India Forging Market Size, Share, Trends and Forecast by Technique, Material, Industry, and Region, 2025-2033

India Forging Market Size and Share:

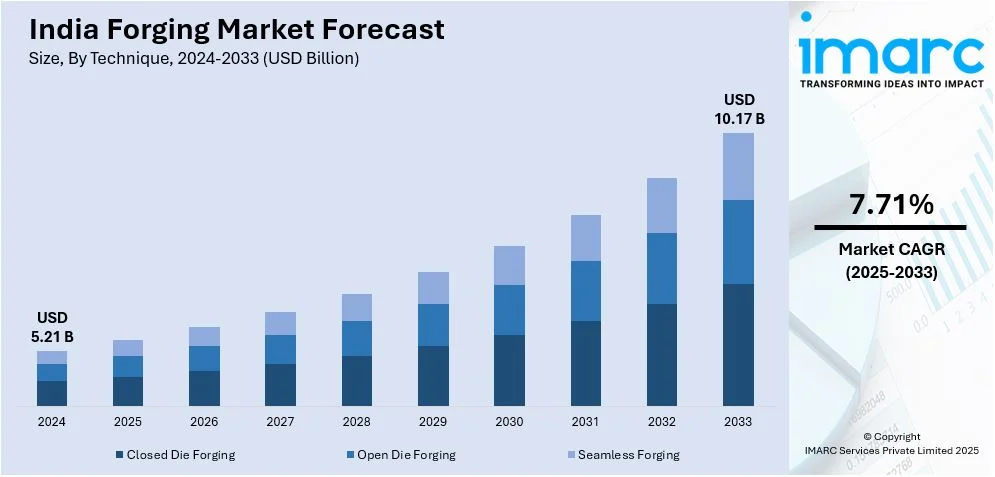

The India forging market size reached USD 5.21 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.17 Billion by 2033, exhibiting a growth rate (CAGR) of 7.71% during 2025-2033. The market is witnessing significant growth driven by rapid industrialization, expansion in the automotive and construction industries, and growing demand for precision-engineered components. The transformation toward high-tech manufacturing technologies, government policies encouraging indigenous manufacturing, and increasing exports are also driving the India forging market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.21 Billion |

| Market Forecast in 2033 | USD 10.17 Billion |

| Market Growth Rate 2025-2033 | 7.71% |

India Forging Market Trends:

Growth in Automotive Forging

With growth in the automobile industry, the Indian forging industry is gearing up for tremendous growth. With India developing further into a global auto manufacturing hub, the focus on manufacturing high-quality durable forged parts such as engine components, chassis, and transmission systems is increasing. As highlighted by the automotive sector, the high-strength forged materials such as aluminum and steel are now in great demand with regards to light-weight vehicles and fuel-efficient ones. With the onset of the electric vehicle era, it further opens avenues for specialty forged parts. As manufacturers try to reduce weight and energy losses in vehicles, the forging industry is in a good position to supply components to suit this new emerging demand. Manufacturers are also beginning to consider precision forging technology for very high-performance, complicated parts. The automotive industry keeping a fast pace in growth and the technological advances are some of the reasons shaping the future of the forging market in India.

To get more information on this market, Request Sample

Adoption of Advanced Forging Technologies

The Indian forging industry is experiencing a trend toward embracing new-age technologies such as computer numerical control (CNC) machines, automation, and 3D printing. These technologies allow producers to create very accurate and intricate forged parts with greater ease. New forging processes including precision forging and isothermal forging are becoming popular for the manufacture of components that require high strength-to-weight characteristics and excellence in durability. Automation is assisting in the reduction of labor and increasing production efficiency, whereas robotics on the forging front enhances accuracy and reduces human error. Furthermore, simulation and modeling software during the design process is streamlining the forging process, lowering material wastage, and enhancing overall product quality. The adoption of these advanced technologies and processes is transforming traditional operations into high-efficiency production systems. These developments are creating a positive India forging market outlook, positioning it as a global contender in terms of quality, innovation, and output.

Rising Demand for Forged Components in Aerospace and Defense

The Indian aerospace and defense industries are witnessing growing demand for forged parts, spurred by government policies such as "Make in India" and rising investments in defense infrastructure. Forged parts with high performance are required for aircraft, missile systems, and defense equipment because they offer greater strength, durability, and resistance to harsh conditions. India's increasing emphasis on defense self-reliance in manufacturing is increasing the demand for domestically produced forged parts, cutting down on imports. In addition, growth in India's civil aviation industry is fueling demand for light-weight, high-strength forged materials for aircraft production. Since aerospace and defense uses demand high-precision, high-quality parts, producers are increasingly investing in sophisticated forging methods to ensure strict safety and performance requirements. This convergence of policy support, technological advancement, and sectoral growth is significantly boosting production volumes and localization efforts across the industry, further strengthening the India forging market share.

India Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technique, material, and industry.

Technique Insights:

- Closed Die Forging

- Open Die Forging

- Seamless Forging

The report has provided a detailed breakup and analysis of the market based on the technique. This includes closed die forging, open die forging, and seamless forging.

Material Insights:

- Nickel-based Alloys

- Titanium Alloys

- Aluminum Alloys

- Steel Alloys

The report has provided a detailed breakup and analysis of the market based on the material. This includes nickel-based alloys, titanium alloys, aluminum alloys, and steel alloys.

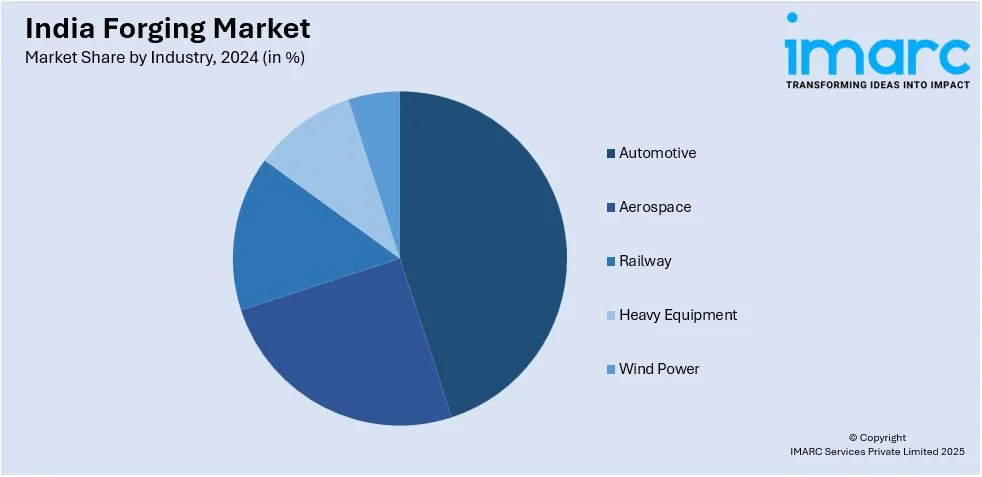

Industry Insights:

- Automotive

- Aerospace

- Railway

- Heavy Equipment

- Wind Power

The report has provided a detailed breakup and analysis of the market based on the industry. This includes automotive, aerospace, railway, heavy equipment, and wind power.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Forging Market News:

- In April 2024, Ramkrishna Forgings announced their entry into the US electric vehicle sector, providing powertrain parts to the biggest EV manufacturer. This signifies their entry into electric vehicles, utilizing their forging skills. The action is in line with their dedication to innovation and sustainable transportation.

- In March 2025, Bharat Forge Limited signed the largest national contract for 184 domestically developed Artillery Systems with the Ministry of Defense. This constitutes 60% of the ₹6900 Cr. acquisition by the MOD. The Advanced Towed Artillery Gun System (ATAGS), developed in collaboration with DRDO, is the most sophisticated 155/52 mm calibre artillery system.

India Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniques Covered | Closed Die Forging, Open Die Forging, Seamless Forging |

| Materials Covered | Nickel-based Alloys, Titanium Alloys, Aluminum Alloys, Steel Alloys |

| Industries Covered | Automotive, Aerospace, Railway, Heavy Equipment, Wind Power |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India forging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The forging market in India was valued at USD 5.21 Billion in 2024.

The India forging market is projected to exhibit a CAGR of 7.71% during 2025-2033, reaching a value of USD 10.17 Billion by 2033.

The India forging market is largely driven by the robust growth of the automotive sector, which accounts for a significant portion of demand. The increasing infrastructure development, "Make in India" initiatives boosting domestic manufacturing and exports, and rising adoption of advanced forging technologies like automation and precision forging are other key growth factors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)