India Harmonic Filter Market Size, Share, Trends and Forecast by Filter Type, Voltage Level, Phase, End User, and Region, 2025-2033

India Harmonic Filter Market Overview:

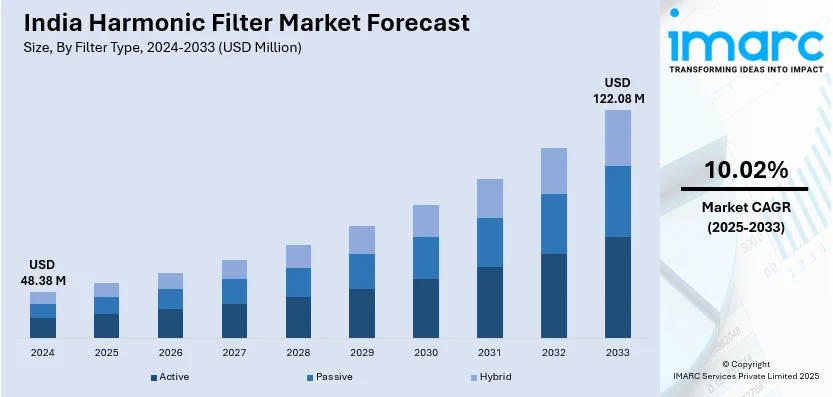

The India harmonic filter market size reached USD 48.38 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 122.08 Million by 2033, exhibiting a growth rate (CAGR) of 10.02% during 2025-2033. The market is driven by increasing industrial automation, stringent power quality standards, and the growing adoption of non-linear loads including VFDs and UPS systems. Additionally, renewable energy integration and government initiatives promoting energy efficiency are further expanding the India harmonic filter market share. Rising awareness about harmonic-related equipment damage also accelerates market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 48.38 Million |

| Market Forecast in 2033 | USD 122.08 Million |

| Market Growth Rate 2025-2033 | 10.02% |

India Harmonic Filter Market Trends:

Increasing Demand for Harmonic Filters in Industrial Applications

The rising demand for power quality solutions in industrial sectors is significantly supporting the India harmonic filter market growth. Industries such as manufacturing, oil and gas, and steel rely heavily on variable frequency drives (VFDs), UPS systems, and other non-linear loads that generate harmonics. These harmonics distort voltage and current waveforms, leading to equipment failure, energy losses, and operational inefficiencies. To mitigate these issues, companies are increasingly adopting active and passive harmonic filters, ensuring smoother power supply and compliance with IEEE-519 standards. Additionally, government initiatives promoting energy efficiency and the expansion of smart manufacturing under Industry 4.0 are further driving market growth. India's manufacturing sector is quickly embracing Industry 4.0 technologies, with artificial intelligence (AI) and machine learning (ML) expected to reach 40% of total manufacturing spending by 2025 compared to 20% in 2021. The industrial automation market is expected to grow at a compound annual growth rate of 14.26% to USD 29.43 Billion by 2029, which is disrupting industries such as automotive, electronics, and pharma. However, the demand for harmonic filters will increase in line with the preponderance of smart factories, enabling automated machinery to achieve both efficiency and precision. With industries prioritizing reliable power systems, the harmonic filter market in India is expected to expand at a steady CAGR.

To get more information on this market, Request Sample

Growth of Renewable Energy Integration Increasing Harmonic Filter Adoption

The rapid integration of renewable energy sources, such as solar and wind power, into India's grid is fueling the demand for harmonic filters. According to a research report by the IMARC Group, the renewable energy market in India reached a value of USD 23.9 Billion in 2024. This market is expected to reach USD 52.1 Billion by 2033, at a CAGR of 8.1% during the forecast period. In addition, the inverters and converters used in renewable energy systems introduce harmonics, which can destabilize the power network and damage sensitive equipment. To ensure grid stability and power quality, utilities and renewable energy providers are deploying advanced harmonic filtering solutions. Government policies supporting clean energy are accelerating renewable projects, indirectly creating a positive India harmonic filter market outlook. Furthermore, the increasing adoption of microgrids and distributed generation systems necessitates harmonic mitigation, creating new opportunities for filter manufacturers. As India continues to expand its renewable energy capacity, the harmonic filter market is poised for substantial growth in the coming decade.

India Harmonic Filter Market Segmentation:

IMARC Group provides an analysis of the key trends in each market segment, along with country level forecasts for 2025-2033. Our report has categorized the market based on filter type, voltage level, phase, and end user.

Filter Type Insights:

- Active

- Passive

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the filter type. This includes active, passive, and hybrid.

Voltage Level Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage level have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

Phase Insights:

- Single Phase

- Multi-Phase

The report has provided a detailed breakup and analysis of the market based on the phase. This includes single phase and multi-phase.

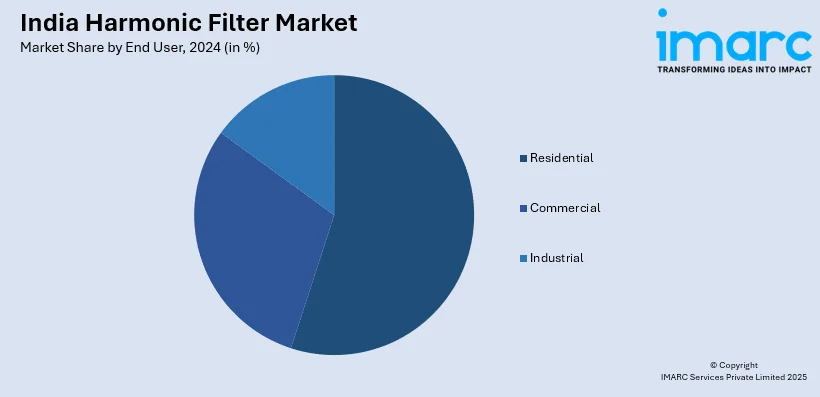

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Harmonic Filter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Filter Types Covered | Active, Passive, Hybrid |

| Voltage Levels Covered | Low Voltage, Medium Voltage, High Voltage |

| Phases Covered | Single Phase, Multi-Phase |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India harmonic filter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India harmonic filter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India harmonic filter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India harmonic filter market was valued at USD 48.38 Million in 2024.

The India harmonic filter market is projected to exhibit a CAGR of 10.02% during 2025-2033, reaching a value of USD 122.08 Million by 2033.

The India harmonic filter market is driven by growing industrial automation, increased use of nonlinear loads, and the expansion of renewable energy systems. Rising awareness about power quality issues, stricter regulatory standards, and infrastructure modernization efforts are also key factors encouraging adoption across manufacturing, commercial buildings, and utility sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)