India Green Building Materials Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

India Green Building Materials Market Overview:

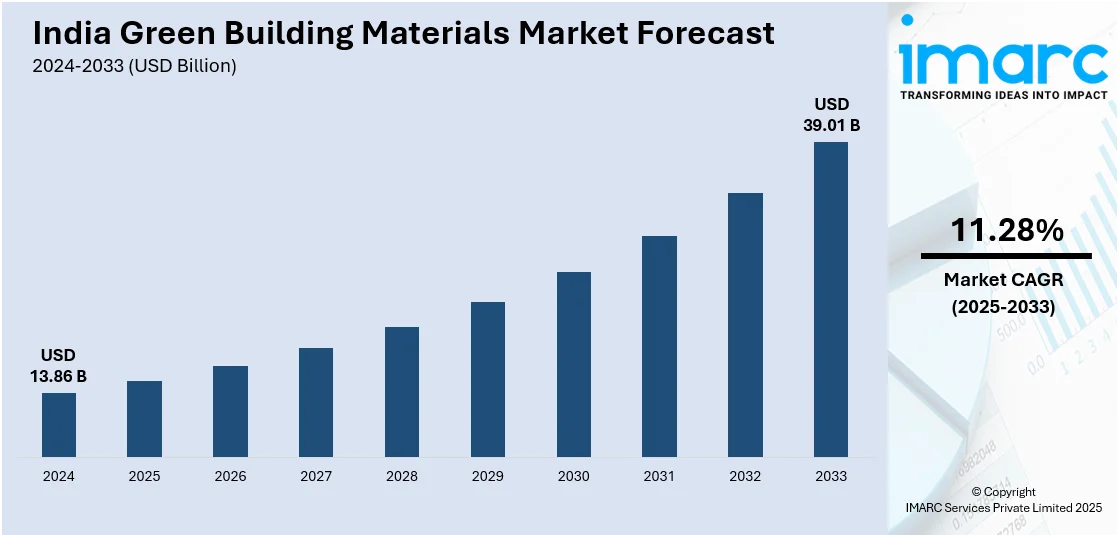

The India green building materials market size reached USD 13.86 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 39.01 Billion by 2033, exhibiting a growth rate (CAGR) of 11.28% during 2025-2033. The market is witnessing significant growth, driven by widespread adoption of energy-efficient and sustainable construction materials and escalating demand for recycled and locally sourced building materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.86 Billion |

| Market Forecast in 2033 | USD 39.01 Billion |

| Market Growth Rate (2025-2033) | 11.28% |

India Green Building Materials Market Trends:

Increased Adoption of Energy-Efficient and Sustainable Construction Materials

The India green building materials market is witnessing a spike in the demand for energy-efficient and sustainable construction materials, primarily due to increasing concerns for the environment and government initiatives for promoting eco-friendly infrastructure. More frequently, developers and architects are using insulated concrete forms (ICFs), autoclaved aerated concrete (AAC) blocks, and high-performance glass in their projects to achieve energy-efficient design in both residential and commercial buildings. These materials very effectively cut down energy consumption with the help of thermal insulation, thereby drastically reducing heat gain and minimizing the need for dependent artificial cooling and heating systems. In addition, the focus on green certifications such as Indian Green Building Council (IGBC) and Leadership in Energy and Environmental Design (LEED) is generating more urgency concerning the adoption of sustainable materials. For instance, according to industry reports, as of September 30, 2024, 95% of assets rated by Crisil Ratings are green-certified, with nearly 100% of office REIT stocks also achieving green certification. Developers seeking to comply with environmental regulations and meet consumer expectations for eco-friendly buildings are investing in innovative products like phase change materials (PCMs), low-emission paints, and recycled steel. Additionally, advancements in smart construction technologies, including prefabrication and modular building techniques, are supporting the use of energy-efficient materials. As consumer awareness regarding sustainable living increases and stringent environmental regulations take effect, the demand for energy-efficient green building materials is expected to witness sustained growth in India.

To get more information on this market, Request Sample

Rising Demand for Recycled and Locally Sourced Building Materials

The Indian green building materials market is witnessing the rising demand for recycled and locally sourced materials as sustainability takes center stage in the construction industry. Builders and developers are prioritizing materials with low environmental impact, such as recycled concrete, reclaimed wood, and fly ash-based bricks, to minimize resource depletion and reduce carbon footprints. The circular economy approach is gaining traction, with industry players repurposing demolition waste and incorporating industrial by-products into new construction materials. Government policies and incentives supporting waste reduction and resource efficiency are further driving this trend. The National Building Code of India (NBC) and state-level sustainability guidelines encourage the use of alternative and recycled materials in construction projects. Additionally, the availability of cost-effective, locally sourced materials is making sustainable construction more viable for developers and contractors. For instance, in 2024, according to industry reports, India’s booming construction market, building 300,000+ units annually, faces environmental challenges, consuming 33% of electricity. As green building adoption grows, the country holds vast potential for innovative materials and sustainable technologies integration. The shift toward green procurement practices and growing consumer preference for environmentally responsible housing solutions are contributing to market expansion. As urbanization continues to accelerate, the emphasis on recycled and locally sourced materials is expected to strengthen, reinforcing India's transition toward a more sustainable construction ecosystem.

India Green Building Materials Market Segmentation:

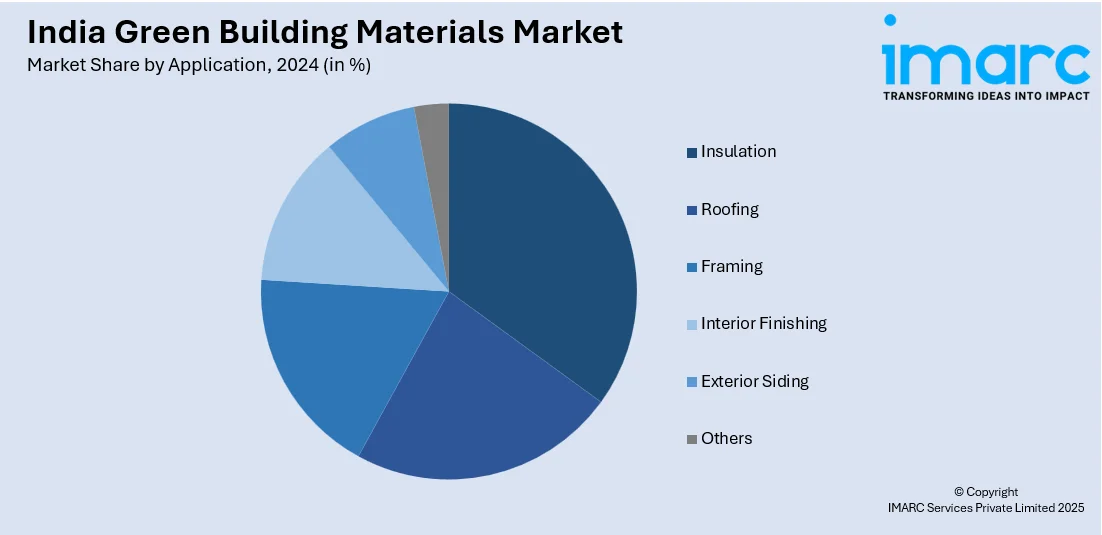

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application.

Application Insights:

- Insulation

- Roofing

- Framing

- Interior Finishing

- Exterior Siding

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes insulation, roofing, framing, interior finishing, exterior siding, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Green Building Materials Market News:

- In April 2024, Navrattan Group, a notable construction company in India, announced its plans to launch an eco-friendly "Green Cement" to the market. This comes in response to the growing demand for eco-friendly construction materials in the country.

- In July 2024, Echon announced its expansion plans in India by increasing the domestic distribution. It aims to revolutionize the construction landscape in India by introducing cutting-edge and eco-friendly building materials.

India Green Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Insulation, Roofing, Framing, Interior Finishing, Exterior Siding, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India green building materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India green building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India green building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The green building materials market in India was valued at USD 13.86 Billion in 2024.

The green building materials market in India is projected to reach USD 39.01 Billion by 2033, exhibiting a growth rate (CAGR) of 11.28% during 2025-2033.

Increasing demand for energy-efficient and sustainable construction materials, along with government initiatives and stricter environmental regulations, are key drivers. The adoption of recycled and locally sourced building materials is also contributing to growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)