India Gourmet Foods Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

India Gourmet Foods Market Overview:

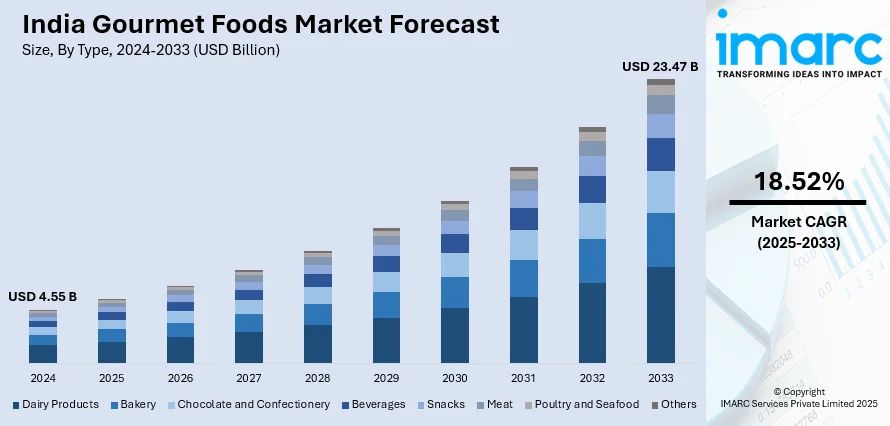

The India gourmet foods market size reached USD 4.55 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.47 Billion by 2033, exhibiting a growth rate (CAGR) of 18.52% during 2025-2033. India gourmet food market is experiencing significant growth, driven by the expansion of boutique bakeries, premium dessert offerings, specialized retail networks, and e-commerce platforms, reflecting increasing consumer demand for high-quality, health-conscious, and globally inspired products that enhance culinary experiences in urban centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.55 Billion |

| Market Forecast in 2033 | USD 23.47 Billion |

| Market Growth Rate (2025-2033) | 18.52% |

India Gourmet Foods Market Trends:

Rise of Boutique Bakeries and Gourmet Dessert Culture

India's evolving dessert culture is driving the need for high-quality baked treats and gourmet sweets. Boutique bakeries focusing on artisanal sourdough, French confections, and handcrafted desserts are growing in city areas, appealing to individuals in search of luxurious but premium snacks. The increasing demand for gourmet chocolates, artisanal ice creams, and unique desserts crafted with top ingredients like Belgian cocoa, Madagascar vanilla, and Iranian saffron is transforming the market. High-end patisseries and home-grown chocolatiers are also gaining popularity by providing bean-to-bar chocolates, personalized cakes, and artisanal pralines. Moreover, the need for healthier gourmet sweets like sugar-free, gluten-free, and high-protein treats is growing among health-aware consumers. The trend of personalized is further driving innovation, with edible gold accents, fusion flavors, and visually appealing presentations enhancing the premium appeal of gourmet confections, making them popular choices for both personal indulgence and luxury gifting. In line with this trend, in 2024, SMOOR partnered with Hangyo Ice Creams to launch a gourmet ice cream range, blending SMOOR's premium chocolates with Hangyo’s ice cream expertise. The new flavors included Black Gold Chocolate, Roasted Almond with Coffee, and Salted Caramel, available in 100 ml and 500 ml containers. This collaboration aimed to elevate the dessert market in India with a luxurious, indulgent ice cream experience.

To get more information of this market, Request Sample

Expansion of Gourmet Retail and E-Commerce Channels

The proliferation of gourmet supermarkets, high-end food stores, and digital grocery platforms is significantly expanding access to gourmet foods in India. Specialty food retailers, along with international gourmet brands entering India, are increasing product availability across major cities. E-commerce platforms are further boosting the market by offering gourmet products with doorstep delivery, subscription models, and exclusive product launches. Direct-to-consumer (D2C) brands specializing in gourmet chocolates, artisanal cheeses, and organic superfoods are leveraging digital platforms to reach a broader audience. The rising penetration of online food delivery services is also enhancing gourmet food accessibility, with premium restaurants and cloud kitchens offering high-end dining experiences at home. Subscription boxes featuring curated gourmet ingredients, international delicacies, and chef-inspired meal kits are also gaining traction, catering to India’s growing appetite for premium and convenience-driven food experiences. In 2025, Nature's Basket launched Elysium, India's first gourmet-food membership, aimed at enhancing the shopping experience for culinary enthusiasts. The membership offered exclusive benefits such as special pricing, free delivery, personalized assistance, and access to masterclasses.

India Gourmet Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Dairy Products

- Bakery

- Chocolate and Confectionery

- Beverages

- Snacks

- Meat

- Poultry and Seafood

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dairy products, bakery, chocolate and confectionery, beverages, snacks, meat, poultry and seafood, and others.

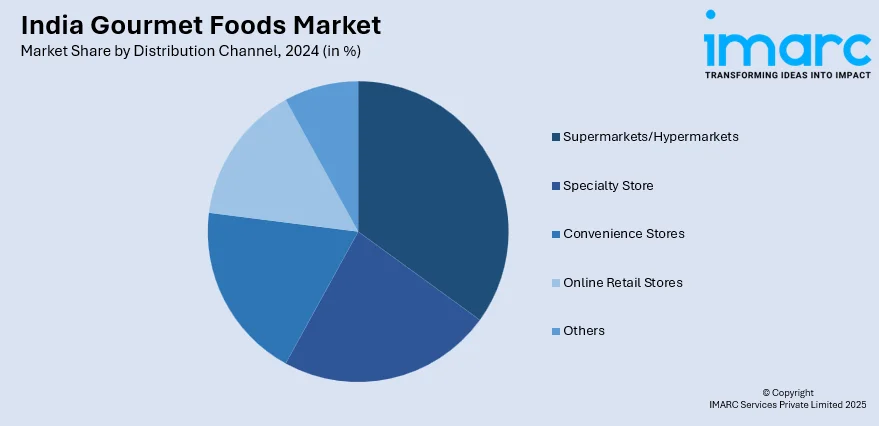

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Store

- Convenience Stores

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, specialty store, convenience stores, online retail stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gourmet Foods Market News:

- In December 2024, LT Foods launched DAAWAT® Jasmine Thai Rice, a Non-GMO certified gourmet product sourced from Thailand. Known for its fragrant aroma and soft texture, it was perfect for Thai and oriental dishes. The rice became available nationally through leading e-commerce platforms and select gourmet stores, catering to Indian consumers exploring global cuisines.

- In October 2024, Sunfeast Baked Creations launched a premium range of Global Gourmet Cookies for the festive season, featuring varieties like Rich Choco Chip, Oats and Hazelnut, and Walnut and Choco Chip. Made with globally sourced ingredients, these cookies aimed to offer an elevated snacking experience.

India Gourmet Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dairy Products, Bakery, Chocolate and Confectionery, Beverages, Snacks, Meat, Poultry and Seafood, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Store, Convenience Stores, Online Retail Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gourmet foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gourmet foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gourmet foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India gourmet foods market was valued at USD 4.55 Billion in 2024.

The India gourmet foods market is projected to exhibit a CAGR of 18.52% during 2025-2033, reaching a value of USD 23.47 Billion by 2033.

The India gourmet foods market is driven by increasing disposable incomes, affluent urbanization, and evolving consumer tastes. Rising health consciousness, demand for exotic and artisanal products, and influence of social media and food trends further boost growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)