India Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End User, and Region, 2026-2034

India Footwear Market Summary:

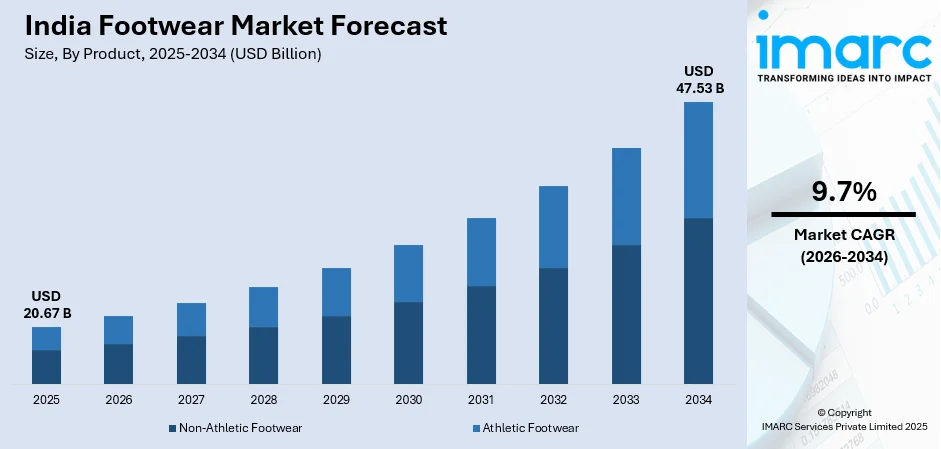

The India footwear market size was valued at USD 20.67 Billion in 2025 and is projected to reach USD 47.53 Billion by 2034, growing at a compound annual growth rate of 9.7% from 2026-2034.

The India footwear market is experiencing transformative growth driven by rapid urbanization, rising disposable incomes, and evolving consumer preferences toward fashionable and functional footwear. The expanding middle-class population, coupled with increasing health consciousness and growing awareness of fashion trends, continues to fuel demand across diverse product categories. The penetration of international brands and the rapid development of e-commerce platforms are reshaping consumer purchasing patterns throughout the country.

Key Takeaways and Insights:

-

By Product: Non-athletic footwear dominates the market with a share of 67.64% in 2025, driven by strong demand for casual, formal, and traditional footwear styles that cater to diverse lifestyle requirements and cultural preferences across Indian consumers.

-

By Material: Leather leads the market with a share of 45% in 2025, owing to its durability, premium appeal, and strong consumer preference for quality footwear in both formal and casual categories.

-

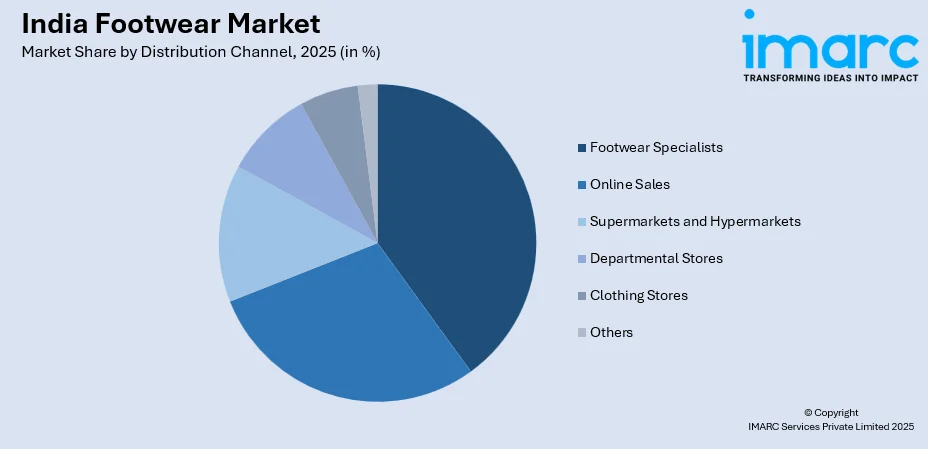

By Distribution Channel: Footwear specialists represent the largest segment with a market share of 38% in 2025, attributed to their extensive product range, expert guidance, and trusted positioning as dedicated retail destinations for footwear purchases.

-

By Pricing: Premium segment dominates with a share of 54% in 2025, reflecting the growing consumer inclination toward branded, high-quality footwear driven by rising disposable incomes and fashion consciousness.

-

By End User: Women lead the market with a share of 54.36% in 2025, driven by increasing female workforce participation, rising fashion awareness, and expanding product variety catering to diverse style preferences.

-

By Region: North India represents the largest segment with a market share of 35% in 2025, supported by high population density, established manufacturing clusters, and strong retail infrastructure in major urban centers.

-

Key Players: The India footwear market features a highly competitive landscape, comprising established domestic manufacturers and well-known international brands competing across product categories, pricing tiers, and distribution channels. Some of the key players include Relaxo Footwears Limited, Liberty, Ajanta Shoes, Khadim India Ltd., Campus Activewear Limited, Nike, Inc., Bata India, Paragon Polymer Product Private Limited, adidas India Marketing Pvt. Ltd., and PUMA India Ltd.

To get more information on this market Request Sample

Footwear encompasses outer coverings worn on feet to provide comfort, protection, and style for various activities. Products are manufactured from numerous materials including leather, rubber, fabric, plastic, and synthetic compounds, offering diverse patterns, colors, and designs with advanced technical fabrications. In 2025, South Korea‑headquartered Hwaseung Footwear Group committed to setting up its first manufacturing facility in India’s Tamil Nadu with an investment of ₹1,720 crore, expected to generate 20,000 direct jobs and bolster non‑leather footwear production, underscoring the country’s appeal as a global manufacturing destination. India stands as the second-largest producer and consumer of footwear globally, with a rapidly growing domestic market supported by an expanding middle class, increasing urbanization, and shifting consumer preferences toward branded products. The footwear industry benefits from government initiatives promoting domestic manufacturing, availability of skilled labor, and access to raw materials, positioning the country as both a significant production hub and a lucrative consumer market.

India Footwear Market Trends:

Rising Demand for Athleisure and Comfort-Focused Footwear

The India footwear market is witnessing a significant surge in demand for athleisure and comfort‑oriented footwear driven by growing health consciousness and evolving lifestyle preferences. In response to this trend, Lehar Footwear Ltd. launched a dedicated sports and athleisure brand, RANNR, in 2025 to cater to consumers seeking performance‑driven, comfortable yet stylish footwear that bridges active and casual wear, reflecting how manufacturers are pivoting toward the comfort‑athleisure segment. The hybrid work culture and increased focus on fitness activities have accelerated consumer preference for versatile footwear that seamlessly transitions between casual and active settings. This trend is particularly pronounced among younger demographics who prioritize both style and functionality, prompting manufacturers to introduce innovative designs that combine aesthetic appeal with ergonomic comfort features.

Accelerated Growth of E-Commerce and Digital Retail Channels

The rapid expansion of e‑commerce is transforming India’s footwear distribution landscape. Rising internet penetration and smartphone adoption enable consumers in tier two and three cities to access diverse options previously unavailable locally. In 2025, Indian e‑commerce firm Meesho expanded AI-driven features and new business lines to improve online shopping for first-time and rural buyers, reflecting how digital platforms enhance personalized experiences. Major brands are also investing in virtual try-ons, AI recommendations, and tailored delivery, while subscription models further reshape purchasing behaviors.

Growing Emphasis on Sustainable and Eco-Friendly Footwear Options

Environmental consciousness is increasingly influencing footwear purchasing decisions as consumers demonstrate growing preference for sustainable and eco‑friendly products. In February 2025, Metro Brands, a major Indian footwear retailer, launched a nationwide campaign to highlight footwear recycling and champion sustainability by encouraging consumers to give used shoes a second life through its recycling initiative, reinforcing industry focus on environmental stewardship, as manufacturers respond by incorporating recycled materials, plant‑based alternatives, and environmentally responsible production processes into their offerings. Leading domestic and international brands are launching eco‑conscious product lines that address consumer concerns about environmental impact while maintaining quality and style standards, positioning sustainability as a key differentiator in the competitive market landscape.

Market Outlook 2026-2034:

The India footwear market is positioned for robust expansion throughout the forecast period, underpinned by favorable demographic factors, rising consumer spending power, and continuous product innovation. The young and dynamic population, combined with increasing urbanization and evolving fashion preferences, creates substantial growth opportunities across all market segments. Government initiatives supporting domestic manufacturing, improving retail infrastructure, and the continued expansion of organized retail are expected to further accelerate market development. The market generated a revenue of USD 20.67 Billion in 2025 and is projected to reach a revenue of USD 47.53 Billion by 2034, growing at a compound annual growth rate of 9.7% from 2026-2034.

India Footwear Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Non-Athletic Footwear |

67.64% |

|

Material |

Leather |

45% |

|

Distribution Channel |

Footwear Specialists |

38% |

|

Pricing |

Premium |

54% |

|

End User |

Women |

54.36% |

|

Region |

North India |

35% |

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The non-athletic footwear dominates with a market share of 67.64% of the total India footwear market in 2025.

Non-athletic footwear maintains its dominant position in the India footwear market driven by strong consumer demand for casual, formal, and traditional footwear styles that cater to diverse lifestyle requirements. This category encompasses a wide range of products including sandals, slippers, formal shoes, and ethnic footwear that align with cultural preferences and everyday wear requirements. In fiscal 2024‑25, India’s exports of leather, non‑leather footwear and related products rose by around 25% year‑on‑year to approximately US $5.7 billion, reflecting rising global demand for Indian footwear offerings across segments including non‑athletic styles. The segment benefits from consistent demand across professional, social, and casual settings, making it an essential category for consumers across all demographic segments.

The extensive product variety within non-athletic footwear enables consumers to select appropriate options for various occasions, from workplace environments to traditional celebrations. Rising urbanization and the expanding organized retail sector have enhanced accessibility to diverse non-athletic footwear options, while the premiumization trend is driving demand for higher-quality products with improved comfort features and aesthetic appeal. The segment continues to evolve with manufacturers introducing innovative designs that combine traditional styling with modern comfort technologies.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

The leather leads with a share of 45% of the total India footwear market in 2025.

Leather footwear maintains its leading position in the India market owing to its durability, premium appeal, and strong consumer preference for quality products in both formal and casual categories. India's position as a major leather producer with access to abundant raw materials supports the domestic leather footwear industry, enabling manufacturers to offer competitive pricing while maintaining quality standards. In 2025, the Uttar Pradesh government notified the UP Footwear and Leather Development Policy, a five‑year initiative designed to attract global investors, enhance infrastructure, and boost exports through incentives and sustainability support, reinforcing the state’s role as a key leather footwear manufacturing hub.

The leather footwear segment benefits from established manufacturing clusters in regions such as Tamil Nadu, Uttar Pradesh, and West Bengal, which provide skilled craftsmanship and production expertise. Rising disposable incomes and growing fashion consciousness are driving demand for premium leather products, while international brand presence is elevating quality expectations. Manufacturers are increasingly adopting sustainable practices and eco-friendly tanning processes to address environmental concerns while maintaining the material's premium positioning in the market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The footwear specialists dominate with a market share of 38% of the total India footwear market in 2025.

Footwear specialist retailers maintain their dominant position in the India market through their comprehensive product offerings, expert customer guidance, and trusted brand positioning as dedicated destinations for footwear purchases. These specialized outlets offer extensive variety across multiple brands, sizes, and price points, enabling consumers to make informed purchasing decisions with professional assistance. The physical retail experience provided by footwear specialists remains particularly valued for products requiring proper fitting and quality assessment.

The expansion of footwear specialist chains into tier two and tier three cities is broadening market accessibility while maintaining service quality standards. Major domestic brands are investing in store modernization, enhanced visual merchandising, and digital integration to improve customer experiences. The omnichannel approach adopted by leading retailers enables seamless transitions between physical and digital touchpoints, catering to evolving consumer preferences while leveraging the strengths of specialized retail expertise.

Pricing Insights:

- Premium

- Mass

The premium leads with a share of 54% of the total India footwear market in 2025.

The premium footwear segment leads the India market driven by rising disposable incomes, growing fashion consciousness, and increasing consumer willingness to invest in quality products. The expanding middle-class population demonstrates strong preference for branded footwear that offers superior comfort, durability, and style, viewing premium purchases as investments in quality and status. International brand presence and their marketing strategies have elevated consumer expectations and aspirations toward premium product categories.

The premiumization trend is supported by improved retail infrastructure that enables consumers to access higher-end products across urban and semi-urban markets. E-commerce platforms have democratized access to premium brands, enabling consumers in smaller cities to purchase products previously available only in metropolitan areas. The segment continues to expand as manufacturers introduce innovative premium offerings that combine international design aesthetics with features specifically tailored to Indian consumer preferences and requirements.

End User Insights:

- Men

- Women

- Kids

The women dominate with a market share of 54.36% of the total India footwear market in 2025.

The women's footwear segment dominates the India market driven by increasing female workforce participation, rising fashion awareness, and expanding product variety catering to diverse style preferences. Women demonstrate higher purchase frequency compared to other demographic segments, with distinct requirements for multiple footwear categories spanning formal, casual, ethnic, and athletic styles. The growing economic independence of women consumers has translated into increased spending power and willingness to invest in quality footwear products. In 2025, Ecco opened its first Mumbai store, expanding retail in India with plans for more outlets, targeting urban consumers seeking premium, comfortable footwear, including women’s styles.

Manufacturers are responding to the women's segment demand by introducing extensive collections that address varied aesthetic preferences, comfort requirements, and occasion-specific needs. The proliferation of fashion-forward designs incorporating current trends, combined with improved sizing options and comfort technologies, has enhanced product appeal among female consumers. Social media influence and celebrity endorsements play significant roles in shaping purchasing decisions within this segment, driving continuous innovation and product differentiation strategies.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The North India exhibits a clear dominance with a 35% share of the total India footwear market in 2025.

North India leads the footwear market supported by its substantial population base, established manufacturing clusters, and strong retail infrastructure concentrated in major urban centers including Delhi, Uttar Pradesh, and Punjab. The region hosts the renowned Agra leather footwear cluster, which contributes significantly to both domestic supply and export production. High consumer density in metropolitan areas combined with rising urbanization in tier two cities creates sustained demand across all footwear categories and price segments.

The North India market benefits from well-developed distribution networks, extensive retail presence of both domestic and international brands, and strong consumer awareness about footwear trends. The region's diverse climate conditions drive demand for varied footwear types suitable for different seasons, while cultural celebrations and wedding seasons create substantial seasonal demand spikes. Continued infrastructure development and retail expansion in emerging urban centers are expected to sustain the region's market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the India Footwear Market Growing?

Rapid Urbanization and Expanding Middle-Class Population

India's accelerating urbanization is fundamentally reshaping footwear consumption patterns as increasing numbers of individuals migrate to urban centers seeking employment opportunities. The expanding middle-class population with rising disposable incomes demonstrates growing preference for stylish, quality footwear that meets diverse lifestyle requirements across professional and social settings. In 2025, sustainable footwear brand Neeman’s opened its 20th exclusive outlet in Jaipur, marking a significant step in its nationwide retail expansion strategy and reflecting rising urban consumer demand for eco‑friendly and design‑led footwear options. Urban consumers increasingly embrace varied footwear options ranging from formal and casual shoes to sports and fashion-oriented products, driving demand across multiple market segments. The shift toward modern living patterns amplifies interest in branded and premium footwear offerings, while improved retail infrastructure in urban areas enhances product accessibility and consumer choice.

Penetration of International Brands and E-Commerce Expansion

The growing presence of international footwear brands combined with rapid e-commerce development has played a transformative role in boosting the India footwear industry. Global brands are effectively establishing their presence across India, introducing products that match the preferences and aspirations of Indian consumers while elevating quality standards and fashion awareness. The India e-commerce market size reached USD 107.7 Billion in 2024, highlighting the scale and potential of online retail channels that are increasingly driving footwear sales. The simultaneous expansion of online purchasing platforms has fundamentally reshaped consumer footwear purchasing patterns by offering convenience, extensive product variety, and user-friendly payment services. This digital transformation has enabled the footwear industry to reach broader consumer bases including previously underserved markets in smaller cities and rural areas.

Young Demographics and Evolving Fashion Consciousness

India's young and dynamic population represents a significant driver of footwear market growth as this demographic demonstrates strong fashion consciousness and willingness to experiment with diverse styles. The influence of social media, celebrity endorsements, and digital marketing has heightened awareness about global footwear trends among younger consumers who prioritize both style and functionality. Rising health consciousness and fitness awareness are driving demand for athletic and athleisure footwear categories, while the growing trend toward premiumization reflects younger consumers' preference for quality branded products. This demographic shift ensures sustained demand growth as manufacturers continuously innovate to meet evolving preferences and expectations.

Market Restraints:

What Challenges the India Footwear Market is Facing?

Intense Competition from Unorganized Sector

The India footwear market faces significant competitive pressure from the unorganized sector, which accounts for a substantial portion of total production and sales. Unorganized players benefit from lower overhead costs, tax advantages, and reduced compliance requirements, enabling them to offer products at highly competitive prices. This price competition constrains growth opportunities for organized players and limits profit margins across the industry.

Fluctuating Raw Material Prices and Supply Chain Challenges

The footwear industry experiences volatility in raw material prices, particularly for leather and synthetic materials, which impacts production costs and pricing stability. Supply chain disruptions and dependence on imported components for certain product categories create operational challenges for manufacturers. These factors affect profitability and limit the ability of companies to maintain consistent pricing strategies in a competitive market environment.

Regulatory Compliance and Quality Standardization Requirements

Evolving regulatory requirements including mandatory quality standards and environmental compliance mandates present challenges for footwear manufacturers, particularly smaller players. Implementation of stricter norms for chemical safety and quality certification requires investment in testing infrastructure and process modifications. These compliance requirements, while beneficial for consumer protection, increase operational complexity and costs for industry participants.

Competitive Landscape:

The India footwear market exhibits an intensely competitive landscape characterized by the presence of established domestic players, international brands, and numerous regional manufacturers operating across diverse market segments. Leading domestic companies leverage extensive distribution networks, strong brand recognition, and understanding of local consumer preferences to maintain market positions. International brands compete through premium positioning, innovative product offerings, and substantial marketing investments. The market structure includes organized players commanding a growing share while the unorganized sector continues to serve price-sensitive consumer segments. Strategic initiatives including retail expansion, digital transformation, product innovation, and sustainability practices are key competitive differentiators among market participants.

Some of the key players include:

- Relaxo Footwears Limited.

- Liberty

- Ajanta Shoes

- Khadim India Ltd.

- Campus Activewear Limited.

- Nike, Inc.

- Bata India

- Paragon Polymer Product Private Limited

- adidas India Marketing Pvt. Ltd

- PUMA India Ltd

Recent Developments:

-

In October 2025, Metro Brands Limited launched MetroActiv, a new multi‑brand athletic footwear retail concept targeting sports and active lifestyle consumers. The initiative aims to strengthen the company’s presence in performance footwear retailing across India, offering a curated range of brands and products to meet growing demand.

India Footwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End Users Covered | Men, Women, Kids |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Relaxo Footwears Limited., Liberty, Ajanta Shoes, Khadim India Ltd., Campus Activewear Limited., Nike, Inc., Bata India, Paragon Polymer Product Private Limited, adidas India Marketing Pvt. Ltd, PUMA India Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India footwear market size was valued at USD 20.67 Billion in 2025.

The India footwear market is expected to grow at a compound annual growth rate of 9.7% from 2026-2034 to reach USD 47.53 Billion by 2034.

Non-athletic footwear dominated the market with a share of 67.64%, driven by strong consumer demand for casual, formal, and traditional footwear styles that cater to diverse lifestyle requirements across Indian consumers.

Key factors driving the India footwear market include rapid urbanization, rising disposable incomes, expanding middle-class population, growing health consciousness, increasing penetration of international brands, expansion of e-commerce platforms, and evolving fashion preferences among the young demographic.

Major challenges include intense competition from the unorganized sector, fluctuating raw material prices, supply chain disruptions, regulatory compliance requirements, and the need for continuous innovation to meet rapidly evolving consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)