India Fortified Baby Food Market Size, Share, Trends and Forecast by Product Type, Ingredients, Nutritional Additives, Distribution Channel, Age Group, and Region, 2025-2033

India Fortified Baby Food Market Overview:

The India fortified baby food market size reached USD 560.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 930.16 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The India fortified baby food market is driven by rising parental awareness of infant nutrition, increasing disposable incomes, and growing urbanization. Government initiatives promoting fortified foods to combat malnutrition, along with expanding retail distribution channels and innovations in organic and plant-based formulations, further propel market demand among health-conscious consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 560.00 Million |

| Market Forecast in 2033 | USD 930.16 Million |

| Market Growth Rate (2025-2033) | 5.80% |

India Fortified Baby Food Market Trends:

Growing Demand for Organic and Natural Fortified Baby Food

Parents from India are progressively focusing on the use of natural and organic food ingredients in infant food, motivating demand for scientifically fortified products containing no artificial preservatives, additives, or chemical nutrients. Purchasers are asking for clean-label products with major vitamins and minerals that come in natural forms based on fruits, vegetables, and grains. Rising health awareness, food safety anxiety, and usage of chemical-free nutrition are inducing this trend. Responding with plant-based enrichment, probiotic-fortified formulas, and organic-certified products, manufacturers position themselves to meet shifting dietary demands. Growth in e-commerce and premium retail channels further speeds up access to these specialized products, placing them increasingly within reach of willing urban consumers willing to pay a premium for higher-quality nutrition solutions.

.webp)

To get more information on this market, Request Sample

Government-Led Initiatives to Combat Infant Malnutrition

Government initiatives in India are playing a crucial role in shaping the fortified baby food market by promoting child nutrition through programs like the National Nutrition Mission (POSHAN Abhiyaan) and fortified food guidelines. These efforts emphasize the inclusion of essential micronutrients such as iron, zinc, and vitamins in infant diets to combat malnutrition. Public-private partnerships are fostering research, innovation, and awareness campaigns, educating parents about the benefits of fortified foods. The Food Safety and Standards Authority of India (FSSAI) has mandated fortification standards for infant nutrition, ensuring compliance among manufacturers. As of 2018, 21% of the milk industry and 47% of the edible oil industry adhered to these standards. These regulations enhance product nutritional value and improve accessibility, particularly in rural and semi-urban regions where malnutrition rates remain a pressing concern.

Expansion of E-commerce and Direct-to-Consumer (DTC) Brands

Digital commerce growth is redefining the market for fortified baby food, making it easier for brands to address a larger clientele with targeted products. Amazon, Flipkart, and targeted websites with parenting communities are reporting rising sales of fortified baby food as a result of convenience, range, and ratings. Direct to Consumer (DTC) brands are exploiting this change with personalized nutritional offerings, subscription-delivery services, and promotions through the online space. Influencer marketing and social media also have a key role to play in influencing consumer choice, with parents using online recommendations to decide on the optimal baby food choices. This is creating increased competition, which translates into more product innovation in formulation, packaging, and customer relationship strategies.

India Fortified Baby Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, ingredients, nutritional additives, distribution channel, and age group.

Product Type Insights:

- Powdered Baby Food

- Jarred Baby Food

- Ready-To-Feed Baby Food

- Snack Bars

The report has provided a detailed breakup and analysis of the market based on the product type. This includes powdered baby food, jarred baby food, ready-to-feed baby food, and snack bars.

Ingredients Insights:

- Fruits

- Vegetables

- Cereals

- Meats

- Dairy

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes fruits, vegetables, cereals, meats, and dairy.

Nutritional Additives Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

The report has provided a detailed breakup and analysis of the market based on the nutritional additives. This includes vitamins, minerals, probiotics, and omega-3 fatty acids.

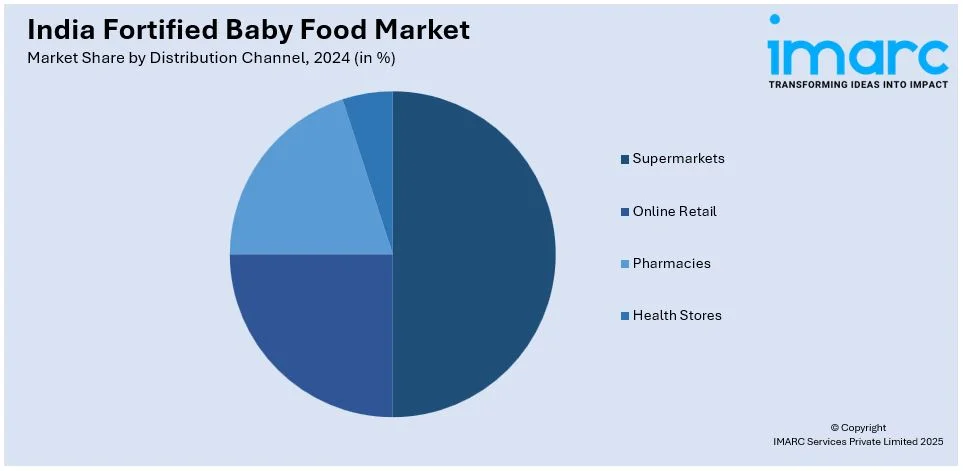

Distribution Channel Insights:

- Supermarkets

- Online Retail

- Pharmacies

- Health Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets, online retail, pharmacies, and health stores.

Age Group Insights:

- Infants

- Toddlers

- Preschoolers

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes infants, toddlers, and preschoolers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fortified Baby Food Market News:

- In October 2024, Nestlé India launched a new Cerelac range with no refined sugar, addressing past criticism over high sugar content. Chairman Suresh Narayanan announced that 14 out of 21 Cerelac variants are now sugar-free, a reformulation process initiated three years ago. Seven variants will be available by November, with the rest launching soon. This move follows scrutiny from Public Eye and IBFAN over added sugar in Cerelac sold in India.

India Fortified Baby Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Powdered Baby Food, Jarred Baby Food, Ready-To-Feed Baby Food, Snack Bars |

| Ingredients Covered | Fruits, Vegetables, Cereals, Meats, Dairy |

| Nutritional Additives Coves | Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids |

| Distribution Channels Covered | Supermarkets, Online Retail, Pharmacies, Health Stores |

| Age Groups Covered | Infants, Toddlers, Preschoolers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fortified baby food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fortified baby food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fortified baby food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fortified baby food market was valued at USD 560.00 Million in 2024.

The India fortified baby food market is projected to exhibit a CAGR of 5.80% during 2025-2033, reaching a value of USD 930.16 Million by 2033.

The India fortified baby food market is driven by increasing parental concern over child nutrition, rising disposable incomes, and urbanization enhancing access to quality products. Growing awareness about immunity-boosting nutrients, such as iron and DHA, through healthcare campaigns and pediatric recommendations fuels demand. Trusted brands and convenient formats further bolster market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)