India Hemoglobin Testing Market Size, Share, Trends and Forecast by Product Type, Technology, End User, and Region, 2026-2034

India Hemoglobin Testing Market Overview:

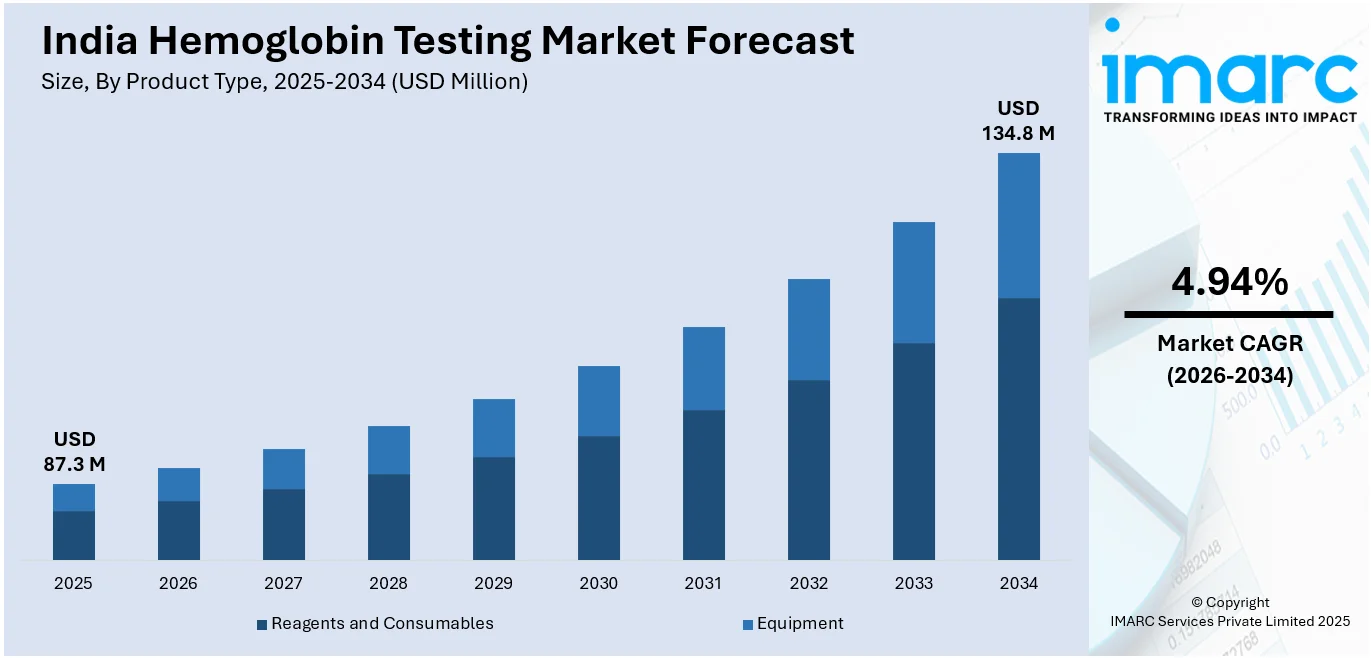

The India hemoglobin testing market size reached USD 87.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 134.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The growing adoption of point-of-care testing (POCT) devices, driven by technological advancements and government initiatives, is significantly boosting the India hemoglobin testing market by enabling rapid, cost-effective, and accessible diagnostics, particularly in rural and remote areas, thereby improving early detection and management of anemia across diverse population segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 87.3 Million |

| Market Forecast in 2034 | USD 134.8 Million |

| Market Growth Rate (2026-2034) | 4.94% |

India Hemoglobin Testing Market Trends:

Government Initiatives and Increased Healthcare Expenditure

The Indian government's investment in developing healthcare infrastructure and services has been a key catalyst for the hemoglobin testing market. Heavy investments in public health have resulted in better diagnostic facilities and greater availability of vital medical tests, including hemoglobin tests. As per the National Health Accounts (NHA) Estimates for 2020-21 and 2021-22, the proportion of government health spending in the overall health spending surged from 29% in 2014-15 to 48% in 2021-22. This substantial boost reflects the government's commitment to enhancing healthcare services throughout the country. A key initiative is the National Health Mission (NHM), whose goal is to deliver universal access to equitable, affordable, and quality healthcare services. The NHM has played a critical role in escalating healthcare coverage, especially in rural and underserved communities, thus driving the demand for diagnostic tests such as hemoglobin testing. The amplifying emphasis on child and maternal health under NHM has also led to a rise in the requirement for routine hemoglobin screening to detect and prevent anemia in pregnant women and children.

To get more information on this market, Request Sample

Rising Prevalence of Hemoglobin Disorders

The rising incidence of hemoglobin disorders, including anemia, has contributed majorly to the development of the hemoglobin test market in India. Anemia, which is defined by low hemoglobin levels, impacts a considerable percentage of the Indian population, especially women and children. Normal hemoglobin checking is important for the early diagnosis and care of anemia, thereby elevating the demand for such diagnostic procedures. The proactive role of the government in combating anemia is reflected through several programs and policies. For example, the Anemia Mukt Bharat (AMB) program focuses on decreasing the rate of anemia among vulnerable populations such as pregnant women, adolescents, and children. The program focuses on frequent screening and early treatment, thus enhancing the need for hemoglobin testing. The National Family Health Survey (NFHS-5) figures reveal that the prevalence of anemia in women aged 15-49 years was 57.0% in 2019-21, which signifies the urgent necessity for continuous surveillance and intervention. Furthermore, the inclusion of hemoglobin testing under routine health check-ups and school health programs further strengthened the market. Early identification through mass screening enables early intervention, lessening the load of hemoglobin diseases and improving population health in general.

India Hemoglobin Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, technology, and end user.

Product Type Insights:

- Reagents and Consumables

- Equipment

The report has provided a detailed breakup and analysis of the market based on the product type. This includes reagents and consumables, and equipment.

Technology Insights:

- Chromatography

- Immunoassay

- Others

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes chromatography, immunoassay, and others.

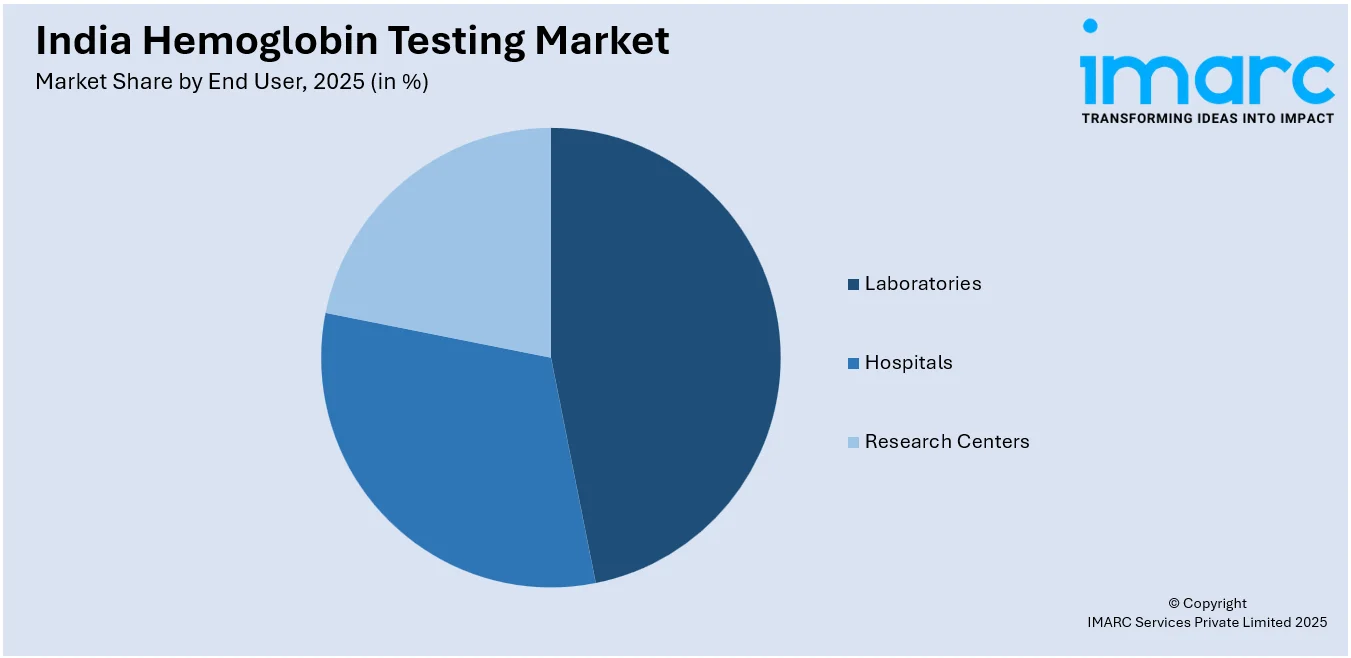

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Laboratories

- Hospitals

- Research Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes laboratories, hospitals, and research centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hemoglobin Testing Market News:

- December 2024: Cornell researchers developed AnemiaPhone, a low-cost, quick diagnostic test for anemia from a finger-stick blood sample. The Indian Council of Medical Research (ICMR) is incorporating the technology into national health programs to increase anemia screening. The innovation is spearheading the India hemoglobin testing market by making it more accessible, affordable, and detectable early, particularly in rural India.

- February 2024: Emcure Pharmaceuticals initiated the 'Unmask Anemia' campaign to raise awareness about iron deficiency anemia in Indian women, providing an online self-assessment questionnaire to assist users in determining their risk of anemia. Simplifying the anemia risk assessment process makes more women go for hemoglobin tests, hence generating more demand for such diagnostics. Increased awareness and proactive management of health are fueling growth in India's hemoglobin testing market.

India Hemoglobin Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Reagents and Consumables, Equipment |

| Technologies Covered | Chromatography, Immunoassay, Others |

| End Users | Laboratories, Hospitals, Research Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hemoglobin testing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hemoglobin testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hemoglobin testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hemoglobin testing market in India was valued at USD 87.3 Million in 2025.

The India hemoglobin testing market is projected to exhibit a CAGR of 4.94% during 2026-2034, reaching a value of USD 134.8 Million by 2034.

Technological progress and supportive government programs are accelerating the use of point-of-care testing (POCT) devices, which are transforming anemia diagnosis by offering faster, more affordable, and easily accessible testing solutions. Their growing use in rural and underserved regions is enhancing early detection and better management of anemia among varied population groups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)