaged food products. People prefer ready-to-eat (RTE) meals, frozen food items, and convenience snacks due to their busy lifestyles, encouraging manufacturers to expand their production capacity. This growing demand is motivating firms to wager on advanced food processing equipment to improve efficiency, maintain quality, and meet strict food safety standards. Supermarkets are also making packaged food items more accessible, further creating the need for large-scale manufacturing facilities. Additionally, health-conscious individuals are looking for hygienically processed and minimally handled food items, prompting manufacturers to upgrade to automated and high-tech equipment that ensures better quality control. The government’s encouragement for the food processing industry through subsidies and incentives also enables companies to modernize their equipment. As competition grows, food businesses seek cutting-edge machinery for tasks like sorting, packaging, and preservation to stay ahead in the market. From dairy and bakery products to ready-to-cook meals, the increasing variety of packaged food options is catalyzing the demand for high-speed food processing equipment across India. According to the IMARC Group, the India packaged food market is set to attain USD 210.81 Billion by 2032, showing a growth rate (CAGR) of 7.08% during 2024-2032.

.webp)

To get more information on this market, Request Sample

Expansion of e-commerce sites

The expansion of e-commerce portals is offering a favorable India food processing equipment market outlook. As per industry reports, the Indian e-commerce sector was expected to attain a gross merchandise value (GMV) of USD 12 Billion during the October to December 2024 festival season, representing a 23% rise compared to 2023. E-commerce sites offer the convenience of ordering food items easily from the comfort of homes. Online grocery platforms and food delivery services require consistent quality, extended shelf life, and efficient packaging, which encourages companies to adopt better machinery for sorting and preserving food products. As e-commerce platforms are broadening their reach, small and large food brands are upgrading their production lines to keep up with bulk orders. Faster processing and automation have become essential to maintain supply chain efficiency and ensure fresh items reach customers quickly. The need for specialized equipment for dairy products is also increasing as online grocery sales surge. With more people adopting digital shopping, the demand for high-tech food processing equipment continues to grow across India.

India Food Processing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on mode of operation, type, and application.

Mode of Operation Insights:

- Semi Automatic

- Automatic

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes semi automatic and automatic.

Type Insights:

- Processing

- Pre-Processing

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes processing and pre-processing.

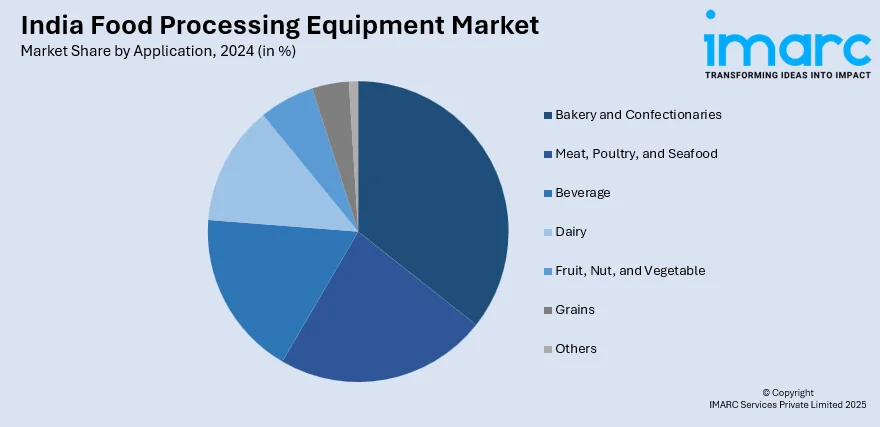

Application Insights:

- Bakery and Confectionaries

- Meat, Poultry, and Seafood

- Beverage

- Dairy

- Fruit, Nut, and Vegetable

- Grains

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes bakery and confectionaries, meat, poultry, and seafood, beverage, dairy, fruit, nut, and vegetable, grains, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Processing Equipment Market News:

- In June 2024, Tummers Food Processing Solutions teamed up with Kiron Food Processing Technologies to reveal the development of a new firm, Tummers Kiron India Pvt. Ltd., which was to be established in Mumbai, India. This was announced at the Inter Food Tech event in New Delhi at the Kiron FPT booth. Both the manufacturers of food processing equipment aimed to launch a production facility that could produce essential products.

- In June 2024, the Indian Union Minister for food processing industries, Chirag Paswan declared that the third edition of World Food India was scheduled to take place from September 19 to 22, 2024, at Bharat Mandapam in New Delhi. It aimed to place emphasis on enhancing the emerging startup ecosystem and encouraging innovations within the food industry. Senior government officials, prominent investors, and stakeholders, such as equipment manufacturers, technology suppliers, and food retailers were invited to this 4-day premier event.

India Food Processing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Operations Covered | Semi Automatic, Automatic |

| Types Covered | Processing, Pre-Processing |

| Applications Covered | Bakery and Confectionaries, Meat, Poultry, and Seafood, Beverage, Dairy, Fruit, Nut, and Vegetable, Grains, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food processing equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food processing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food processing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food processing equipment market in India was valued at USD 1.1 Billion in 2024.

The India food processing equipment market is projected to exhibit a CAGR of 3.70% during 2025-2033, reaching a value of USD 1.5 Billion by 2033.

The India food processing equipment market is driven by rising demand for packaged and processed foods, government support for food manufacturing, and technological advancements in automation. Growing urbanization, changing dietary habits, and the expansion of organized food retail also contribute to increased equipment adoption across the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)