India Gaming Chair Market Size, Share, Trends and Forecast by Type, Material, Price, Distribution Channel, End User, and Region, 2025-2033

India Gaming Chair Market Overview:

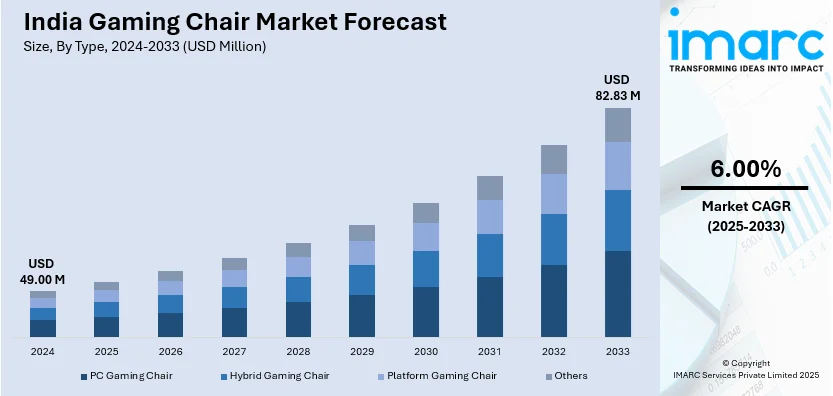

The India gaming chair market size reached USD 49.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 82.83 Million by 2033, exhibiting a growth rate (CAGR) of 6.00% during 2025-2033. The market is driven by the growing gaming culture, increasing awareness of ergonomic benefits, and the rise of e-sports. Affordable, locally manufactured options are gaining popularity, catering to price-sensitive consumers. Health-conscious gamers are prioritizing comfort and posture support, while e-commerce platforms enhance accessibility, furthering the India gaming chair market share across urban and tier 2/3 cities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 49.00 Million |

| Market Forecast in 2033 | USD 82.83 Million |

| Market Growth Rate 2025-2033 | 6.00% |

India Gaming Chair Market Trends:

Increasing Popularity of Affordable and Locally Manufactured Gaming Chairs

The rising popularity of affordable and locally manufactured options is majorly driving the India gaming chair market growth. With the gaming community expanding beyond metro cities to Tier 2 and Tier 3 regions, price sensitivity has become a critical factor. Indian consumers are increasingly opting for budget-friendly gaming chairs that offer decent quality without compromising on essential features. Local manufacturers are capitalizing on this demand by producing cost-effective chairs tailored to the preferences of Indian gamers. These chairs often come with basic ergonomic features, vibrant designs, and durable materials, making them accessible to a wider audience. Additionally, the "Make in India" initiative has encouraged domestic production, reducing reliance on expensive imports. This trend is further supported by e-commerce platforms, which offer competitive pricing and easy availability. Industrialization with the Make in India program has played a pivotal role in attracting huge investments and propelling the Indigenous manufacturing sector. This has influenced growth across the electronics, automotive, and gaming chair industries, with USD 26 Billion of the total investment commitment coming from the Production Linked Incentive (PLI) scheme. Goldmine of Gaming Possibilities. Key states such as Maharashtra, Karnataka, and Gujarat are leading the direction for foreign direct investment (FDI) and establishing India as one of the upcoming manufacturing hubs for gaming chairs and more tech-driven industries. As a result, affordable gaming chairs are gaining traction, making gaming setups more accessible to the average Indian consumer and driving market growth.

To get more information on this market, Request Sample

Growing Influence of Streaming and Content Creation

The rise of streaming and content creation is significantly creating a positive India gaming chair market outlook. With platforms such as YouTube, Twitch, and Instagram gaining popularity, streamers and content creators are investing in high-quality gaming setups, including premium gaming chairs, to enhance their on-screen presence and comfort. This trend is creating a ripple effect, as fans and followers aspire to replicate their favorite creators' setups. India is estimated to have over 900 million social media users by the year 2025, and the platforms with the highest number of users are WhatsApp (83%), Instagram (80.6%), and YouTube (476 million users). The average time spent by individuals in India on social media is 2 hours and 30 minutes a day, hence making it one of the most sought-after platforms for conducting virtual events. As more of the country comes online and social media usage matures, digital and virtual interactions are expected to grow massively across India. Moreover, brands are collaborating with influencers to promote their products, further enhancing visibility and demand. Additionally, the increasing number of gaming tournaments and live-streamed events is driving the need for professional-grade chairs, making this segment a key contributor to the market's growth.

India Gaming Chair Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, material, price, distribution channel, and end user.

Type Insights:

- PC Gaming Chair

- Hybrid Gaming Chair

- Platform Gaming Chair

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes PC gaming chair, hybrid gaming chair, platform gaming chair, and others.

Material Insights:

- PU Leather

- PVC Leather

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes PU leather, PVC leather, and others.

Price Insights:

- High-Range

- Medium-Range

- Low-Range

The report has provided a detailed breakup and analysis of the market based on the price. This includes high-range, medium-range, and low-range.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gaming Chair Market News:

- November 13, 2024: Pelican Group launched Pelicanwork in India, a premium range of ergonomic office furniture comprising gaming chairs and desks that optimize comfort, performance, and aesthetics. Made of the finest materials including Italian Donati and German Bock mechanisms, this collection is targeted at urban millennials and their increasingly ergonomic needs across India’s rapidly growing gaming and professional work environment. Pelicanwork aims to revolutionize the Indian gaming chair market with its comfortable and health-focused designs that promote well-being and productivity.

- April 15, 2024: IKEA announced launching the BRÄNNBOLL collection in September 2024 (20 modular products geared towards Indian gamers), stating that they adapt to both community and individual settings. This range includes ergonomic gaming chairs and multifunctional furniture that caters to the ever-growing global gaming community, which now numbers 3.3 billion consumers. This collection offers a fresh take on style for the casual gamer that places importance on comfort and versatility in both traditional gaming settings and beyond. BRÄNNBOLL, which reimagines gaming furniture in the country, blends the energy of street sports design with practicality woven in for modern-day interiors.

India Gaming Chair Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | PC Gaming Chair, Hybrid Gaming Chair, Platform Gaming Chair, Others |

| Materials Covered | PU Leather, PVC Leather, Others |

| Prices Covered | High-Range, Medium-Range, Low-Range |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gaming chair market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gaming chair market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gaming chair industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gaming chair market in India was valued at USD 49.00 Million in 2024.

The India gaming chair market is projected to exhibit a CAGR of 6.00% during 2025-2033, reaching a value of USD 82.83 Million by 2033.

The India gaming chair market is driven by the rising popularity of online gaming, increasing awareness of ergonomic seating, and higher spending on home entertainment setups. Growth in esports, social media influence, and availability of feature-rich, comfortable chairs through online platforms also support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)