India Geotextiles Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

India Geotextiles Market Overview:

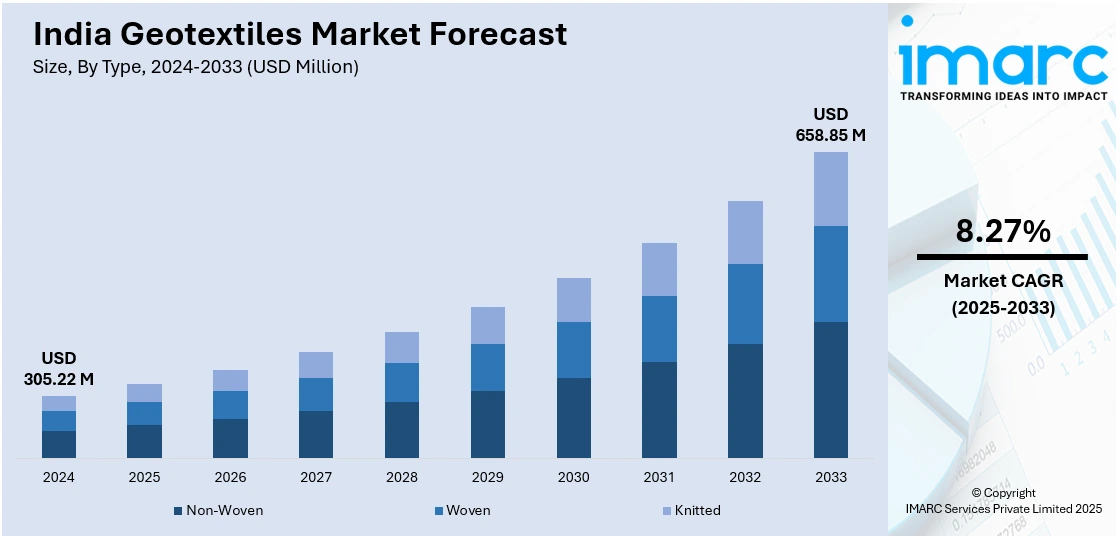

The India geotextiles market size reached USD 305.22 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 658.85 Million by 2033, exhibiting a growth rate (CAGR) of 8.27% during 2025-2033. The rising infrastructure development, government initiatives like Bharatmala and Smart Cities, and increasing demand for soil stabilization in road construction. Additionally, heightened environmental concerns, advancements in polymer technology, and the expanding agricultural sector's need for erosion control are further fueling market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 305.22 Million |

| Market Forecast in 2033 | USD 658.85 Million |

| Market Growth Rate 2025-2033 | 8.27% |

India Geotextiles Market Trends:

Expansion of Infrastructure Projects

India's fast-paced urbanization and expanding economy have driven substantial investments in infrastructure, especially in transportation and urban development. Government-led initiatives such as the Bharatmala Pariyojana and the Smart Cities Mission are at the forefront of this transformation. The Bharatmala Pariyojana aims to develop approximately 83,677 kilometers of national highways by 2025, significantly improving connectivity across the country. Geotextiles play a vital role in these large-scale projects by enhancing soil stabilization, facilitating drainage, and preventing erosion, all of which are crucial for the durability and safety of road infrastructure. Similarly, the Smart Cities Mission is focused on upgrading 100 cities through urban renewal and retrofitting programs to create more sustainable and livable spaces. In urban infrastructure, geotextiles are widely used for subgrade separation, reinforcement in roadways, efficient drainage systems, and erosion control in green spaces. As India continues to modernize its infrastructure, the demand for geotextiles is expected to rise, reinforcing their importance in building resilient and long-lasting developments.

To get more information on this market, Request Sample

Increasing Adoption of Sustainable Construction Practices

Greenhouse gas (GHG) emissions from construction material consumption account for 18% of annual emissions, highlighting the sector's significant environmental impact. As sustainability gains prominence, geotextiles are increasingly being used in construction to enhance structural durability, reduce repair frequency, and optimize resource efficiency. With the construction sector responsible for 50% of landfill waste, geotextiles play a crucial role in waste management by serving as liners and covers in landfills, preventing contamination, and improving waste control. Additionally, the rising focus on environmental protection has driven the adoption of geotextiles in flood control and water management systems. Government policies further support sustainable infrastructure by promoting eco-friendly materials like biodegradable jute and coir-based geotextiles. The Ministry of Textiles has also introduced quality control orders to standardize and encourage the use of geotextiles in infrastructure projects.

India Geotextiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, material, and application.

Type Insights:

- Non-Woven

- Woven

- Knitted

The report has provided a detailed breakup and analysis of the market based on the type. This includes non-woven, woven, and knitted.

Material Insights:

- Polypropylene

- Polyester

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes polypropylene, polyester, and others.

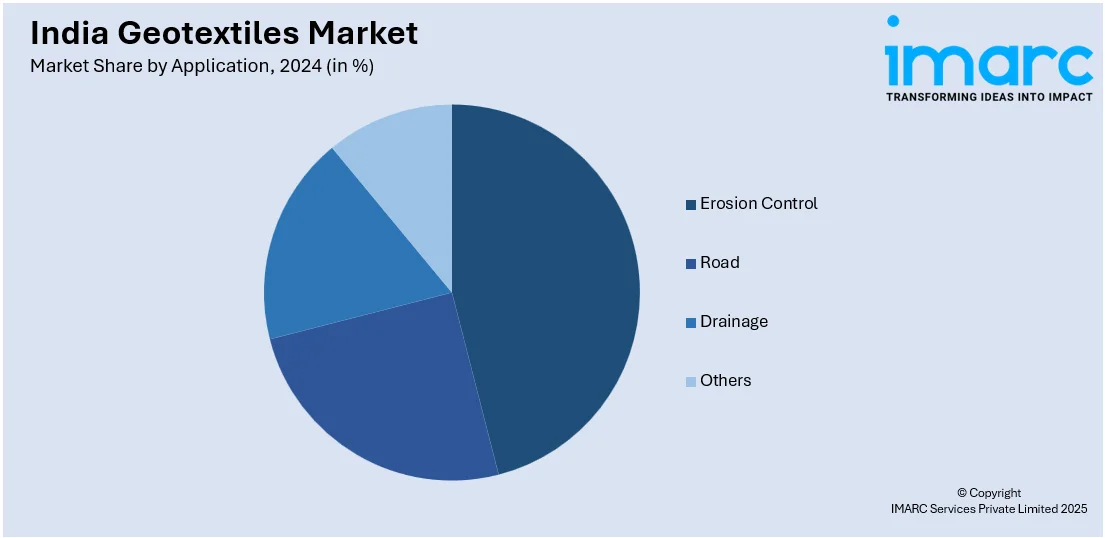

Application Insights:

- Erosion Control

- Road

- Drainage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes erosion control, road, drainage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Geotextiles Market News:

- August 2024: Pathanamthitta's local body authorities launched the new phase of a coir geo textile project, which will begin in Aranmula Panchayat. The project's goal is to stabilize the banks of the Kozhithodu stream utilizing 7,350 square meters of geotextiles.

- August 2024: The Ministry of Textiles approved grants under the National Technical Textiles Mission. Four start-ups received approximately USD 60,000 each through the GREAT scheme for projects in Composites, Sustainable, and Smart Textiles. Additionally, about USD 2.4 million was allocated to five educational institutes to introduce new B.Tech courses in technical textiles, including Geotextiles and Composites.

India Geotextiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Non-Woven, Woven, Knitted |

| Materials Covered | Polypropylene, Polyester, Others |

| Applications Covered | Erosion Control, Road, Drainage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India geotextiles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India geotextiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India geotextiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India geotextiles market was valued at USD 305.22 Million in 2024.

The India geotextiles market is projected to exhibit a CAGR of 8.27% during 2025-2033, reaching a value of USD 658.85 Million by 2033.

The India geotextiles market is driven by extensive infrastructure and roadway projects, emphasizing soil stabilization, erosion control, and drainage solutions. Government investment in environmental protection initiatives and sustainable construction accelerates its usage. Growth in rail, metro, and coastal defense development also supports demand, alongside increased focus on long-term asset durability and performance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)