India Grinding Wheels Market Size, Share, Trends, and Forecast by Type, Material, and Region, 2025-2033

India Grinding Wheels Market Overview:

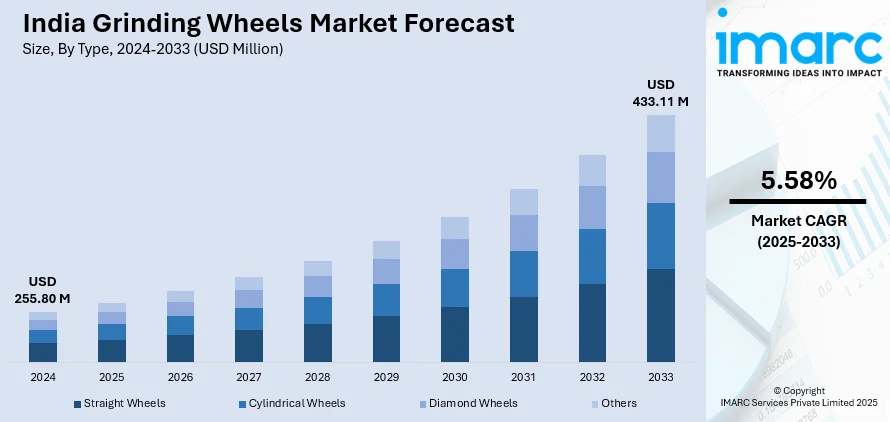

The India grinding wheels market size reached USD 255.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 433.11 Million by 2033, exhibiting a growth rate (CAGR) of 5.58% during 2025-2033. The market is witnessing significant growth, driven by an escalating demand for precision grinding wheels in automotive and aerospace industries, along with the widespread adoption of sustainable and high-efficiency abrasive material.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 255.80 Million |

| Market Forecast in 2033 | USD 433.11 Million |

| Market Growth Rate (2025-2033) | 5.58% |

India Grinding Wheels Market Trends:

Increasing Demand for Precision Grinding Wheels in Automotive and Aerospace Industries

Massive growth is seen by the Indian grinding wheels market because of the emerging requirement of precision grinding solutions in automobile and aerospace applications. Since vehicle manufacturing has increased, aircraft production also increased and therefore high-performance grinding wheels are in high demand for engine component finishing, gear grinding, turbine blade machining, and other applications. Superb super-abrasive tools like diamonds and cubic boron nitride (CBN) wheels exhibit very high performance with regard to tighter tolerances, improved surface finish, and increased tool life and are being trendsetters. This shift, in fact, has another effect on the same market as manufacturers need specialized grinding for processing EV battery components, lightweight alloys, and high-strength materials. For instance, in November 2024, The Clean Mobility Shift’s EV Dashboard reports 1,365,491 EV sales in India, achieving 5.66% penetration across multiple vehicle segments, highlighting the growing adoption of electric mobility nationwide. Additionally, aerospace manufacturers are adopting advanced ceramic and hybrid grinding wheels to enhance productivity and precision while reducing material waste. Government initiatives such as the Make in India campaign and increased foreign direct investment (FDI) in manufacturing are further accelerating market expansion. As automation in production lines grows, manufacturers are investing in CNC-compatible grinding wheels to improve efficiency and meet the evolving requirements of high-precision machining applications.

To get more information of this market, Request Sample

Rising Adoption of Sustainable and High-Efficiency Abrasive Materials

High-efficiency, sustainable abrasive materials are being developed in the Indian grinding wheels market due to serious environmental regulations and the need for economic production techniques. Conventional processes using abrasive products like aluminum oxide and silicon carbide grinding wheels are quickly being replaced with eco-friendly alternatives like ceramic alumina and seeded gel abrasives, promising higher durability and lower energy consumption. The grinding efficiency of these materials is increased with less heat generation, so tools are sustained longer, and the operational costs of end users are brought down. For instance, in February 2025, Norton Abrasives India's representative highlighted advancements in diamond and CBN abrasives, enhancing quality and reducing waste in automotive, steel, and foundry sectors through sustainable innovation and tailored solutions. Industries such as metal fabrication, construction, and tool manufacturing are shifting toward vitrified and resin-bonded grinding wheels, which provide improved cutting performance and reduced downtime. The growing emphasis on workplace safety and dust-free grinding processes has also led to the increased adoption of precision-engineered abrasives that minimize airborne particles. Furthermore, manufacturers are integrating smart sensors and IoT-based monitoring systems into grinding wheels to optimize performance and reduce material wastage. With global supply chain disruptions affecting raw material availability, domestic production of high-quality abrasives is gaining momentum, supported by government incentives for indigenous manufacturing. As industries prioritize sustainable and high-efficiency solutions, the adoption of advanced abrasive materials in India's grinding wheels market is expected to grow steadily.

India Grinding Wheels Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and material.

Type Insights:

- Straight Wheels

- Cylindrical Wheels

- Diamond Wheels

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes Straight Wheels, Cylindrical Wheels, Diamond Wheels, and Others.

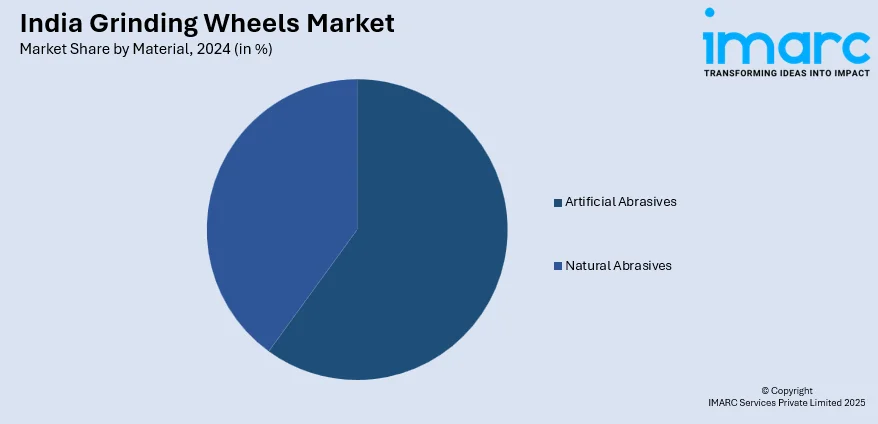

Material Insights:

- Artificial Abrasives

- Natural Abrasives

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes artificial abrasives and natural abrasives.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Grinding Wheels Market News:

- In October 2024, Weiler Abrasives introduced the Precision Express program, reducing gear grinding wheel lead times from months to days. Designed for automotive, energy, and aerospace manufacturers, it enhances quality and consistency. Featuring proprietary V59 bond technology, the high-performance wheels offer flexibility and precision in sizes ranging from 6 to 24 inches in diameter.

India Grinding wheels Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Straight Wheels, Cylindrical Wheels, Diamond Wheels, Others |

| Materials Covered | Artificial Abrasives, Natural Abrasives |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India grinding wheels market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India grinding wheels market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India grinding wheels industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The grinding wheels market in India was valued at USD 255.80 Million in 2024.

The grinding wheels market in India is projected to exhibit a (CAGR) of 5.58% during 2025-2033, reaching a value of USD 433.11 Million by 2033.

The market is mainly boosted by industrialization, automotive manufacturing growth, and construction activity. Increasing demand for precision tools in industries such as aerospace, metal fabrication, and heavy engineering also sustains growth. Policies such as the Make in India initiative and growing automation in manufacturing plants are boosting usage of high-performance abrasive tools and machinery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)