India Furniture Market Size, Share, Trends and Forecast by Material, Distribution Channel, End Use, and Region, 2026-2034

India Furniture Market Summary:

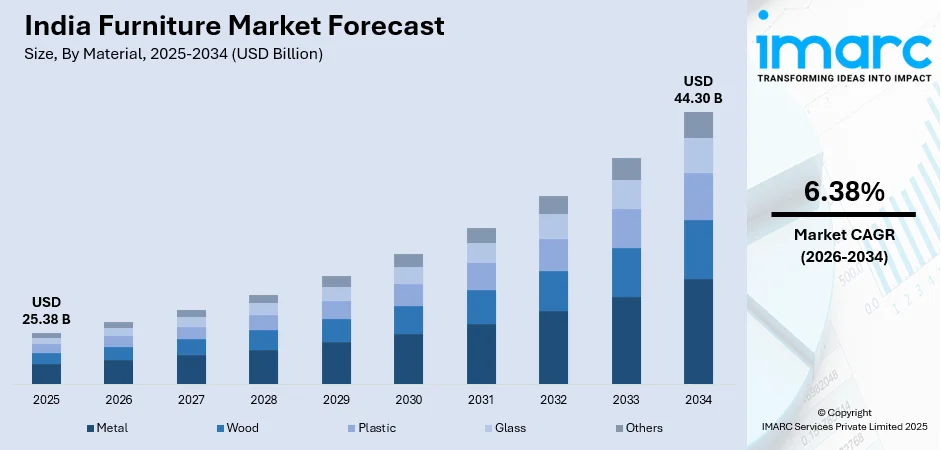

The India furniture market size was valued at USD 25.38 Billion in 2025 and is projected to reach USD 44.30 Billion by 2034, growing at a compound annual growth rate of 6.38% from 2026-2034.

Rising disposable incomes, rapid urbanization, and expanding real estate and housing sector development across the country is driving the market. Growing consumer preference for modular and customized furniture solutions, coupled with increasing demand for branded and premium products, further accelerates market expansion. The influence of global design aesthetics, changing lifestyle patterns, and demand for sustainable materials continue shaping purchasing decisions. E-commerce platform proliferation has enhanced product accessibility, strengthening the India furniture market share.

Key Takeaways and Insights:

-

By Material: Wood dominates the market with a share of 59.8% in 2025, driven by cultural significance, aesthetic versatility, durability, and widespread availability of conventional and engineered wood for traditional and contemporary furniture designs.

-

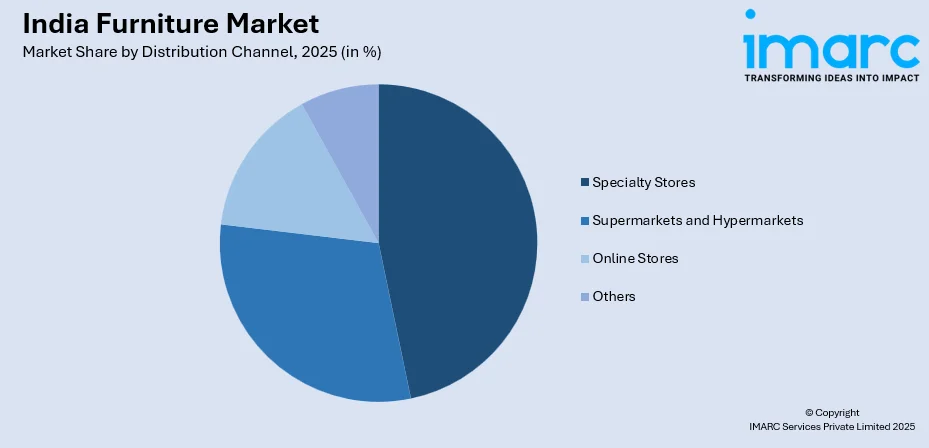

By Distribution Channel: Specialty Stores lead the market with a share of 46.5% in 2025, owing to exclusive product ranges, customization, expert guidance, personalized service, and hands-on in-store experience enabling quality evaluation before purchase.

-

By End Use: Residential represents the largest segment with a market share of 70.6% in 2025, driven by rising homeownership, increasing household furniture needs, investments in interiors, demand for space-saving solutions, and cultural preference for well-furnished living spaces.

-

By Region: North India dominates the market with a share of 33.2% in 2025, owing Delhi-NCR urbanization, economic activity, consumer purchasing power, infrastructure and real estate growth, and established furniture manufacturing and trading hubs.

-

Key Players: The India furniture market is moderately fragmented, with domestic and international players competing through design innovation, distribution expansion, sustainability efforts, and omni-channel retail strategies to meet evolving consumer preferences. Some of the key players operating in the market include Cello World Private Limited, Damro Furnitures Pvt. Ltd., Durian Industries Ltd., Godrej & Boyce Manufacturing Company Limited, IKEA India (Inter IKEA Holding B.V.), Nilkamal Limited, Supreme Industries Ltd., Usha Shriram Enterprises Pvt. Ltd., Wakefit Innovations Pvt. Ltd, Wipro Consumer Care and Lighting Group (Wipro Enterprises Private Limited) and Zuari Furniture.

To get more information on this market Request Sample

The India furniture market is experiencing robust expansion fueled by multiple converging factors that are reshaping the industry landscape. Rising disposable incomes among the burgeoning middle-class population have enabled consumers to invest in quality home furnishings that combine functionality with aesthetic appeal. Rapid urbanization continues driving demand as millions migrate to metropolitan areas seeking better opportunities, necessitating modern living solutions. The flourishing real estate and housing sector, supported by government initiatives promoting affordable housing, has created substantial demand for residential and commercial furniture. Changing lifestyle patterns influenced by global design trends have elevated consumer expectations, while growing environmental consciousness is pushing demand for sustainably sourced materials. The expansion of organized retail channels and e-commerce platforms has democratized access to diverse furniture options across geographic regions. In December 2025, Wakefit Innovations made a flat debut on NSE and BSE, listing near its IPO price, signaling cautious investor sentiment despite strong brand presence in India’s home and furnishings market.

India Furniture Market Trends:

Growing Demand for Modular and Space-Saving Furniture

The rising trend of compact urban living has catalyzed substantial demand for modular and multifunctional furniture solutions across Indian households. Consumers residing in metropolitan areas with limited living spaces increasingly prefer furniture that maximizes utility without compromising aesthetic appeal. Expandable dining tables, sofa-cum-beds, storage ottomans, and wall-mounted units have gained prominence among urban dwellers seeking versatility. Manufacturers are responding by developing innovative designs that address space constraints while maintaining style quotients. As per sources, in November 2025, Spacewood Furnishers raised ₹300 crore from PE firm A91 Partners to expand manufacturing, retail stores, and omnichannel presence, highlighting growing demand for modular and space-saving furniture across urban India. Further, this preference for adaptable furniture extends beyond residential applications into commercial spaces where flexible configurations support evolving workplace requirements.

Rising Preference for Sustainable and Eco-Friendly Materials

Environmental consciousness among Indian consumers is driving significant transformation in material preferences within the furniture industry. Buyers increasingly seek products crafted from sustainably sourced wood, bamboo, reclaimed materials, and recyclable composites that minimize ecological footprint. Certification credentials from recognized forestry organizations have become important purchase considerations among discerning consumers in metropolitan markets. In September 2025, AFC Furniture Solutions became the first Indian firm to achieve BIFMA Level® 3 certification, establishing global sustainability leadership in furniture manufacturing and promoting eco-friendly practices across India. Moreover, manufacturers are adopting green production processes utilizing renewable energy sources and low-emission techniques to appeal to environmentally conscious segments. This sustainability shift encompasses the entire product lifecycle, from raw material sourcing through manufacturing processes to packaging and delivery methodologies.

Integration of Smart Technology into Furniture

The proliferation of smart home ecosystems has sparked growing demand for technology-integrated furniture solutions across India. Consumers increasingly seek furniture pieces featuring built-in wireless charging capabilities, USB ports, integrated speakers, and automated adjustment mechanisms. Smart recliners with massage functions, desks with cable management systems, and bedroom furniture with ambient lighting controls represent emerging product categories. The remote work culture has particularly accelerated demand for ergonomic home office furniture with technological enhancements supporting productivity. This convergence of traditional furniture functionality with modern technology reflects evolving lifestyle aspirations among tech-savvy Indian consumers. As per sources, in May 2025, Hettich showcased future-ready furniture innovations at Interzum 2025, featuring smart fittings, transformable systems, and AR-enabled tools, highlighting growing demand for technology-integrated furniture in India.

Market Outlook 2026-2034:

The India furniture market is set to experience steady revenue growth over the forecast period, supported by ongoing urbanization, increasing household incomes, and the expansion of real estate projects. Revenue generation is expected to accelerate as organized retail penetration deepens and e-commerce adoption broadens consumer access across tier-two and tier-three cities. Government initiatives supporting affordable housing and domestic manufacturing will further catalyze market expansion. The growing preference for premium, customized, and sustainable furniture solutions will drive revenue growth across all market segments. The market generated a revenue of USD 25.38 Billion in 2025 and is projected to reach a revenue of USD 44.30 Billion by 2034, growing at a compound annual growth rate of 6.38% from 2026-2034.

India Furniture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material | Wood | 59.8% |

| Distribution Channel | Specialty Stores | 46.5% |

| End Use | Residential | 70.6% |

| Region | North India | 33.2% |

Material Insights:

- Metal

- Wood

- Plastic

- Glass

- Others

Wood dominates with a market share of 59.8% of the total India furniture market in 2025.

Wood maintains its dominant position in the India furniture market, commanding the largest revenue share among all material categories. This leadership stems from wood's timeless aesthetic appeal, exceptional durability, and deep cultural significance within Indian households where wooden furniture has traditionally symbolized prosperity and permanence. The material's versatility enables manufacturers to create diverse design expressions ranging from intricately carved traditional pieces to sleek contemporary styles that appeal to modern sensibilities.

The sustained expansion of the wood segment reflects consumers' preference for quality craftsmanship and natural materials that enhance living spaces. Growing availability of diverse wood varieties, from premium teak and sheesham to cost-effective engineered wood alternatives, has broadened accessibility across consumer segments. According to sources, INDIAWOOD 2025 opened at Greater Noida, showcasing innovations in furniture manufacturing and woodworking, reinforcing wood production share and India’s growing global leadership in the sector. The rising demand for customized and bespoke furniture further reinforces wood's preferred status, as the material readily accommodates intricate designs and personalized specifications that discerning buyers increasingly seek.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores lead with a share of 46.5% of the total India furniture market in 2025.

Specialty stores represent the leading distribution channel in the India furniture market, offering consumers exclusive product ranges and superior shopping experiences. These retail establishments provide personalized customer service, expert consultation on furniture selection, and opportunities for customization that differentiate them from other channels. In July 2025, Hettich India launched its first HEX store in Agra, marking the start of a nationwide rollout of 25 stores, offering curated furniture solutions and expert guidance to consumers. Moreover, the tactile shopping experience enabling customers to physically evaluate product quality, comfort, and aesthetic appeal before purchase drives continued preference for specialty retail formats.

The segment's dominance is further reinforced by specialty stores' ability to curate diverse product assortments spanning various design themes, price points, and functional categories. Strategic partnerships with interior designers, architects, and digital influencers enhance brand visibility and customer engagement. The expansion of experience-focused showrooms featuring augmented reality (AR) visualization tools, mock apartment setups, and design consultation services has elevated the specialty store proposition, attracting consumers seeking comprehensive furniture solutions.

End Use Insights:

- Residential

- Commercial

Residential exhibits a clear dominance with a 70.6% share of the total India furniture market in 2025.

Residential commands the largest share of the India furniture market, driven by fundamental household furniture requirements and growing investments in home improvement. Rising homeownership rates, supported by government housing initiatives and expanding mortgage accessibility, have created substantial baseline demand for essential furniture categories including bedroom suites, living room sets, and dining furniture. Urban consumers particularly invest in quality furnishings that reflect personal style while maximizing functionality within compact living spaces. In August 2025, IKEA India inaugurated its first Delhi store at Pacific Mall, Tagore Garden, featuring 15,000 sq ft and over 2,000 home furnishing products, expanding access for urban residential consumers.

Growing emphasis on home aesthetics and interior decoration among the expanding middle-class population fuels continued residential segment expansion. The cultural importance of well-furnished homes in Indian society drives investment in quality furniture as households progress economically. Increasing work-from-home arrangements have further stimulated demand for home office furniture and ergonomic solutions. The rising preference for branded and designer furniture among urban households, combined with customization trends allowing personal expression, sustains residential segment leadership across the market.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 33.2% of the total India furniture market in 2025.

North India maintains market leadership driven by substantial urban population concentration in major metropolitan centers including Delhi-NCR, Chandigarh, and Lucknow. The region's robust economic activity, significant infrastructure development, and expanding real estate projects create sustained furniture demand across residential and commercial applications. Higher purchasing power among consumers, combined with established furniture manufacturing and trading clusters, reinforces North India's dominant market position.

The region benefits from mature distribution networks, including prominent furniture markets like Delhi's Kirti Nagar, which serve as national sourcing destinations for retailers and institutional buyers. Ongoing urbanization, rising disposable incomes, and growing consumer awareness of design trends continue driving market expansion across North Indian states. The combination of traditional furniture appreciation and openness to contemporary designs positions the region for continued leadership as infrastructure and real estate development accelerate throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the India Furniture Market Growing?

Rising Disposable Incomes and Expanding Middle-Class Population

The substantial growth in disposable incomes among Indian households represents a primary catalyst driving furniture market expansion across the country. As the middle-class population continues expanding, an increasing number of consumers possess the financial capacity to invest in quality furniture that enhances their living environments. This economic empowerment enables households to progress beyond basic functional furniture toward premium products offering superior design, craftsmanship, and durability. As per sources, in July 2025, Indian furniture brand WoodenStreet announced plans to quadruple revenue in three years, expand modular and mattress offerings, and open new stores, signaling strong consumer demand for premium home furnishings. Moreover, the aspiration for improved living standards manifests in growing willingness to allocate household budgets toward furniture that reflects personal taste and lifestyle preferences.

Rapid Urbanization and Real Estate Sector Expansion

The accelerating pace of urbanization across India continues generating sustained demand for furniture as millions migrate to metropolitan areas annually. Urban population growth necessitates residential development, commercial infrastructure expansion, and hospitality sector growth, each creating furniture requirements across diverse categories. The flourishing real estate sector, supported by government initiatives promoting affordable housing and infrastructure development, directly stimulates furniture demand as new residential units require furnishing. According to sources, in 2025, UP RERA approved six projects worth ₹864 crore across Noida, Lucknow, Varanasi, Kanpur Nagar, and Bareilly, adding 1,470 residential and commercial units, boosting urban development and furniture demand. Moreover, commercial real estate expansion including office spaces, retail establishments, and hospitality venues further amplifies market opportunities.

E-Commerce Platform Proliferation and Digital Adoption

The remarkable expansion of e-commerce platforms has fundamentally transformed furniture accessibility and purchasing behavior across India. In September 2025, TCC Concept acquired Pepperfry for ₹1,200 crore, expanding its presence in India’s digital furniture market, integrating e-commerce expertise with manufacturing, and boosting organized sector growth. Further, digital channels have democratized access to diverse furniture options for consumers regardless of geographic location, enabling residents in smaller cities to access product varieties previously available only in metropolitan markets. The convenience of online shopping, combined with enhanced visualization tools, virtual room planners, and augmented reality (AR) features, has reduced traditional barriers to furniture purchase. E-commerce platforms offer attractive pricing through reduced overhead costs while providing comprehensive product information and customer reviews that inform purchase decisions.

Market Restraints:

What Challenges the India Furniture Market is Facing?

Raw Material Price Volatility and Supply Chain Challenges

Fluctuations in raw material prices, particularly wood and metal, significantly impact furniture manufacturing costs and industry margins. India's reliance on imported timber for premium hardwood varieties exposes manufacturers to currency fluctuations and international supply disruptions. This volatility complicates pricing strategies and creates uncertainty for manufacturers attempting to maintain competitive positioning while preserving quality standards. Supply chain constraints affecting logistics and transportation further challenge operational efficiency across the industry.

Fragmented Market Structure and Unorganized Sector Competition

The substantial presence of unorganized sector players offering low-cost furniture alternatives poses ongoing challenges for organized manufacturers and retailers. These informal operators maintain competitive pricing through lower overhead costs, limited regulatory compliance, and simplified business structures. The fragmentation complicates standardization efforts, quality consistency, and brand differentiation across the market. Organized players must continuously balance competitive pricing against quality maintenance and margin preservation in this competitive landscape.

Consumer Price Sensitivity and Premium Segment Limitations

High price sensitivity among significant consumer segments limits the scalability of premium furniture offerings beyond metropolitan markets. Many consumers prioritize affordability over brand value or design sophistication, constraining opportunities for premium positioning. Limited awareness regarding design ergonomics, quality certifications, and sustainable product benefits in price-conscious segments slows adoption of higher-value furniture categories. This sensitivity necessitates diverse product portfolios spanning multiple price points to address varied consumer requirements.

Competitive Landscape:

The India furniture market exhibits a moderately fragmented competitive structure characterized by the coexistence of established domestic manufacturers, international entrants, and numerous unorganized local players operating across diverse price segments. Organized players differentiate through continuous investment in design innovation, product quality enhancement, and brand building initiatives that establish consumer trust. Distribution network expansion, encompassing both physical retail presence and digital commerce capabilities, represents a critical competitive dimension. Strategic partnerships with architects, interior designers, and real estate developers strengthen market positioning. Sustainability credentials and customization capabilities increasingly influence competitive positioning as consumer preferences evolve.

Some of the key players include:

- Cello World Private Limited

- Damro Furnitures Pvt. Ltd.

- Durian Industries Ltd.

- Godrej & Boyce Manufacturing Company Limited

- IKEA India (Inter IKEA Holding B.V.)

- Nilkamal Limited

- Supreme Industries Ltd.

- Usha Shriram Enterprises Pvt. Ltd.

- Wakefit Innovations Pvt. Ltd

- Wipro Consumer Care and Lighting Group (Wipro Enterprises Private Limited)

- Zuari Furniture

Recent Developments:

-

In January 2025, Recliners India launched the Omega 3+2+1 Seats, marking India’s first fire-retardant, emission-free recliners. Designed for safety and health, these motorized recliners feature sustainable materials, USB Type A and C ports for device charging, and premium leather upholstery, combining luxury, functionality, and eco-conscious innovation to create safer, non-toxic, and stylish living spaces.

-

In November 2024, Pelican Group launched Pelicanwork, a premium ergonomic office furniture range in India. Designed for modern professionals, the lineup combines advanced ergonomics, sustainable materials, and refined aesthetics to enhance workplace comfort, productivity, and overall employee wellbeing in contemporary office environments.

India Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Cello World Private Limited, Damro Furnitures Pvt. Ltd., Durian Industries Ltd., Godrej & Boyce Manufacturing Company Limited, IKEA India (Inter IKEA Holding B.V.), Nilkamal Limited, Supreme Industries Ltd., Usha Shriram Enterprises Pvt. Ltd., Wakefit Innovations Pvt. Ltd, Wipro Consumer Care and Lighting Group (Wipro Enterprises Private Limited) and Zuari Furniture |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India furniture market size was valued at USD 25.38 Billion in 2025.

The India furniture market is expected to grow at a compound annual growth rate of 6.38% from 2026-2034 to reach USD 44.30 Billion by 2034.

Wood held the largest market share, supported by its enduring aesthetic appeal, cultural significance in Indian households, robust durability, and versatile applicability across diverse furniture styles, encompassing both traditional designs and contemporary, modern interiors.

Key factors driving the India furniture market include rising disposable incomes, rapid urbanization, expanding real estate development, growing demand for modular and customized furniture, e-commerce proliferation, and increasing preference for premium branded products.

Major challenges include raw material price volatility affecting manufacturing costs, fragmented market structure with substantial unorganized sector competition, supply chain constraints impacting logistics efficiency, high consumer price sensitivity limiting premium segment growth, and limited awareness of sustainable and ergonomic furniture benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)