India Fortified Health Drinks Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Region, 2025-2033

India Fortified Health Drinks Market Size and Share:

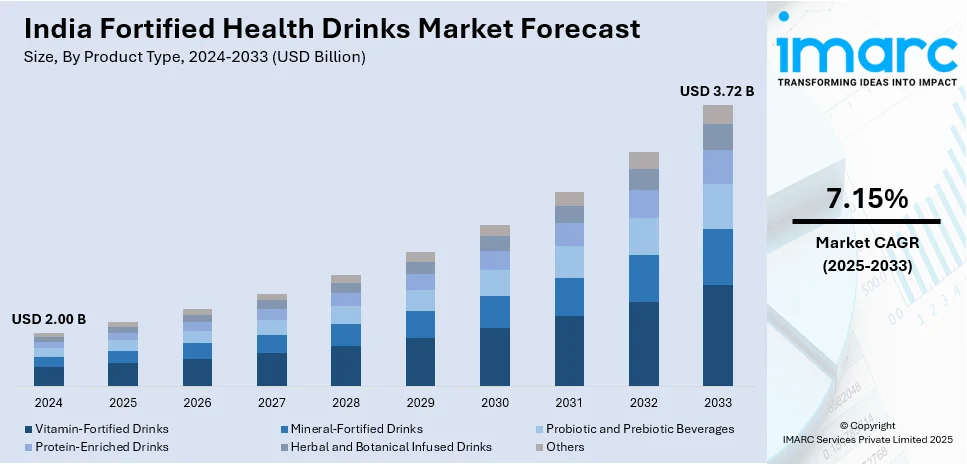

The India fortified health drinks market size reached USD 2.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.72 Billion by 2033, exhibiting a growth rate (CAGR) of 7.15% during 2025-2033. The market is driven by rising health consciousness, increasing disposable income, growing demand for functional beverages, and advancements in nutritional science. The growing preference for immunity-boosting, protein-rich, and vitamin-enriched drinks by consumers, and innovations in fortified ingredients and marketing strategies further contribute to the India fortified health drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.00 Billion |

| Market Forecast in 2033 | USD 3.72 Billion |

| Market Growth Rate 2025-2033 | 7.15% |

India Fortified Health Drinks Market Trends:

Rising Health Consciousness and Nutritional Awareness

The Indian consumer base demonstrates a shift toward health drinks that offer essential vitamins and minerals, and proteins because they have become more aware of nutrition and immunity factors and well-being practices. The market for functional beverages has expanded due to prevalent health problems like lifestyle diseases together with obesity, and immunity problems. People who lead healthy lives, together with fitness athletes along with professionals, and elderly demographics, now seek beverages containing fortifications because they want to gain health benefits for bone strength and digestive health, and mental clarity. This growing trend, fueled by social media and digital health influencers, is a key driver of the India fortified health drinks market growth. For instance, in January 2025, a popular hydration drink from Unilever, Liquid IV, was introduced in India with an eye toward the high-end market. The goal of the introduction is to appeal to wealthy customers who lead active lives. This action was in line with Hindustan Unilever's plan to expand its line of high-end beauty and wellness products.

To get more information on this market, Request Sample

Growing Demand for Functional and Immunity-Boosting Beverages

Consumers are increasingly choosing fortified drinks enriched with probiotics, prebiotics, antioxidants, and herbal extracts for improved gut health, energy levels, and immunity. The COVID-19 pandemic accelerated the demand for immunity-boosting beverages containing vitamin C, zinc, and herbal ingredients like turmeric and ashwagandha. This trend has led to a surge in fortified dairy-based and plant-based health drinks, catering to different dietary preferences, including vegan and lactose-intolerant consumers, which is further creating a positive India fortified health drinks market outlook. For instance, in October 2024, Zydus Wellness expanded its longstanding brand Complan into adult nutrition through the introduction of VieMax. The new nutritional beverage is scientifically formulated with protein, prebiotics, and probiotics to promote muscle mass, gut health, and overall immunity in adults. The introduction of VieMax arrives during a period when nutrient shortages among Indian adults are an increasing worry. Research showed that 73 percent of Indians lack sufficient protein, impacting muscle health, everyday tasks, and overall life quality.

India Fortified Health Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional/country level for 2025-2033. Our report has categorized the market based on product type, form, and distribution channel.

Product Type Insights:

- Vitamin-Fortified Drinks

- Mineral-Fortified Drinks

- Probiotic and Prebiotic Beverages

- Protein-Enriched Drinks

- Herbal and Botanical Infused Drinks

- Others

The report has provided a detailed breakup and analysis of the market based on the product types. This includes vitamin-fortified drinks, mineral-fortified drinks, probiotic and prebiotic beverages, protein-enriched drinks, herbal and botanical infused drinks, and others.

Form Insights:

- Powdered Drinks

- Ready-to-Drink (RTD)

- Liquid Concentrates

A detailed breakup and analysis of the market based on the forms have also been provided in the report. This includes powdered drinks, ready-to-drink (RTD), and liquid concentrates.

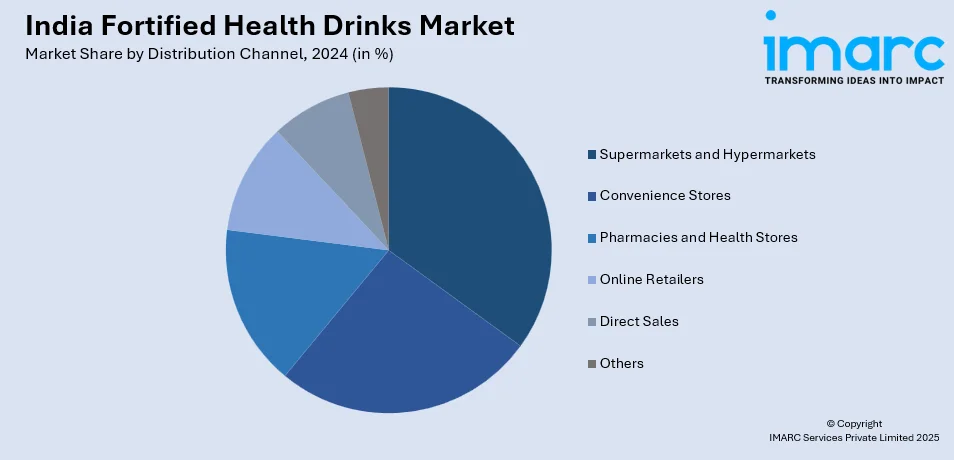

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies and Health Stores

- Online Retailers

- Direct Sales

- Others

A detailed breakup and analysis of the market based on the distribution channels have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies and health stores, online retailers, direct sales, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fortified Health Drinks Market News:

- In November 2024, MilkyMist, in partnership with SIG and AnaBio Technologies, introduced the first aseptic carton packs of long-lived probiotic buttermilk in history. Together with SIG and AnaBio Technologies, MilkyMist, a well-known dairy pioneer from South India, launched the first aseptic carton packs of long-life probiotic buttermilk in history.

- In September 2024, the main product of Maiva Fresh, Maiva Unsweetened Almond Milk, was introduced. This new line of health drinks is marketed under the name "Maiva Fresh" and is marketed as "Pure Good" (implying health) and "Pure Joy" (implying taste), encapsulating the idea of being both pleasant and healthy. Maiva Fresh Almond is a low-GI, cholesterol-free, vitamin B12 and vitamin D-fortified almond that is ideal for daily consumption.

India Fortified Health Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin-Fortified Drinks, Mineral-Fortified Drinks, Probiotic and Prebiotic Beverages, Protein-Enriched Drinks, Herbal and Botanical Infused Drinks, Others |

| Forms Covered | Powdered Drinks, Ready-to-Drink (RTD), Liquid Concentrates |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies and Health Stores, Online Retailers, Direct Sales, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fortified health drinks market performed so far and how will it perform in the coming years?

- What is the breakup of the India fortified health drinks market on the basis of product type?

- What is the breakup of the India fortified health drinks market on the basis of form?

- What is the breakup of the India fortified health drinks market on the basis of distribution channel?

- What is the breakup of the India fortified health drinks market on the basis of region?

- What are the various stages in the value chain of the India fortified health drinks market?

- What are the key driving factors and challenges in the India fortified health drinks market?

- What is the structure of the India fortified health drinks market and who are the key players?

- What is the degree of competition in the India fortified health drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fortified health drinks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fortified health drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fortified health drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)