India Frozen Baked Goods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

India Frozen Baked Goods Market Overview:

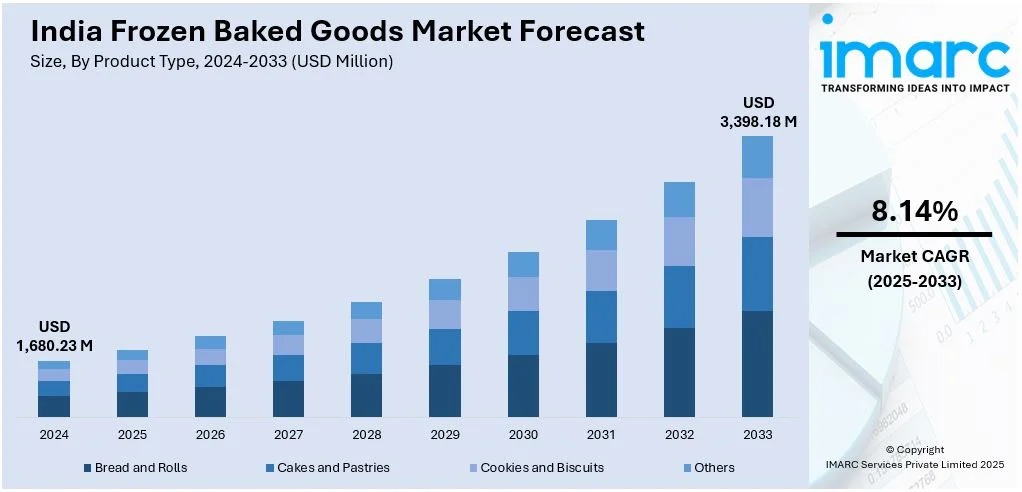

The India frozen baked goods market size reached USD 1,680.23 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,398.18 Million by 2033, exhibiting a growth rate (CAGR) of 8.14% during 2025-2033. The market is propelled by boosting consumer demand for ready-to-eat (RTE) and convenient foods, urbanization, changing dietary habits, and rising disposable incomes, which promote product innovation and increased distribution channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,680.23 Million |

| Market Forecast in 2033 | USD 3,398.18 Million |

| Market Growth Rate 2025-2033 | 8.14% |

India Frozen Baked Goods Market Trends:

Rising Popularity of Convenience and Ready-to-Eat Products

The growing demand for frozen baked food in India is primarily fueled by convenience needs. Busy urban lifestyles, hectic work timetables, and the expansion of nuclear families have turned quick- and ready-to-consume products a sensible option for customers. Quick and easy-to-prepare frozen baked foods like bread, pizza bases, pastries, and croissants are convenient options without diluting taste and quality. Furthermore, expansion of food delivery platforms online and growth of modern retail chains have increased access to such products among consumers in urban and semi-urban locations. Quick-service restaurants (QSR), cafes, and cloud kitchens also depend significantly on frozen bakery products for convenience of operation and time reduction for preparation. Advances in cold chain logistics and better packaging solutions guarantee longer shelf life and freshness, causing further consumers' confidence boost. As convenience is still an important buying driver, the frozen baked foods segment will continue to grow in the years ahead.

To get more information on this market, Request Sample

Increased Demand for Healthier and Premium Frozen Baked Goods

Health-conscious Indian consumers are now demanding healthier frozen baked products that contain natural, nutrient-dense ingredients. They prefer products with whole grains, multigrain flour, and high fiber content, mirroring the general trend towards wellness-focused eating. Consumers are also trying gluten-free, plant-based, and low-sugar versions, especially in urban centers where awareness of food choices is greater. Also popular are fortified frozen baked goods containing vitamins, minerals, and protein among health-conscious consumers. At the same time, the premium category is growing substantially. While consumers are ready to pay extra for gourmet desserts, artisanal items, and genuine international products containing clean-label ingredients. For instance, in October 2024, Sunfeast Baked Creations launched its premium portfolio with Global Gourmet Cookies, with international tastes, such as Rich Choco Chip, Oats and Hazelnut, and Walnut and Choco Chip, which are sold online through Blinkit, Zepto, and ITC's store. Moreover, frozen bread, pastry, and cakes containing no artificial preservatives or additives are popular among quality seekers. This trend demonstrates an increasing trend towards indulgent yet responsible consumption, making healthier and premium frozen baked products a key growth driver in the Indian market.

Growth of Regional and Authentic Flavors in Frozen Baked Goods

The growing need for regional and traditional flavors within India's frozen baked products sector is an indicator of the cultural desire for familiar tastes. Although traditional Western baked products, such as cakes, cookies, and pizzas remain popular, the consumer is also looking for frozen form of the traditional Indian products. For example, in September 2023, Binge on Baked (BOB) launched baked offerings, such as cookies, cakes, puffs, pizza crusts, bread, buns, rusks, baked mathi, baked potato wafers, and baked aloo bhujiya. Furthermore, frozen stuffed parathas, naans, kulchas, and regional sweets provide consumers with the taste of home without actually cooking from scratch. This convenience is particularly appealing in festive times, family occasions, and celebrations. Moreover, the blending of international culinary trends with Indian spices is giving rise to new product lines, such as masala-spiced bread and spiced savory pastry. Several brands are launching region-specific product lines to address varied tastes, employing locally sourced ingredients to lend authenticity. With more urban consumers venturing into nostalgic flavors in contemporary formats, regionally inspired frozen bakery foods are poised to drive market growth, further diversifying the India frozen food market.

India Frozen Baked Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Bread and Rolls

- Cakes and Pastries

- Cookies and Biscuits

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bread and rolls, cakes and pastries, cookies and biscuits, and others.

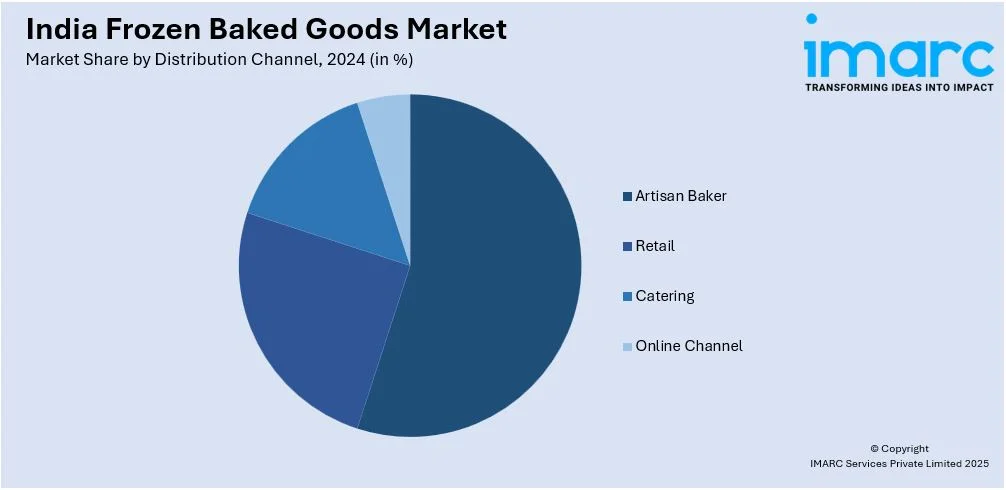

Distribution Channel Insights:

- Artisan Baker

- Retail

- Catering

- Online Channel

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes artisan baker, retail, catering, and online channel.

End User Insights:

- Retail

- Food Service Industry

- Food Processing Industry

The report has provided a detailed breakup and analysis of the market based on the end user. This includes retail, food service industry, and food processing industry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Frozen Baked Goods Market News:

- In June 2024, Mondelez collaborated with Lotus Bakeries to launch Biscoff in India, entering the premium cookie category. With local manufacturing, Mondelez hopes to increase affordability and market coverage, with additional co-branded product plans in international markets by 2025.

- In April 2024, Agrimax Foods LLP has unveiled its new brand, Bake&Co., that sells millet-based baked foodstuffs under the government's PMFME initiative. Products featured in the initial launch include Millet and Indulgence Cookies targeting health-focused buyers. Bake&Co. has further expansion plans in the read-to-eat snack space across domestic as well as global markets.

India Frozen Baked Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bread and Rolls, Cakes and Pastries, Cookies and Biscuits, Others |

| Distribution Channels Covered | Artisan Baker, Retail, Catering, Online Channel |

| End Users Covered | Retail, Food Service Industry, Food Processing Industry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India frozen baked goods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India frozen baked goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India frozen baked goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The frozen baked goods market in India was valued at USD 1,680.23 Million in 2024.

The India frozen baked goods market is projected to exhibit a CAGR of 8.14% during 2025-2033, reaching a value of USD 3,398.18 Million by 2033.

The market is driven by changing food preferences, busy urban lifestyles, and demand for ready-to-eat bakery products. Rising exposure to global food trends, especially among younger consumers, supports frozen product adoption. Improved cold chain logistics and wider product availability in supermarkets and online platforms are further fueling market expansion across metro and tier-2 cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)