India Hearing Aid Devices Market Size, Share, Trends and Forecast by Type, Type of Hearing Loss, Product Type, Technology Type, Patient Type, Distribution Channel, and Region, 2025-2033

India Hearing Aid Devices Market Overview:

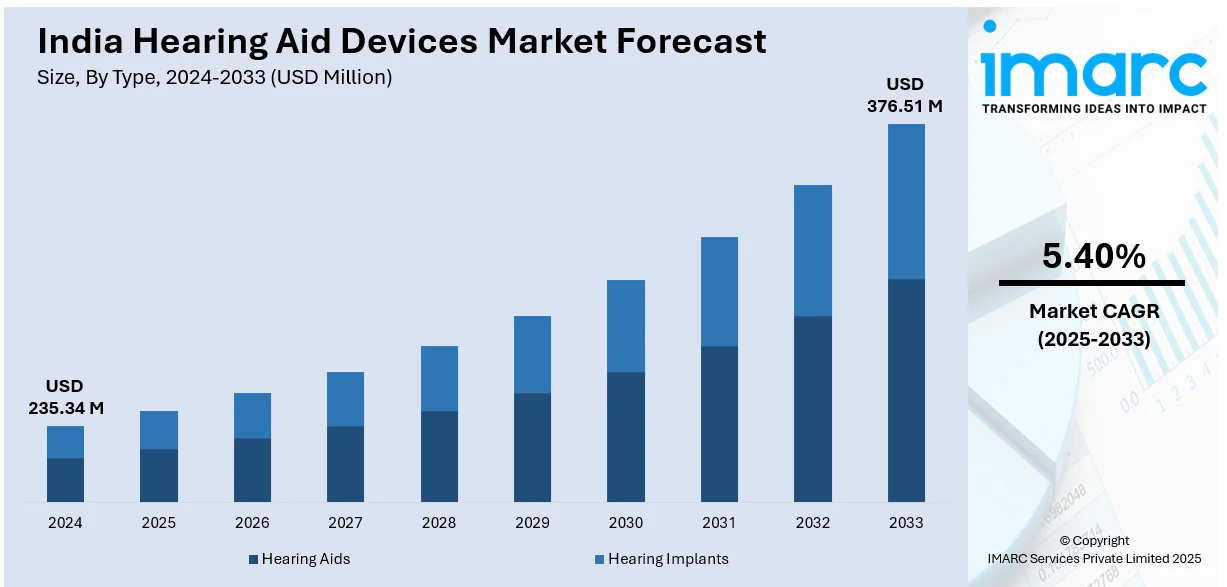

The India hearing aid devices market size reached USD 235.34 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 376.51 Million by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The market is fueled by the growing incidence of hearing loss, increasing aging population, and enhanced awareness regarding hearing health. Digital and smart hearing aid technology development, government initiatives toward accessibility, and increased emphasis on affordability and convenience are some of the other major drivers that are fueling the India hearing aid devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 235.34 Million |

| Market Forecast in 2033 | USD 376.51 Million |

| Market Growth Rate 2025-2033 | 5.40% |

India Hearing Aid Devices Market Trends:

Rise in Demand for Digital and Smart Hearing Aids

The India hearing aid devices market outlook is witnessing a shift toward digital and intelligent hearing aids, led by technological innovation. The World Health Organization estimates that 63 Million people in India experience significant hearing loss, highlighting the urgent requirement for effective interventions and solutions. Moreover, the incidence of hearing loss is expected to increase as India's elderly demographic exceeds that of children by 2050, underscoring the necessity of implementing early measures to tackle this vital health concern. Digital hearing aids provide better sound quality, greater amplification, and more personalized settings than their analog counterparts. The incorporation of smart capabilities, including Bluetooth connectivity, allows hearing aids to be connected to smartphones and other devices, enabling real-time adjustment and control. What is more, clever hearing aids contain features such as noise cancellation, speech enhancement, and customized settings according to the hearing requirements of the user. This trend is being driven by growing awareness for hearing loss matters, as well as an intensified demand for unseen, high-technology solutions. Younger clients are especially eager to embrace the latest devices due to their innovative design and intelligence. With digital and intelligent hearing aids being more affordable, their use in India is bound to increase, further improving users' hearing experience.

To get more information on this market, Request Sample

Growth of Rechargeable and Lithium-Ion Hearing Aids

Rechargeable hearing aids are gaining popularity in India due to the convenience factor and ecological reasons. Hearing aids with batteries need frequent replacement, which is expensive and time-consuming for the consumer. Rechargeable hearing aids do away with the disposable battery option, providing a greener and cheaper alternative. Most rechargeable hearing aids employ lithium-ion technology, giving long battery life and fast charging capability. With the convenience of wireless charging and the possibility to use the device all day without interruption, rechargeable hearing aids are increasingly in demand. It is especially favored by older individuals who might not be able to manage small batteries or remember when to replace them. Moreover, with increased concern for the environment, rechargeable hearing aids offer an environmentally friendly option that responds to the trend of sustainability at a global scale. As the use of rechargeable hearing aids increases, companies are likely to concentrate on creating long-lasting, effective, and user-friendly models for the Indian market.

Rising Focus on Affordable Hearing Aids and Government Initiatives

Affordability is emerging as a major driver in the India hearing aid devices market, as most of the population continues to be financially constrained in accessing hearing aids. In reaction to this, companies are placing greater emphasis on making affordable devices without compromising on quality. Government programs and subsidies for making affordable healthcare choices available are also fueling the growth in hearing aid adoption. Several state and national initiatives are providing subsidies or financial support for hearing aids to make them more affordable for lower-income persons, particularly those in rural settings. This trend is being assisted by initiatives aimed at increasing awareness of hearing loss and the accessibility of affordable alternatives. The rising focus on affordability is expected to drive the India hearing aid devices market growth, with more people, especially those in underserved areas, able to access hearing aids that enhance their quality of life. Manufacturers will therefore have to come up with a wider spectrum of cost-effective, functioning devices.

India Hearing Aid Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, type of hearing loss, product type, technology type, patient type, and distribution channel.

Type Insights:

- Hearing Aids

- Hearing Implants

The report has provided a detailed breakup and analysis of the market based on the type. This includes hearing aids and hearing implants.

Type of Hearing Loss Insights:

- Sensorineural

- Conductive

The report has provided a detailed breakup and analysis of the market based on the type of hearing loss. This includes sensorineural and conductive.

Product Type Insights:

- Wired

- Wireless

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wired and wireless.

Technology Type Insights:

- Digital

- Analog

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes digital and analog.

Patient Type Insights:

- Adult

- Pediatric

The report has provided a detailed breakup and analysis of the market based on the patient type. This includes adult and pediatric.

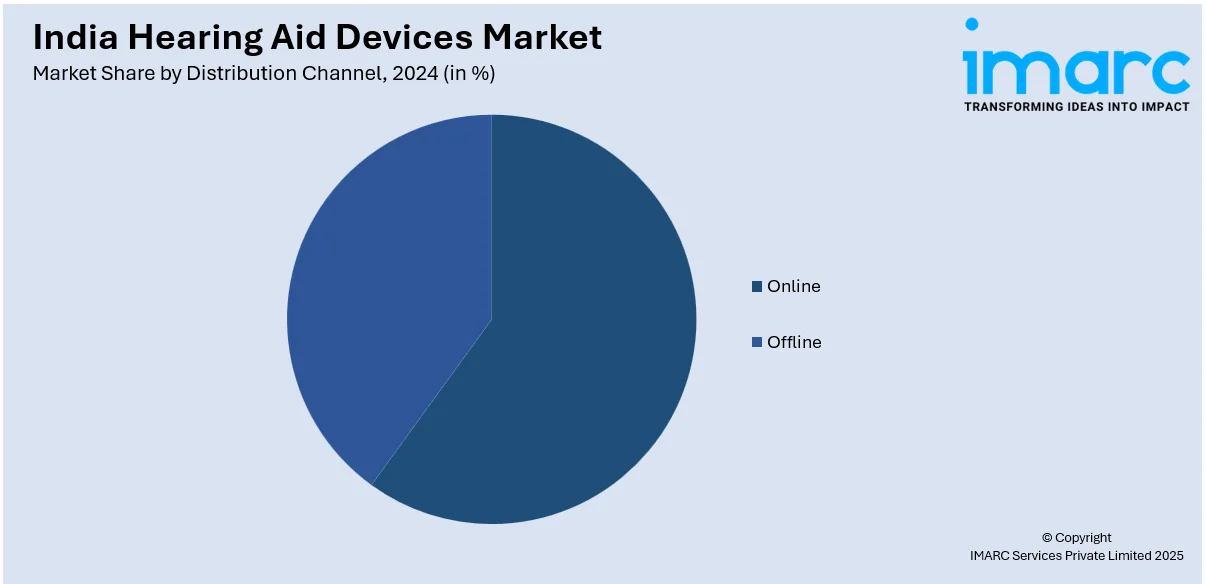

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hearing Aid Devices Market News:

- In February 2024, Starkey announced that their revolutionary Genesis AI hearing aids would be launched in India. Continuing its extensive tradition of innovation, Starkey is providing cutting-edge solutions tailored to address the rising prevalence of hearing loss in India. These approaches are designed to improve both auditory health and overall wellness.

- In July 2024, GKB Opticals partnered with Widex, a hearing aid producer from Denmark, to offer both ophthalmic and audiology services in Kolkata.

India Hearing Aid Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hearing Aids, Hearing Implants |

| Types of Hearing Losses Covered | Sensorineural, Conductive |

| Product Types Covered | Wired, Wireless |

| Technology Types Covered | Digital, Analog |

| Patient Types Covered | Adult, Pediatric |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hearing aid devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hearing aid devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hearing aid devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India hearing aid devices market was valued at USD 235.34 Million in 2024.

The India hearing aid devices market is projected to exhibit a CAGR of 5.40% during 2025-2033, reaching a value of USD 376.51 Million by 2033.

The India hearing aid devices market is driven by growing prevalence of hearing loss, especially among seniors and youth exposed to noise, combined with increasing awareness and reduced stigma around use. Rapid advances in digital, Bluetooth-connected, and rechargeable devices—and supportive government programs expanding access—are also fueling adoption across diverse socioeconomic groups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)