India Gas Compressors Market Size, Share, Trends and Forecast by Compressor Type, End Use Industry, and Region, 2026-2034

India Gas Compressors Market Overview:

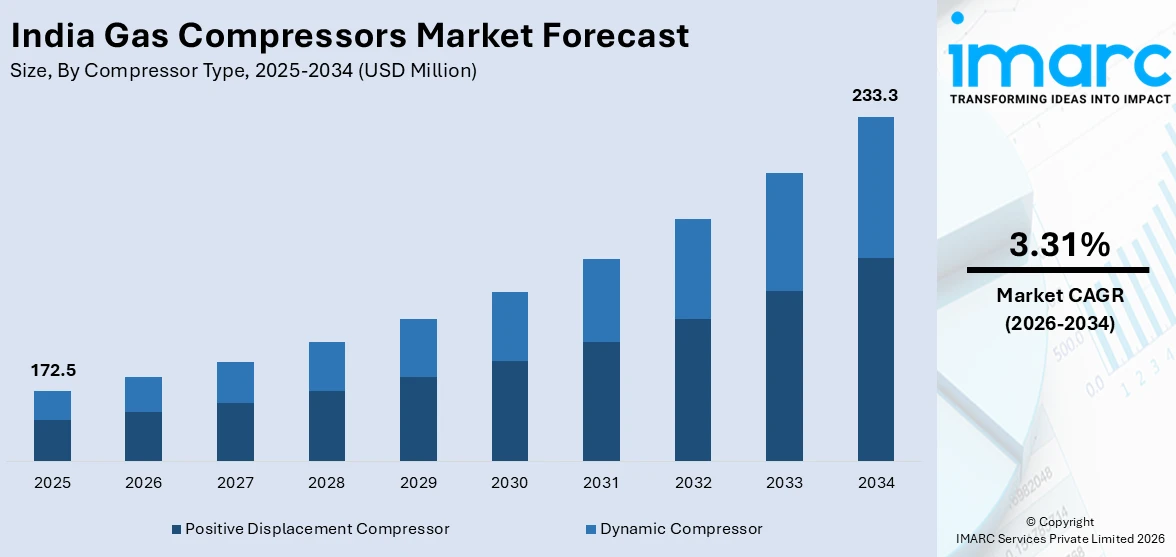

The India gas compressors market size reached USD 172.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 233.3 Million by 2034, exhibiting a growth rate (CAGR) of 3.31% during 2026-2034. India gas compressor market is expanding due to the increasing gas-based power generation and city gas distribution (CGD) network development. The escalating demand for grid stability, energy efficiency, and cleaner fuel alternatives is also driving investments in advanced compression technologies for efficient fuel distribution and pressure regulation across various applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 172.5 Million |

| Market Forecast in 2034 | USD 233.3 Million |

| Market Growth Rate (2026-2034) | 3.31% |

India Gas Compressors Market Trends:

Rising Demand for Gas-Based Power Generation

The increasing dependence on gas-powered electricity generation is a major factor contributing to the gas compressor market in India. In an effort to cut carbon emissions, natural gas is being promoted as a transitional fuel to connect traditional coal power with renewable energy alternatives. Gas-powered power plants need large-capacity compressors for fuel delivery, pressure control, and efficiency enhancement. This demand is additionally strengthened by the necessity for grid stability, especially as renewable energy sources play a bigger role in the electricity mix. Moreover, innovations in combined-cycle power stations that enhance energy efficiency are boosting the usage of gas compressors. Government incentives promoting gas-powered power plants and enhancing infrastructure for efficient fuel distribution are also supporting the market growth. For example, in 2025, the Ministry of Petroleum & Natural Gas pointed out that India's gas-fired power plants are functioning at reduced Plant Load Factors (PLF). To enhance the availability of natural gas, the government has classified LNG under the Open General License (OGL), permitting power plants to import LNG whenever necessary. Main efforts consist of extending the national gas network, establishing LNG facilities, and encouraging Bio-CNG via the SATAT program.

To get more information on this market Request Sample

Expansion of City Gas Distribution (CGD) Networks

Government programs focused on boosting domestic natural gas utilization are resulting in significant investments in pipeline infrastructure for residential, commercial, and industrial users. For example, in 2024, the Union Minister of Petroleum and Natural Gas declared that India aimed to set up 17,500 CNG stations and offer 120 million PNG connections by 2030. This growth was anticipated to enhance related sectors and promote the idea of an independent India. The project involved establishing a national gas grid and a city gas distribution system to improve energy security and encourage the use of cleaner fuel alternatives. Gas compressors are vital for upholding ideal pressure and guaranteeing smooth distribution throughout CGD networks. As more cities receive CGD licenses, the need for sophisticated compression solutions is growing. The transition to cleaner energy sources for cooking, heating, and industrial purposes is speeding up infrastructure development. Moreover, regulatory requirements encouraging the extensive use of piped natural gas (PNG) in cities are increasing the need for dependable compression technology. With the ongoing expansion of CGD networks to encompass a broader geographical area, manufacturers of gas compressors are experiencing ongoing demand for efficient, high-capacity systems to facilitate distribution activities.

India Gas Compressors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on compressor type and end use industry.

Compressor Type Insights:

- Positive Displacement Compressor

- Dynamic Compressor

The report has provided a detailed breakup and analysis of the market based on the compressor type. This includes positive displacement compressor and dynamic compressor.

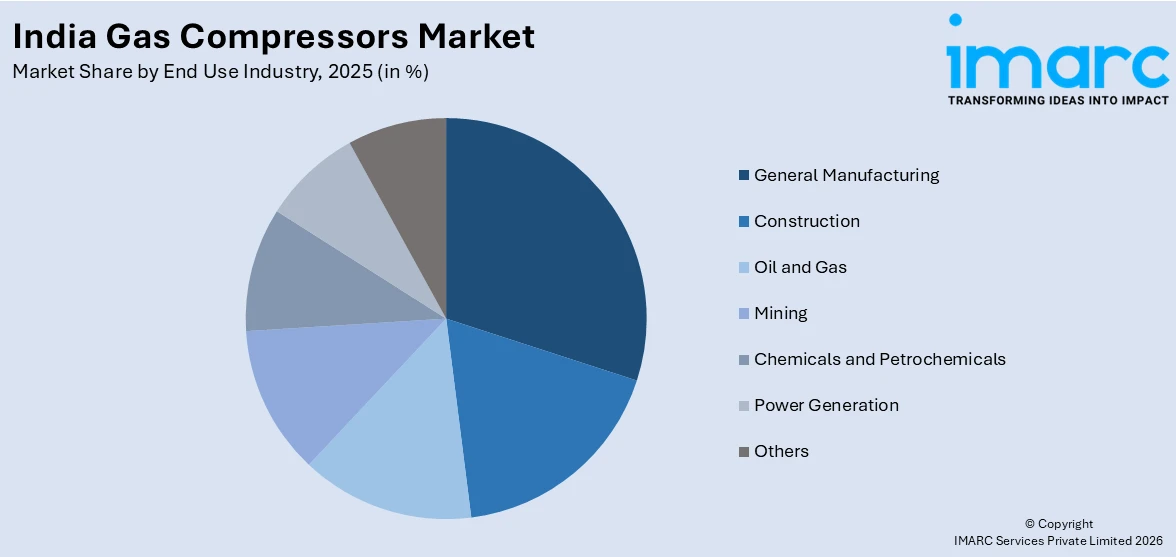

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- General Manufacturing

- Construction

- Oil and Gas

- Mining

- Chemicals and Petrochemicals

- Power Generation

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes general manufacturing, construction, oil and gas, mining, chemicals and petrochemicals, power generation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gas Compressors Market News:

- In March 2024, L&T Energy Hydrocarbon (LTEH) secured a "significant" order from ONGC for the MHN TCPP PGC BGC Project off India's West Coast. The order, valued between ₹1,000 crore and ₹2,500 crore, included the engineering, procurement, and installation of new gas compressor modules at offshore locations. The project aimed to enhance production capabilities and support India's energy needs.

- In August 2023, Atlas Copco launched a new manufacturing facility in Talegaon, Pune, covering 270,000 square feet with an investment of ₹1,400 million. The facility was set to manufacture air and gas compressor systems for domestic and international markets. The plant was set to create over 200 jobs and incorporate sustainable practices, with 80% of its energy sourced from solar power.

India Gas Compressors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Compressor Types Covered | Positive Displacement Compressor, Dynamic Compressor |

| End Use Industries Covered | General Manufacturing, Construction, Oil and Gas, Mining, Chemicals and Petrochemicals, Power Generation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India gas compressors market performed so far and how will it perform in the coming years?

- What is the breakup of the India gas compressors market on the basis of compressor type?

- What is the breakup of the India gas compressors market on the basis of end use industry?

- What is the breakup of the India gas compressors market on the basis of region?

- What are the various stages in the value chain of the India gas compressors market?

- What are the key driving factors and challenges in the India gas compressors market?

- What is the structure of the India gas compressors market and who are the key players?

- What is the degree of competition in the India gas compressors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gas compressors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gas compressors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gas compressors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)