India Gypsum Plaster Market Size, Share, Trends and Forecast by Type, Sector, and Region, 2025-2033

India Gypsum Plaster Market Overview:

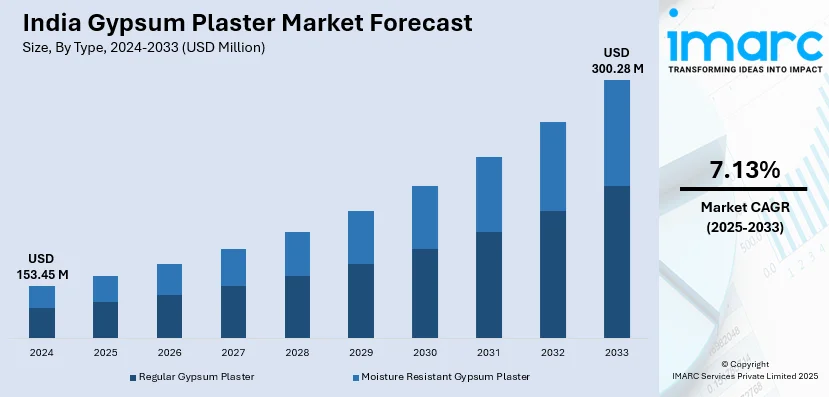

The India gypsum plaster market size reached USD 153.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 300.28 Million by 2033, exhibiting a growth rate (CAGR) of 7.13% during 2025-2033. The India gypsum plaster market is driven by expanding infrastructure projects, government initiatives like "Housing for All," rapid urbanization, escalating preference for eco-friendly construction materials, advancements in gypsum production technology, and rising demand for cost-effective, time-efficient building solutions in residential, commercial, and industrial construction sectors across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 153.45 Million |

| Market Forecast in 2033 | USD 300.28 Million |

| Market Growth Rate 2025-2033 | 7.13% |

India Gypsum Plaster Market Trends:

Government Initiatives in the Construction Sector

The efforts of the Indian government to strengthen the construction sector have significantly impacted the gypsum plaster market. Most prominently, the "Housing for All" initiative focuses on providing low-cost housing to millions. Such schemes have caused a boom in residential building projects across the country, thus boosting the demand for quality and efficient building materials, such as gypsum plasters. Further, opening 100% Foreign Direct Investment (FDI) in the gypsum products sector has brought fresh opportunities to overseas investors, thereby boosting the industry. With this policy, overseas investors have come into the industry, with advanced technologies and inflated capacities to produce. This inflow of investment has resulted in the setting up of sophisticated manufacturing plants, improving India's efficiency of gypsum plaster production. Thus, domestic supply has amplified, lessening dependence on imports and providing a consistent supply to the escalating construction industry. Further, the use of modern production methods has enhanced product quality, with gypsum plaster becoming more resistant and adaptable to various climatic conditions in India. In addition, state-supported infrastructure schemes, such as smart cities and urban re-development plans, have further pushed up the demand for gypsum plasters. With the focus on sustainability and energy-efficient building, developers and construction companies are looking toward gypsum plasters because of their environmentally friendly attributes and ease of application. The fact that the material helps cut down on construction time and labor costs has also made it a popular option with large-scale public and private sector ventures.

To get more information on this market, Request Sample

Rapid Urbanization

The Indian urban scenario has been changing at an unprecedented scale. The process of population shifts from rural to urban areas has increased the demand for residential and commercial structures. The urban exodus is triggering demand for building materials that are high in quality as well as low in price, and products that stand out in terms of their features, such as resistance to heat, conservation of moisture, sound absorption, and fireproofing, is gypsum plaster. The urban migration has also driven the construction of contemporary housing complexes, shopping malls, and office buildings, all of which need to be constructed efficiently. Gypsum plaster, with its fast setting and smooth surface finish, is tailor-made for the fast construction timelines that are the norm in urban projects. Such compatibility has ensured its extensive use in urban construction projects. In short, the reinforcing role of favorable government policies and quick urbanization has established a conducive environment for India's gypsum plaster market. They have not only raised the demand but have also opened doors to innovation and investment, guaranteeing the strong development path of the market in the near future.

India Gypsum Plaster Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and sector.

Type Insights:

- Regular Gypsum Plaster

- Moisture Resistant Gypsum Plaster

The report has provided a detailed breakup and analysis of the market based on the type. This includes regular gypsum plaster and moisture resistant gypsum plaster.

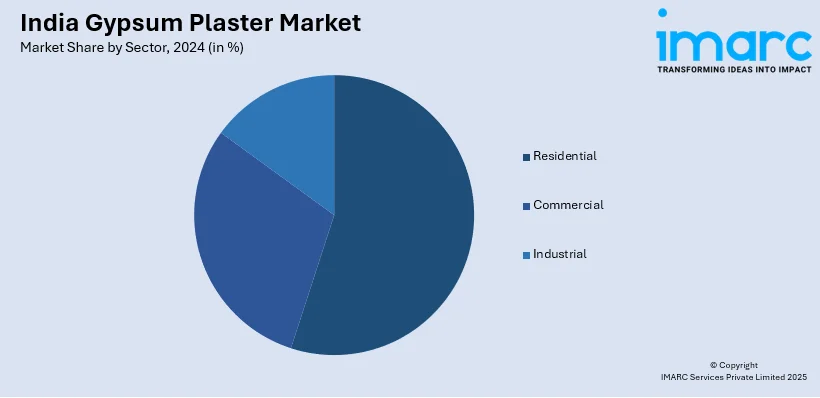

Sector Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gypsum Plaster Market News:

- July 2024: Walplast Products introduced a new campaign for its retail brand HomeSure, highlighting its wide and technology-driven range of products. This step strengthens brand awareness and customer confidence, which results in better demand for HomeSure's gypsum products. The campaign reinforces strong growth in the HomeSure range, comprising HomeSure Wall Putty, HomeSure TileEx (Tile Adhesives), HomeSure GypEx (Gypsum products), and HomeSure wShield (Construction Chemicals, Admixtures), further consolidating India's gypsum plaster market.

- April 2024: Saint-Gobain Gyproc India started manufacturing low-carbon gypsum plasters at its Tiruvallur plant located close to Chennai, reducing global warming potential by more than 40% over the entire product life cycle. Availability of low-carbon plasters encourages India's sustainability agenda, which can lead to more use of gypsum plaster in Indian construction activities.

India Gypsum Plaster Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Regular Gypsum Plaster, Moisture Resistant Gypsum Plaster |

| Sectors Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gypsum plaster market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gypsum plaster market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gypsum plaster industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India gypsum plaster market size reached USD 153.45 Million in 2024.

The India gypsum plaster market is expected to reach USD 300.28 Million by 2033, exhibiting a CAGR of 7.13% during 2025-2033.

The India gypsum plaster market is driven by increasing construction activities, a shift toward sustainable and efficient building materials, rising demand for quicker wall finishing solutions, and growing awareness about the benefits of gypsum plaster over traditional cement plaster.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)