India Hair Curler Market Size, Share, Trends, and Forecast by Product Type, Technology, Distribution Channel, Application, and Region, 2025-2033

India Hair Curler Market Overview:

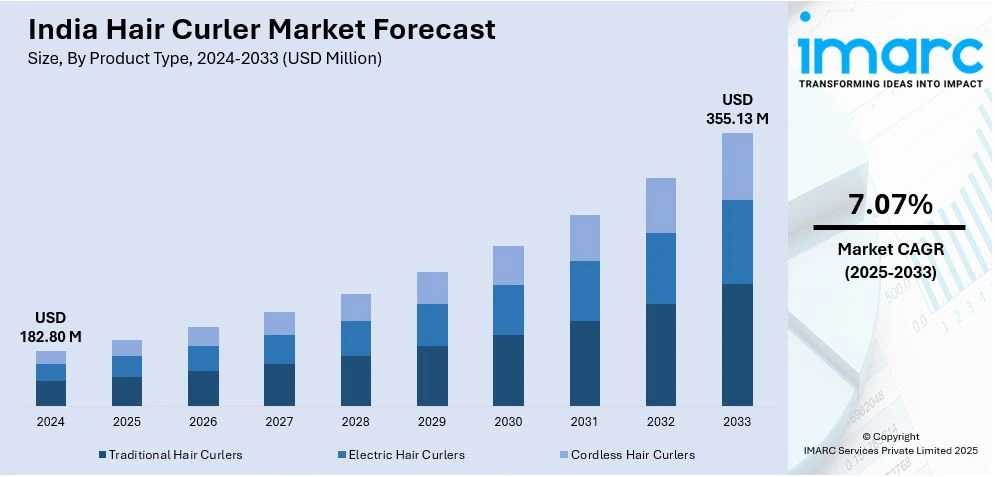

The India hair curler market size reached USD 182.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 355.13 Million by 2033, exhibiting a growth rate (CAGR) of 7.07% during 2025-2033. The market is driven by rising beauty consciousness, increasing disposable income, growth of the personal grooming industry, and influence of social media and celebrity culture. Urbanization and the expanding presence of beauty products on e-commerce platforms also support India hair curler market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 182.80 Million |

| Market Forecast in 2033 | USD 355.13 Million |

| Market Growth Rate 2025-2033 | 7.07% |

India Hair Curler Market Trends:

Rising Beauty and Grooming Awareness

An increasing focus on personal grooming and appearance, especially among young adults and working professionals, is a major factor driving the hair curler market in India. Consumers are more aware of hairstyling tools and techniques, thanks to beauty influencers, YouTube tutorials, and salon culture. This growing awareness has led to a higher demand for hair curlers that offer salon-like results at home which in turn creates a positive India hair curler market outlook. Additionally, the desire to maintain a well-groomed look for social events, work, or everyday appearances is encouraging more individuals to invest in personal grooming tools like hair curlers for regular and convenient use. For instance, in May 2023, Urban Yog introduced India's first 3-IN-1 Hot Air Brush for today's brave and busy ladies. In addition to drying hair, it also straightens or curls it all at once, saving 50% of time and 100% of salon costs.

To get more information on this market, Request Sample

Increasing Disposable Income and Urban Lifestyle

The growth of India's middle-class population and rising disposable income allow consumers to spend more on non-essential lifestyle products, including beauty and personal care tools. Urban lifestyles, particularly in metro cities, promote self-care routines and frequent grooming. Women, especially in the working and college-going segments, are increasingly buying personal styling devices for quick and easy hair makeovers. Compact, travel-friendly, and budget-friendly curlers are particularly popular among young consumers, fueling the India hair curler market share. This shift in lifestyle and spending patterns is a key factor boosting the adoption of hair curlers across diverse age groups and income segments in India.

Growing Preference for Cordless & Advanced Curlers

Indian consumers are increasingly opting for cordless and advanced hair curlers driven by the need for convenience, efficiency, and hair protection. Cordless curlers offer portability and ease of use eliminating the hassle of tangled wires and making them ideal for travel. Automatic curlers equipped with temperature control and timer settings provide uniform curls with minimal effort catering to both beginners and professionals. Additionally, ceramic-coated curlers are gaining popularity due to their ability to distribute heat evenly reducing the risk of hair damage and frizz. These innovations align with the growing consumer preference for time-saving and user-friendly beauty tools boosting demand in the Indian market. The rise of e-commerce has further accelerated the availability of these advanced curling devices.

India Hair Curler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, technology, distribution channel, and application.

Product Type Insights:

- Traditional Hair Curlers

- Electric Hair Curlers

- Cordless Hair Curlers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes traditional hair curlers, electric hair curlers, and cordless hair curlers.

Technology Insights:

- Manual

- Semi-Automatic

- Full-Automatic

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes manual, semi-automatic, and full-automatic.

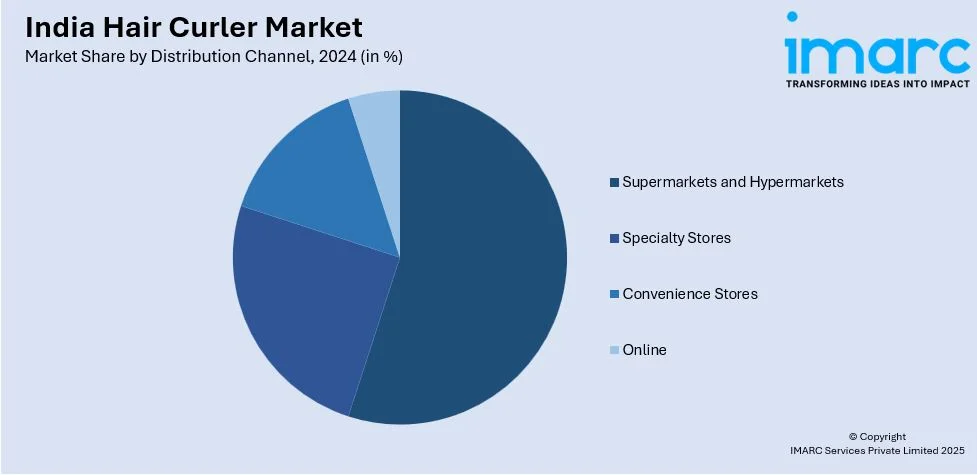

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, and online.

Application Insights:

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hair Curler Market News:

- In October 2023, Beurer, the German health and personal care brand, announced the launch of its premium StylePro Ocean haircare range in India, featuring a hair dryer, volumizing brush, and hair straightener. These innovative tools promise to elevate hair care routines, offering luxury and performance. Curler options are also included for versatile styling.

- In October 2024, PROTOUCH announced the launch of the Airshot Hair Multi Styler, a versatile hair tool now available exclusively on Nykaa. Priced competitively, it features multiple attachments for styling, curling, and drying, catering to all hair types. The lightweight design and user-friendly interface aim to simplify beauty routines and deliver salon-quality results at home.

India Hair Curler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Traditional Hair Curlers, Electric Hair Curlers, Cordless Hair Curlers |

| Technologies Covered | Manual, Semi-Automatic, Full-Automatic |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online |

| Applications Covered | Household, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hair curler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hair curler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hair curler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hair curler market in India was valued at USD 182.80 Million in 2024.

The India hair curler market is projected to exhibit a CAGR of 7.07% during 2025-2033, reaching a value of USD 355.13 Million by 2033.

Key factors driving the India hair curler market include rising beauty and grooming awareness, expanding presence of salons and styling services, and increasing disposable income among urban consumers. Additionally, growing social media influence, availability of affordable and advanced curlers, and surge in online retail platforms are fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)