India Hair Growth Products Market Size, Share, Trends and Forecast by Product Type, Gender, Age Group, Distribution Channel, and Region, 2025-2033

India Hair Growth Products Market Overview:

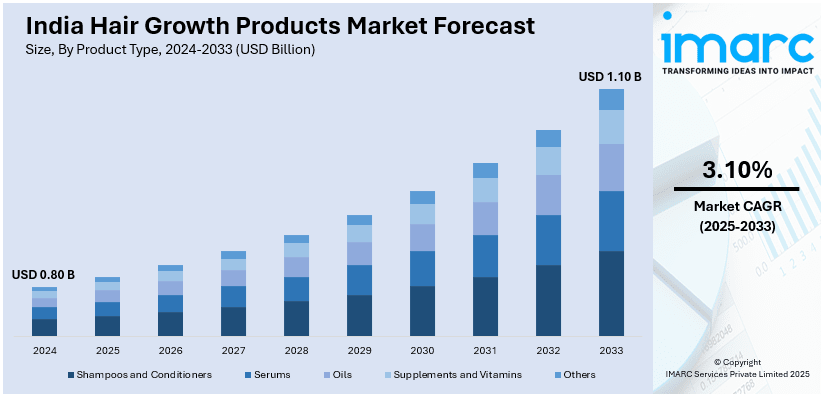

The India hair growth products market size reached USD 0.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.10 Billion by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The rising hair-related concerns like hair loss and thinning, increasing pollution and stress levels, growing awareness of scalp health, demand for natural and Ayurvedic solutions, expanding urbanization, higher disposable incomes, influencer-driven marketing, and the surge in male grooming and self-care trends are some of the major factors fueling the India hair growth products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.80 Billion |

| Market Forecast in 2033 | USD 1.10 Billion |

| Market Growth Rate 2025-2033 | 3.10% |

India Hair Growth Products Market Trends:

Growing Popularity of Natural and Ayurvedic Products

Indian consumers are shifting toward natural, organic, and Ayurvedic hair care solutions, avoiding chemical-based products due to concerns over toxicity, side effects, and long-term hair damage. The preference for ingredients like bhringraj, amla, onion oil, aloe vera, and essential oils has led brands to develop herbal hair growth products. Companies such as Patanjali, Biotique, Kama Ayurveda, and Forest Essentials have capitalized on this trend, offering plant-based solutions. This shift aligns with the broader clean beauty movement, where people prioritize safe, non-toxic, and environmentally friendly formulations, further driving the India hair growth products market demand. For instance, in January 2025, Soulflower, India's beauty brand focused on farm-to-face products, broadened its range with the introduction of its rosemary redensyl hair growth serum crafted with the tetragain formula. The company asserts that its latest product tackles hair loss, encourages regrowth, and fights early greying. The Tetragain formula has been developed using a blend of innovative actives such as redensyl, melanogray, anagain, and rosemary oil.

To get more information on this market, Request Sample

Digital Influence, E-Commerce Growth, and Influencer Marketing

The boom in e-commerce platforms and digital marketing has significantly expanded access to hair growth products across India. Online marketplaces like Nykaa, Amazon, Flipkart, and brand-owned websites allow consumers to explore, compare, and purchase a wide range of hair care solutions. The role of influencer marketing, YouTube reviews, Instagram promotions, and dermatologist-backed endorsements has made hair growth products more desirable which is creating a positive India hair growth products market outlook. Personalized recommendations through AI-driven beauty apps and subscription-based models have also enhanced consumer engagement. As digital penetration grows in Tier 2 and Tier 3 cities, demand for specialized and customized hair growth solutions is set to rise. For instance, in April 2024, Beauty Garage Professional, an authentic made-in-India brand transforming the hair care sector revealed its impressive 60% annual growth this year and a rising market share in the hair care and treatment category via their wide array of products. This accomplishment aligns with the brand's recent receipt of the esteemed National Feather Awards in the Best Hair Care Product Manufacturing category. Established in 2017 by Mahesh and Jigar Ravaria, Beauty Garage Professional has quickly risen to prominence as a top brand in the hair care industry, reflecting the essence of creativity and determination.

India Hair Growth Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, gender, age group, and distribution channel.

Product Type Insights:

- Shampoos and Conditioners

- Serums

- Oils

- Supplements and Vitamins

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes shampoo and condition, serums, oils, supplements and vitamins, and others.

Gender Insights:

- Men

- Women

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes men and women.

Age Group Insights:

- Under 35

- 35 to 50

- Above 50

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes under 35, 35 to 50, and above 50.

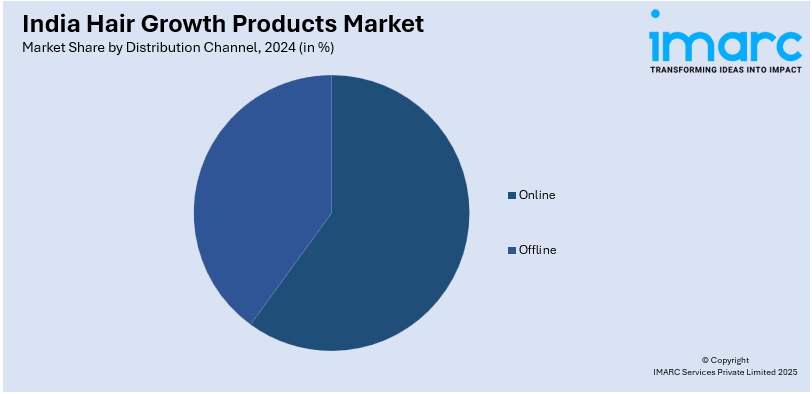

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hair Growth Products Market News:

- In December 2024, Dabur India Ltd., the top natural personal care brand in the country, unveiled its latest breakthrough in hair care with the introduction of Dabur Vatika Rosemary Hair Growth Oil, which is an innovative hair oil enriched with the benefits of Rosemary, Hibiscus, and Coconut, under the Vatika name.

- In August 2024, Pilgrim, India’s rapidly expanding beauty and personal care brand, revealed the selection of Pan India star, Rashmika Mandanna, as the latest brand ambassador for its hair care line. The collaboration with Mandanna embodies Pilgrim's fundamental value and its new brand initiative stating that ‘The Secret is in the Mix’. As a youthful and swiftly expanding beauty brand known for its creativity and strong connection to Gen Z, Pilgrim sees a perfect alignment with Mandanna’s energetic persona and appeal to younger crowds.

India Hair Growth Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoo And Condition, Serums, Oils, Supplements And Vitamins, Others |

| Gender Covered | Men, Women |

| Age Groups Covered | Under 35, 35 To 50, Above 50 |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hair growth products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hair growth products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hair growth products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hair growth products market in India was valued at USD 0.80 Billion in 2024.

The India hair growth products market is projected to exhibit a CAGR of 3.10% during 2025-2033, reaching a value of USD 1.10 Billion by 2033.

Key drivers for the India hair growth products market are increased awareness of hair health, higher rates of hair loss due to pollution and stress, and greater demand for natural and herbal products. Urban lifestyle, increased disposable income, and growing personal care practices among men and women also substantiate market growth, coupled with the availability of digital marketing influenced by influencers and e-commerce.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)