India Generative AI Market Size, Share, Trends and Forecast by Component, Technology, Application, Model, Customers, End Use, and Region, 2025-2033

India Generative AI Market Overview:

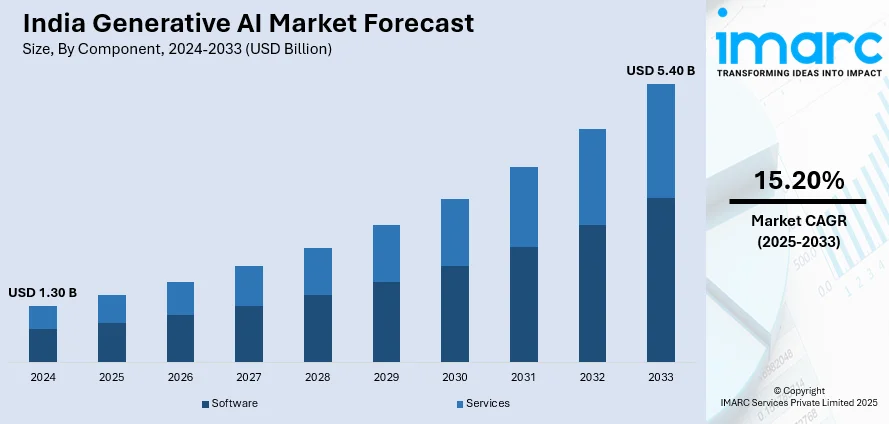

The India generative AI market size reached USD 1.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.40 Billion by 2033, exhibiting a growth rate (CAGR) of 15.20% during 2025-2033. The rising enterprise adoption for automation, cost efficiency, and innovation, increased digital transformation, government AI initiatives, and demand for localized multilingual solutions expand the India generative AI market share. Startups and global players are investing in AI tools, while sectors including IT, healthcare, and e-commerce drive demand, despite challenges such as skill gaps and data privacy concerns.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.30 Billion |

| Market Forecast in 2033 | USD 5.40 Billion |

| Market Growth Rate 2025-2033 | 15.20% |

India Generative AI Market Trends:

Rapid Adoption of Generative AI in Indian Enterprises

The escalating adoption across enterprises, driven by the need for automation, cost efficiency, and innovation is majorly driving the India generative AI market growth. Businesses in sectors including IT, healthcare, banking, and e-commerce are leveraging AI tools for content creation, customer support, and data analysis. Startups and large corporations are integrating generative AI to enhance productivity, with platforms such as ChatGPT, Gemini, and locally developed solutions gaining traction. A research report from the IMARC Group indicates that the artificial intelligence market in India was valued at USD 1,251.8 Million in 2024. It is projected to grow to USD 12,429.6 Million by 2033, reflecting a compound annual growth rate (CAGR) of 27.6% from 2025 to 2033. In addition, growing governance efforts toward policy support are driving the momentum of AI technology adoption. However, there are still challenges, such as data privacy concerns and a shortage of professionals, among others. Despite these obstacles, the appetite for generative AI solutions is likely to grow as more Indian enterprises recognize the ability of generative AI to drive efficiency and offer a competitive edge.

To get more information on this market, Request Sample

Rise of Localized Generative AI Solutions for Indian Languages

The development of localized AI models supporting regional languages is creating a positive India generative AI market outlook. India has 22 official languages and hundreds of dialects, leading to increased demand for AI tools that serve non-English speakers. Companies are creating open-source models designed specifically for Hindi, Tamil, and other Indian languages, which would make these models available to a wider number of users. This is notable in the context of education, agriculture, and rural banks, whereby those who are not fluent in English find it difficult to adopt technology. Key global players have also tailored their AI products to the local market here with the integration of more linguistic capabilities. This trend is further fuelled by Bhashini and other government efforts to improve AI-powered language solutions. With internet penetration expanding into smaller towns, the Indians’ push for vernacular AI content in the form of voice assistants, chatbots, and automated translations is speeding up, setting localization as a crucial growth driver of India’s generative AI ecosystem. Voice assistants worldwide have witnessed significant growth, with devices expected to increase devices from 4.2 billion to 8.4 billion by the end of 2024. Additionally, there are more than 1 billion voice searches done a month and 25% of the users in India use voice technology on a weekly basis to get the information. Specifically, 58% of consumers use voice assistants for local searches, and voice shopping is expected to hit USD 40 Billion in the coming years. This holds immense scope for the generative AI space in India, especially in terms of voice-enabled commerce, Natural Language Processing, and hyper-local search innovations.

India Generative AI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, technology, application, model, customers, and end use.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Technology Insights:

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto Encoders

- Diffusion Networks

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes generative adversarial networks (GANs), transformers, variational auto encoders, and diffusion networks.

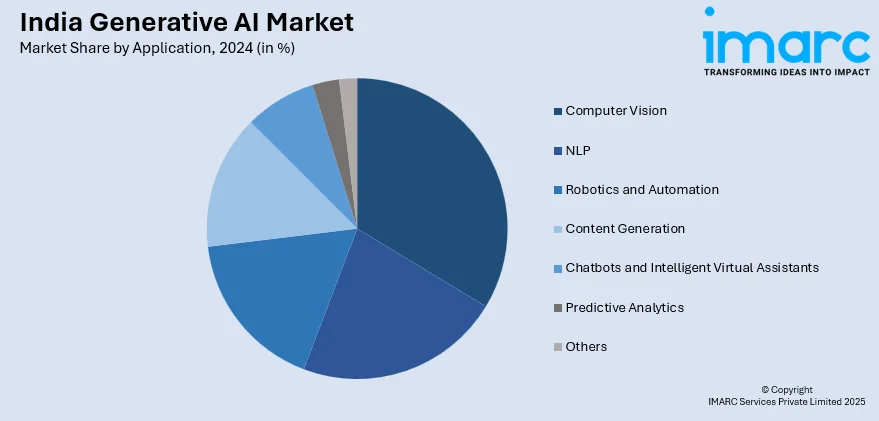

Application Insights:

- Computer Vision

- NLP

- Robotics and Automation

- Content Generation

- Chatbots and Intelligent Virtual Assistants

- Predictive Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes computer vision, NLP, robotics and automation, content generation, chatbots and intelligent virtual assistants, predictive analytics, and others.

Model Insights:

- Large Language Models

- Image and Video Generative Models

- Multi Modal Generative Models

- Others

A detailed breakup and analysis of the market based on the model have also been provided in the report. This includes large language models, image and video generative models, multi modal generative models, and others.

Customers Insights:

- Model Builders

- App Builders

The report has provided a detailed breakup and analysis of the market based on the customers. This includes model builders and app builders.

End Use Insights:

- Media and Entertainment

- BFSI

- IT and Telecommunication

- Healthcare

- Automotive and Transportation

- Gaming

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes media and entertainment, BFSI, IT and telecommunication, healthcare, automotive and transportation, gaming, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Generative AI Market News:

- February 26, 2025: Yotta launched myShakti, India's first-ever sovereign B2C generative AI chatbot, developed in a record 24 hours and powered by 128 Nvidia H100 GPUs at its Navi Mumbai-based Tier IV data center. It is based on the open-source DeepSeek-R1 model, offers end-to-end encryption, and uses a token-based pricing model for enterprise clients, targeting healthcare, banks, financial services, and educational industries. As part of its Shakti Cloud initiative, Yotta plans to scale its capacities to 32,768 GPUs by 2025, positioning itself as an integral player in the burgeoning generative AI infrastructure market in India.

- May 10, 2024: SML India, along with Abu Dhabi-based 3AI Holding, unveiled Hanooman, a free generative AI assistant offering support in 98 languages, 12 of them Indian, to make it easier for those who do not speak English. The platform is on the web and Android, with an iOS version coming soon. It intends to hit 200 million users in a year and roll out a premium version late next year. Backed by NASSCOM, HP, and Yotta and targeting 3,000 colleges, Hanooman is an advancement in tailoring generative AI to India's diverse user segment.

India Generative AI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Technologies Covered | Generative Adversarial Networks (GANs), Transformers, Variational Auto Encoders, Diffusion Networks |

| Applications Covered | Computer Vision, NLP, Robotics and Automation, Content Generation, Chatbots and Intelligent Virtual Assistants, Predictive Analytics, Others |

| Models Covered | Large Language Models, Image and Video Generative Models, Multi Modal Generative Models, Others |

| Customers Covered | Model Builders, App Builders |

| End Uses Covered | Media and Entertainment, BFSI, IT and Telecommunication, Healthcare, Automotive and Transportation, Gaming, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India generative AI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India generative AI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India generative AI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The generative AI market in India was valued at USD 1.30 Billion in 2024.

The India generative AI market is projected to exhibit a CAGR of 15.20% during 2025-2033, reaching a value of USD 5.40 Billion by 2033.

The key factors driving the India generative AI market include rising digital transformation, growing demand for localized content, government-backed AI initiatives, and adoption across industries for automation, innovation, and cost efficiency, fueling the rapid deployment of GenAI tools and platforms nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)