India Forklift Market Size, Share, Trends and Forecast by Class, Power Source, Load Capacity, Electric Battery, End User, and Region, 2025-2033

India Forklift Market Overview:

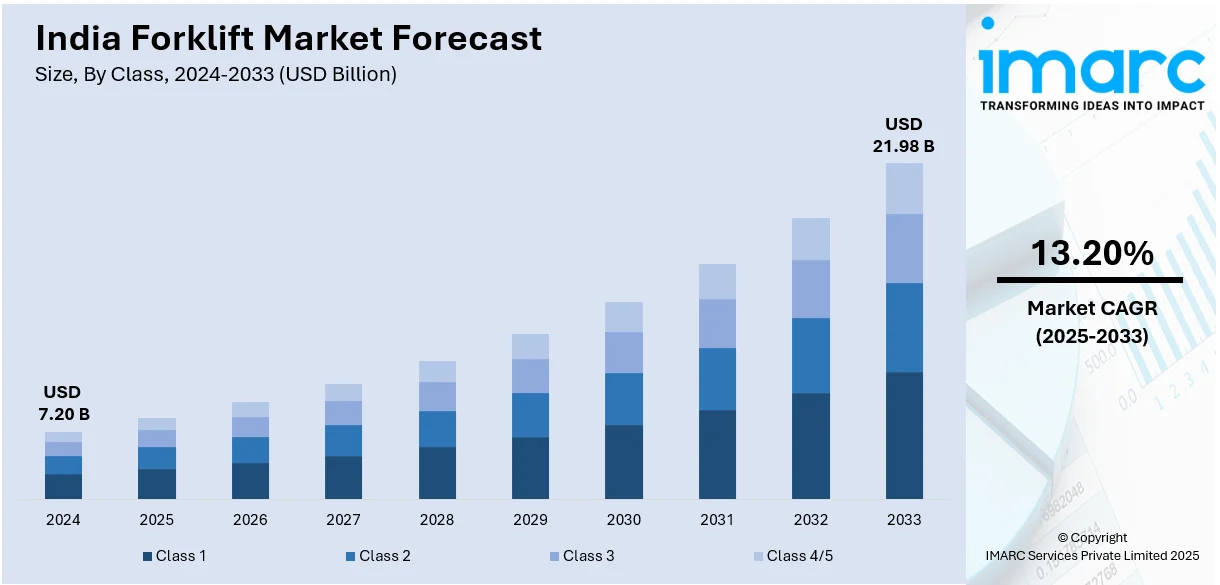

The India forklift market size reached USD 7.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.98 Billion by 2033, exhibiting a growth rate (CAGR) of 13.20% during 2025-2033. Rising e-commerce, warehouse expansion, infrastructure growth, manufacturing automation, logistics sector demand, government initiatives, smart forklift adoption, electrification trends, increasing imports and exports, safety regulations, and rental market expansion are driving the growth of India’s forklift market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.20 Billion |

| Market Forecast in 2033 | USD 21.98 Billion |

| Market Growth Rate (2025-2033) | 13.20% |

India Forklift Market Trends:

Shift Towards Electric Forklifts

The Indian forklift industry is experiencing a significant transition from internal combustion engine (ICE) forklifts to electric forklifts. The impetus for the shift comes from the demand for green solutions, increasing fuel prices, and tight emission norms. Electric forklifts are characterized by less emission, lower operating expenses, and quieter operation, which are perfect for indoor and urban environments. Furthermore, India plans to have 30% of its vehicle market electrified by the year 2030, of which encouraging electric forklift adoption is part. As such, government schemes encouraging sustainable industry practices and incentive schemes for adoption of electric vehicles are also driving this trend. For example, government efforts, as the proposed expenditure of USD 1.35 Trillion on infrastructure development between the years 2021 and 2025, are likely to increase the usage of material handling equipment, like electric forklifts. With the extension of infrastructure for electric charging becoming common, industries are more likely to make investments in electric forklifts to make their operations more efficient and decrease carbon emissions.

To get more information on this market, Request Sample

Integration of Advanced Technologies

The Indian industry for forklifts is adopting advanced technologies to increase operational efficiency as well as security. For example, PwC reported that 30% of Indian forklift producers introduced automation options, such as autonomous navigation, in the recent years. Besides this, companies are also introducing features like telematics, IoT integration, and automation into forklift models. These developments facilitate real-time monitoring, predictive maintenance, and enhanced fleet management. Parallel to this, Frost & Sullivan indicates that IoT-enabled forklifts have reduced accidents in the workplace by 10% in pilot programs in India. This is contributing to increased demand for these vehicles. In addition, the rising adoption of telematics systems offering information on equipment utilization, performance levels, and operator habits, thus enabling companies to streamline operations and minimize downtime, is driving market growth. Moreover, Deloitte puts the potential for predictive maintenance facilitated by telematics and IoT at 20% reduction in downtime in Indian operations, further fueling the market growth. Forklifts enabled by IoT can be made to communicate with warehouse management systems, automating inventory handling and minimizing errors. Autonomous navigation and collision avoidance systems are features that improve safety and productivity in material handling operations.

India Forklift Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on class, power source, load capacity, electric battery, and end user.

Class Insights:

- Class 1

- Class 2

- Class 3

- Class 4/5

The report has provided a detailed breakup and analysis of the market based on the class. This includes Class 1, Class 2, Class 3, and Class 4/5.

Power Source Insights:

- ICE

- Electric

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes ICE and electric.

Load Capacity Insights:

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

The report has provided a detailed breakup and analysis of the market based on the load capacity. This includes below 5 Ton, 5-15 Ton, and above 16 Ton.

Electric Battery Insights:

- Li-ion

- Lead Acid

A detailed breakup and analysis of the market based on the electric battery have also been provided in the report. This includes Li-ion and lead acid.

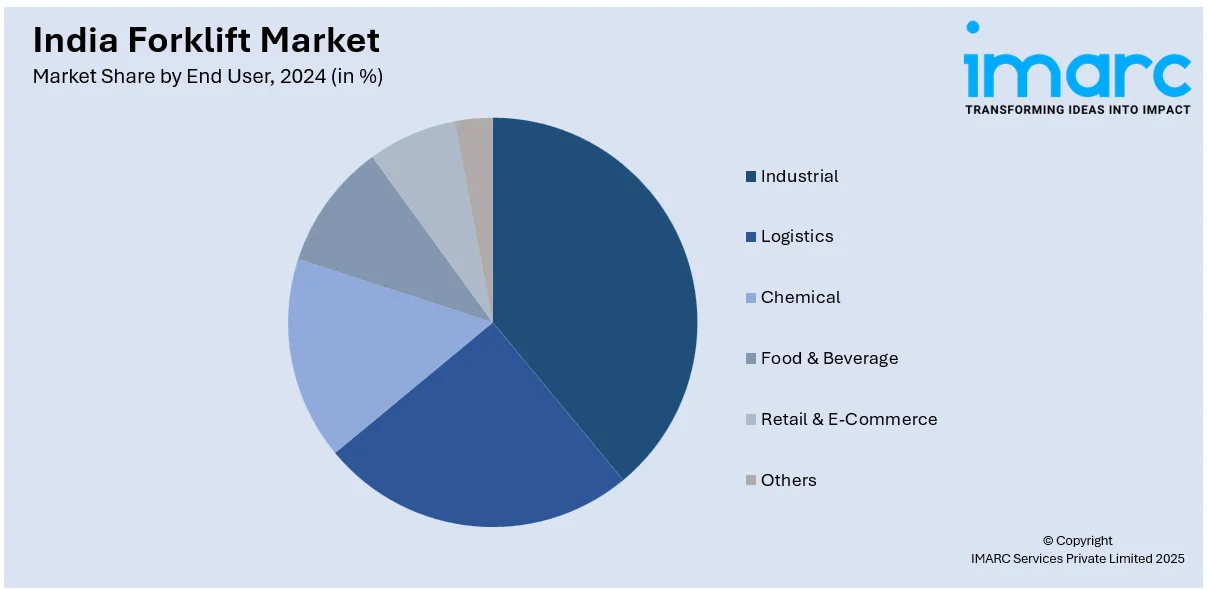

End User Insights:

- Industrial

- Logistics

- Chemical

- Food & Beverage

- Retail & E-Commerce

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, logistics, chemical, food & beverage, retail & e-commerce, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Forklift Market News:

- August 2024: Godrej & Boyce has unveiled India's first lithium-ion battery-powered forklift trucks, taking a big step towards industrial sustainability. The unique technology incorporates an indigenously created Battery Management System (BMS), which provides a self-sufficient and secure lithium-ion battery system.

- August 2024: Hikrobot launched the Forklift Latent Mobile Robot QF-1000 for the first time in India at the 17th edition of Automation Expo-Mumbai. The robot, which can carry pallet loads, is designed for low-floor load-bearing scenarios and supports narrow roadway picking and putaway. It also offers 360° protection and Wi-Fi communication.

India Forklift Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Classs Covered | Class 1, Class 2, Class 3, Class 4/5 |

| Power Sources Covered | ICE, Electric |

| Load Capacitys Covered | Below 5 Ton, 5-15 Ton, Above 16 Ton |

| Electric Batteries Covered | Li-ion, Lead Acid |

| End Users Covered | Industrial, Logistics, Chemical, Food & Beverage, Retail & E-Commerce, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India forklift market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India forklift market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India forklift industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The forklift market in India was valued at USD 7.20 Billion in 2024.

The India forklift market is projected to exhibit a CAGR of 13.20% during 2025-2033, reaching a value of USD 21.98 Billion by 2033.

Rapid industrial growth, increased demand for logistics and warehousing, and advancements in automation are driving the India forklift market. Rising e-commerce activities, the need for material handling efficiency, and expanding manufacturing sectors contribute significantly to the market growth. Government initiatives and infrastructure development also play an essential role in boosting the demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)