India Herbal Digestive Supplements Market Size, Share, Trends and Forecast by Product Type, Ingredient Type, Functionality, Distribution Channel, End User and Region, 2025-2033

India Herbal Digestive Supplements Market Size and Share:

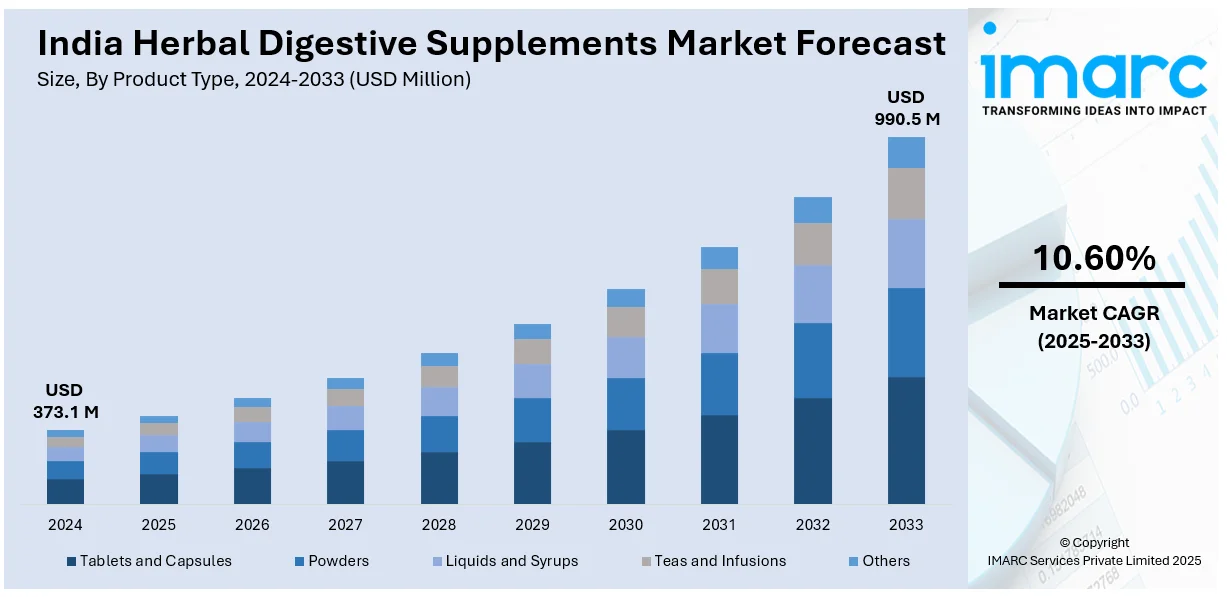

The India herbal digestive supplements market size reached USD 373.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 990.5 Million by 2033, exhibiting a growth rate (CAGR) of 10.60% during 2025-2033. The market is fueled by growing health awareness, rising demand for natural and organic products, growing awareness about digestive health, and movement away from chemical-based remedies toward herbal ones. Moreover, the growing e-commerce channel and Ayurvedic heritage are major drivers propelling the India herbal digestive supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 373.1 Million |

| Market Forecast in 2033 | USD 990.5 Million |

| Market Growth Rate 2025-2033 | 10.60% |

India Herbal Digestive Supplements Market Trends:

Increasing Preference for Gut Health Supplements

The India herbal digestive supplements market outlook is witnessing a shift toward products that support the overall health of the gut. With increasing knowledge about the significance of a balanced digestive system, there is increased demand for herbal supplements that help in digestion, alleviate bloating, and support gut flora. Ingredients such as triphala, ginger, fennel, and peppermint, which are traditionally associated with digestive properties, are being increasingly used in formulations. Furthermore, consumers are also looking for products that aid digestion while also boosting immunity and facilitating detoxification. The knowledge about the gut-brain axis and its implications for mental health is further driving this trend. Therefore, both old Ayurvedic brands and new entrants are riding this wave by launching herbal digestive supplements made from natural, plant-based ingredients. The move toward preventative care, fueled by e-commerce platforms and greater access to information, is propelling this segment's growth.

To get more information on this market, Request Sample

Rise of Personalized and Targeted Digestive Health Solutions

Indian consumers are increasingly seeking personalized digestive health products, which has driven the popularity of custom-formulated herbal digestive supplements. Companies are now launching products formulated for specific digestive issues, including bloating, indigestion, acidity, and irritable bowel movements. Improvements in Ayurvedic and natural healthcare have enabled companies to develop solutions for various age groups and lifestyles, including supplements for the elderly, working populations, and sportspeople. Also, with the growth of online diagnostics and health consultations, brands are offering customized suggestions based on personal health evaluations. This customization trend is appealing to consumers who want more effective and specific solutions. In addition, new products are now combining herbs and probiotics to ensure improved digestion and restore the balance of gut microbiota. This move toward accuracy and ease is assisting brands in establishing niche segments in the larger category of digestive health. This in turn, is further fueling the India herbal digestive supplements market growth.

Increased Focus on Sustainability and Clean Label Products

The Indian market for herbal digestive supplements is moving toward sustainability and clean label offerings. With growing concern for the environment, consumers are looking for products that reflect their values of green responsibility and fair sourcing. To meet this need, companies are turning to sustainably sourced materials, environmentally friendly packaging, and clear labeling. Clean label products, emphasizing natural, organic content without artificial preservatives or additives, are increasing in popularity. This is especially seen in millennials and Gen Z, who are more likely to go for products that are free from chemical synthetics and cruelty-free. Herbal digestive supplements highlighting their purity, ethical sourcing, and organic certifications are gaining popularity. With the Indian market becoming increasingly health- and environment-aware, consumers are also asking companies to cut carbon footprints, further shaping product offerings. This trend is defining the future of India's herbal digestive supplement market.

India Herbal Digestive Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, ingredient type, functionality, distribution channel, and end user.

Product Type Insights:

- Tablets and Capsules

- Powders

- Liquids and Syrups

- Teas and Infusions

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tablets and capsules, powders, liquids and syrups, teas and infusions, and others.

Ingredient Type Insights:

- Triphala

- Amla (Indian Gooseberry)

- Ginger

- Fennel

- Peppermint

- Licorice

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes triphala, amla (Indian gooseberry), ginger, fennel, peppermint, licorice, and others.

Functionality Insights:

- Digestive Health

- Gut Health and Microbiome Support

- Detoxification and Cleansing

- Acid Reflux and Heartburn Relief

- Others

The report has provided a detailed breakup and analysis of the market based on the functionality. This includes digestive health, gut health and microbiome support, detoxification and cleansing, acid reflux and heartburn relief, and others.

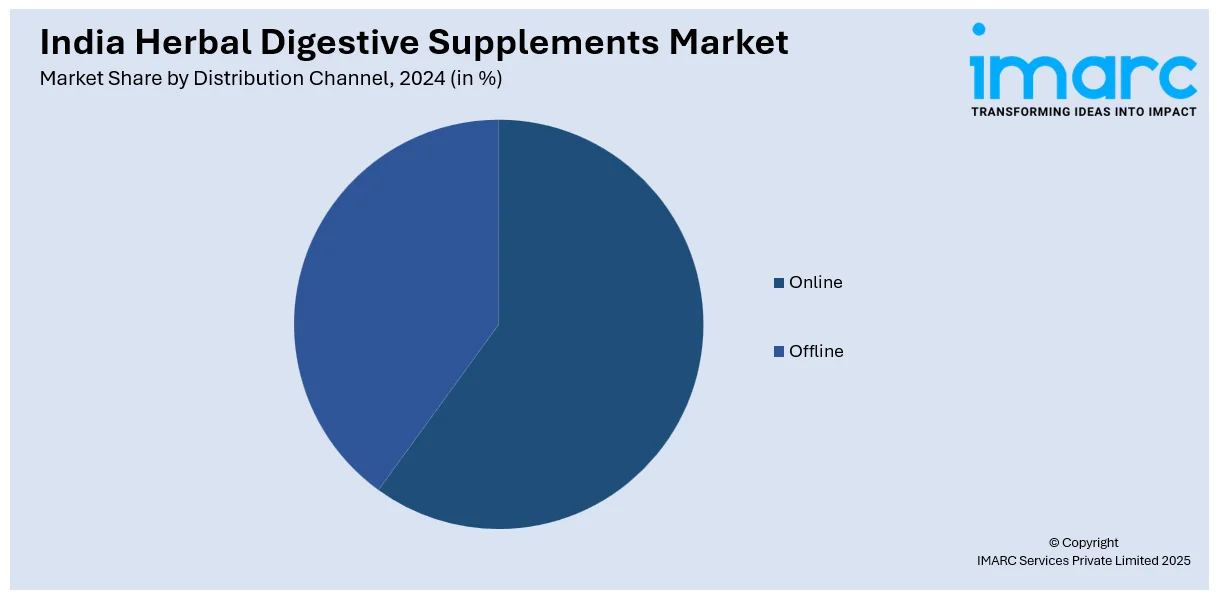

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

End User Insights:

- Adults

- Children

- Elderly

The report has provided a detailed breakup and analysis of the market based on the end user. This includes adults, children, and elderly.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Herbal Digestive Supplements Market News:

- In June 2023, Kapiva, an indigenous direct-to-consumer brand that offers accessible and modern Ayurveda, declared that it is enhancing its footprint in the United States with the strategic hiring of industry veterans Nicholas Kelley as Chief Executive Officer and Maria N. Lacher as Chief Marketing Officer. With a robust customer base of 500,000, Kapiva seeks to bring modern Ayurveda to homes across the globe, improving their everyday wellness levels.

India Herbal Digestive Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tablets and Capsules, Powders, Liquids and Syrups, Teas and Infusions, Others |

| Ingredient Types Covered | Triphala, Amla (Indian Gooseberry), Ginger, Fennel, Peppermint, Licorice, Others |

| Functionalities Covered | Digestive Health, Gut Health and Microbiome Support, Detoxification and Cleansing, Acid Reflux and Heartburn Relief, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Adults, Children, Elderly |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India herbal digestive supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the India herbal digestive supplements market on the basis of product type?

- What is the breakup of the India herbal digestive supplements market on the basis of ingredient type?

- What is the breakup of the India herbal digestive supplements market on the basis of functionality?

- What is the breakup of the India herbal digestive supplements market on the basis of distribution channel?

- What is the breakup of the India herbal digestive supplements market on the basis of end user?

- What is the breakup of the India herbal digestive supplements market on the basis of region?

- What are the various stages in the value chain of the India herbal digestive supplements market?

- What are the key driving factors and challenges in the India herbal digestive supplements market?

- What is the structure of the India herbal digestive supplements market and who are the key players?

- What is the degree of competition in the India herbal digestive supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India herbal digestive supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India herbal digestive supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India herbal digestive supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)