India Fortified Foods Market Size, Share, Trends and Forecast by Raw Material, Micronutrients, Application, Technology, Sales Channel, and Region, 2025-2033

India Fortified Foods Market Overview:

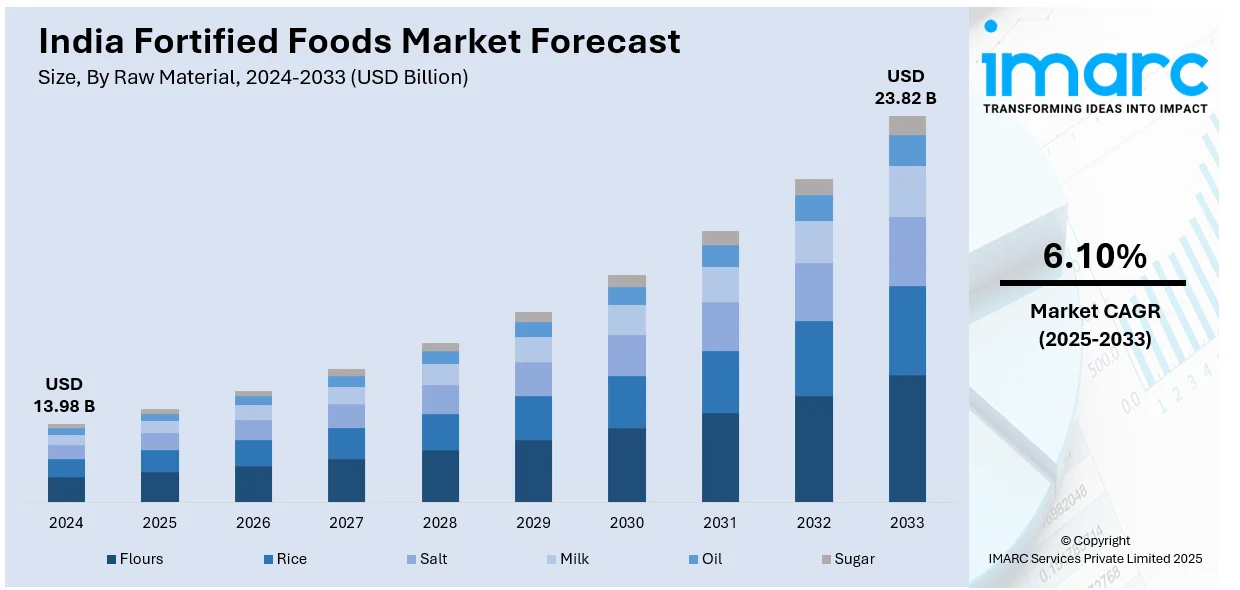

The India fortified foods market size reached USD 13.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.82 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The India fortified foods market is driven by rising health awareness, increasing micronutrient deficiencies, and government initiatives promoting fortified staples. Urbanization and changing lifestyles fuel demand for convenient, nutrient-rich foods, while growing disposable income enables premium product adoption. Expanding retail channels and industry innovations further boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.98 Billion |

| Market Forecast in 2033 | USD 23.82 Billion |

| Market Growth Rate (2025-2033) | 6.10% |

India Fortified Foods Market Trends:

Expansion of Government Fortification Programs and Regulatory Push

The Indian government has been actively promoting food fortification to combat malnutrition and micronutrient deficiencies. Mandated fortification of staple foods such as salt, milk, wheat flour, and edible oils aims to enhance nutritional intake for its 1.3 billion people. Initiatives like the Food Fortification Resource Centre (FFRC) under FSSAI and policies supporting fortified food distribution through the Public Distribution System (PDS), mid-day meal programs, and Integrated Child Development Services (ICDS) have strengthened market growth. Regulatory bodies are enforcing stricter labeling norms and quality standards to ensure compliance and consumer trust. With strong policy backing, fortified food products are becoming more accessible across urban and rural regions, improving public health and driving widespread industry adoption. This growing accessibility is fostering increased market penetration and consumer acceptance nationwide.

To get more information on this market, Request Sample

Rising Demand for Functional and Nutrient-Enriched Foods

Growing interest in preventive healthcare and wellness has driven demand for fortified foods supplemented with key vitamins and minerals. Consumers are looking actively for products that boost immunity, brainpower, and general well-being, prompting manufacturers to develop fortified staples, dairy, and drinks. Growing lifestyle disorders, including diabetes and cardiovascular disease (CVDs), have also boosted this trend. Government programs favoring fortification of staple items such as rice, wheat, and edible oils have also facilitated market growth. Urbanization and hectic lifestyles further fueled demand for convenient, easy-to-consume fortified products. As awareness for nutritional deficiencies grows and people seek fortified foods as a solution for them, this trend is poised to dominate the Indian fortified food market.

Growing Consumer Shift Toward Plant-Based and Clean-Label Fortified Products

Indian customers are increasingly opting for clean-label fortified foods with low amounts of additives and plant-based ingredients. Increasingly vegan and vegetarian populations, together with fear regarding synthetic fortificants and artificial additives, have driven the demand for natural sources of fortificants such as plant-based proteins, omega-3s, and herbal extracts. This is reflected in dairy alternatives, fortified plant-based drinks, and protein-fortified snacks. In a recent survey, 77% of Indian consumers indicated that they would try plant-based meat products, highlighting increasing acceptance of alternative plant-based solutions. To counter this, manufacturers are turning towards highlighting transparent labels, natural components, and environmentally friendly practices as they appeal to health-focused customers. With increasing awareness of environmental concerns and ethics-based consumption, plant-based and clean-label fortification is driving the market as manufacturers look towards investing in research and development (R&D) for cutting-edge, naturally fortified products.

India Fortified Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on raw material, micronutrients, application, technology, and sales channel.

Raw Material Insights:

- Flours

- Rice Flour

- Wheat Flour

- Corn Flour

- Rice

- Salt

- Milk

- Oil

- Sugar

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes flours, (rice flour, wheat flour, corn flour), rice, salt, milk, oil, sugar.

Micronutrients Insights:

- Vitamins

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Others

- Minerals

- Calcium

- Iron

- Zinc

- Iodine

- Others

- Other Fortifying Nutrients

The report has provided a detailed breakup and analysis of the market based on the micronutrients. This includes vitamins (vitamin A, vitamin B, vitamin C, vitamin D, others), minerals (calcium, iron, zinc, iodine, others), Other fortifying nutrients.

Application Insights:

.webp)

- Basic Food

- Cheese

- Butter

- Yogurt

- Others

- Processed Food

- Extruded Products

- Powdered Products

- Value Added Food

- Condiments

- Juice

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes basic food (cheese, butter, yogurt, others), processed food (extruded products, powdered products), value added food, condiments, and juice.

Technology Insights:

- Drying

- Oven Drying

- Drum Drying

- Spray Drying

- Extrusion

- Coating and Encapsulation

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes drying (oven drying, drum drying, spray drying), extrusion, coating and encapsulation, others.

Sales Channel Insights:

- Modern Trade

- Online Sales

- Neighborhood Stores

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes modern trade, online sales, neighborhood stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fortified Foods Market News:

- In December 2024, HarvestPlus and Cargill launched the NutriHarvest project in India to enhance food security and support farmers. This three-year, $3 million initiative will provide 1.4 million nutritious meals in Uttar Pradesh, Maharashtra, and Bihar while training over 100,000 farmers. The project promotes biofortified crops like iron pearl millet and zinc wheat, integrating them into school feeding programs to improve children's nutrition and dietary diversity while boosting local agricultural production.

- In November 2024, The Food Corporation of India (FCI) launched an awareness campaign in Kakinada to educate the public about fortified rice and dispel misconceptions. Some people mistakenly believe fortified rice contains plastic and remove fortified kernels before cooking. The campaign aims to clarify its nutritional benefits and ensure acceptance, especially among vulnerable populations relying on the Public Distribution System (PDS). FCI's initiative seeks to improve awareness and promote fortified rice consumption.

India Fortified Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered |

|

| Micronutrients Covered |

|

| Applications Covered |

|

| Technologies Covered |

|

| Sales Channels Covered | Modern Trade, Online Sales, Neighborhood Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fortified foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fortified foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fortified foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fortified foods market in India was valued at USD 13.98 Billion in 2024.

The India fortified foods market is projected to exhibit a CAGR of 6.10% during 2025-2033, reaching a value of USD 23.82 Billion by 2033.

Rising nutritional awareness and growing health concerns are driving demand in India fortified foods market. Increased prevalence of deficiencies (like vitamins and minerals), supportive government nutrition programs, and busy lifestyles prompting demand for convenient, nutritious options (cereals, dairy, snacks) are also critical drivers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)