India Geopolymer Market Size, Share, Trends and Forecast by Application, End-Use Industry, and Region, 2025-2033

India Geopolymer Market Overview:

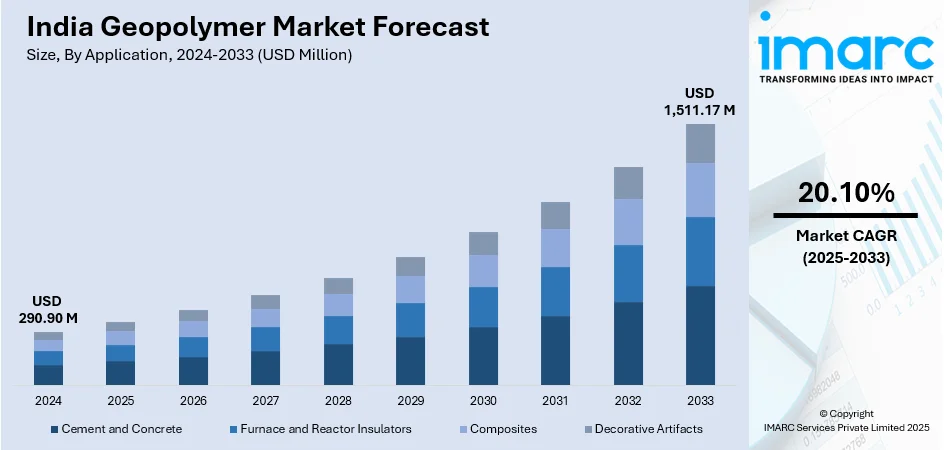

The India geopolymer market size reached USD 290.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,511.17 Million by 2033, exhibiting a growth rate (CAGR) of 20.10% during 2025-2033. The rising demand for sustainable construction materials, implementation of government initiatives promoting eco-friendly alternatives, increasing infrastructure projects, stringent regulations on carbon emissions, advancements in geopolymer technology, cost-effective production methods, and growing awareness of geopolymer benefits are some of the major factors augmenting India geopolymer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 290.90 Million |

| Market Forecast in 2033 | USD 1,511.17 Million |

| Market Growth Rate (2025-2033) | 20.10% |

India Geopolymer Market Trends:

Increasing Industrial Adoption and Market Penetration

Numerous industries in India are increasingly adopting geopolymer technology to enhance sustainability and operational efficiency, which is positively impacting the India geopolymer market outlook. Sectors such as infrastructure, real estate, and road construction, as well as energy-intensive industries like steel and power are integrating geopolymers to minimize their environmental impact. In an effort to attract in eco-aware investors and customers, cement substitute manufacturers are coordinating with the nation's green construction certifications issued by the Indian Green construction Council (IGBC) and GRIHA. According to industry reports, India's national highway development expanded at a 9.3% CAGR from FY16 to FY24, with over 12,349 km of new national highways constructed in FY24 alone. This rapid road infrastructure growth is driving demand for sustainable materials, while positioning geopolymer-based pavement solutions as a viable alternative to traditional concrete. The National Highways Authority of India (NHAI) and state public works departments are testing geopolymer concrete in pilot projects, demonstrating its potential for large-scale infrastructure applications. Real estate developers are using geopolymer bricks and precast panels to meet the growing demand for green buildings. As awareness spreads among architects, engineers, and contractors, geopolymer materials are being incorporated into commercial and residential projects, further driving market expansion and industrial-scale production.

To get more information on this market, Request Sample

Government Policies Promoting Sustainable Construction

India's push for sustainable infrastructure is driving the adoption of geopolymer materials, particularly in construction and road development. According to an industry report, India aims to achieve net-zero emissions by 2070 as a part of its Long-term Strategy for Low Carbon Development (LT-LEDS). To support this goal, the government is enforcing stringent policies to curb carbon emissions, with a primary focus on reducing reliance on traditional cement production. This shift is driving the adoption of geopolymers as a sustainable alternative in construction. Agencies like the Bureau of Indian Standards (BIS) and the Ministry of Environment, Forest and Climate Change (MoEFCC) are introducing guidelines favoring alternative binders, such as geopolymers, which offer significant environmental benefits. Additionally, the Pradhan Mantri Awas Yojana (PMAY) and Smart Cities Mission encourage the use of eco-friendly materials in housing and urban projects, increasing demand for geopolymer-based concrete. In line with this, growing infrastructure projects are incorporating sustainable construction materials to meet India's net-zero commitments. Furthermore, research institutions and public-sector units (PSUs) are collaborating to standardize geopolymer applications, which makes them a viable alternative in mainstream construction. These policy measures are fostering India geopolymer market growth by creating incentives for manufacturers, builders, and technology developers to invest in geopolymer production, thereby ensuring long-term industry expansion.

India Geopolymer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application and end-use industry.

Application Insights:

- Cement and Concrete

- Furnace and Reactor Insulators

- Composites

- Decorative Artifacts

The report has provided a detailed breakup and analysis of the market based on the application. This includes cement and concrete, furnace and reactor insulators, composites, and decorative artifacts.

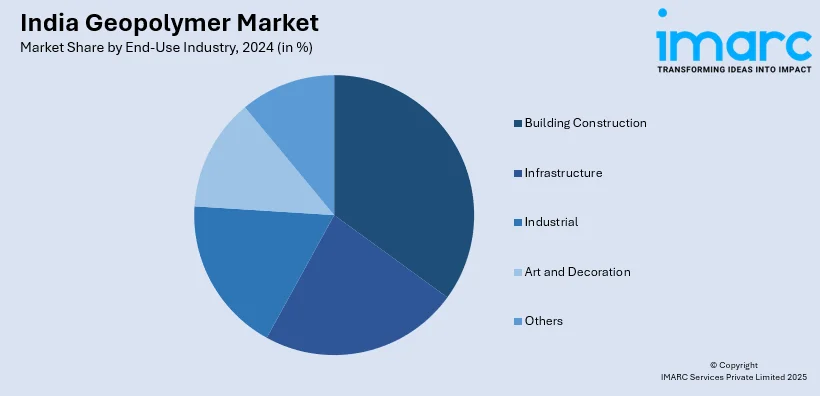

End-Use Industry Insights:

- Building Construction

- Infrastructure

- Industrial

- Art and Decoration

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes building construction, infrastructure, industrial, art and decoration, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Geopolymer Market News:

- On July 18, 2024, Manmohan Jain, an alumnus of the College of Agricultural Engineering and Technology (CoAE), Punjab Agricultural University (PAU), introduced an innovative geopolymer cement aimed at sustainable construction. This eco-friendly cement sets rapidly without requiring water for mixing and curing, contrasting with traditional Ordinary Portland Cement (OPC), whose production emits approximately 800 kg of carbon dioxide per ton. Notably, geopolymer concrete gains strength over time and has been utilized in projects such as parts of the Delhi Metro, with Indian Railways adopting precast geopolymer elements for pavers, marking a significant advancement towards sustainable construction practices.

- On November 20, 2024, a research team at the Indian Institute of Technology (IIT) Guwahati, led by Professor Anil K. Mishra from the Department of Civil Engineering, announced the development of an eco-friendly geopolymer utilizing industrial byproducts such as fly ash (FA), water treatment sludge (WTS), and ground granulated blast furnace slag (GGBS). This innovation addresses significant environmental challenges associated with industrial waste management by converting these materials into sustainable construction alternatives. The geopolymer exhibits high strength and durability, offering a low-carbon, energy-efficient substitute to traditional cement, thereby promoting greener infrastructure solutions.

India Geopolymer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Cement and Concrete, Furnace and Reactor Insulators, Composites, Decorative Artifacts |

| End-Use Industries Covered | Building Construction, Infrastructure, Industrial, Art and Decoration, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India geopolymer market performed so far and how will it perform in the coming years?

- What is the breakup of the India geopolymer market on the basis of application?

- What is the breakup of the India geopolymer market on the basis of end-use industry?

- What is the breakup of the India geopolymer market on the basis of region?

- What are the various stages in the value chain of the India geopolymer market?

- What are the key driving factors and challenges in the India geopolymer market?

- What is the structure of the India geopolymer market and who are the key players?

- What is the degree of competition in the India geopolymer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India geopolymer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India geopolymer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India geopolymer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)