India Hard Seltzer Market Size, Share, Trends and Forecast by ABV Content, Packaging Material, Distribution Channel, Flavor, and Region, 2025-2033

India Hard Seltzer Market Overview:

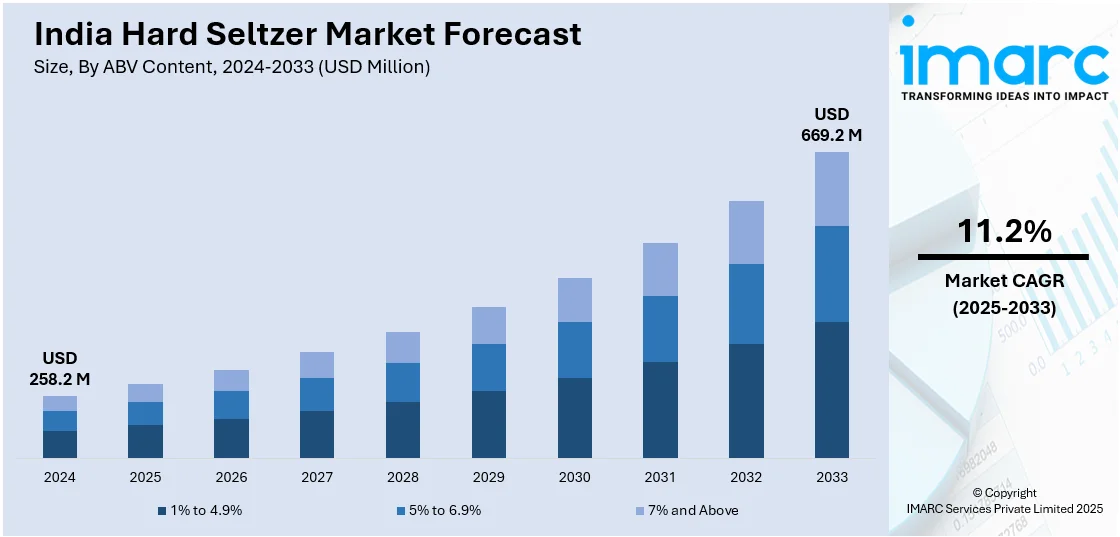

The India hard seltzer market size reached USD 258.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 669.2 Million by 2033, exhibiting a growth rate (CAGR) of 11.2% during 2025-2033. The health consciousness, growing demand for low-calorie alcoholic beverages, increasing urbanization, expanding millennial consumer base, premium product positioning, wider retail availability, and the introduction of new flavors catering to evolving taste preferences are some of the major factors augmenting the India hard seltzer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 258.2 Million |

| Market Forecast in 2033 | USD 669.2 Million |

| Market Growth Rate 2025-2033 | 11.2% |

India Hard Seltzer Market Trends:

Health-Driven Alcohol Consumption

Indian consumers, especially urban millennials and Gen Z are shifting toward alcoholic beverages that align with wellness goals. According to an industry report, about 52% of customers in cities are looking for healthier beverage options. The shift in consumer preference is providing a boost to India hard seltzer market growth. Hard seltzers are perceived as lighter, lower-calorie alternatives to traditional beer, wine, and cocktails. Hard seltzers typically contain around 100 calories per serving, are low in sugar, and around 5% ABV. They appeal to individuals seeking moderation without sacrificing social drinking. The growth of fitness culture and clean-label preferences is reinforcing this behavior. Labels with transparent ingredient lists, gluten-free claims, and natural flavors are receiving positive attention. The pandemic further accelerated this shift, creating long-term changes in drinking habits. Major cities in the country are witnessing the rise of health-conscious social spaces, where demand for "better-for-you" alcohol is steadily increasing. Influencer-led fitness content, combined with rising disposable incomes, is allowing younger consumers to experiment with premium health-aligned beverage options. Hard seltzer brands positioning themselves on these wellness cues are gaining early-mover advantages in niche segments of upscale retail, online marketplaces, and premium bars.

To get more information on this market, Request Sample

Alcohol Retail Modernization and Premiumization

The transformation in India's retail alcohol landscape is creating opportunities for niche segments like hard seltzers, which is positively impacting India hard seltzer market outlook. In several urban centers, state governments are liberalizing excise norms to allow private liquor outlets, improve the aesthetics of retail stores, and expand home delivery channels. According to an industry report published on July 2024, many states in India, including Punjab, Karnataka, Delhi, Haryana, Kerala, Tamil Nadu, and Goa, are considering permitting online platforms like Swiggy, Zomato, and BigBasket to deliver alcohol to consumers. This initiative aims to boost revenue and meet consumer demand, particularly for low-alcohol beverages favored by younger demographics. States, including Maharashtra, Jharkhand, Chhattisgarh, and Assam, briefly permitted the delivery of alcohol during the COVID-19 lockdowns. Sales in West Bengal and Odisha increased significantly as a result, rising by 20–30%. These regulatory developments are creating a more favorable environment for hard seltzer brands to scale across urban India. The digital alcohol retail channels enable direct access to younger, tech-savvy consumers who prefer convenient, at-home experiences. Hard seltzers, often sold in sleek cans with modern branding, are benefiting from this shift toward a more curated buying experience. Moreover, the rise of duty-free shops and gourmet food stores is helping premium seltzer brands build visibility. Hard seltzers, with their imported feel and flavor diversity, are finding shelf space alongside craft beers, ciders, and boutique spirits, aided by targeted digital marketing and product collaborations with lifestyle brands.

India Hard Seltzer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on ABV content, packaging material, distribution channel and flavor.

ABV Content Insights:

- 1% to 4.9%

- 5% to 6.9%

- 7% and Above

The report has provided a detailed breakup and analysis of the market based on the ABV content. This includes 1% to 4.9%, 5% to 6.9%, and 7% and above.

Packaging Material Insights:

- Cans

- Glass

- Others

A detailed breakup and analysis of the market based on the packaging material have also been provided in the report. This includes cans, glass, and others.

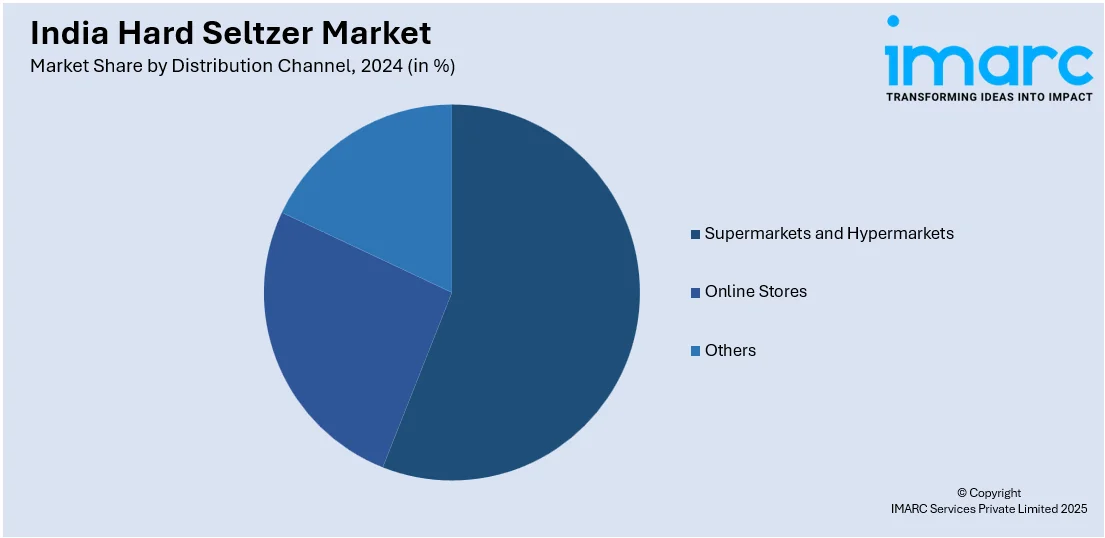

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, online stores, and others.

Flavor Insights:

- Cherry

- Grapefruit

- Mango

- Lime

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes cherry, grapefruit, mango, lime, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hard Seltzer Market News:

- February 2023: Bira 91 entered the hard seltzer market with the launch of 'Grizzly' Hard Seltzer Ale, initially introduced in Bengaluru. Developed by professional mixologists, Grizzly presents an all-natural, low-sugar beverage designed for health-conscious consumers seeking both flavor and balance. It is available in three variants: Peach & Black Tea, Blueberry & Rosemary, and Pineapple & Okinawa Sugar.

- May 2023: Spyk Hard Seltzer, India's first hard-brewed seltzer, launched in Hyderabad following its successful debut in Bengaluru. The drink is available in four flavors, including lime, orange, mixed berry, and original. Spyk contains 5.5% alcohol with just 2 grams of carbs per serving. Spyk is available at select bars and MRP stores across Hyderabad. The brand plans to expand to other cities, including Mumbai and Goa, aiming to cater to India's young, health-conscious consumers.

India Hard Seltzer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| ABV Content Covered | 1% to 4.9%, 5% to 6.9%, 7% Above |

| Packaging Materials Covered | Cans, Glass, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Others |

| Flavors Covered | Cherry, Grapefruit, Mango, Lime, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hard seltzer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hard seltzer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hard seltzer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India hard seltzer market was valued at USD 258.2 Million in 2024.

The India hard seltzer market is projected to exhibit a CAGR of 11.2% during 2025-2033, reaching a value of USD 669.2 Million by 2033.

The India hard seltzer market is driven by health consciousness, growing demand for low-calorie alcoholic beverages, urbanization, and the expanding millennial consumer base. Additionally, the introduction of new flavors and the premiumization of products are contributing to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)