India Freight Management Systems Market Size, Share, Trends, and Forecast by Component, Transportation Mode, End User, and Region, 2025-2033

India Freight Management Systems Market Size and Share:

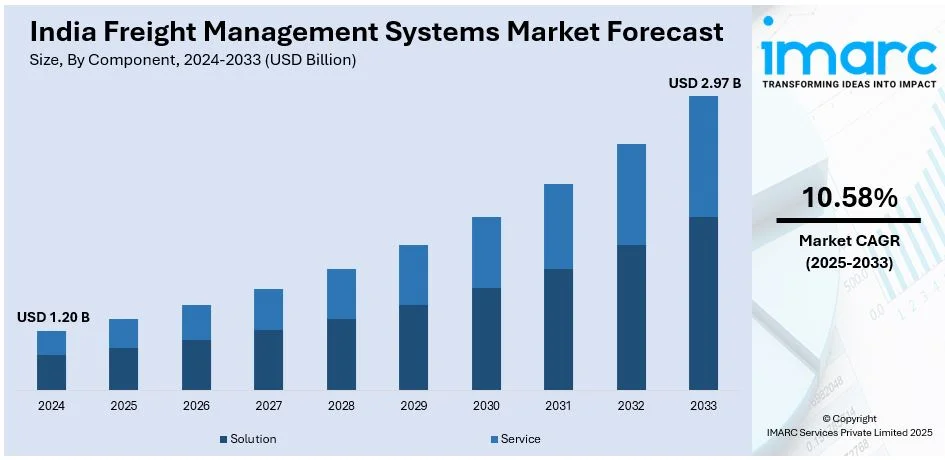

The India freight management systems market size reached USD 1.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.97 Billion by 2033, exhibiting a growth rate (CAGR) of 10.58% during 2025-2033. The market is expanding due to rising logistics digitization, increasing e-commerce, and government initiatives like Gati Shakti. The demand for real-time tracking, automation, and cost optimization is driving adoption across transportation, warehousing, and supply chain operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 2.97 Billion |

| Market Growth Rate (2025-2033) | 10.58% |

India Freight Management Systems Market Trends:

Growing Adoption of AI and IoT for Real-Time Freight Tracking

The India freight management systems market is witnessing widespread adoption of the Internet of Things (IoT) as well as artificial intelligence (AI) for real-time tracking and operational efficiency. For instance, in December 2024, the government emphasized the revolutionizing potential of AI in transforming logistics segment within the country, with resilient targets to reduce logistic expenditure by 2% in upcoming two years. As a result, logistics companies are integrating AI-driven predictive analytics to optimize route planning, reduce transit delays, and enhance cost efficiency. IoT-enabled sensors and telematics are improving asset tracking, offering real-time data related to fuel utilization, vehicle location, and cargo conditions. The growing need for visibility across supply chains is driving investments in smart logistics solutions, reducing operational risks and improving fleet utilization. Government initiatives like the Unified Logistics Interface Platform and the National Logistics Policy are further promoting digitalization in freight management. As companies focus on automation and data-driven decision-making, the adoption of AI and IoT in freight operations is expected to accelerate, enhancing overall logistics efficiency and competitiveness in the market.

To get more information on this market, Request Sample

Expansion of E-Commerce Driving Demand for Digital Freight Solutions

The rapid expansion of India’s e-commerce sector is significantly influencing the demand for advanced freight management systems. For instance, as per industry reports, e-commerce segment across India is positioned to exhibit growth by 23.8% in the year 2024, anticipated to reach USD 292.3 Billion by 2028. In line with this, 30% of individuals in a survey revealed to be utilizing online payment service like Google Pay for online shopping, followed by Amazon Pay and PhonePe, each at 13%. With growing online shopping volumes, logistics providers are prioritizing digital solutions to streamline inventory movement, optimize last-mile deliveries, and improve customer service. Automated freight solutions, including cloud-based transportation management systems (TMS) and warehouse management software (WMS), are enhancing order fulfillment speed and accuracy. The surge in quick-commerce platforms has further increased the need for real-time freight tracking and automated dispatching solutions. E-commerce giants and third-party logistics providers (3PLs) are heavily investing in AI-powered logistics platforms to handle complex delivery networks and fluctuating demand patterns. Additionally, regulatory measures such as GST and e-way bill implementation have strengthened the formalization of logistics operations, fostering the adoption of digital freight management solutions.

India Freight Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, transportation mode, and end user.

Component Insights:

- Solution

- Planning

- Execution and Operations

- Control and Monitoring

- Service

- Consulting

- System Integration and Deployment

- Support and Maintenance

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (planning, execution and operations, and control and monitoring) and service (consulting, system integration and deployment, and support and maintenance).

Transportation Mode Insights:

- Rail Freight

- Road Freight

- Ocean Freight

- Air Freight

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes rail freight, road freight, ocean freight, and air freight.

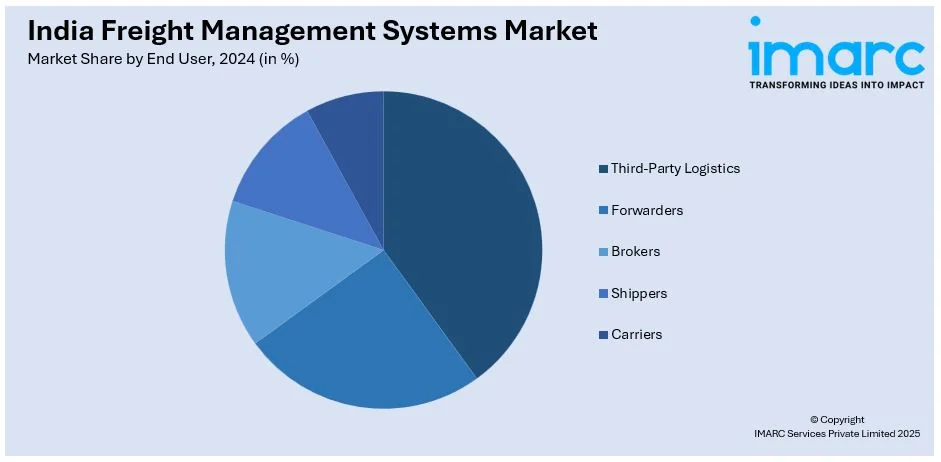

End User Insights:

- Third-Party Logistics

- Forwarders

- Brokers

- Shippers

- Carriers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes third-party logistics, forwarders, brokers, shippers, and carriers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Freight Management Systems Market News:

- In February 2025, RapidShyp, a platform for e-commerce shipping, announced collaboration with India Post to offer last-mile delivery solutions in India. This partnership targets to cater to the heightening need in the logistics segment. RapidShyp will incorporate its leading-edge logistics technology to enable more dependable and quicker delivery services. The incorporation utilizes APIs for end-to-end track, pickup schedule, trace abilities, and label generation, guaranteeing a smooth experience for e-commerce firms.

- In November 2024, C.H. Robinson, a global firm specializing in 3PL and 4PL announced the launch of its next-gen logistics management C.H. Robinson Managed Solutions. This development will mitigate a notable gap in the industry for shippers navigating for seamless availability to leading-edge 4PL solutions, TMS technology, and 3PL managed transportation from a single provider with enhanced scalability and exceptional configuration.

India Freight Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Transportation Modes Covered | Rail Freight, Road Freight, Ocean Freight, Air Freight |

| End Users Covered | Third-Party Logistics, Forwarders, Brokers, Shippers, Carriers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India freight management systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India freight management systems market on the basis of component?

- What is the breakup of the India freight management systems market on the basis of transportation mode?

- What is the breakup of the India freight management systems market on the basis of end user?

- What is the breakup of the India freight management systems market on the basis of region?

- What are the various stages in the value chain of the India freight management systems market?

- What are the key driving factors and challenges in the India freight management systems market?

- What is the structure of the India freight management systems market and who are the key players?

- What is the degree of competition in the India freight management systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India freight management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India freight management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India freight management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)