India Glass Pharmaceutical Packaging Materials Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

India Glass Pharmaceutical Packaging Materials Market Overview:

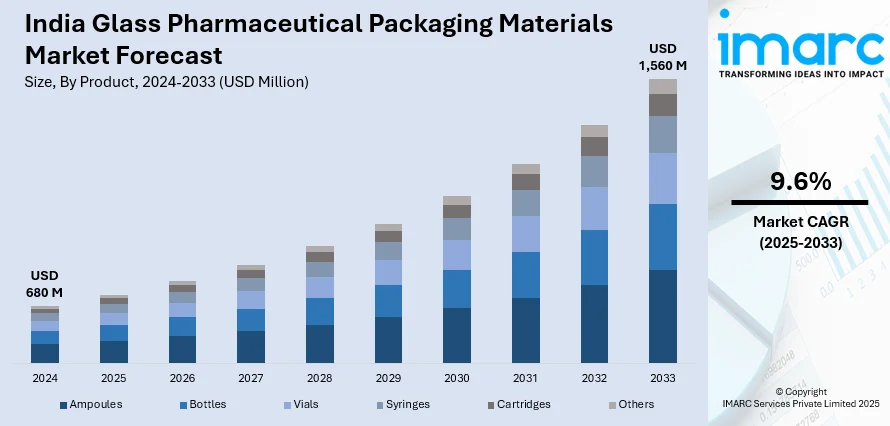

The India glass pharmaceutical packaging materials market size reached USD 680 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,560 Million by 2033, exhibiting a growth rate (CAGR) of 9.6% during 2025-2033. The market is growing due to increasing drug production, stricter regulations, and rising demand for sustainable solutions. Additionally, manufacturers are adopting lightweight, recyclable glass, while innovations in barrier coatings and durability enhance drug stability, safety, and regulatory compliance, impacting market growth by driving demand for sustainable, high-performance pharmaceutical packaging solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 680 Million |

| Market Forecast in 2033 | USD 1,560 Million |

| Market Growth Rate 2025-2033 | 9.6% |

India Glass Pharmaceutical Packaging Materials Market Trends:

Increasing Adoption of Borosilicate Glass for Injectable Drugs

The demand for borosilicate glass in India's pharmaceutical packaging market is rising as injectable drugs, biologics, and vaccines gain prominence. With India being a leading supplier of generic injectables, manufacturers are shifting toward Type I borosilicate glass due to its high chemical resistance, thermal stability, and low extractables. For instance, according to IMARC Group, India's generic injectables market is projected to reach USD 7.6 Billion by 2033. Additionally, this shift is essential to prevent drug interactions, contamination risks, and pH alterations in sensitive formulations. Pharmaceutical companies are also upgrading their packaging materials to meet stricter regulatory standards from agencies such as the USFDA and EMA, ensuring product safety in both domestic and export markets. Moreover, increasing investments in glass manufacturing infrastructure are driving innovation in vial and ampoule production, improving dimensional accuracy and break resistance. As biologics and specialty injectables grow in demand, pharmaceutical firms are focusing on packaging that maintains drug integrity throughout the supply chain and storage lifecycle. Furthermore, with rising quality expectations from both regulators and healthcare providers, borosilicate glass packaging is becoming the preferred choice for high-value and sensitive pharmaceutical products in India.

To get more information on this market, Request Sample

Growing Emphasis on Lightweight and Sustainable Glass Packaging

Sustainability is becoming a key focus in India's pharmaceutical glass packaging industry, with manufacturers adopting lightweight and recyclable glass to reduce environmental impact. As regulatory bodies and pharmaceutical companies emphasize sustainable supply chains, glassmakers are developing thinner yet durable glass containers that minimize raw material usage and carbon emissions during production and transportation. The growing acceptance of lightweight glass vials and bottles also lowers logistics costs while maintaining the necessary strength for pharmaceutical storage. Additionally, recycled glass content is gaining traction as companies work toward circular economy models in packaging. Moreover, government initiatives promoting green manufacturing and corporate commitments to carbon footprint reduction are further accelerating the transition toward eco-friendly glass packaging solutions. For instance, in November 2024, the Government of India (GOI) announced the launch of two greenfield plants under the PLI scheme to strengthen domestic pharmaceutical manufacturing. These facilities will produce penicillin G, 6-APA, significantly influencing the market. As sustainability takes center stage, pharmaceutical companies are increasingly choosing low-carbon, recyclable glass packaging to align with evolving environmental regulations and global market expectations.

India Glass Pharmaceutical Packaging Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, material, and application.

Product Insights:

- Ampoules

- Bottles

- Vials

- Syringes

- Cartridges

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes ampoules, bottles, vials, syringes, cartridges, and others.

Material Insights:

- Type I Glass

- Type II Glass

- Type III Glass

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes type I glass, type II glass, and type III glass.

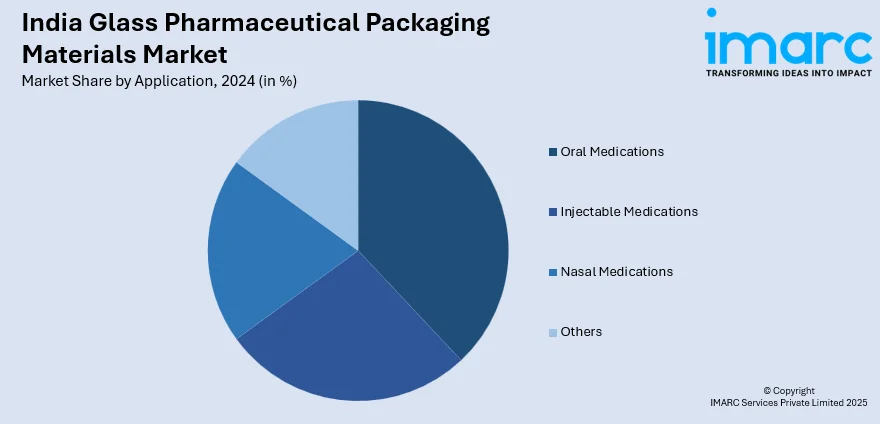

Application Insights:

- Oral Medications

- Injectable Medications

- Nasal Medications

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes oral medications, injectable medications, nasal medications, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Glass Pharmaceutical Packaging Materials Market News:

- In March 2023, SCHOTT announced the launch of amber pharma glass production in India, investing €75 million (INR 660 crores) to expand its Gujarat facility. This enhances local supply of FIOLAX® borosilicate glass tubing for vials, ampoules, and syringes, improving availability, cost efficiency, and planning reliability.

India Glass Pharmaceutical Packaging Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ampoules, Bottles, Vials, Syringes, Cartridges, Others |

| Materials Covered | Type I Glass, Type II Glass, Type III Glass |

| Applications Covered | Oral Medications, Injectable Medications, Nasal Medications, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India glass pharmaceutical packaging materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India glass pharmaceutical packaging materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India glass pharmaceutical packaging materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The glass pharmaceutical packaging materials market in India was valued at USD 680 Million in 2024.

The India glass pharmaceutical packaging materials market is projected to exhibit a (CAGR) of 9.6% during 2025-2033, reaching a value of USD 1,560 Million by 2033.

The market is driven by pharmaceutical production growth, tough regulatory requirements for high-quality packaging, and growing exports. The inertness and higher barrier properties of glass packaging make it the choice for sensitive drugs. Consumer demand for safe, contamination-free medicines drives the use of glass packaging solutions to maintain drug stability and shelf life by manufacturers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)