India Gluten-Free Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Gluten-Free Products Market Overview:

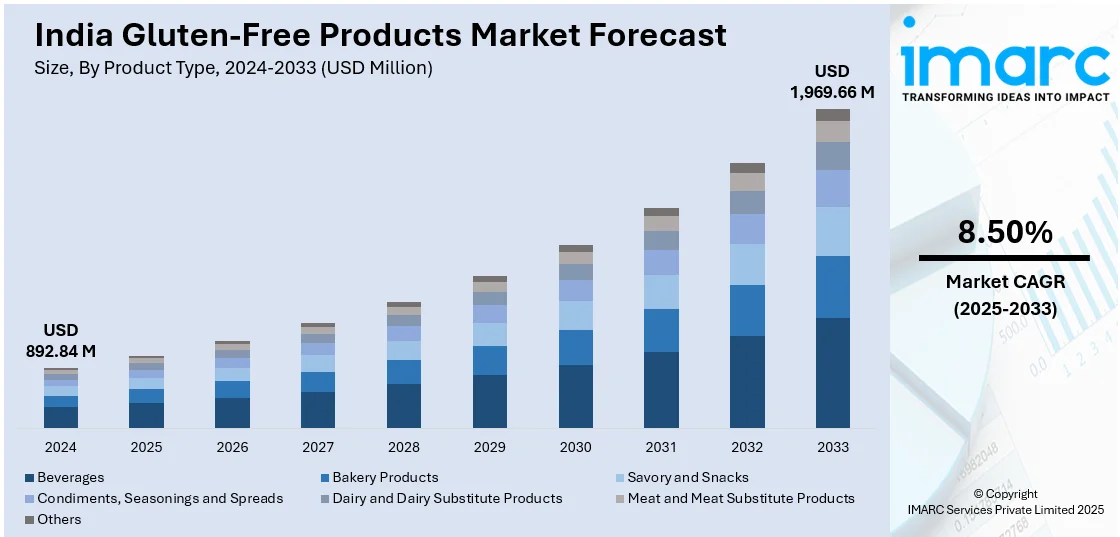

The India gluten-free products market size reached USD 892.84 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,969.66 Million by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market is observing growth influenced by increasing awareness of health issues, diversified product offerings made from nutrient-dense ingredients and widened e-commerce channels that allow consumers easy access to a range of gluten-free products catering to both gluten-intolerant consumers and health-conscious buyers on the lookout for healthier eating options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 892.84 Million |

| Market Forecast in 2033 | USD 1,969.66 Million |

| Market Growth Rate 2025-2033 | 8.50% |

India Gluten-Free Products Market Trends:

Rising Health Awareness

Growing health and well-being consciousness among Indian consumers has had a strong impact on the development of gluten-free foods. Various people are turning to gluten-free diets not just because of medical issues such as celiac disease or gluten intolerance but also to improve overall well-being. Gluten-free diets tend to be observed as assisting in more efficient digestion, alleviating bloating, and assisting in weight control. In addition, the increased clean eating trend and the use of natural and organic ingredients have additionally promoted the usage of gluten-free products. Nutritionists and healthy consumers alike have also tried them as a form of healthy consumption, feeling they provide better gut health and energy levels. Even social media personalities and nutritionists endorsing gluten-free diets have influenced the transition. As consumers keep looking for healthier food options, gluten-free items are becoming mainstream, leading to their wider distribution throughout supermarkets, health stores, and the Internet. For example, in July 2023, CFTRI launched a high-protein, fiber, and mineral content gluten-free cake mix for India's increasing demand for healthier and convenient gluten-free food.

To get more information on this market, Request Sample

Expansion of Product Offerings

The gluten-free product segment in India has gone beyond the conventional staples to meet the increasing demand for variety and convenience. The market was initially dominated by simple substitutes such as gluten-free flour and rice products. With changing consumer tastes, innovative products such as gluten-free bread, cookies, pasta, and even ready-to-eat (RTE) meals have entered the market. For instance, in June 2024, gobbleright, a startup from Mumbai, introduced a new line of gut-friendly, gluten-free, and vegan food products, such as chickpea wraps, pizza crusts, and high-protein snacks, for health-conscious consumers. Moreover, vegetable ingredients such as millet, quinoa, and almond flour find extensive application for nutritional improvement. Vegan and dairy-free formulations are also being added to gluten-free products, targeting health-oriented and green consumers. Restaurants and cafes have also begun to list gluten-free on their menu offerings, further integrating gluten-free into mainstream culture. This expanded product variety not only serves individuals with gluten intolerance but also appeals to a broader consumer base looking for healthier food options. The ongoing emphasis on research and development within the food sector guarantees the launch of new and better gluten-free products.

E-Commerce Growth

E-commerce has become a key propellant for India's gluten-free products market, providing consumers with convenience and accessibility. The internet offers consumers a wide range of gluten-free products that cannot easily be found in local retail outlets. Through this easy accessibility, consumers are able to view specialized products by local and global brands. Subscription models and product suggestions according to dietary needs are also enriching the shopping experience. Moreover, shoppers are highly using product reviews, extensive nutritional data, and ingredient labeling offered by e-commerce websites to make purchasing decisions. Online grocery delivery platforms and health-conscious marketplaces are offering increasingly extensive gluten-free product lines to serve urban consumers in search of convenience. The rising penetration of the internet and enhanced usage of smartphones also augment the development of the e-commerce segment, rendering it a crucial platform for both new and existing gluten-free brands.

India Gluten-Free Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, and distribution channel.

Product Type Insights:

- Beverages

- Bakery Products

- Savory and Snacks

- Condiments, Seasonings and Spreads

- Dairy and Dairy Substitute Products

- Meat and Meat Substitute Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beverages, bakery products, savory and snacks, condiments, seasonings and spreads, dairy and dairy substitute products, meat and meat substitute products, and others.

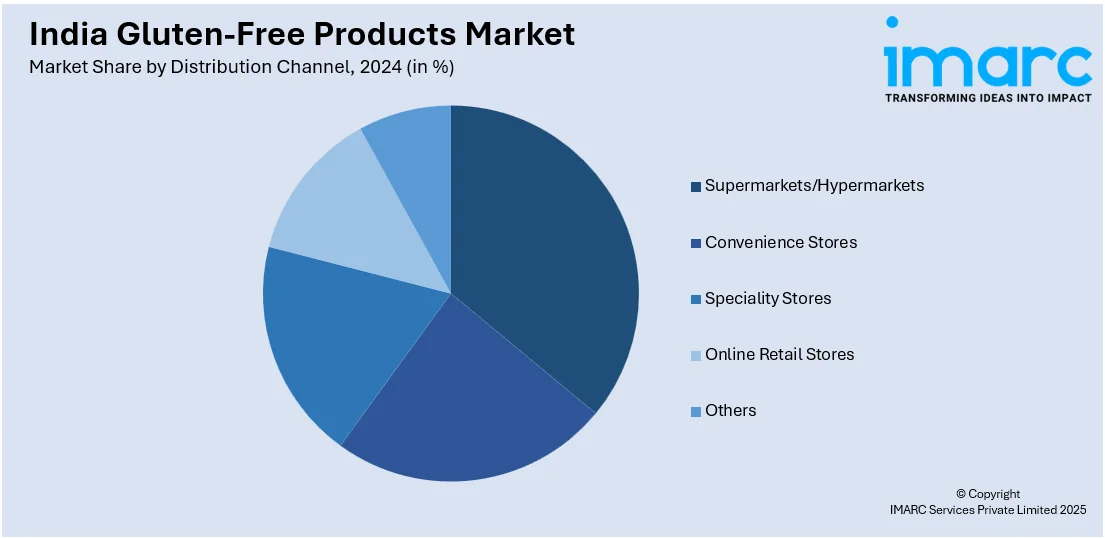

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Speciality Stores

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty stores, online retail stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gluten-Free Products Market News:

- In May 2023, ITC Foods launched millet cookies under the brand Sunfeast Farmlite as part of the 'ITC Mission Millet' initiative. These cookies have choco-chip and multi-millet flavors and are part of ITC's expanding range of millet-based products, which include Aashirvaad multi-millet mix, ragi flour, and gluten-free flour.

India Gluten-Free Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Beverages, Bakery Products, Savory and Snacks, Condiments, Seasonings and Spreads, Dairy and Dairy Substitute Products, Meat and Meat Substitute Products, Others |

| Distribution Channel Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gluten-free products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gluten-free products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gluten-free products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gluten-free products market in India was valued at USD 892.84 Million in 2024.

The India gluten-free products market is projected to exhibit a CAGR of 8.50% during 2025-2033, reaching a value of USD 1,969.66 Million by 2033.

Growing awareness about gluten sensitivities and celiac disease is motivating consumers to seek safer food alternatives. Rising health and wellness trends, along with better availability through supermarkets and online platforms, support adoption. Interest in clean-label and specialty diet products further boosts market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)