India Gas Engine Market Size, Share, Trends and Forecast by Fuel Type, Power Output, Application, Industry Vertical, and Region, 2025-2033

India Gas Engine Market Overview:

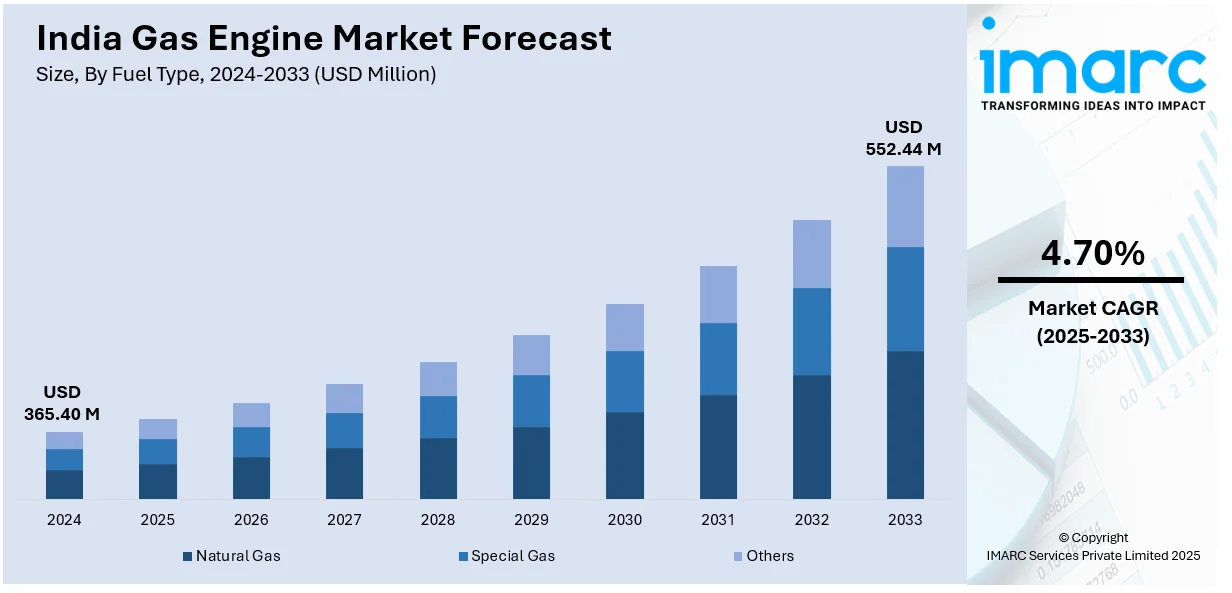

The India gas engine market size reached USD 365.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 552.44 Million by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The India gas engine market is driven by rising industrialization, increasing demand for cleaner energy solutions, and expanding adoption of gas-based power generation. Government initiatives promoting natural gas infrastructure, coupled with cost advantages over diesel engines, further boost market growth. Technological advancements enhancing efficiency and reliability also support increased adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 365.40 Million |

| Market Forecast in 2033 | USD 552.44 Million |

| Market Growth Rate (2025-2033) | 4.70% |

India Gas Engine Market Trends:

Rising Adoption of Gas-Based Power Generation

India’s transition to cleaner energy sources is accelerating with a strong push toward gas-based power generation. Concerns over emissions from coal and diesel-fired plants are prompting industries and utilities to adopt gas engines. Government initiatives, including a $67 billion investment to expand the gas pipeline network by 9,630 miles (15,500 km) and city gas distribution projects, are improving natural gas accessibility. The cost-effectiveness of natural gas compared to liquid fuels further strengthens its appeal for power producers. Industrial sectors such as manufacturing, oil and gas, and data centers are increasingly using gas engines for captive power. Additionally, gas engines are playing a crucial role in supporting renewable energy integration, ensuring grid stability, and reducing reliance on conventional fossil fuels.

To get more information on this market, Request Sample

Expansion of Gas Distribution Infrastructure

India's expanding natural gas infrastructure is driving gas engine adoption across industries. With natural gas demand projected to grow nearly 60% by 2030, reaching approximately 103 billion cubic meters per year, government-led initiatives such as the City Gas Distribution (CGD) network expansion and cross-country pipeline investments are enhancing gas accessibility. Growing supply of LNG and CNG is driving the use of gas engines for power generation, transportation, and industrial usage. Foreign investment and private sector ventures are further increasing the strength of the gas supply chain. Growing urbanization and rural development leading to improvement in gas distribution means industries and commerce are more moving towards using gas engines as a cleaner and economic option to the conventional diesel and coal-fired based power sources.

Technological Advancements Enhancing Efficiency

Continuous advancements in gas engine technology are significantly enhancing efficiency, performance, and reliability. Innovations in combustion technology, turbocharging, and emission control systems enable manufacturers to develop high-power, low-emission gas engines. The integration of digital monitoring and predictive maintenance optimizes fuel consumption and minimizes downtime. Notably, GE Power's 9HA series gas turbine has achieved 64% efficiency, driven by additive manufacturing and advanced combustion technology. Dual-fuel and hybrid engine innovations expand applications across industries, while the push for hydrogen and biogas-compatible engines aligns with India’s renewable energy targets. These advancements make gas engines more competitive than diesel counterparts, fostering increased adoption in power generation, industrial, and commercial sectors as India transitions toward cleaner energy solutions.

India Gas Engine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on fuel type, power output, application and industry vertical.

Fuel Type Insights:

- Natural Gas

- Special Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes natural gas, special gas, and others.

Powe Output Insights:

- 0.5-1 MW

- 1-2 MW

- 2-5 MW

- 5-10 MW

- 10-20 MW

A detailed breakup and analysis of the market based on the power output have also been provided in the report. This includes 0.5-1 MW, 1-2 MW, 2-5 MW, 5-10 MW, and 10-20 MW.

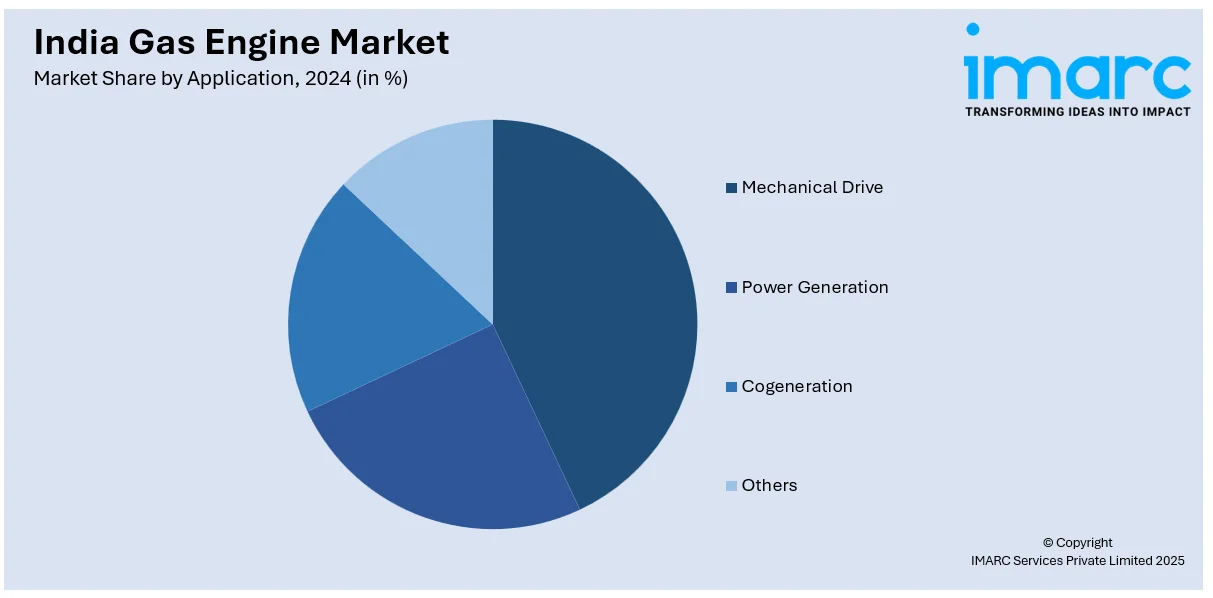

Application Insights:

- Mechanical Drive

- Power Generation

- Cogeneration

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes mechanical drive, power generation, cogeneration, and others.

Industry Vertical Insights:

- Utilities

- Manufacturing

- Oil and Gas

- Mining

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes utilities, manufacturing, oil and gas, mining, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gas Engine Market News:

- In January 2025, Cummins Group India has launched its next-gen HELM engine platform and hydrogen fuel system, introducing the BSVI-compliant L10 engine and a hydrogen fuel system with 350-bar and 700-bar pressure. The B6.7N natural gas engine supports CNG and LNG adoption. Leaders emphasized alignment with India's Viksit Bharat and Make in India initiatives, ensuring cleaner, future-ready transportation solutions.

- In February 2025, CNH India commenced engine production at its new facility in Greater Noida, New Delhi, with the 2.8-litre Trem V (F28) as its first model. The 7,000 sq. m plant has an annual capacity of 20,000 units and features AI-driven technologies for quality assurance. Narinder Mittal, CNH India’s president, emphasized the company’s commitment to locally engineered solutions. Licensed by FPT Industrial, these engines enhance machine localization while improving efficiency and performance.

India Gas Engine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Natural Gas, Special Gas, Others |

| Power Outputs Covered | 0.5-1 MW, 1-2 MW, 2-5 MW, 5-10 MW, 10-20 MW |

| Applications Covered | Mechanical Drive, Power Generation, Cogeneration, Others |

| Industry Verticals Covered | Utilities, Manufacturing, Oil and Gas, Mining, and Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gas engine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gas engine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gas engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gas engine market in India was valued at USD 365.40 Million in 2024.

The India gas engine market is projected to exhibit a CAGR of 4.70% during 2025-2033, reaching a value of USD 552.44 Million by 2033.

Rising industrialization, shift toward cleaner energy, cost benefits over diesel, government investments in natural gas pipelines, LNG and CNG supply growth, and advancements in engine efficiency and emissions control are boosting demand for gas engines in power generation and industrial use.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)