India Green Tea Market Size, Share, Trends and Forecast by Type, Flavour, Distribution Channel, and Region, 2025-2033

India Green Tea Market Size and Share:

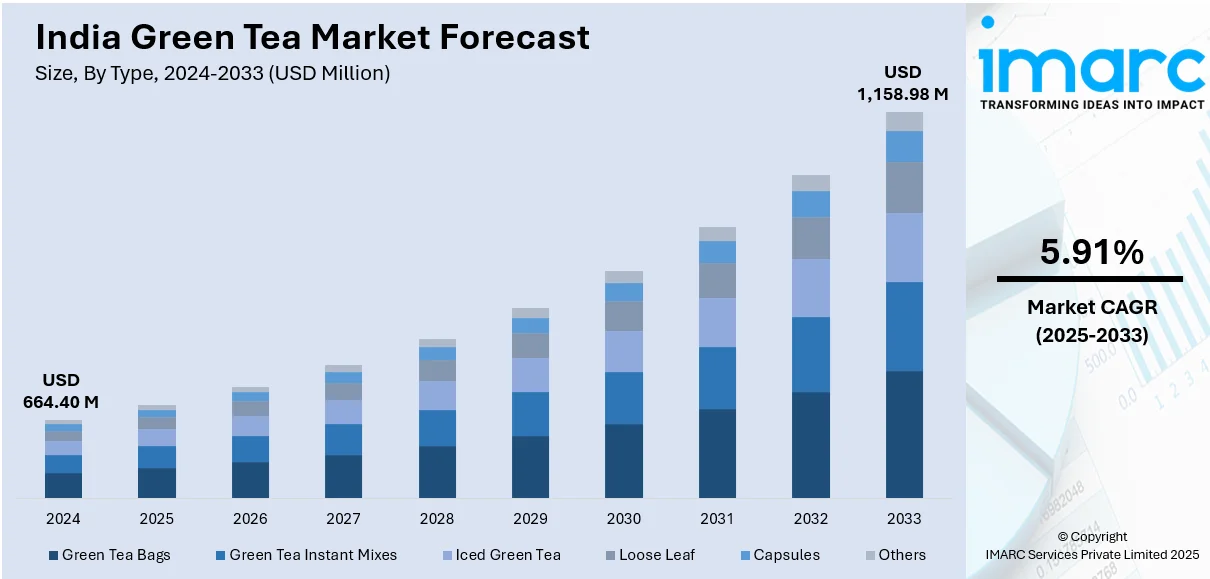

The India green tea market size reached USD 664.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,158.98 Million by 2033, exhibiting a growth rate (CAGR) of 5.91% during 2025-2033. The market is growing strongly, driven by rising health awareness and trend towards natural, sustainable products. The market is experiencing high demand for premium, organic, wellness-oriented green tea products, in favor of sustained growth opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 664.40 Million |

| Market Forecast in 2033 | USD 1,158.98 Million |

| Market Growth Rate (2025-2033) | 5.91% |

India Green Tea Market Trends:

Surge in Demand for Organic Green Tea

The Indian market for green tea is witnessing a significant boost in demand for organic versions. As people become more health-conscious, they are turning towards natural and chemical-free alternatives, driving the demand for organic green tea. Organic green tea is grown without artificial pesticides, fertilizers, or genetically modified organisms, providing a clean and natural experience. This demand is also supported by increasing consciousness of the ecofriendly impact of organic agriculture, aligning with the sustainability trend around the world. For instance, in March 2024, Pansari Group introduced TVOY Green Tea at AAHAR 2024 in the flavors of Classic, Chamomile, and Kahwa. Derived from Nilgiris, Tamil Nadu, TVOY has biodegradable packaging and advocates for health and sustainability. Moreover, the demand is fueled by Indian customers, especially millennials in cities, who are seeking the assurance and purity provided by organic produce. Government schemes of organic cultivation and certification have further strengthened the consumers' trust. The organic green tea phenomenon is not merely a reaction to health cycles but also a reflection of consumer lifestyle choice impacting the launch of new organic flavors, blends, and creative packaging in India.

To get more information on this market, Request Sample

Functional Green Tea Blends Gaining Popularity

Functional green tea blends are gaining traction in India, providing consumers with additional health benefits over regular tea. This includes mixing green tea with functional ingredients like turmeric, ashwagandha, tulsi (holy basil), ginger, and lemongrass. These have immunity-boosting, stress-reducing, and digestive health properties and address consumers' overall well-being needs. The trend is also in line with India's age-old practice of Ayurvedic and herbal health, blending wisdom of the past with convenience of the present. Functional green teas come packaged as solvents of a particular health issue, like detoxification, weight loss, and mental balance. Convenience is also a factor here, with companies providing the ready-to-drink (RTD) format and convenient tea bags and sachets. This product innovation of green tea is capitalizing on increasing demand for health-oriented, functional drinks among career professionals and health-oriented millennials.

Green Tea’s Expansion into Beauty and Personal Care

Green tea is picking up steam as a primary ingredient in the Indian beauty and personal care sector. Its high antioxidant and anti-inflammatory content makes it suitable for skincare and haircare products. The trend is fueled by growing consumer demand for natural and clean beauty products, with green tea extracts used in face masks, creams, serums, shampoos, and conditioners. The beauty world is capitalizing on green tea's virtues of calming the skin, clearing acne, regulating sebum, and fostering healthy hair growth. It is a phenomenon of a general movement towards functional beauty products with cosmetic and curative advantages. For example, in October 2023, INNISFREE India introduced the INNSIFREE Vitamin C Green Tea Enzyme Brightening Serum, blending nature-driven skincare with a new brand identity, celebrating the brand's dedication to clean nature and healthy beauty. Moreover, beauty products containing green tea align with the global culture shift toward ecologically friendly and plant-based beauty products that will attract eco-savvy customers. As the health and beauty industries overlap, the adaptability of green tea is setting it up to be an effective ingredient in the self-care space.

India Green Tea Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, flavour, and distribution channel.

Type Insights:

- Green Tea Bags

- Green Tea Instant Mixes

- Iced Green Tea

- Loose Leaf

- Capsules

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes green tea bags, green tea instant mixes, iced green tea, loose leaf, capsules, and others.

Flavour Insights:

- Lemon

- Aloe Vera

- Cinnamon

- Vanilla

- Wild Berry

- Jasmin

- Basil

- Others

A detailed breakup and analysis of the market based on the flavour have also been provided in the report. This includes lemon, aloe vera, cinnamon, vanilla, wild berry, jasmine, basil, and others.

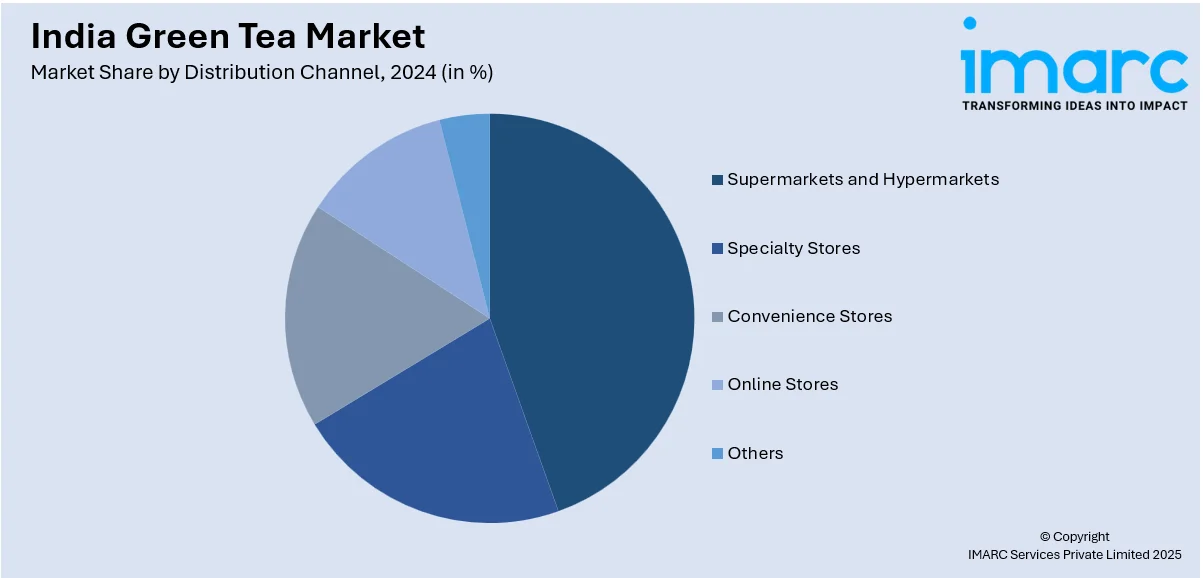

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Green Tea Market News:

- In January 2025, Organic India introduced "Purely Chamomile," the inaugural product in its new Single-Origin Tea line, with Regenerative Organic Certification (ROC). The caffeine-free tea, made from single-origin chamomile flowers, demonstrates the company's dedication to sustainability, biodiversity, and ethical sourcing through regenerative agriculture methods.

- In November 2023, Coca-Cola India introduced "Honest Tea", a ready-to-drink iced green tea brewed with organic green tea from Luxmi Tea's Makaibari Tea Estate. Lemon-Tulsi and Mango are the two flavors of the drink, which is aimed at health-oriented consumers looking for refreshing, high-quality tea-based beverages in some Indian cities.

India Green Tea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Green Tea Bags, Green Tea Instant Mixes, Iced Green Tea, Loose Leaf, Capsules, Others |

| Flavours Covered | Lemon, Aloe Vera, Cinnamon, Vanilla, Wild Berry, Jasmin, Basil, Others |

| Applications Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India green tea market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India green tea market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India green tea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The green tea market in India was valued at USD 664.40 Million in 2024.

The India green tea market is projected to exhibit a CAGR of 5.91% during 2025-2033, reaching a value of USD 1,158.98 Million by 2033.

The India green tea market is driven by rising health awareness, growing preference for antioxidant-rich beverages, and increasing influence of fitness and wellness trends. Expanding urban populations, higher disposable incomes, and greater availability of flavored and value-added green tea variants further boost market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)